zorazhuang

zorazhuang

In the lead-up to their now-completed Sinclair acquisitions earlier in 2022, HF Sinclair (NYSE:DINO), formally known as HollyFrontier was poised to provide very desirable shareholder returns, as my previous article highlighted. The subsequent months also saw their dividends reinstated, although with their share price powering ahead to levels not seen since 2019, it nevertheless leaves their yield at only a low 2.79%. Due to the risks of a recession gathering on the horizon, it appears the easy money is made and thus now seemingly time to consider exiting whilst the markets are still supportive, as discussed within this refreshed analysis.

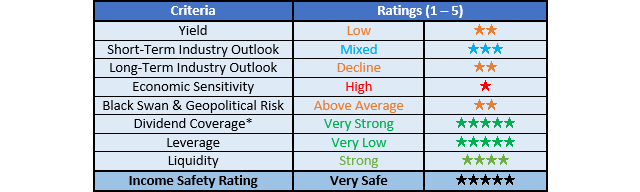

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Author

Author

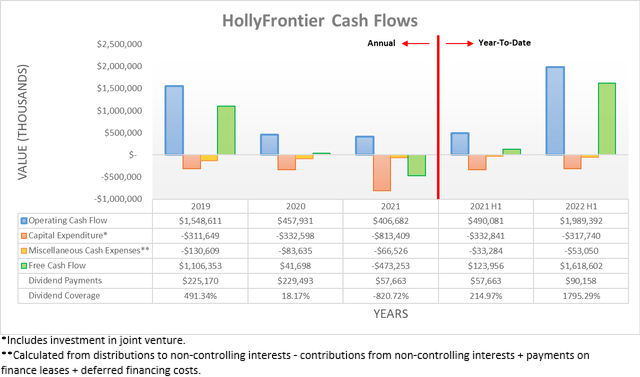

Despite the rough end to 2021, their cash flow performance more than simply recovered during 2022 but actually surged to record-setting levels following the Russian invasion of Ukraine that sent energy markets into a frenzy. Whilst prices have since moderated, they still saw a massive cash windfall during the first half with their operating cash flow almost $2b and thus effectively four times higher year-on-year versus their previous result of $490.1m during the first half of 2021. Admittedly, some of this benefit stems from their large Sinclair acquisition but nevertheless, it does not change the fact they generated massive free cash flow of $1.619b.

Quite surprisingly, they retained most of their free cash flow during the first half of 2022 with their dividend payments only hitting a relatively modest $90.2m and accompanying share buybacks of $110.8m. Although, this appears to have changed during the third quarter given their announcement of a new $1b share buyback program in late September, as upon reading their accompanying 8-K SEC filing, it states that $974.9m under their previous $1b program had been completed by the 23rd of September, which in a practical sense is the end of the third quarter. Since they conducted $110.8m of this previous share buyback program during the first half, it indicates the third quarter saw at least $864.1m, possibly slightly more depending upon the last week of September following the 23rd. This marks a very large ramp-up versus earlier in the year and appears set to continue into the future, as per the commentary from management included below.

“We bought two — we made two different acquisitions which we consider to be really high value and at this point, we intend to pay our shareholders back for their patients and those investments. So that basically says that in the near term, we’re most interested in returning capital to HF Sinclair shareholders.”

– HF Sinclair Q2 2022 Conference Call.

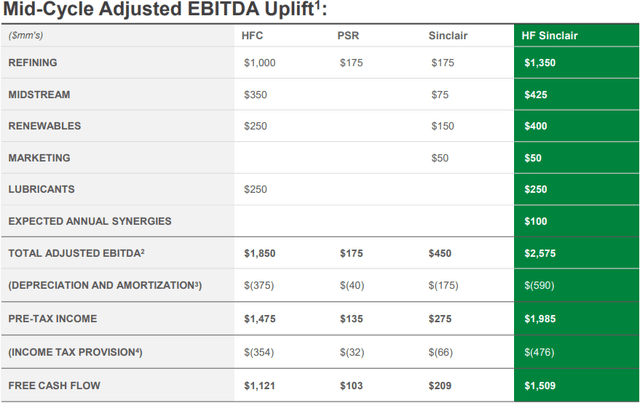

Regardless of how much free cash flow they generate across any future quarters, the majority appears likely to find its way into the pockets of their shareholders as they prioritize shareholder returns. In the short-term, the risks of a recession leave the outlook mixed as economic pain weighs against structural energy shortages but thankfully, management provided very useful mid-cycle guidance, as the table included below displays.

HF Sinclair September 2022 Investor Presentation

HF Sinclair September 2022 Investor Presentation

When looking at their mid-cycle guidance, they expect to generate $1.509b of free cash flow per annum as their larger operational following their Sinclair acquisition size dramatically boosts their potential. If compared against their current market capitalization of approximately $12.5b, it would see a very high free cash flow yield of circa 12% on current cost. Whilst this sounds very desirable for a middle-of-the-road scenario, there are still several points to consider that diminish its appeal, largely relating to the volatility of the refining industry.

The mid-cycle point is subjective and thus is open to personal views and despite not necessarily doing anything wrong, obviously management did not release the detailed calculations underpinning this forecast, which clouds the ability of investors to judge whether they agree or not. Even ignoring this consideration, the past does not necessarily reflect the future, especially since fossil fuel demand faces headwinds from the clean energy transition that could erode their financial performance, thereby progressively pushing the mid-point of their cycles lower across time.

Due to these considerations, I feel their shares warrant a margin of safety, which disappointingly is diminished by their share buybacks. As easily apparent, their shareholder returns are very heavily weighted towards these instead of dividends, which are seemingly taking a backseat. Whilst share buybacks can help increase dividend growth in the medium to long-term via reducing their outstanding share count, they are likely to be conducted at less opportune times due to the inherent volatility of their industry. It stands to reason their share buybacks will scale up and down with their free cash flow, which in turn sees their share price follow in tandem and thus means that more share buybacks will almost certainly be conducted at cyclical highs than at cyclical lows.

By going against the old adage of buy low, sell high, it almost guarantees they will pay an above mid-cycle price for their shares, thereby diminishing the appeal of their forecast very high double-digit free cash flow yield. Plus, it also stands to see their share price fall further during a downturn as they not only see less demand from third-party investors buying their shares but also less demand from their buyback program.

Author

Author

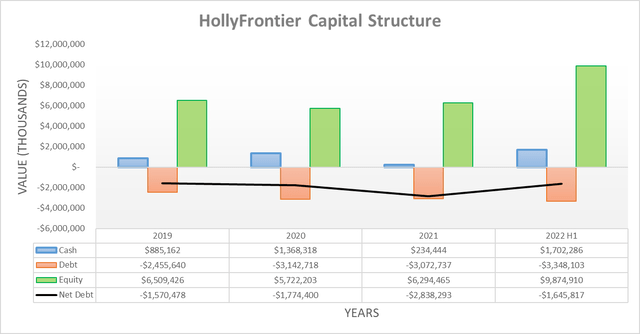

After seeing their net debt soar by over $1b during 2021 on the back of negative free cash flow and their Puget Sound Refinery acquisition, the first half of 2022 saw this more than reverse, despite being merely half the length of time, as a result of their booming cash flow performance. This now leaves their net debt at $1.646b and thus apart from being down a massive 42.01% versus where it ended 2021 at $2.838b, it is also effectively back to where it ended 2019 at $1.57b, before the COVID-19 pandemic rocked their industry.

When looking ahead to their upcoming results for the third quarter of 2022, their near $900m of share buybacks will likely see their net debt cease falling at this rate, as they consume most, if not the entirety of their free cash flow. Considering they plan to prioritize shareholder returns, this should also be the case during the fourth quarter and most likely beyond into 2023.

Author

Author

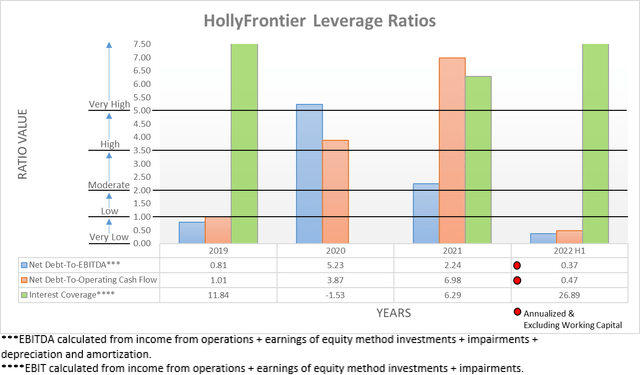

Quite unsurprisingly, their leverage also benefitted immensely as their financial performance reached new heights and their net debt plunged with their net debt-to-EBITDA and net debt-to-operating cash flow down to 0.37 and 0.47 respectively, which are firmly beneath the threshold of 1.00 for the very low territory. Although positive, realistically the more important aspect to consider is not their current leverage but rather their leverage if operating conditions normalize, as booming financial performance could potentially mask hidden issues.

If comparing their net debt of $1.646b against their mid-cycle guidance for adjusted EBITDA of $2.575b as seen earlier, it produces a net debt-to-EBITDA of 0.64. Whilst almost twice my current result based from the first half of 2022, it nevertheless remains easily within the very low territory and thus worry-free. Elsewhere, the fact that their accompanying free cash flow guidance of circa $1.5b is almost equal to their net debt provides further support to this view and therefore, they can safely return the entirety of their free cash flow to shareholders until such time as something significant changes.

Author

Author

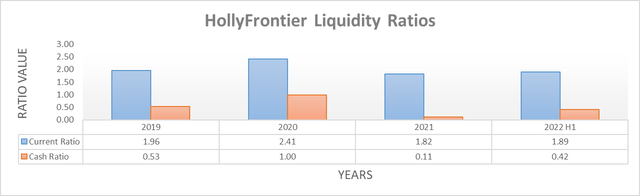

Unsurprisingly, their massive cash windfall from the booming operating conditions pushed their respective current and cash ratios higher during the first half of 2022 with their results landing at 1.89 and 0.42 versus their previous respective results of 1.82 and 0.11 at the end of 2021. This easily keeps their liquidity strong and when looking ahead, their relatively very large cash balance of $1.702b roughly equals half of their total debt of $3.348b and thus significantly eases any risk of future debt maturities for the foreseeable future, even if central banks further tighten monetary policy.

It seems their Puget Sound Refinery and Sinclair acquisitions could not have come at a better time as they helped send their free cash flow to record-setting levels during the first half of 2022. Thanks to this cash windfall expediting their deleveraging, they can safely return the entirety of their free cash flow to shareholders indefinitely into the future. Although positive, the very heavy weighting towards share buybacks diminishes the appeal of their shares in my eyes. Due to the risks of a recession on the horizon, I now believe that downgrading to a neutral rating is appropriate with it seemingly time to consider exiting whilst their share price is still defying this gloomy short-term outlook.

Notes: Unless specified otherwise, all figures in this article were taken from HF Sinclair’s SEC Filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.