Maskot

Maskot

LTC Properties Inc. (NYSE:LTC) is currently for sale as a result of a sudden spike in market volatility and growing risk aversion.

When compared to last month, the healthcare trust is selling for a much lower funds from operations multiple, while providing income investors with a well-performing real estate portfolio, recovering FFO, and a stable dividend that may even grow in the future.

There is no reason for LTC Properties’ stock to be trading at such a low FFO multiple, and I believe investors should take advantage of the trust’s current oversold situation.

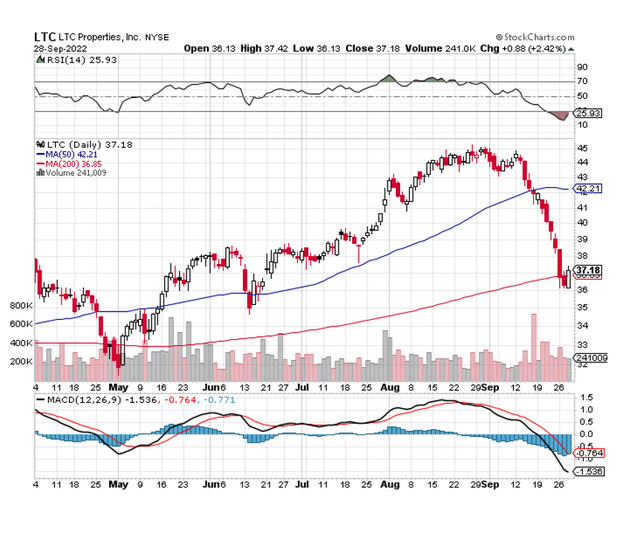

According to the Relative Strength Index, healthcare real estate investment trust LTC Properties is currently oversold, providing investors with a potentially short-term opportunity to dip their toes in the water and buy the stock. The RSI is at 25.93, indicating that LTC sentiment is officially oversold.

The reason for the recent stock (and market) decline is the central bank’s increased push for interest rate hikes. The market received its third super-sized interest rate hike this year last week, resulting in a significant decline in the market value of LTC Properties.

RSI (StockCharts.com)

RSI (StockCharts.com)

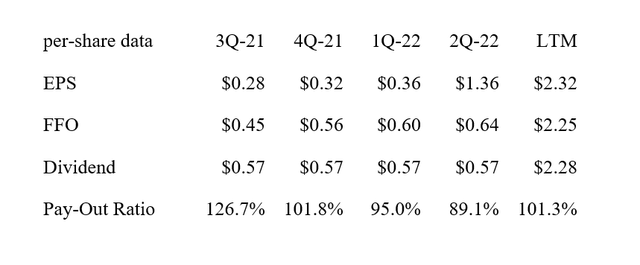

Aside from the exaggerated bearish sentiment reflected by the Relative Strength Index, the obvious justification for buying LTC Properties here is the healthcare trust’s improving business condition, as evidenced by recovering funds from operations and improving pay-out metrics.

The trust’s pay-out ratio based on funds from operations has significantly improved as a result of a broader recovery in the healthcare market following Covid-19.

While the real estate investment trust underpaid its dividend last year while Covid-19 remained a major issue for the industry, LTC Properties’ funds from operations are recovering, as is the trust’s pay-out ratio.

LTC Properties paid out less than 90% of its second quarter funds from operations in 2Q-22, the year’s lowest pay-out ratio. The pay-out ratio has been 101% over the last twelve months.

The trust pays a monthly dividend of $0.19 per share ($0.59 per share quarterly), making the stock appealing to income investors who prefer monthly payments.

Dividend And Pay-Out Ratio (Author Created Table Using Company Earnings Supplements)

Dividend And Pay-Out Ratio (Author Created Table Using Company Earnings Supplements)

The aging of the 80+ population, which is expected to grow 22% between 2022 and 2027, is a driver of LTC Properties’ growth. LTC Properties, as a medium-sized company in the industry, stands to benefit from the 80+ population, which is the core demographic of healthcare real estate investment trusts.

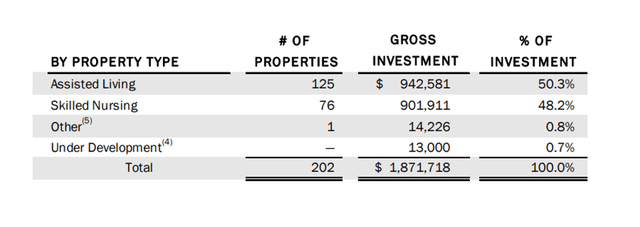

LTC Properties has developed a strong focus on the assisted living and skilled nursing sectors of the healthcare market, accounting for roughly half of total gross investments. As of June 30, 2022, the trust had 202 properties leased to operators.

Investments By Property Type (LTC Properties)

Investments By Property Type (LTC Properties)

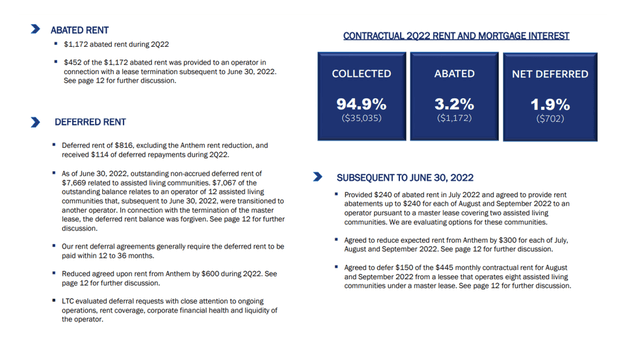

The portfolio is also performing well. LTC Properties collected 95% of its rent in the second quarter, with the remaining 5% abated or deferred. As Covid-19 plays a smaller and smaller role in the trust’s operations, the trust’s recovery trends in funds from operations and rent collection are expected to continue.

Rent Information (LTC Properties)

Rent Information (LTC Properties)

Because interest rates and yields have risen recently, high yield investments have become less expensive, making REITs less appealing to income investors.

Having said that, the trust is performing well, and long-term aging trends in the United States strongly suggest future growth potential. LTC Properties also has a recession-resistant business model that avoids volatile demand patterns.

I continue to forecast $2.40-$2.50 per share in funds from operations for the healthcare real estate investment trust in 2022, despite the sector’s broad recovery, which has resulted in a recovery of LTC Properties’ rental income and FFO. I talked about the rebound here.

The stock has an FFO multiple of 15.1x, down from 18.4x a month ago, based on $2.40 to $2.50 per share in funds from operations.

Purchase LTC Properties stock while it is on sale. When compared to last month, the real estate investment trust has a much lower funds from operations multiple, and the stock is oversold as higher interest rates and general market volatility weigh on stock valuations. These factors, however, will have no impact on LTC Properties’ portfolio or funds from operations performance.

LTC Properties is a very high-quality healthcare real estate investment trust in my opinion, and the pay-out ratio is improving and low enough to suggest that the dividend could grow.

As long as the market shows little regard for value, investors who like monthly dividend payouts may want to consider LTC Properties’ stock.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of LTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.