DNY59

DNY59

Historically, real estate investment trusts (“REITs”) (VNQ) have been some of the most rewarding investments of all time.

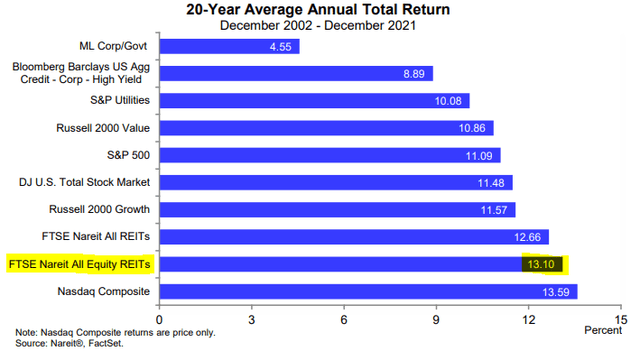

Below, you can see a comparison pitting REIT returns against those of the S&P 500 (SPY), Tech stocks (QQQ), Gold (GLD), Treasuries (IEF), and many other asset classes:

NAREIT

NAREIT

REITs earned 13% annual returns in the 20 year period ending in 2022. That’s truly phenomenal when you consider that this is coming from a relatively safe and income-rich investment.

But how many investors do you actually know who earned such high returns over the past 30-years?

I only know very few and I suspect that most REIT investors did quite a bit worse because of mistakes that hurt their performance.

I know that early into my REIT investing career I did a lot worse than that due to stupid mistakes that cost it dearly. In today’s article, I present some of these mistakes so that you don’t have to learn the hard way.

Below I list the 5 most common mistakes that will cause you to fail as a REIT investor:

This is something that I see all the time.

Investors buy a REIT. It drops in value. They regret their purchase decision. Sell and move on, thinking that REITs aren’t for them.

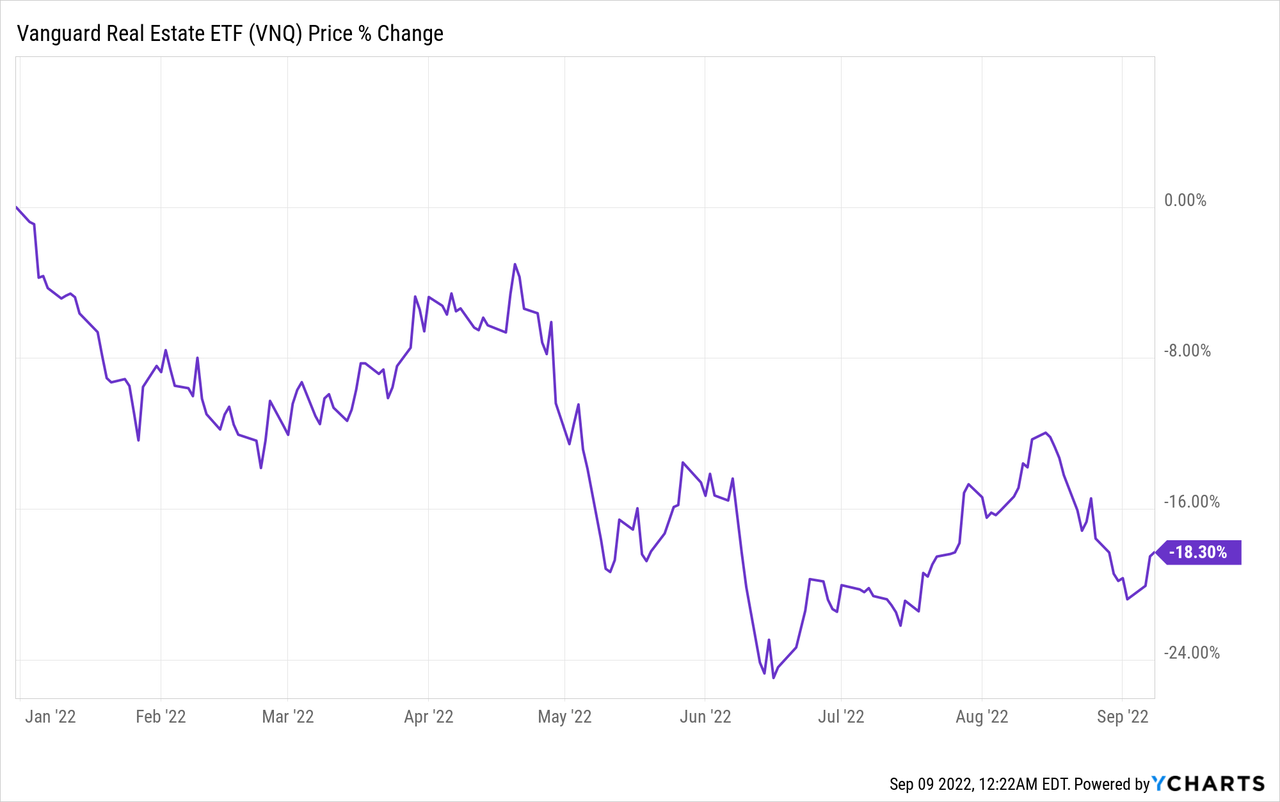

Especially today, a lot of REIT investors are losing patience following the recent dip, fearing that there could be a lot more pain ahead.

But the funny thing is that if they owned these properties in the private market and didn’t have a daily quote, they would be perfectly happy about their investment.

My advice to you: if you are going to lose sleep after a REIT or any other stock drops by 20%, then active REIT investing isn’t for you. It is impossible to time the market and even the best REIT investment opportunity can drop 20% or more without any good reason. That’s the nature of the public stock market. Prices are volatile and adjust daily to the mood of Mr. Market.

You need to accept this and stop fixating at daily quotes and charts. REITs are fantastic long-term investments, and they are even more rewarding in the periods following a market dip. But if you aren’t patient, none of this matters as you will sell at the worst possible time.

I have rewired my brain to react in the opposite way. I get happy when prices decline because this allows me to buy more shares of REITs at even better prices, which will ultimately result in even larger gains in the long run. Meanwhile, I earn dividend income, which does not change, regardless of what the market does.

Most new REIT investors are attracted to them by their high income potential. Real estate is an income investment first and foremost, and there are a number of REITs that offer mouth-watering yields of up to 10%.

But believe me when I say that I talk from experience when I say that the highest yielding REITs are typically the very worst REIT investments that you could make.

The market may at times misprice a REIT, but it rarely misprices the lowest quality REITs. The high yield is typically well-justified and the result of poor management, overleverage, and/or declining cash flow and asset values.

One of my biggest REIT investment mistakes was to invest in a REIT called CBL & Associates (CBL) five years ago. It was a mall REIT that offered a 15%+ yield! I understood that there were significant risks, but in hindsight, I greatly underestimated them and I paid the price for it.

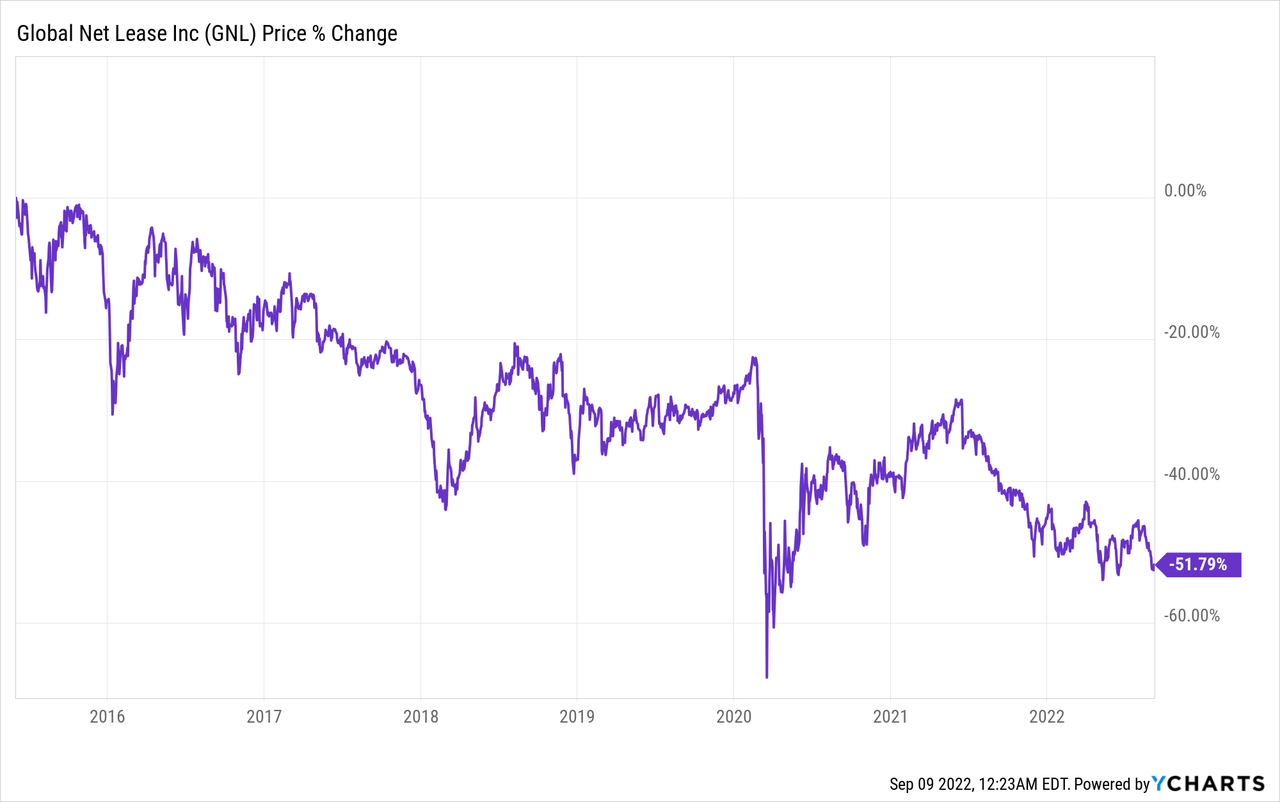

Today, a popular high yielding REIT on Seeking Alpha is Global Net Lease (GNL). It yields 10% and bulls will quickly point that the company has long leases with mainly investment grade rated tenants. But bulls have continuously downplayed the management issues and they have paid the price:

Instead of going for the highest yields, investors would do far better if they sought a healthy mix of yield, growth, and safety. This is what we do at High Yield Landlord.

To give you a good example: STORE Capital Corporation (STOR) is a high-quality REIT that’s currently undervalued. Its cash flow is rock-solid, it has a strong investment grade rated balance sheet, and its cash flow is expected to grow by 10% in 2022. Despite that, it is currently priced at just 12x FFO and offers a near 6% dividend yield.

I am nearly certain that a REIT like STOR will generate higher returns than GNL in the long run, despite offering a lower yield.

REITs remain real estate investments at the end of the day.

And each real estate sector goes through its own cycles of under and over supply.

Anticipating these multi-year cycles and investing in the right property sector at the right time is key to avoid losses and improve your returns.

To be clear, this does not mean that you should just chase what’s hot in the moment because that is typically also reflected in the valuations.

On the contrary, you should look for troubled sectors that enjoy margin of safety and present upside potential as oversupply finally turns into undersupply.

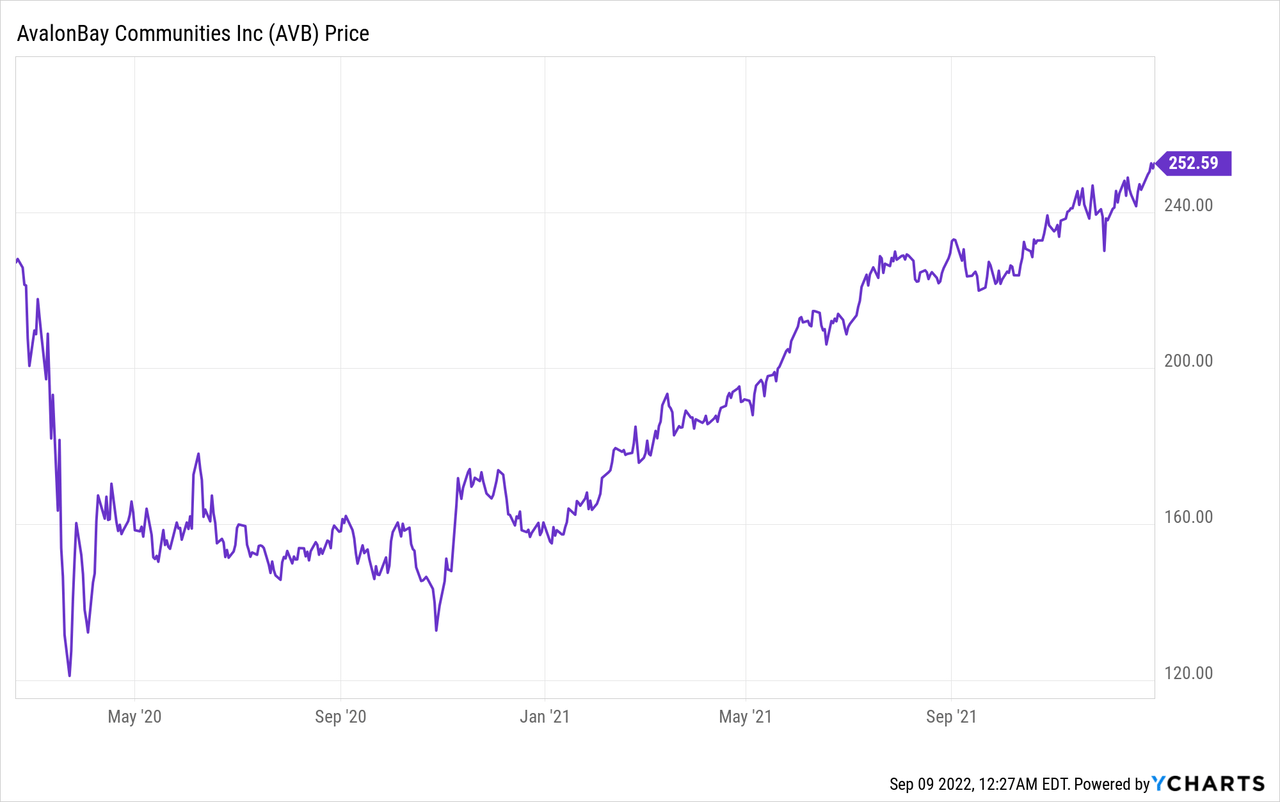

To give you an example: early into the pandemic, urban apartment REITs took a huge hit as people fled cities and the sector was suddenly overbuilt. Occupancy rates dropped and rents went missing.

A number of REITs, including AvalonBay (AVB) and Camden (CPT), temporarily traded at large discounts to their NAV, which afforded downside protection and future upside potential.

That was a great time to buy because you could easily see that the situation was temporary. It was only a panic reaction to a global pandemic. Shortly after, people returned to cities and these REITs recovered, earning large returns to their shareholders.

Meanwhile, those who bought office REITs did much worse. They also appeared cheap, but the oversupply of office will likely take far longer to work itself out. Is now a good time to buy office REITs? I am not so sure. I think that it will take at least a few years for occupancy rates to stabilize and so I am not rushing to invest just yet. There are better opportunities in other sectors at today’s prices.

The #1 factor to explain the long term returns of a REIT is the quality of its management. A REIT that’s well-managed is likely to outperform a poorly-managed REIT even if its assets are much worse.

Yet, most new REIT investors appear to spend a lot more time studying the assets than the management. Many don’t spend any time evaluating the management as they assume that all REITs are well-managed and that’s a big mistake.

There are large differences in not just quality, but also alignment, and poorly-aligned managers will always find ways to steal from shareholders to enrich themselves.

At High Yield Landlord, we conduct extensive interviews of REIT management teams to identify the best players and we are willing pay a large premium to invest with the best.

There are over 200 REITs out there in the U.S.

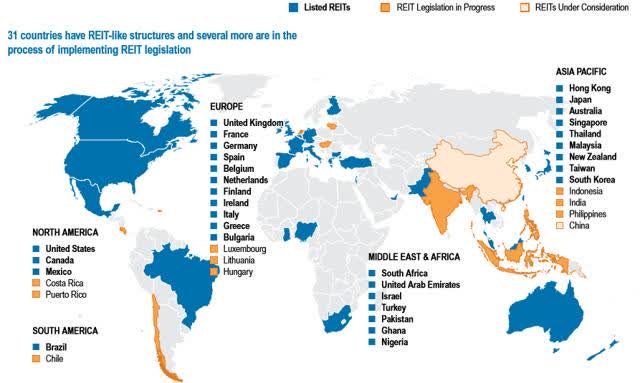

Moreover, there are also REITs in 30 other countries.

NAREIT

NAREIT

Despite that, most REIT investors only own 5-10 REITs and they may hold many REITs that provide similar exposure, so the concentration is even greater than it may first seem.

More concentration may result in higher returns, but most of the time, it actually results in lower returns for individual investors because they are not REIT specialists and end up investing too heavily in the wrong REITs at the wrong time.

Too much diversification is not good either, but a portfolio of 15-20 REITs is likely to provide higher returns than a portfolio of just 5-10 REITs in most cases. If you only own 5-10 REITs, a single mistake will ruin your performance. At High Yield Landlord, we currently hold 24 REITs in our Core Portfolio.

As you can see, REIT investing is not easy.

It can be very rewarding if done well, but it can quickly also become frustrating if you don’t know what you are doing.

Over the past 5 years, my REIT portfolio has significantly outperformed benchmarks and earned ~15% annual returns. But my first years of REIT investing weren’t as good as I was still learning the hard way.

High Yield Landlord recently broke the 2500-member mark! Our prices will increase soon but all members who sign up now are grandfathered for life at today’s discounted rate!

If you are still sitting on the sidelines… now is your time to act. Start your 2-week free trial TODAY and lock in this discounted rate before we hike it!

We have over 500 five-star reviews from members who are already profiting from our 8% yielding portfolio.

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of “High Yield Landlord” – the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital – a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I/we have a beneficial long position in the shares of STOR; CPT; AVB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.