Maksymenko Nataliia/iStock via Getty Images

Maksymenko Nataliia/iStock via Getty Images

Dow Inc. (NYSE:DOW) is coming off record free cash flow for its previous 12 months and yielding 5+% at today’s prices. The stock is down 29% year to date and is a buy for dividend investors at this price with a wide margin of safety for the dividend being covered at 3.3x by TTM free cash flow.

Dow Inc. has a portfolio of plastics, industrial intermediates, coatings, and silicones businesses, which produce science-based products and solutions for its diverse customer base, such as packaging, infrastructure, and consumer care. In 2021, 36% of DOW’s sales were to customers in the U.S. and Canada; 36% in Europe, the Middle East, Africa, and India (EMEAI); and 28% in the Asia Pacific and Latin America.

The specialty chemical company is a member of the DJIA and one of the index’s highest yielders. Dow Inc. is a 2018 spin-off from DuPont (DD), which itself was a dividend aristocrat whose dividends have been paid for 100 years. The stock has been trading in a narrowband since the spin-off occurred in 2018 with the price only around $3 more per share than its inception.

The bear case, for the time being, is that Dow Inc. will have higher input and energy costs with their main feedstock being petroleum byproducts. I would argue that this case is way overblown and that these headwinds are nothing new, high oil prices have been here for over a year and Dow Inc. is still performing very well. As with all spin-offs, a large amount of debt is unloaded onto the balance sheet of the smaller company, with this case being no different. With that being said, Dow Inc. was able to reduce some of that debt because of the strong free cash flow in 2021, reducing its overall debt by $2.4 Billion.

Westlake (WLK) and LyondellBasell (LYB) are Dow Inc.’s largest competitors, with Dow Inc. taking the cake for the largest market cap at $36 Billion. Gross profit margin wise, Dow Inc. is behind the industry standard at 18.9% vs 30.7%; however, their net profit margin edges out the industry at 11.42% vs 9% for the specialty chemicals industry.

We can see from the margins that Dow Inc. might not have the lowest cost of feedstock on the gross margin end, but a very well-oiled machine on the back end with their operating margins at 14% (industry avg. is 10.6%) and better than average aforementioned net margins. This is certainly a result of being the one specialty chemical company that has its roots from a blue chip operation in DuPont, whenever I look to put my money to work in a sector, I always try to choose the most efficient operator. I believe Dow Inc. is the sole blue chip in this sector and my favorite of the bunch.

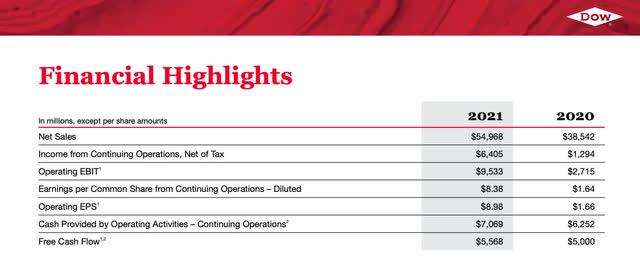

Dow 2021 performance (Dow 2021 Annual Report)

Dow 2021 performance (Dow 2021 Annual Report)

The very nature of the specialty chemicals industry is cyclical, with periods of both over and under-supply. Growth in almost every category is apparent from 2020-2021, with Dow Inc. crushing it in all key financial metrics. Companies that can handle their supply chain efficiently will end up being the top leaders in the industry. Analysts have been recommending to underweight this industry due to said headwinds and exposure to Europe, where energy prices are surging. Whereas a company like BASF (OTCQX:BASFY) has had to shut down some plants altogether in Germany due to energy costs, Dow has 214 plants in 37 countries. The wide diversification of plants in other countries gives Dow Inc. a competitive advantage in switching between plant output directives that will help it to make up for lost margins in European plants. Shipping costs will increase and hurt margins to an extent if Dow is forced to source more and more products to Europe and other high-cost energy countries as the inflationary environment is prolonged, but at least they have the option where others don’t.

If we compare this stock to a couple of its sector peers, we can see similar price-to-earnings ratios. Westlake Corporation is trading at 4.3x earnings with a yield of 1.48% and Lyondell at 4.91x with a yield of 5.81%. BASF would be another competitor, but I chose to leave them out as they are going through operational issues in Germany due to energy costs. In this case, for the ratios and yield, Lyondell is the best comparison. With similar 3x dividend coverage, my main reason for choosing Dow Inc. over Lyondell would be a better debt-to-equity ratio. With Lyondell leveraged 106% of equity value, they have a higher exposure to interest rate risk than Dow Inc.

Another reason I love the stock is that it shows up favorably on Joel Greenblatt’s Magic Formula screener. For those unfamiliar with Greenblatt’s definition of cheap and good, it is typically a formula based on the earnings yield plus the return on invested capital. With an earnings yield of 17% (TTM EPS of 8.77/SP of $51) and a return on invested capital of 19.6%, the total magic formula score would be a whopping 36.6, a very high score for those familiar with the screener.

The trailing price-to-earnings is at 6.11x and the price to free cash flow is only 5.5x. The forward annual dividend is slated at $1.95 billion, with their trailing 12 months of free cash flow at $6.38 billion. This results in a payout ratio of only 30% of free cash flow, a very juicy ratio for the buy and hold dividend compounder. If we simply divide the TTM free cash flow of $6.38 billion by the forward annual dividend of USD 1.91 billion, we find ourselves with a dividend coverage of 3.3x if free cash flow simply remains constant.

Again, the above assumptions are optimistic, with the sentiment around the specialty chemicals sector being forward pessimistic. I remain an optimist because we can already see demand destruction taking oil down with very little assistance from rising interest rates. Jerome Powell remains vigilant to fight inflation as per his recent meeting in Jackson Hole, this policy could bode very well for companies whose primary cost of goods sold has to do with energy and commodities as the Federal Funds rate is still close to historic lows.

The next exercise I love to do is a 5-year compound dividend calculation. I’m going to assume that this stock eventually trades for a modest 10x earnings at some point during these next 5 years, which would at today’s prices be equivalent to an $87 stock, or a 70% upside if earnings remain flat over this period giving us an annual return of 14% on the upside.

A $1,000 investment after 5 years assuming that the dividend increases 6% per year and is reinvested would give us an ending balance of $2,248, total dividends received during this period at $261, and a total return of 124%. The average combined annual return would be 24.96%. Rarely do we see both a good value and a company with solid potential to increase dividends over a long period sitting in our lap. I love compounding dividends as one of my sole sources of long-term alpha, if you’ve never seen the infographic of the return on an S&P 500 index fund with and without dividends reinvested, it is truly a sight to behold.

For this reason, I switch to a dividend and dividend growth strategy whenever I see the market as overvalued. If I’m under the assumption that prices will fall in the short to medium term, the dividend is my backstop to help me accumulate more shares at lower prices. After the bottom is in, and I view the market as having more long-term upside, I tend to switch back to blue chip growth strategies focusing on 5-year forward PEG ratios under 1.

Good financial performance may not be enough to elevate any stock that relies heavily on raw commodity materials, especially petroleum-based ones, until oil prices come down. A deal or truce with Russia and Ukraine that opens some avenues to a more global supply of oil could be a catalyst that would potentially have analysts re-rating the stock quickly and its peers that have all been downgraded recently.

The Fed’s continuation to raise rates could also put income-producing stocks like Dow Inc. at the forefront of several investors’ radars. They will be looking for some guaranteed dividend and interest payments as long-duration stocks, such as those in the Nasdaq, could continue to lose favor to short-duration stocks, basically those with low vs high multiples of earnings and cash flow. This stock is already on my radar and in my portfolio as I am not playing the growth game for the foreseeable future.

This, in my opinion, is not an industry-specific risk but a risk to every stock that is not a fully integrated oil company. For this reason, in every sector besides energy and mining, I’m looking to own only the highest quality names. The highest quality operators know how to pull all the levers and keep a strong balance sheet. While the total debt-to-equity ratio for Dow Inc. is at 77%, the company has shown that debt reduction is a priority, and they have a very healthy margin between their earnings and the dividend payment that they can use to pay down debt and reinvest in their business. Being that the company was a spin-off, they are doing an excellent job of managing the debt and increasing free cash flow to deal with the cards they were given by DuPont.

With all the above considered, there are a few other cheap candidates with a price-to-earnings ratio sub 10 in the DJIA. Walgreens (WBA) and Intel (INTC) come to mind, but I would argue that none has as strong of overall fundamentals as Dow Inc., with Dow having a lower debt-to-equity ratio than Walgreens and have not had a huge earnings flop like Intel did earlier this year. Whilst I own both of those other names I mentioned as well, being a DJIA self-indexer, I’m more overweighted Dow Inc. due to both its excellent fundamentals and second-highest yield in the DJIA index.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DOW, INTC, WLK, WBA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author owns Dow inc. and is long the stock only.