z1b

z1b

Everyone has their own definition of a blue-chip stock.

Some investors classify companies as blue chips simply based on their size. Others only look at their past track record. And some only consider the risk of the underlying business.

My definition of a blue-chip stock is one that enjoys some of the following characteristics:

Put simply, a blue chip is a high-quality business that has done well in the past and is expected to keep producing strong results in the long run.

Good examples would include companies like Walmart (WMT) or Procter & Gamble (PG).

Typically, such companies trade at expensive valuations and low yields because they are in high demand among investors.

But following the recent market dip, a few blue-chip dividend stocks have become unusually cheap and now offer yields exceeding 6% in some cases. Such opportunities are particularly many in the real estate sector because it is currently out of favor.

At High Yield Landlord, we specialize in listed real estate investments, and we have rarely seen so many blue-chips trade at such high valuations and in what follows, we highlight two such opportunities that we are accumulating:

Residential real estate is typically considered to be a defensive investment because everybody needs a roof over their head whether the economy is doing well or not. It is also something that you cannot easily substitute with technology and a property that’s well-located has always gained value over the long run.

For this reason, residential properties typically sell at low cap rates, and the real estate investment trusts (“REITs”) that own them also priced at low yields.

Some popular names in the U.S. include Mid-America (MAA), Equity Residential (EQR), and Independence Realty (IRT). They all yield right around 2-3%.

Mid-America

Mid-America

But one of these companies is currently yielding 6.5%, and against all odds, it is actually one of the biggest and best-respected companies in this space:

Vonovia.

Vonovia is the biggest landlord in Europe, with a portfolio of ~€100 billion worth of properties, mainly located in Germany.

The company has all the characteristics of a blue-chip:

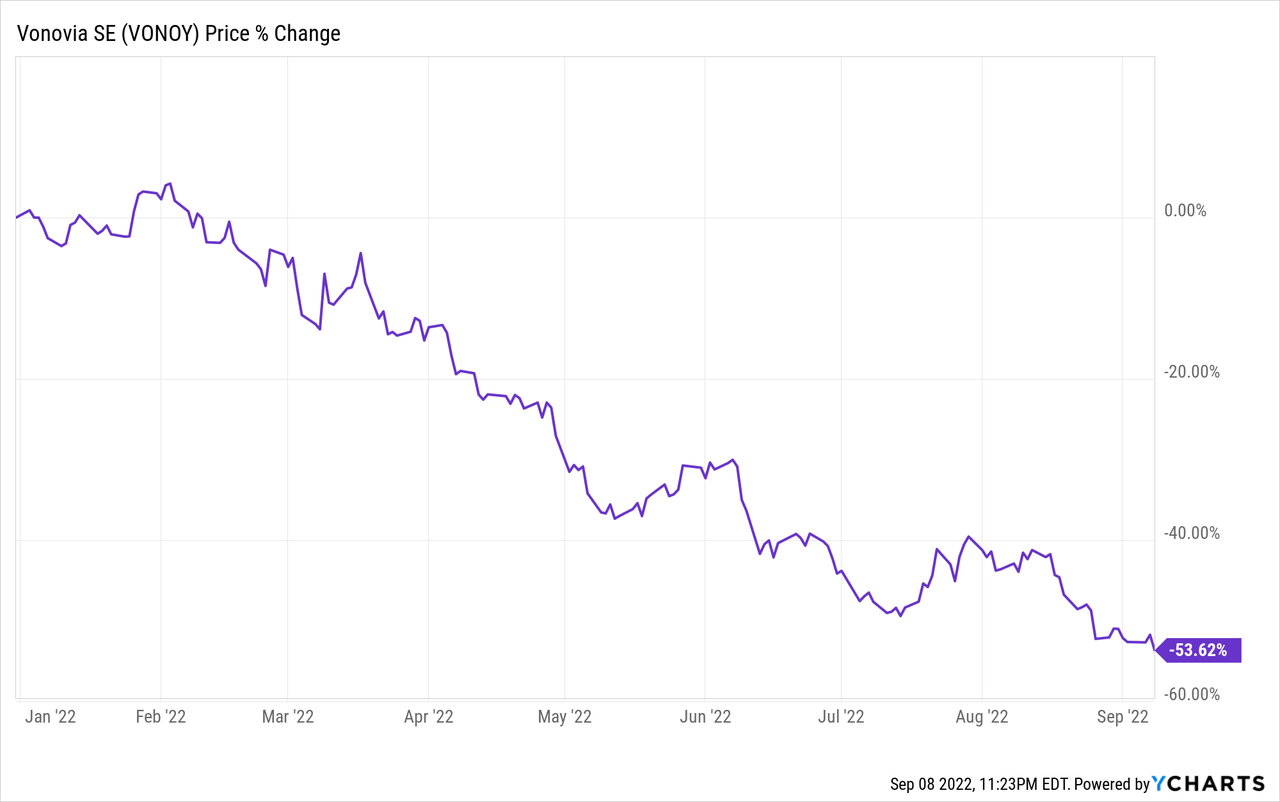

But despite that, the share price of the company has collapsed over the past year, dropping by 50% and as a result, it is now priced at an exceptionally low valuation.

Historically, Vonovia has been priced at a small premium to NAV and a low 2-3% yield most of the time.

But currently, it is priced at a 55% discount relative to the value of its assets and it pays a 6.5% dividend yield – which is the lowest valuation in the company’s history.

The market has priced it at such an exceptionally low valuation because of fears that the rising interest rates and the energy crisis in Germany will significantly harm its business.

But we just don’t see it.

Sure, those are significant near-term issues, but their long-term implications are not actually that significant.

Vonovia has a strong BBB+ rated balance sheet with a 43% LTV and well-staggered debt maturities. Only about 10% of its debt matures yearly, and Vonovia has enough cash from its retained income (73% payout ratio) and its recurring asset sale program to pay off the maturing debt. Besides, interest rates are only rising because of the high inflation, which also increases Vonovia’s rental income and the value of its assets. In the first half of the year, the company’s funds from operations (“FFO”) per share rose by another 5.5% and hit new all-time highs.

The energy crisis may seem even scarier, especially to U.S.-based investors who lack boots on the ground. But having lived in Germany for years, I am not nearly as concerned.

What most investors appear to ignore is that it is the tenants who are responsible for paying the energy bills. So the direct impact on Vonovia is not that significant. Sure, it may limit its ability to push for rent hikes in the near term since tenants can only afford so much, but it is not going to suddenly kill Vonovia’s profitability as its share price makes it seem to be. Vonovia’s properties are also more energy efficient than average and its rents are affordable and below market, which should provide further margin of safety.

Lastly, rent delinquencies were very low even during the worst of the pandemic. People in Germany are more conservative with their finances, have better savings, less credit, and are less likely to skip rent payments than in the U.S. It is also a cultural thing.

So at most, this is a temporary crisis that will hurt Vonovia’s growth in the near term, but eventually, things will get worked out, and its long-term prospects won’t be affected by this.

Now, you have the opportunity of a lifetime to buy Europe’s biggest and bluest blue-chip landlord at a hugely discounted valuation. We are buying it hand over fist at High Yield Landlord.

Historically, Berkshire Hathaway’s (BRK.A, BRK.B) biggest REIT investment has been a REIT called STORE Capital. Apparently, it is Warren Buffett himself that made the investment years ago.

In case you aren’t familiar with STOR, it is one of the leading net lease REITs. It owns mainly single-tenant service-oriented properties such as KFC fast food restaurants (YUM), car washes, pharmacies, and other recession and e-commerce-resistant properties:

Net Lease Advisor

Net Lease Advisor

STOR generates steady rental income from 15+ year leases with no landlord responsibilities and the company’s cash flow grows via contractual rent hikes and new property acquisitions, which are made at large spreads over its cost of capital. It is typically seen as a blue-chip because it has a solid BBB-rated balance sheet and one of the best track records and reputations in its sector.

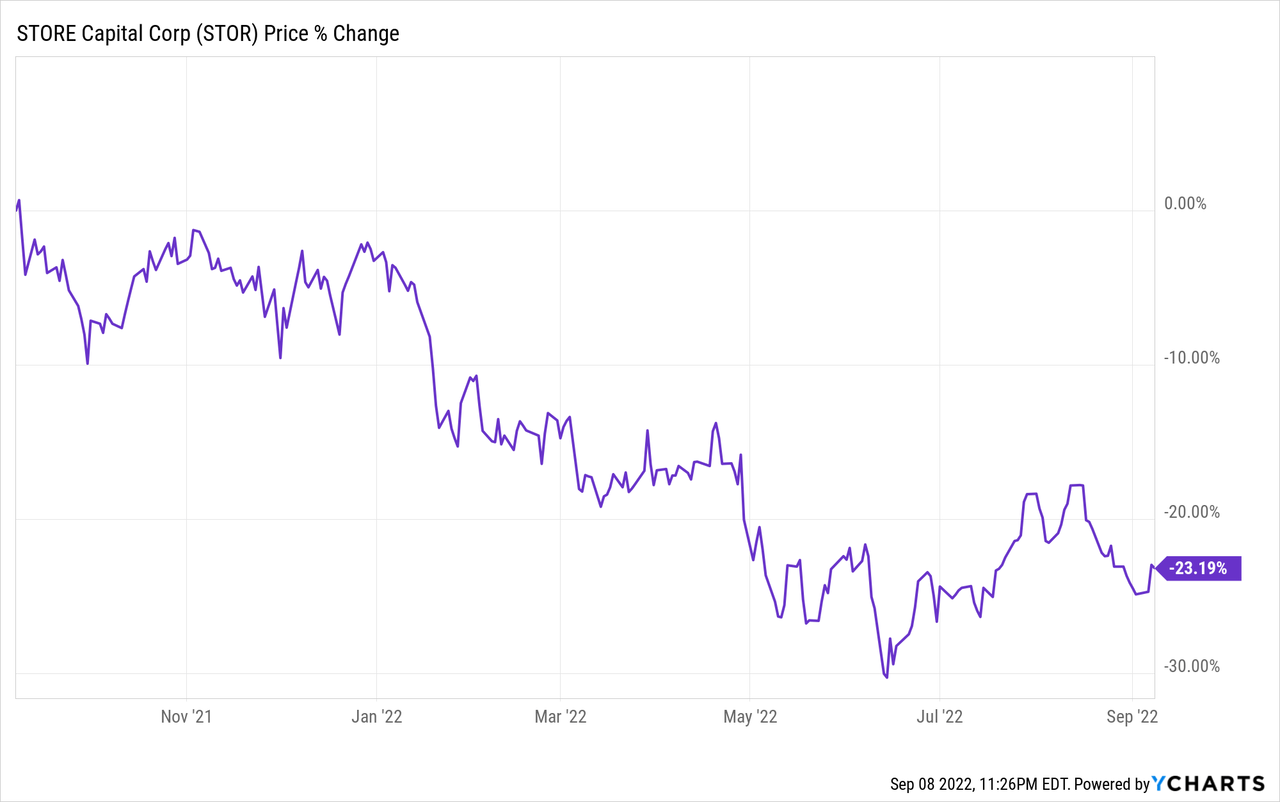

But recently, Berkshire decided to exit its stake in STORE, and that has caused its share price to underperform. Many investors took this as a red flag, thinking that if Berkshire is exiting, then perhaps they should exit as well.

But the reality is that STORE was a rather small holding for Berkshire and it seems like they had mainly invested due to the company’s former CEO Chris Volk. When he left, they decided to sell as well. It is as simple as that.

So we don’t see it as a red flag.

On the contrary, we see it as an opportunity to buy more shares at a historically low valuation. Fundamentally, STORE is doing better than average with record cash flow generation and dividend payments.

It is expected to grow its AFFO per share by ~10% in 2022, which is far more than its historic average, and yet, it’s current FFO multiple is far below its historic average at just 12x.

Its dividend yield is now also 6%, which is a lot higher than its historic average. The dividend is set to grow at 5%+ per year and it is secured with a low 74% payout ratio.

We expect investors to earn a 12-15% annual returns from the yield and growth alone. And as investors move past Berkshire’s recent decision to exit its position, we also expect STORE to rerate at closer to 18x FFO, unlocking 50% upside to patient shareholders. 12x FFO is simply too cheap for a blue-chip that’s doing so well.

Vonovia and STORE Capital are two examples of blue chips in the listed real estate sector that are currently undervalued.

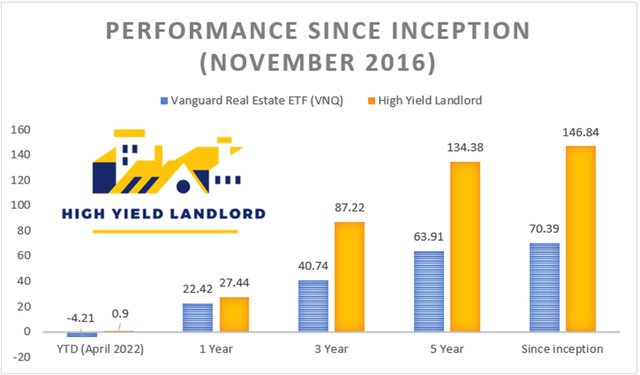

They are doing better than ever but their market sentiment has taken a big hit in 2022. The last time these companies were so cheap was in early 2020 and we doubled our money in the following year.

The best time to buy is when everyone else seems to be selling. Today is no different.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of “High Yield Landlord” – the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital – a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I/we have a beneficial long position in the shares of VNA; STOR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.