My Account

Follow us on:

Powered By

Learn, discover & invest in smallcases across different types to build your long term portfolio.

Invest Now

Explore from India`s leading investment managers and advisors curating their strategies as smallcases.

Invest Now

Powered By ![]()

Diversify your portfolio by investing in Global brands.

Invest Now

Pre-configured baskets of stocks & ETFs that you can invest

in with a single click. Developed by hedge funds, global

asset management companies, experienced wealth

management firms and portfolio managers.

Invest Now![]()

AMBAREESH BALIGA

Fundamental, Stock Ideas, Multibaggers & Insights

Subscribe

CK NARAYAN

Stock & Index F&O Trading Calls & Market Analysis

Subscribe

SUDARSHAN SUKHANI

Technical Call, Trading Calls & Insights

Subscribe

T GNANASEKAR

Commodity Trading Calls & Market Analysis

Subscribe

MECKLAI FINANCIALS

Currency Derivatives Trading Calls & Insights

Subscribe

SHUBHAM AGARWAL

Options Trading Advice and Market Analysis

Subscribe

MARKET SMITH INDIA

Model portfolios, Investment Ideas, Guru Screens and Much More

Subscribe

TraderSmith

Proprietary system driven Rule Based Trading calls

Subscribe![]()

![]()

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Subscribe

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Explore

STOCK REPORTS BY THOMSON REUTERS

Details stock report and investment recommendation

Subscribe

POWER YOUR TRADE

Technical and Commodity Calls

Subscribe

INVESTMENT WATCH

Set price, volume and news alerts

Subscribe

STOCKAXIS EMERGING MARKET LEADERS

15-20 High Growth Stocks primed for price jumps

Subscribe

Compared to pre-pandemic years, real estate, as a sector, has boomed in India thanks to relatively lower interest rates and rising sales. This has also increased the yields on investments in the sector.

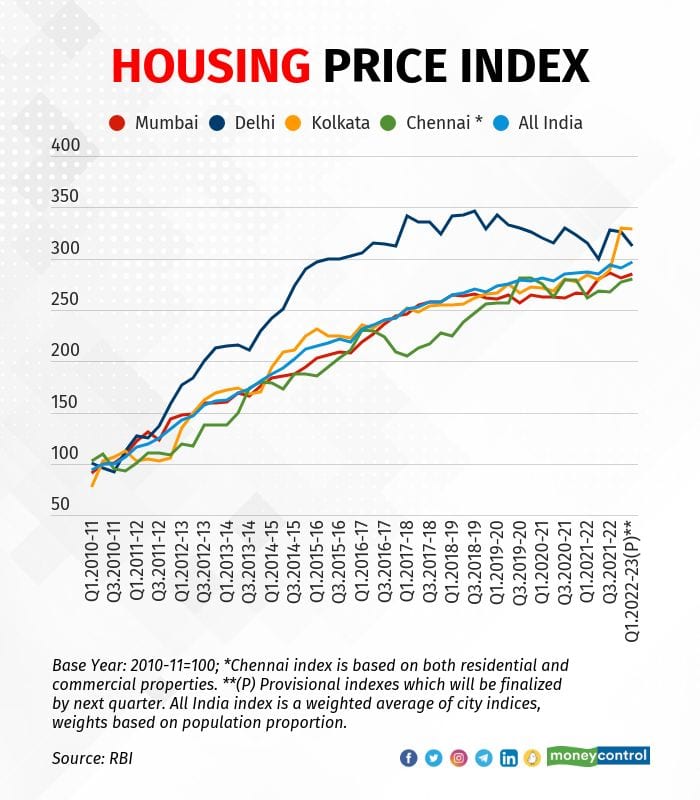

The increase in demand for real estate can be gauged from RBI’s House Price Index. The data shows that in the period Q1FY19 till Q1FY22, the prices stagnated around the same level, meaning demand was not enough to lead to higher housing prices. This was in Mumbai.

In Delhi, prices actually fell during the period and yet to reverse to its peak levels. Chennai has fared relatively better – returning 16 percent over three years during Q1FY19 till Q1FY22- partly thanks to momentum in commercial properties, data for which other cities are not included.

However, since Q1FY22, the index is up about 8 percent within a year in Mumbai. In Kolkata, the improvement is even more stark at 16 percent. Delhi is the only region that has done worse.

Another way to read this data is that an investment in real estate in Mumbai at the start of FY19 would have delivered, nothing while in Delhi it would have bled money for the next three years. Whereas, if the same money was invested at the start of FY22, it would have delivered a cool 8 percent in Mumbai and very cool 16 percent in Kolkata. Both are much more than what fixed deposits (FDs) deliver.

This looks attractive for sure but investors are always looking for a bigger bang for their bucks. And, there are many other real estate markets across the world that can be even more attractive.

Nish Bhatt, Founder & CEO, Millwood Kane International, an investment consulting firm, said, typically, high networth individuals (HNIs) invest in countries that promise higher returns.

“A country or region that has the potential, investment and tax-friendly policies; places that have industrial set-ups, and marquee education institutes attract investment, as investors look to set up an alternative base over there to oversee their businesses,” he said.

Bhatt pointed out that London and Singapore have long attracted investment in real estate due to their policies and strategic locations, acting as the financial nerve centres of Europe and Asia respectively. Dubai has become an investment hotspot due to the transformation it has seen in the last three decades. The emirate has changed rules for investment as it looks to reduce its dependency on income from oil to tourism, entertainment hub, etc.

According to him, below are some regions that have attractive real estate and HNIs continue to chase such assets:

London: Despite Brexit the UK continues to remain the business hub of the EU, and NRIs continue to invest in the region. This is evident in the appreciation of real estate prices.

Singapore: One of the world’s biggest financial hubs that have attracted funds from NRIs and HNIs alike.

UAE: Comprising Abu Dhabi, Sharjah, and Dubai, the region has witnessed a relentless transformation in the past few decades and has been one of the fastest-developing residential hubs globally.

Canada: The number of Indians settled in Canada is huge. The migration was for reason of higher education and employment opportunities. Indians have become a key part of the affluent strata in the country.

Besides, Bhatt pointed out that as real estate is tied to several EU immigration routes, countries like Cyprus, Greece, and Portugal are also benefiting from foreign real estate investments.

Globally, for new home purchases, the US was the top favourite, analysts said, with 45 percent of the people choosing the Land of the Free. It was followed by the UK, Australia, Spain and France.

Analysts said returns generated will depend on the kind of assets you buy and how the investment pans out in future. For instance, luxury residential markets around the world enjoyed a red hot 2021.

Markets like Dubai and Moscow delivered more than 40 percent returns during the year, said Knight Frank. While in Moscow, prices rose thanks to tight supply, the rally in Dubai came after seven years of negative price growth. The top-end of the market ― above $10 million ― saw more than triple the amount of deals than usual.

San Diego, Miami, The Hamptons, Seoul and Toronto were other best performing markets delivering 20-30 percent in 2021. On average, the Americas was the best performing region with average returns at 12.7 percent while Asia Pacific delivered 7.5 percent.

Knight Frank, a global real estate consultancy, expects Dubai to continue its outperformance albeit at a moderate return of 12 percent in 2022. Miami and Zurich will also likely deliver over 10 percent. Seoul, Sydney and Los Angeles are likely to be the next best markets with 7 to 8 percent returns.

Knight Frank pointed out some of the best properties to own across the world, including countries mentioned above. Many of these are already popular among investors, while some are emerging as new avenues for investors.

-Strata office: space in a high-rise building that may be used as an office or residence

-Pubs: Provide strong lease covenants and reliable income streams, and those located in attractive lifestyle destinations are underpinned by high land values

-Distribution warehouses: Covid-19 has also driven a permanent shift in online shopping habits across the region.

-Northern Metropolis: this will include housing as well as a high-tech hub near the border with mainland China

-Forests: Opportunity for sustainability-conscious investors, low entry point, starting from €2,000 per hectare.

-Healthcare assets: Hospitals, labs, etc. will benefit from long-term structural tailwinds such as ageing populations and a rise in healthcare spending.

-Hospitality: Hotels, tourism businesses and golf resorts all look interesting in post Covid-19 era.

-Digital infrastructure: A lot of interest in data centres and micro-fulfilment and central fulfilment centres in metropolitan areas.

-Logistics: In combination with rental growth, it represents good investment opportunities.

-Prime offices: There is a specific lean to constructing them generally and these are attracting a lot of investment.

-Data centres: They are being developed close to the geothermal springs of the Great Rift Valley. The power-hungry facilities making use of geothermal energy produced by the volcanic activity in the region.

Copyright © e-Eighteen.com Ltd. All rights reserved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited.

Copyright © e-Eighteen.com Ltd All rights resderved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited.