Helping Traders Thrive

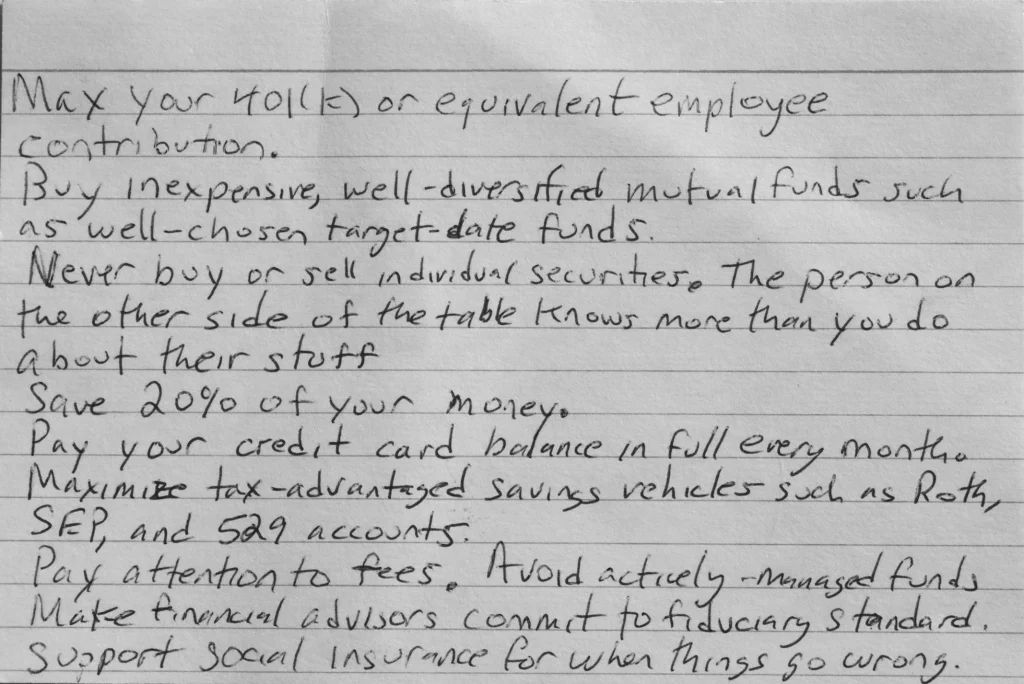

When University of Chicago professor Harold Pollack was interviewing Helaine Olen he said that “The financial advice most people actually need is common sense and simple enough that it would fit onto a 4-by-6 index card.” “I started getting emails saying, ‘Where’s the index card?’” Pollack explains. So even though it had more of a joke, he decided to create the index card he alluded to. “I reached in the drawer, grabbed one of my daughter’s index cards, and scribbled down in about two minutes nine sensible things.” [1]

“Everything should be as simple as possible, but not simpler.” – Albert Einstein

Authors Helaine Olen and Harold Pollack wrote a clever book: The Index Card: Why Personal Finance Doesn’t Have to Be Complicated. In this book they simplify personal finance down to principles that can fit onto a 4X6 index card for easy reference and execution based on the above event and the card going viral online.

This take a quick look at simplifying finances into easy to understand concepts and principles.

What are the 5 areas of personal finance?

Savings

This is how much money you keep after you use your paycheck to pay your bills each month. Savings are for emergencies and to give you a cushion between your job and needs.

Investing is where you convert savings into assets. Investments are things that increase in value over time and some can also create cash flow.

Protection

This is your financial defense where you hedge large risks with small monthly payments for insurance. Home insurance, car insurance, health insurance, and life insurance are all examples of protecting yourself against large risks.

Spending

This is the amount of income you use for your wants, needs, and debt payments. The less you spend the easier it is to save and invest.

Your income is how much you consistently earn from a job, cash flow, pension, or government benefits. The higher you can get your income the easier your personal finances will be. This is the most important area to focus on for financial success.

What’s the best financial advice?

Here is an expanded summary of the principles the author first wrote on the index card above.

- Save 10-20% of your income.

- Pay off your credit card balances every month.

- Max out your retirement accounts (401ks and IRAs) that have tax advantages.

- Never speculate randomly on individual stocks.

- Invest in diversified index mutual funds and exchange traded funds.

- Any financial advisor you use must align with your needs not theirs.

- Buy a house when you can afford it.

- Manage large risks through proper insurance.

- Pay the taxes you owe and be charitable.

- Maintain the discipline to follow the index card rules.

Save 10-20%

The 10-20% is optimal but don’t be discouraged. Start with whatever you can save and build up with time as your income increases or your debt decreases. This percentage counts any money going into savings, retirement funds, health savings accounts, or direct investing. This is a good metric to consider when getting into debt if it affects your ability to save this amount. Also advance in your career or change jobs when it helps with your savings goals.

Pay off credit cards

The best returns you can get on your money when you are in credit card debt is to pay off outstanding balances each month or pay off large balances to eliminate the high interest rates. If you can’t pay off your credit cards at the end of the month you are spending more money than you earn. When you are out of money each month stop spending on wants, budget accordingly.

Optimize 401ks

The best investment you can make is to get the full 401K match if available at your job. A 401K match gives you a 100% return on your capital at entry. These are returns you will not find anywhere else and they add up over time.

Also, tax deferred retirement accounts allow you to both decrease your income tax burden and grow capital tax free only paying taxes when you withdraw it. Roth retirement accounts let you pay income taxes now, grow capital tax free, and also not be taxed when you withdraw the money later.

Whether it’s best to use a traditional 401k or a Roth 401k depends on your income tax bracket now versus your income tax bracket in the future when you withdraw the money.

Don’t gamble on individual stocks

Buying individual stocks randomly with no edge and no research is gambling not investing. Most professionals are terrible at stock picking so the odds are stacked against you as an amateur. Unless you have a quantified systematic investing or trading system with an edge for individual stocks you should not be speculating on them.

For most people looking to build an investment portfolio for retirement, dollar cost averaging into index mutual funds or ETFs over 20-30 year periods is the best systematic process to follow. A diversified index fund portfolio can average approximately 10% a year over most 20-year periods. Of course there are ups and downs and there can be flat decades but dollar cost averaging helps smooth returns.

Index funds hold diversified stock portfolios so you always have exposure to the winners and their weightings optimize the winning stocks and decrease holdings on the losing stocks in an index. Indexes are investing systems with an edge their self.

Many people will want to start moving into more bond funds as their accounts grow to decrease equity exposure. Other people may want to get more strategic with their portfolio allocations as their capital grows and the more active may even want to add trend following elements to their index systems.

Only work with money managers that are fiduciaries not salesman out for a commission. Be sure they are putting your interests ahead of their own and you trust them.

Own your own home

Home ownership is both a hedge against rent inflation risk and can allow you to build up wealth in home equity. This is one of the smartest financial decisions you can make if you can afford to own a home in a growing area with a high quality of life.

Insurance is worth it

Insurance is not wasted money, it’s a hedge against risk that can destroy you financially. You must keep your home, car, health, and life insured against the risk of ruin after one event.

The authors of the book believe it’s crucial to pay our fair of taxes as it funds the social safety nets for others that helps people with disabilities, medical events, and personal financial crises.

I would add it’s also important to ensure or children are set up for a great start in their own financial life as well as help family out when it’s constructive.

Follow the rules

Knowing these principles are not the same as following them as rules for your own personal finances. Knowledge is not power as much as the execution of what you know. Your results will only be as good as your discipline and focus to stay on track with these guidelines.

Yes, it’s possible to manage your personal finances from an index card. 90% of results come from 10% of taking the right actions. Personal finance is more about self-control and discipline than math. If you know the right ten things to do, then you do them consistently you will win at money.

With the size and complexity of the financial industry it’s a nice change to just focus on the ten things that will make all the difference in your personal finances. If you can do these ten things consistently over your lifetime this will be enough to ensure financial success in almost any situation according to the authors mentioned above.

Steve Burns:

After a lifelong fascination with financial markets, Steve Burns started investing in 1993, and trading his own accounts in 1995. It was … Read More

The information provided through the Website and our services is intended for educational and informational purposes only and not recommendations to buy or sell a specific security. Read More…

Helping Traders Thrive

Proudly powered by WordPress | Theme: Newsup by Themeansar.