Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Motley Fool Issues Rare “All In” Buy Alert

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

The market’s decline has knocked many investors for a loop so far in 2022. If there’s an upside to a down market, it’s that companies that pay their investors a dividend generally do so based on their ability to generate cash, not on the price of their shares. That means that when dividend stocks fall, there’s a good chance they’ll simply be offering their investors that much better of a yield as they wait for a potential recovery in share price.

With that in mind, three experienced investors each selected a beaten-down dividend stock that they expect has a decent chance at bouncing back. They picked AT&T (T -1.11%), Domino’s Pizza (DPZ -4.10%), and Broadmark Realty Capital (BRMK -1.98%). Read on to find out why and decide for yourself whether it’s worth your while to wait for any potential stock recovery.

Image source: Getty Images.

Eric Volkman (AT&T): AT&T is having a bummer of a summer. In mid-July it reported its second-quarter results, in which it cut its free cash flow (FCF) guidance. Since free cash flow is the wellspring from which flow dividend payments, this was alarming to the many income investors who hold the stock. Or held it, anyway, before the subsequent post-earnings sell-off.

I think those folks are overreacting, and I believe AT&T’s price slump provides an excellent chance to snap up this high-yield dividend stock at a discount. It’s now yielding nearly 6.2%, giving it the edge over eternal rival Verizon Communications with its 5.8%.

AT&T and Verizon have been perennial dividend-lover favorites because they are monster cash generators. After all, their customer bases consist of millions of post-paid (i.e., contract) customers who pay them on a regular basis. This also gives the two companies plenty of scope to borrow huge amounts of dosh from lenders eager to loan to big enterprises with torrents of recurring revenue.

Since cash is always a concern for investors, particularly those who hold AT&T, it can be worrying when the guidance for it is cut. I think, however, that the company’s chop (to an estimated $14 billion for 2022, down from the previous guidance of $16 billion) might be overly cautious.

After all, the telecom giant is still growing very healthily where it counts. In that recent earnings release, it revealed its post-paid customer net additions totaled around 813,000 — the best second-quarter figure in over 10 years.

Meanwhile, high-speed fiber internet service notched roughly 316,000 “adds,” for a steep 28% year-over-year increase. That motor of growth powered AT&T’s overall broadband revenue nearly 6% higher, and there’s plenty of scope for more in this ever-bandwidth-hungry world. Also, the company is doing a good job paying down its mountain of debt, and its core mobile business should continue to see a boost with the spread of 5G technology.

So growth is on the line for AT&T, as is the continued distribution of that attractive high-yield dividend.

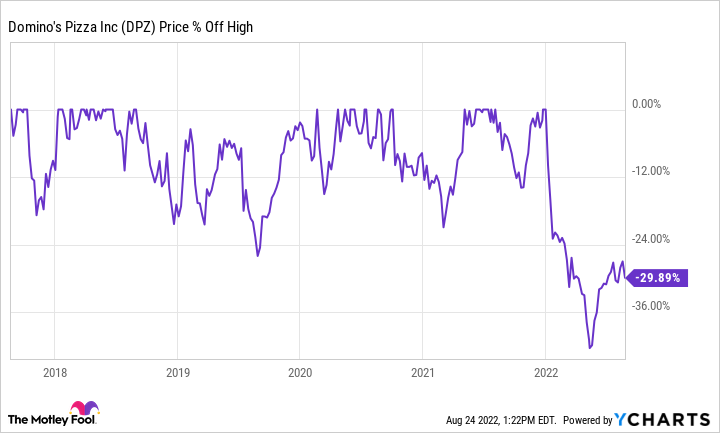

Parkev Tatevosian (Domino’s Pizza): Domino’s Pizza has hit a rough patch ever since the economic reopening gained momentum in 2021. The international pizza company thrived at the pandemic’s onset when governments restricted in-person dining at restaurants. Sales growth more than doubled to 13.8% in 2020 from 5.4% in 2019. That said, now that people have more options on where they can eat when they choose not to cook, Domino’s is falling in priority.

DPZ data by YCharts

As a result, the stock is 30% off its high. Still, Domino’s success did not start at the pandemic’s onset. Indeed, over the last decade, the company has grown revenue at a compound annual rate of 10.2%. At the same time, it grew earnings per share at a compound annual rate of 23%. Those are impressive figures for a business in the restaurant industry, which is not known for explosive growth.

Those profits were sufficient to increase Domino’s dividend nearly fivefold from $0.80 in 2013 to $3.76 in 2021. Admittedly, Domino’s will be pressured in the near term as consumers unleash pent-up demand for away-from-home dining experiences. However, investors can reasonably expect Domino’s to return to its long-run average growth rates in revenue and earnings. Domino’s share price could jump in response if or when that happens. Investors would be prudent to buy Domino’s stock before that happens.

Chuck Saletta (Broadmark Realty Capital): Within about the past year, hard-money lender Broadmark Realty Capital traded as high as $10.72 per share. Its recent price of $6.95 per share is a whopping 35% below that level, which certainly qualifies the company’s shares as beaten down.

Despite that decline in stock price, the company has diligently maintained its $0.07-per-share monthly dividend, giving it a current annualized yield around 12%. That’s a fairly hefty yield, indicative of both the fact that the company is in the money lending business and that it is structured as a real estate investment trust (REIT). Because of that structure, it must pay out at least 90% of its earnings as a dividend. That mandate pretty much assures a fairly decent dividend as long as the company remains profitable.

As a hard-money lender, Broadmark Realty Capital often issues tougher-to-place loans like construction and bridge loans, especially ones where the borrower needs fairly quick access to the money. That may seem risky as the economy teeters around recession territory, but the company prides itself on being principled with its lending standards.

For instance, its weighted average loan-to-value ratio is around 60%. In other words, for every $60 it loans on average, the property securing that loan is generally worth around $100. That’s a stronger equity position than the typical 80% loan-to-value needed to get the best rates on a conventional mortgage. That means it has a very good chance of recovering the money it loaned out if it has to foreclose on a property because the borrower defaulted on the debt.

While it’s not a guarantee that the company will make it through a recession unscathed, it does provide a decent reason to believe it can survive a downturn and emerge stronger on the other side. Backing up that operational discipline is the company’s balance sheet, with a very modest debt-to-equity ratio below 0.1. That adds to the company’s resiliency to weather an economic storm and provides hope that its shares could very well rebound once the overall economic future looks brighter.

Regardless of whether you choose AT&T, Domino’s Pizza, or Broadmark Realty Capital, each of these stocks offers you a decent combination of current income, a reason to believe that income can continue, and a potential path to a stock recovery. There are few better ways to invest than to get paid while you wait for a market recovery. If you decide to invest in any of these companies, remember that you must be an owner before the ex-dividend date in order to receive the company’s next dividend.

Chuck Saletta has positions in Broadmark Realty Capital Inc. Eric Volkman has no position in any of the stocks mentioned. Parkev Tatevosian has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Domino’s Pizza. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

*Average returns of all recommendations since inception. Cost basis and return based on previous market day close.

Market-beating stocks from our award-winning analyst team.

Calculated by average return of all stock recommendations since inception of the Stock Advisor service in February of 2002. Returns as of 08/26/2022.

Discounted offers are only available to new members. Stock Advisor list price is $199 per year.

Calculated by Time-Weighted Return since 2002. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

Market data powered by Xignite.