Dzmitry Dzemidovich

Dzmitry Dzemidovich

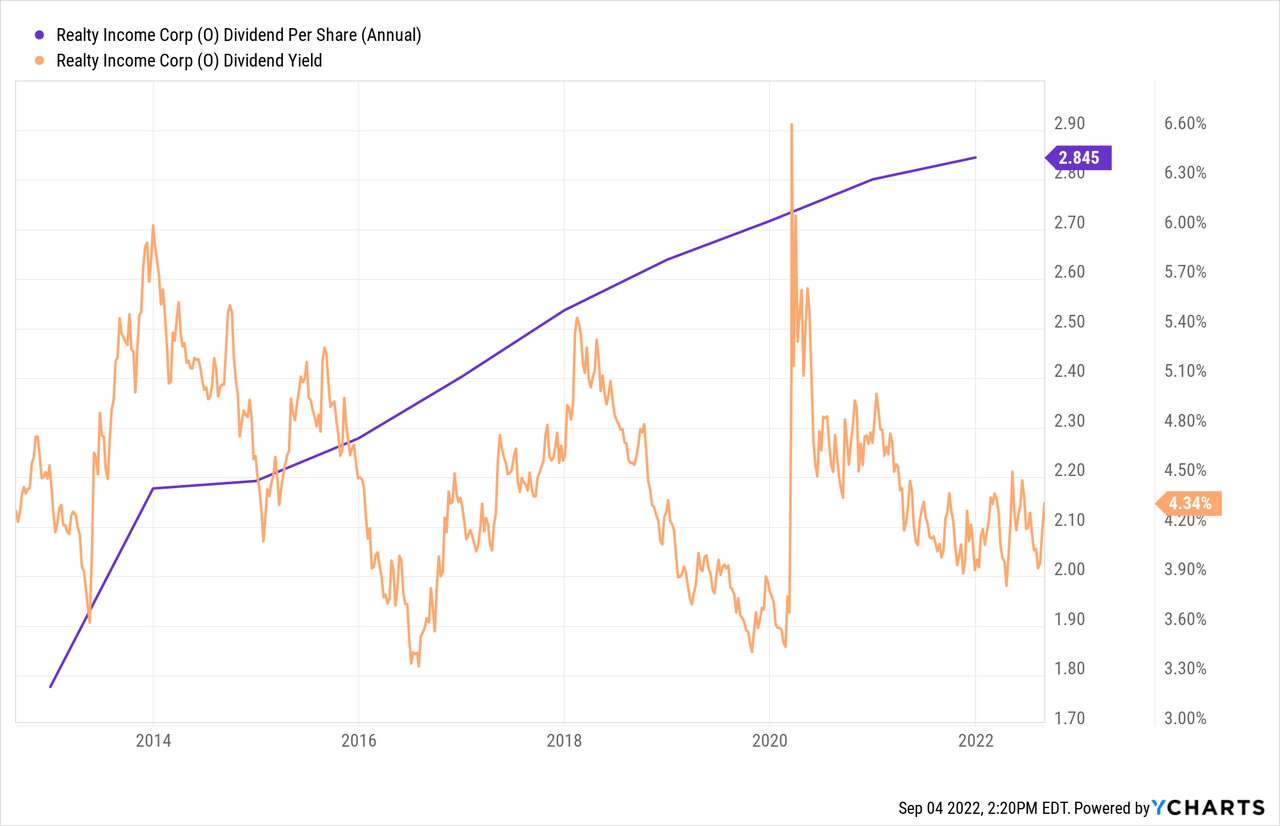

This is your second chance to purchase Realty Income Corporation (NYSE:O) stock and its highly secure 4.34% dividend yield.

Realty Income experienced some stock price weakness in late August, which I believe is due to growing uncertainty about the short-term path of interest rates, as well as profit-taking following an increase in the stock’s price in July and the first half of August.

Realty Income, in my opinion, is an exceptionally well-managed real estate investment trust with impressive portfolio metrics. Given Realty Income’s low pay-out ratio, the trust provides an extremely well-covered dividend yield while investors can profit from the recent stock price drop.

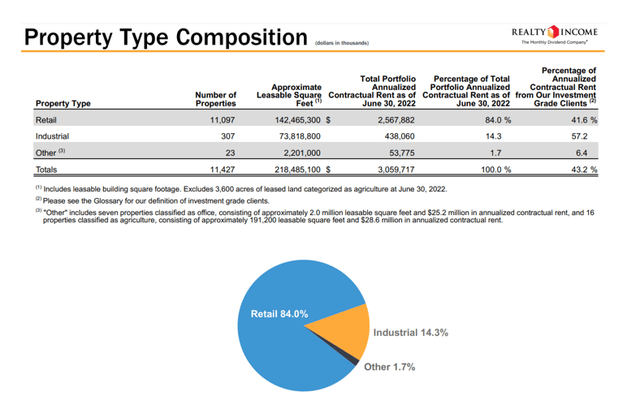

Realty Income is a first-rate net-lease REIT whose core strength is its large and diverse real estate portfolio. The trust has developed a focus on the retail sector, which accounts for 84% of its annualized contractual rent and includes 11,097 out of a total of 11,427 properties.

In addition to retail cash flows, the industrial portion of Realty Income’s property base accounts for approximately 14% of the trust’s rental income.

As of June 30, 2022, the portfolio contained 218 million leasable square feet and generated approximately 3.1 billion in annualized contractual rent. The trust rents its (mostly) retail properties to tenants on long-term leases, with a weighted average remaining lease term of 8.8 years as of June 30, 2022.

Property Type Composition (Realty Income)

Property Type Composition (Realty Income)

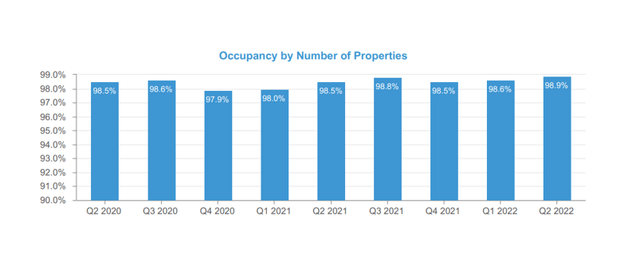

The trust’s occupancy rate improved by 0.3 percentage points in the second quarter, indicating that Realty Income’s real estate portfolio is well-managed. As of June 30, 2022, the trust’s portfolio was leased at a 98.9% occupancy rate, indicating that the trust has very high asset utilization.

Occupancy By Number Of Properties (Realty Income)

Occupancy By Number Of Properties (Realty Income)

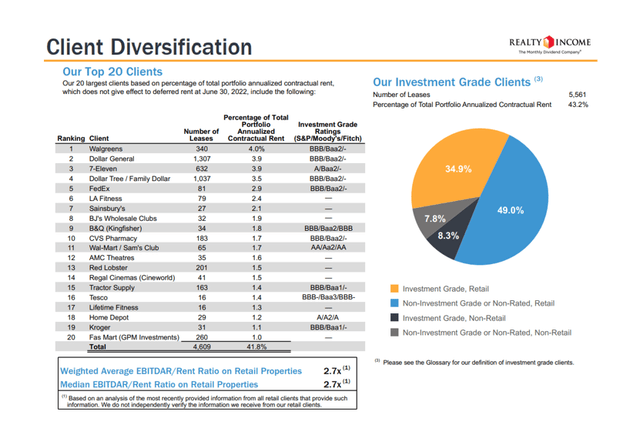

Realty Income’s portfolio is also well-diversified, with Walgreens (WBA) accounting for only 4% of the trust’s annualized contractual rent. Realty Income has a high degree of diversification, which is a protective measure to ensure cash flow stability.

Client Diversification (Realty Income)

Client Diversification (Realty Income)

Stock prices have dropped after Jerome Powell recently warned of more pain due to rising interest rates, which are expected to cool the U.S. economy.

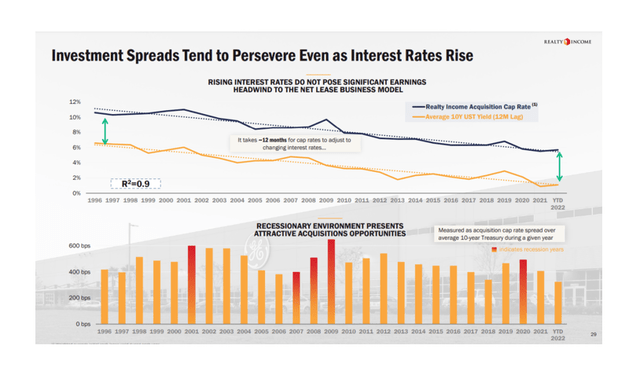

Higher interest rates, however, are not as serious a threat to Realty Income’s business as one might believe.

Higher interest rates pose a risk to Realty Income’s short-term borrowing costs to some extent, but investment spreads, which serve as an indicator of cash flow stability, have remained relatively stable over the last two decades.

Furthermore, recessionary periods have historically been favorable for the trust to purchase properties at reduced prices.

Rising Interest Rates (Realty Income)

Rising Interest Rates (Realty Income)

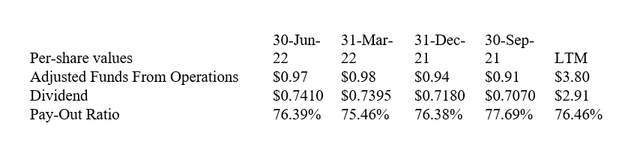

Realty Income’s dividend coverage is outstanding. The REIT has consistently produced a pay-out ratio in the mid-to-high 70% range, indicating that the dividend is extremely well-covered.

Realty Income generated $0.97 per share in adjusted funds from operations from its real estate portfolio in 2Q-22, but paid out only $0.7410 per share cumulatively, resulting in a pay-out ratio of 76%.

Pay-Out Ratio (Author Created Table Using Trust Information)

Pay-Out Ratio (Author Created Table Using Trust Information)

The trust currently pays a monthly dividend of $0.2475 per share, which equates to a 4.34% dividend yield based on a stock price of $68.45.

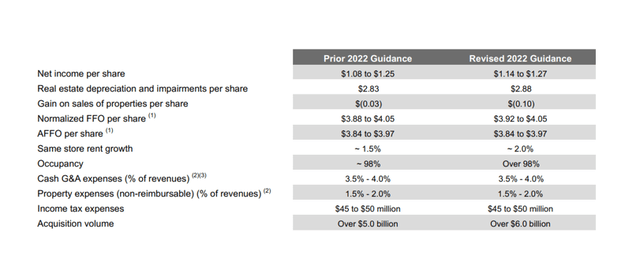

Realty Income’s 2022 adjusted funds from operations guidance remained unchanged in the second quarter. This year, the real estate investment trust expects to earn $3.84 to $3.97 per share in adjusted funds from operations. The trust did, however, raise its acquisition volume guidance from $5.0 billion to $6.0 billion.

AFFO (Realty Income)

AFFO (Realty Income)

The trust’s AFFO multiple is 17.5x based on adjusted funds from operations. In August, Realty Income’s shares demanded a 19.2x AFFO multiple from investors.

Realty Income’s stock has a moderately low valuation in my opinion, given the very high-quality nature of its dividend and adjusted funds from operations, which are supported by strong portfolio fundamentals.

Realty Income’s stock has recently entered a downtrend, owing to growing market uncertainty about the timing of interest rate hikes.

However, higher interest rates have no negative impact on Realty Income’s real estate business. What could become a (manageable) issue for the real estate investment trust is a correction in the commercial property market, which could cause the trust’s tenants to reduce their retail footprint.

This is your second opportunity since June to purchase Realty Income’s extremely safe monthly dividend at a 4.34% yield.

Because of the consistency of its AFFO results over time, as well as the very low pay-out ratio, I have a very positive view on the real estate investment trust.

The impact of interest rates on Realty Income’s business may also be misunderstood, as higher rates may give well-funded real estate investment trusts with a track record of opportunistic acquisitions an advantage.

Aside from the yield, I consider the AFFO valuation and the stability that an investment in Realty Income provide reasons to purchase the dividend stock.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.