Dilok Klaisataporn

Dilok Klaisataporn

The TFS Financial Corporation (NASDAQ:TFSL) is a Cleveland-based holding company that provides retail consumer banking products and services. Its primary services include real estate mortgage lending and refinancing and home construction lending. Deposit products include savings, checking, retirement plan, and money market. It has a market capitalization of over $4 billion, making it as large as some S&P 400 components. But, over 80% of its stocks are held by MHC, a federally chartered mutually holding company.

I have been keeping an eye on this company since 1Q 2022. In my previous article, it was still a bit slow-moving. Even so, its financials and growth prospects were already promising, matched with its undervalued stock price. Now, the stock has regained its footing amidst the sustained inflation. It also generates enough income to cover dividends and sustain its operating capacity. Yet, it has to keep an eye on its interest-sensitive portfolio to improve liquidity. It must be more careful even if its capitalization on earning assets continues to pay off. Meanwhile, investors may enjoy the current stock price that remains undervalued.

TFS Financial Corporation has not averted the impact of economic downturns. Its growth had been hampered in the last two years. Now that interest and mortgage rates are rising, its portfolio yields higher returns. It appears to be more interest-sensitive, given its high concentration on loans. That is why it increases its capitalization on loans rather than securities.

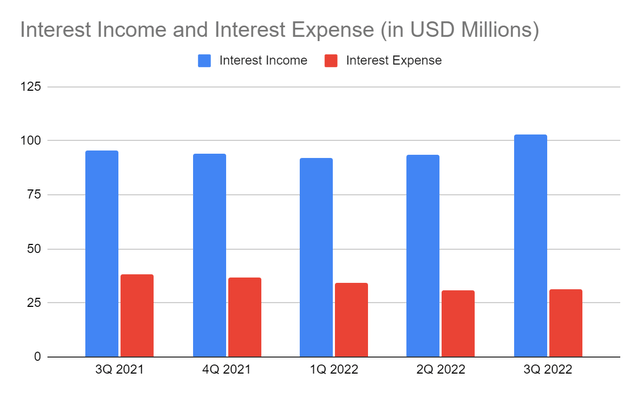

At $102 million, TFS Financial has an 8% year-over-year growth. It is also 10% higher than in 2Q 2022. We can also see that in three quarters, interest income is increasing. So, it is safe to assume that its rebound started in the previous quarter. Indeed, its returns are moving in parallel with the interest and mortgage rates. Its securities increase their value as the interest and mortgage rates increase. Its prudent asset management and portfolio diversification are paying off. But, it must still be careful since a massive chunk of its assets is from mortgage loans. It may be both a primary growth driver and a problem. We will discuss more of this part in the next section.

The impact of its strategy also extends to a low-interest expense. In one year, organic loan growth has outpaced deposit growth. That may be the reason for the faster increase in interest income than an expense. Also, there are adjustments in the interest rates in the components of borrowings that have a partial offsetting impact. Given this, the net interest margin is 68% vs 67% in 2Q 2022 and 61% in 3Q 2021. If we disregard loan provisions, it will be higher at 69%. Note that loan provisions may be normalized this year, given the increased interest and mortgage rates. Unlike in the previous year, provisions may be more of an expense than a writeback.

Interest Income and Interest Expense (MarketWatch)

Interest Income and Interest Expense (MarketWatch)

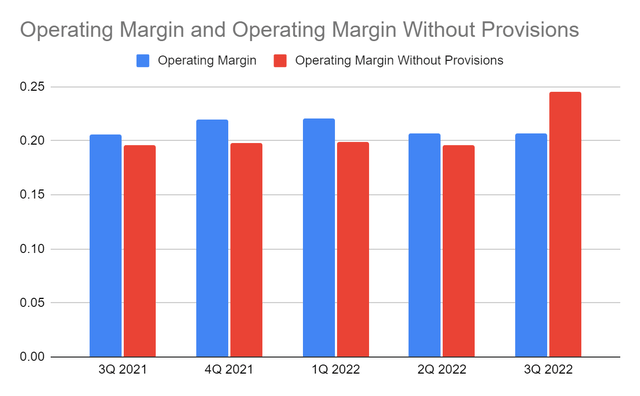

Meanwhile, the operating margin is almost unchanged. It can be attributed to the increase in labor expenses. The operating capacity is increasing in line with the increase in employees. Another factor that affects the operating margin is provisions. Even so, the actual operating income is an uptrend. If we disregard provisions, the operating margin will be higher at 25% vs 20% in 3Q 2021.

Operating Margin (MarketWatch)

Operating Margin (MarketWatch)

In the second half, I expect its sustained rebound. I adhere to my projection in my previous article. The quality of its portfolio, especially loans may drive its continued growth. Both loans and deposits are increasing, showing the demand for its products and services. Its efforts and strategies may pay off as TFSL remains sensitive to interest rate changes. Higher interest rates may entice more deposits and investments.

TFS Financial Corporation is a durable company in a challenging market landscape. Its viability and stability are evident despite inflationary pressures. Even better, the quality of its earning assets is impressive, which yields more returns. Loans have been expanding due to increased borrowers, interest rates, and mortgage rates. This quarter, their yield is 2.95% vs 2.83% in the previous quarter. Also, 48% of loans are using fixed rates, making them stable amidst interest and mortgage rate changes. Meanwhile, its-bearing liabilities yield 0.98% vs 1%. The decrease may be the reason for lower interest expenses. It is proof that its interest-sensitive assets are yielding more returns in a high-interest environment.

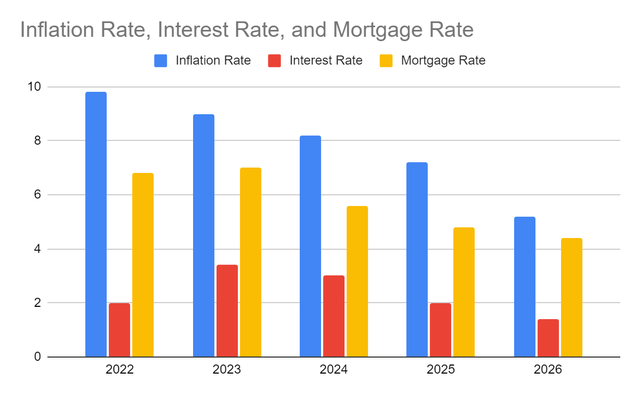

Now, the inflation rate is 8.5%, a lull from 9.1% in June. But, the pent-up demand, slow improvement in port congestion, and geopolitical unrest in Europe may cause more changes in the market. As such, I project the inflation rate to peak at 9.6-9.8%. Meanwhile, the interest rate is about to exceed the initial estimation. Last month, the Fed raised the Fed Funds Rate by 75 basis points. That is why borrowers and lenders must watch out for interest rate hikes. Likewise, the mortgage rate is skyrocketing at 5.7%, which is already higher than the initial estimation of 5.1-5.3%. So, it may not be a surprise if the interest and mortgage rate increase to 3-3.4% and 6.8-7%.

Inflation Rate, Interest Rate, and Mortgage Rate (MarketWatch)

Inflation Rate, Interest Rate, and Mortgage Rate (MarketWatch)

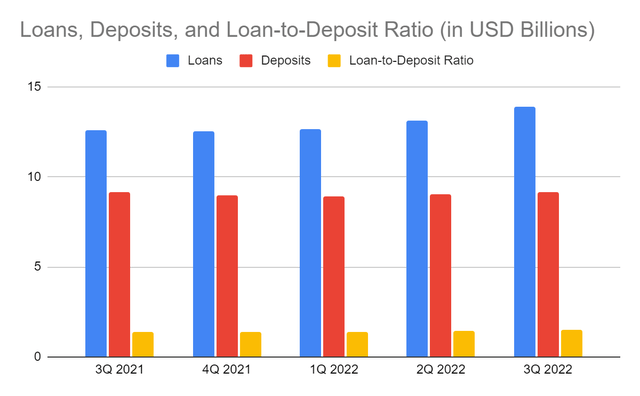

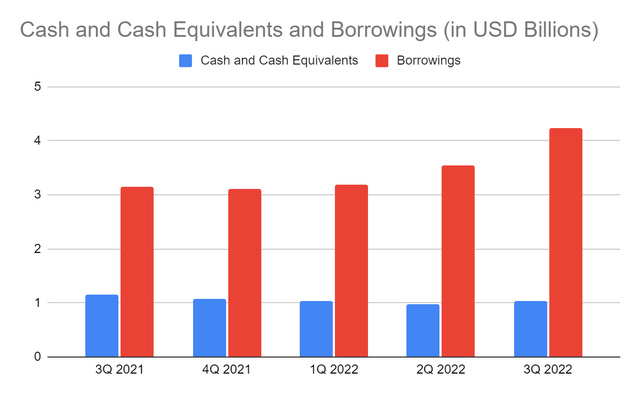

It may be a good opportunity to maintain its current interest-sensitive portfolio. That is why the increase in loans leads to increased returns. Yet, it must be more careful since loans, particularly mortgage loans, comprise 90% of total assets. Also, the loan-to-deposit ratio continues to increase from 138% to 152%. Although it may drive an increase in interest income, it increases the risk in operations. Excessive loans mean lower reserves in case of defaults or delinquencies. Another thing to consider is the lower percentage of cash and investments to borrowings at 24%.

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

Cash and Cash Equivalents and Borrowings (MarketWatch)

Cash and Cash Equivalents and Borrowings (MarketWatch)

Fortunately, the quality of TFS Financial’s loans is impressive. Its loans have a 2.95% yield with only 0.10% average delinquency. Also, almost half of loans are fixed so they are more stable. Note that its loans are backed by collateral although the fair value of assets may either be higher or lower. Many of its loans will also mature this year, which may yield by 3-3.4%. Likewise, its investment securities realize more yields, making its portfolio more durable. Cash levels are increasing as returns increase. Meanwhile, 57% of its borrowings will mature in at least thirteen months. So, it has more time and means to cover them. The economy may stabilize in the following years, making its growth prospects more enticing.

The stock price has been in an uptrend in the last month although it has had a slight decline in the last two weeks. At $14.82, it is still 15% lower than the starting price, but it has already increased by 8% from my previous article. It appears expensive as shown by the P/E Ratio. But note that over 80% of the shares are owned by MHC. If we divide the net income by the true common shares, the EPS TTM will increase from $0.24 to $1.16. So, the P/E Ratio will be 12.76. Likewise, the PTBV Ratio will be as low as 0.44 if we use the true common shares to compute the BVPS.

Even better, the company remains consistent with its dividend payments with a yield of 7.64%. It is far higher than that of the S&P 600 components at 2.06% and the NASDAQ composite at 1.51%. Also, the dividend payout ratio is 94% compared to 96% in my previous article. So, the company is still earning enough to cover dividends. We may assess the stock price better using the discounted cash flow (“DCF”) Model.

DCF Model

FCFF $124,200,000

Cash $29,995,000

Outstanding Borrowings $1,830,200,000

Perpetual Growth Rate 4.8%

WACC 9%

Common Shares Outstanding 53,463,609

Stock Price $14.82

Derived Value $19.72

The derived value proves the undervaluation of the stock price. There may be a 33% upside in the next 12-18 months. It is already higher than in my previous estimation, given the improvement in its fundamentals. I did not use the Dividend Discount Model since quarterly dividends are still the same. The derived value will still be $17.29, so, the stock price is still undervalued.

The TFS Financial Corporation remains secure and stable in a stormy market. But, it still has to be careful with its liquidity. Despite this, it continues to exude prudent portfolio management with solid asset quality. It is no surprise that it remains bold with its loan and deposit management. It generates more yields in a high-interest environment with its loans and investment securities. So, growth prospects are optimistic, which may produce more returns once interest rates stabilize. The recommendation is that TFS Financial Corporation is still a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.