Alex Wong

Alex Wong

Real estate investment trusts (“REITs”) are down heavily in the recent past.

Year-to-date, the Vanguard Real Estate ETF (VNQ) is down by 20%, which may not seem like much, but here you need to consider that this is a market-cap weighted ETF that’s mainly invested in mega-cap, investment-grade rated REITs. Its top holdings are defensive blue-chip REITs like Public Storage (PSA), Prologis (PLD), and American Tower (AMT), which are not representative of the average REIT, and, therefore, VNQ isn’t, either.

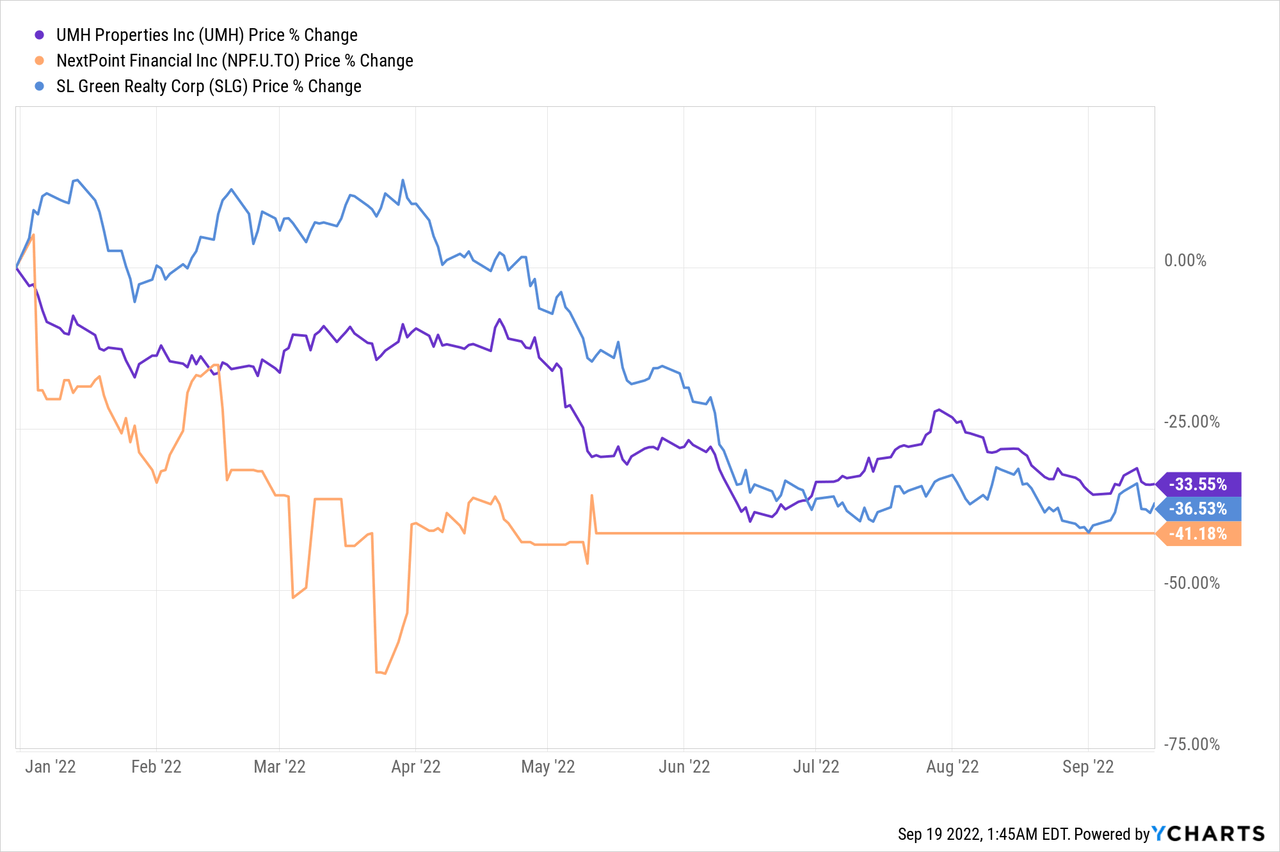

If you look at smaller and lesser-known REITs, it is not uncommon to find companies that are down by 30, 40, or even 50% in some cases. Good examples include:

That’s a quite steep drop in less than a year!

Most REITs are small-caps or mid-caps so this is more reflective of the REIT sector for many investors who build their own portfolio.

Understandably, many are now concerned about these paper losses and wondering whether they should get out before prices drop even further.

REITs have dropped mainly due to rising interest rates, and the Fed has made it clear that they expect to hike rates again in the near term.

Therefore, it may seem as if REITs are likely to drop a lot more in the near term. I have seen many people comment about this on my recent REIT articles. A few examples:

” I’m holding off current purchases, expecting robust selling at some time in the next few months to year due to ever rising rates, should the FED bring that to fruition.”

“Since we are starting to enter a recession with unemployment starting to go up and tightening hasn’t even seriously started yet, REITs still have long way down.”

But before you panic and sell, here’s my important message for you: REIT share prices can recover just as fast as they dropped, and the shift in market direction is always unexpected.

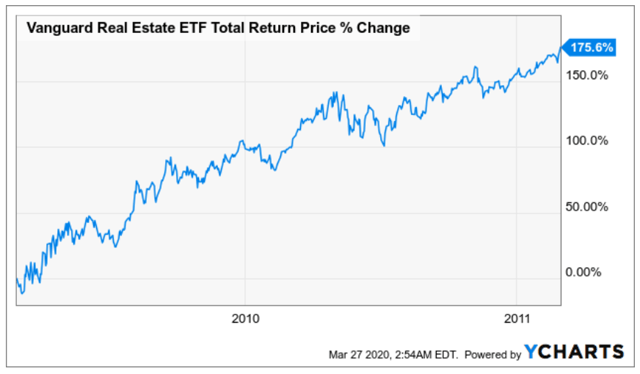

To illustrate this point, consider that REITs nearly tripled in the two years following the great financial crisis. Back then, economic conditions were terrible, but it didn’t prevent REITs from recovering:

YCHARTS

YCHARTS

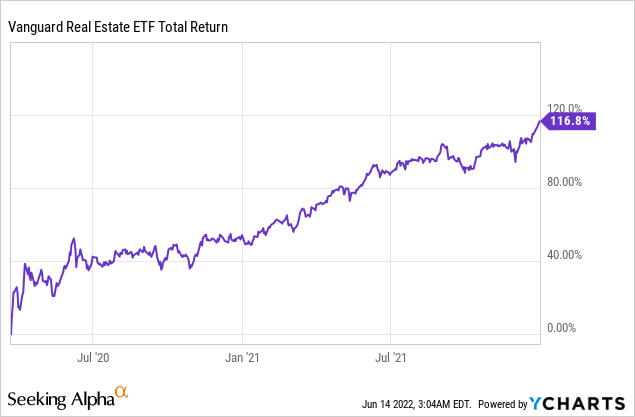

REITs also nearly doubled in the year following the initial pandemic sell-off. Back then, the pandemic was still causing great uncertainty, but REITs recovered anyway:

YCHARTS

YCHARTS

My point here is that it is not as simple as to say that “rates will be hiked so REITs will drop.”

The market is a forward-looking machine and while it is impossible to know how it will perform in the short run, the market knows already that rates will be hiked, and so it won’t come as a surprise to anyone.

Eventually, the narrative will shift to something else and prices will recover rapidly. Those who attempt to time the market by getting out to hopefully get back in at even lower prices may well miss the recovery.

An important reminder is that the biggest gains typically occur in just a handful of days in the recovery. This is why it is so important to remain invested, even despite the market volatility.

Business Insider

Business Insider

Besides, the whole rationale that REITs should drop because rates will be hiked is simply nonsense.

Yes, REITs have dropped this time around as interest rates were hiked, but this does not mean that the future will be the same.

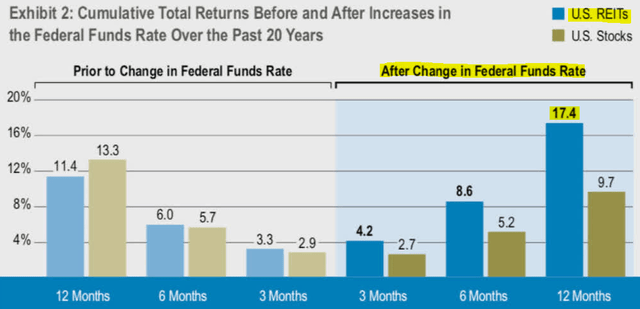

Historically, REITs have actually generated high returns in the period following rate hikes. On average, they have generated a 17% total return in the 12 months following a rate hike, as you can see in the chart below:

Cohen & Steers

Cohen & Steers

This is because there are many more factors at play that you need to consider.

Interest rates are not just hiked for the sake of hiking them.

They are being hiked because inflation is at a 40-year high and needs to be brought back under control.

Inflation has many positive effects on REITs:

So yes, interest rates are rising and this has a negative impact on REITs, but this is because inflation is sky-high, and inflation has a clear positive impact on REITs.

Therefore, the question should be: which is greater?

The positive impact of inflation or the negative impact of rising interest rates?

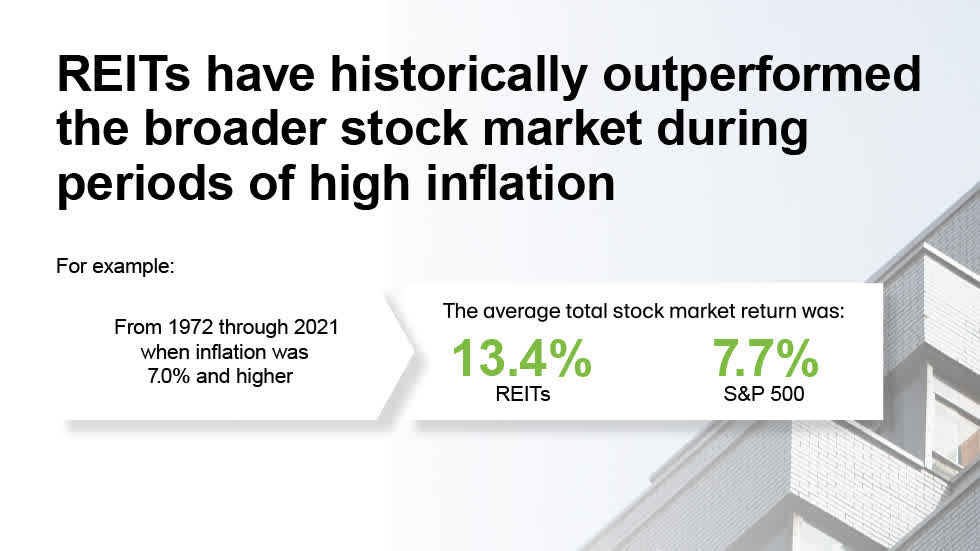

Historically, the positive impact of inflation has been far greater and this explains why REITs tend to perform so well when rates are rising. Here is another source to show how REITs benefit from high inflation:

NAREIT

NAREIT

Today, REIT balance sheets are stronger than ever with low LTVs and long debt maturities. Therefore, REITs should perform even better during times of rising rates than in the past.

Why hasn’t this been the case so far in 2022? Why have REITs performed so poorly, despite all the evidence that they should perform better?

It is tough to answer because that’s the nature of the market. It is impossible to explain short-term market movements or to time the market. You may think that the market should drop, but it may rise, and vis-versa.

A great example of this is how REITs reacted to the pandemic. They nearly doubled in value in less than a year following the sell-off, and that’s despite going through the sharpest economic contraction in history.

Who could have predicted that? The answer is no one.

The same is true today. We think that REITs should be rising, but they have dropped. Is this a cause for panic?

No, it is the exact opposite. It is an opportunity for us to buy REITs at historically low valuations in anticipation of a future recovery.

Adding further evidence to that is the fact that Blackstone (BX), the most sophisticated private equity firm in the world, has been aggressively accumulating REITs in 2022. They have bought over $30 billion of them so far this year, which is huge, and they recently explained in a conference call that they are seeing the best opportunities in the REIT sector at the moment:

“The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.” COO of Blackstone

In other words, private real estate values are up, but REITs are down sharply. As a result, REITs are now priced at a steep discount relative to the value of the real estate they own. Historically, it has always paid off to accumulate REITs after a selloff. Will this time be different?

I doubt so, and this is why I am accumulating them aggressively, just like Blackstone.

High Yield Landlord recently broke the 2500-member mark! Our prices will increase soon but all members who sign up now are grandfathered for life at today’s discounted rate!

If you are still sitting on the sidelines… now is your time to act. Start your 2-week free trial TODAY and lock in this discounted rate before we hike it!

We have over 500 five-star reviews from members who are already profiting from our 8% yielding portfolio.

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of “High Yield Landlord” – the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital – a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I/we have a beneficial long position in the shares of UMH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.