Razvan

Razvan

One of the basic premises in my international-selling book, Build Wealth With Common Stocks, is that successful retail investing requires the discipline to buy and hold the shares of enduring enterprises for as long as the company’s fundamentals and downside risks remain compelling, including forever.

I equate the premise of buy-and-hold-forever as a commitment to companies and the common stocks representing each-to buy low, hold high, and only sell when you die.

In other words, be willing to hold the common shares of great companies for a generation, enjoying the compounding growth of capital and dividends. “Sell when you die” translates to passing the asset on to your heirs or designated charities, as the information thus far is vague on whether stocks are trading in any afterlife. Unfortunately, too many investors find it challenging to think 10 to 20 years out instead of the more common behavior of 10 to 20 months or 10 to 20 days.

The Walt Disney Company (NYSE:DIS) is a prime example of a legacy portfolio holding despite its operational struggles during the coronavirus pandemic. For example, our family portfolio has owned DIS shares since June 2009, enjoying a five-bagger return.

In this updated primary ticker research report, I put Disney and its common shares through my market-beating, data-driven investment research checklist of the value proposition, shareholder yields, fundamentals, valuation, and downside risk.

The resulting investment thesis:

Despite the emergence of Disney+ steaming to compliment Hulu and ESPN+, a tough go during the pandemic negatively impacted theme park attendance, cruise bookings, and the box office. But this is Walt Disney, the eminent global leader in entertainment content creation. Although currently a bit pricey on valuation, remember to buy DIS whenever the price becomes reasonable, hold it high, and when the inevitable occurs, pass on the shares to the next generation.

My current overall rating: Hold, based on a bullish view of the company’s value proposition and downside risks, but a neutral view of its fundamentals and valuation.

Unless noted, all data presented is sourced from Seeking Alpha and YCharts as of the market close on August 16, 2022; and intended for illustration only. Although Disney had a favorable earnings release on 8/10/22, the timing of this report is coincidental as I avoid investment decisions based on quarterly earnings or breaking news, aka the noise.

DIS is a non-dividend-paying large-cap stock in the communications services sector’s movies and entertainment industry.

The Walt Disney Company and its subsidiaries operate as an entertainment company worldwide through Disney Media and Entertainment Distribution; and Disney Parks, Experiences, and Products. The company was founded in 1923 and is based in Burbank, California, USA.

My value proposition elevator pitch for Disney:

The reigning king of original entertainment content produces endless cash flow from operations.

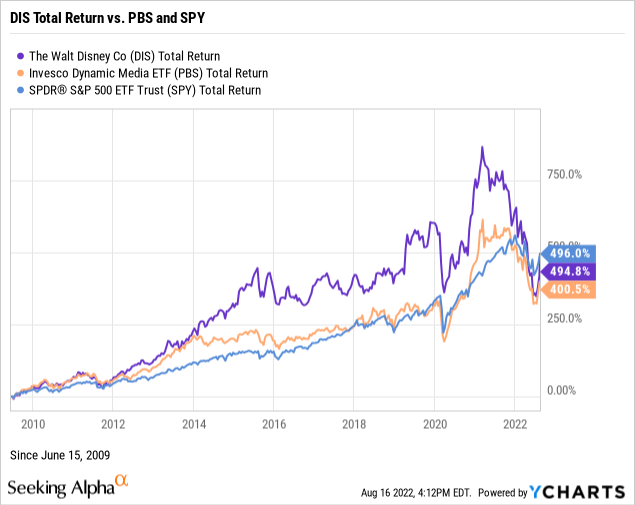

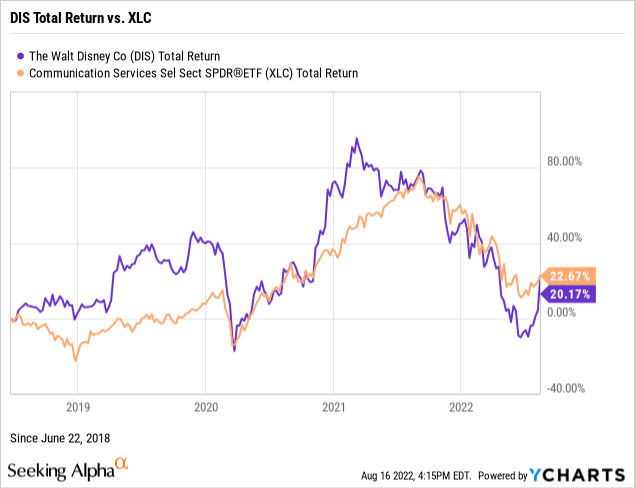

The charts below illustrate the stock’s performance against the Invesco Dynamic Media ETF (NYSE:PBS) and the SPDR S&P 500 Trust ETF (NYSE:SPY) since adding the shares to our family portfolio in June 2009. In addition, the Communications Services Sector SPDR® Fund ETF (NYSE:XLC) did not commence until after the initiation date and, thus, warrants a separate chart.

Ultimately, investing in individual common stocks should aim to beat the benchmark indices over time. Although outperforming its industry, sector, and market for much of the past 13 years, its notable decline during the pandemic had DIS matching the cumulative total returns of the sector and market during the specified periods.

My value proposition rating for DIS: Bullish.

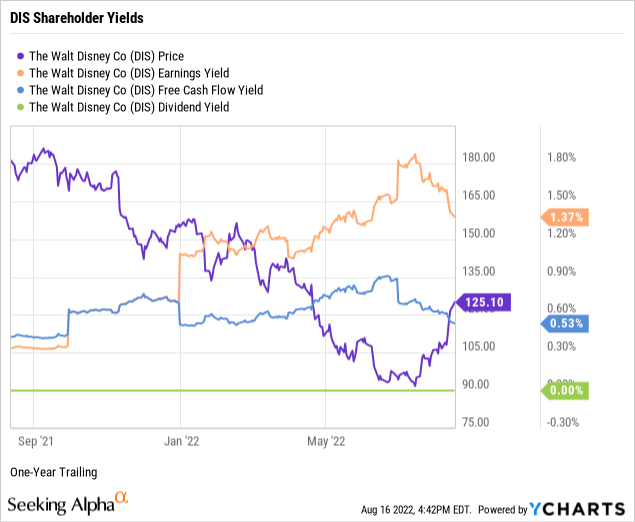

As part of your due diligence, average the total shareholder yields on earnings, free cash flow, and dividends to measure how a targeted stock compares to the prevailing yield on the 10-year Treasury benchmark note. In other words, what is the equity bond rate of the common shares?

Target an earnings yield greater than 6 percent or the equivalent P/E multiple below 17 times. DIS is far under the floor at 1.37%, as demonstrated in the below chart.

Target a free cash flow yield of 7 percent or higher, or fewer than 15 times the inverted price-to-free cash flow multiple. At 0.53%, DIS is significantly under the threshold.

Whether or not you are a dividend investor, consider dividend-paying stocks for compensation in the short term while waiting for capital gains to compound over time. Of note, Disney ceased paying a dividend during the pandemic, and the company has reportedly offered a return to paying dividends in the “distant future.”

Next, take the average of the three shareholder yields to measure how the stock compares to the prevailing yield of 2.81% on the 10-year Treasury note. The average shareholder yield for DIS was just 0.63%. Arguably, equities are deemed riskier than U.S. bonds. Thus, securities that punish shareholders at yields much lower than the government benchmark, such as DIS, favor owning the bond instead of the stock.

Remember that earnings and free cash flow yields are inverse valuation multiples, suggesting that DIS trades at a premium. I’ll further explore valuation later in this report.

My shareholder yields rating for DIS: Bearish.

Let’s explore the fundamentals of Disney, uncovering the performance strength of the company’s senior management.

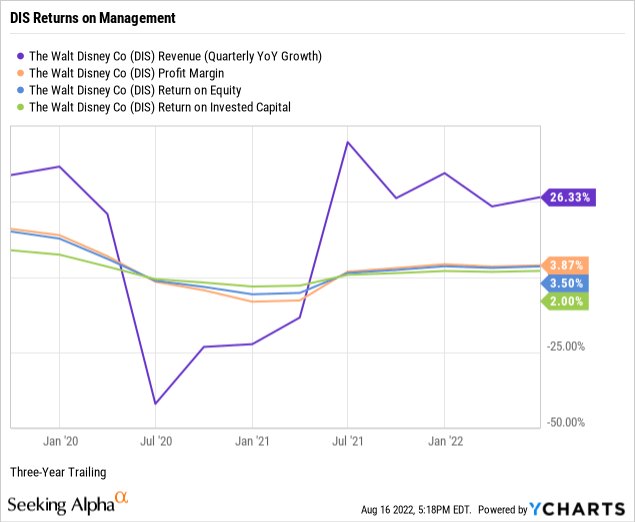

When analyzing a business, stay biased toward established growth instead of executive guidance and sell-side analyst projections. For example, per the below chart, Disney had three-year revenue growth of 26.33%, more than double the 11.82% median growth for the communications services sector.

Notably, the early 2020 falloff in top line growth directly resulted from the COVID-19 negative impact on theme park, cruise, and movie theater attendance.

Disney had a trailing three-year pre-tax net profit margin of 3.87%, slightly underperforming the sector’s median net margin of 4.79%. Remember to screen for profitable companies to avoid unnecessary speculation.

Return on equity or ROE reveals how much profit a company generates from shareholder investment in the stock. Target an ROE of 15 percent or higher to discover shareholder-friendly management. Unfortunately, Disney was producing trailing three-year returns on equity of just 3.50% against a median ROE of 6.56% for the sector.

Target a return on invested capital or ROIC above 12%. At 2.00%, Disney was underperforming the threshold and the sector’s median ROIC of 3.56%, indicating that Disney’s senior executives are struggling with capital allocation. Return on invested capital measures how well a company invests its resources to generate excess returns.

ROIC needs to exceed the weighted average cost of capital or WACC by a comfortable margin, giving management’s ability to outperform its capital costs. Notably, Disney’s trailing WACC at 9.71% was more than quadruple its ROIC (Source: GuruFocus).

The accelerating growth coming out of the pandemic, low but positive profit margins, plus a solid history of producing cash flow from operations countered by paltry returns on equity and capital further exacerbated by the negative spread between ROIC and WACC, indicate a mixed management performance in Burbank.

My fundamentals rating for DIS: Neutral.

A quality-focused value investor can rely on just four valuation multiples to estimate the intrinsic value of a targeted enterprise’s stock price.

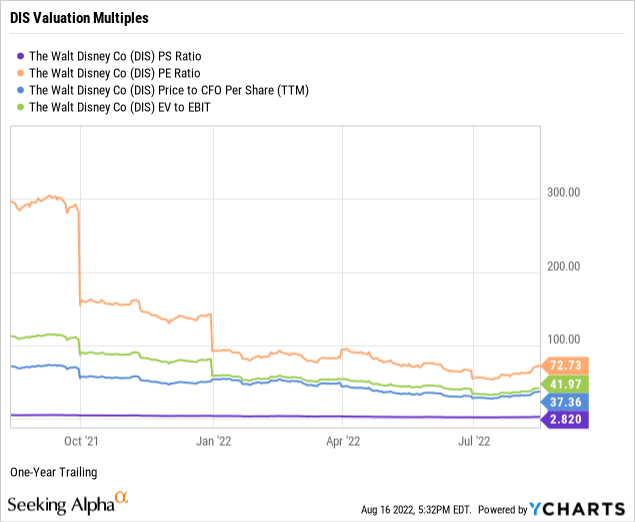

The price-to-sales ratio or P/S measures the stock price relative to revenues. Target fewer than 2.0 times, and at 2.82, DIS was trading above the ceiling. In addition, the trailing P/S ratio exceeded 1.47 times for the communications services sector but was closer to the 2.54 times sales for the S&P 500. Thus, the weighted industry plus market sentiment suggests an overvalued stock relative to Disney’s top line.

Although often a hit or miss multiple, target price-to-trailing earnings or P/E multiples fewer than 17 times or below the target stock’s sector averages. DIS had a lofty price-to-earnings multiple of 72.73 times against a sector P/E of 17.55, indicating investor sentiment places a super premium on the stock price relative to earnings per share. DIS also traded at a premium to the S&P 500’s recent overall P/E of 22.75. (Source of S&P 500 P/E: Barron’s).

Target single-digit price-to-operating cash flow multiples for the best value. At 37.36 times, DIS was trading well above the ceiling and about four times the sector’s median of 8.78, indicating the market prices the stock at a premium relative to current cash flows.

Enterprise value to operating earnings or EV/EBIT measures whether a stock is overbought, a bearish signal, or oversold, a bullish signal, by the market. Target an EV/EBIT of fewer than 15 times. Against the broader sector median of 17.28 times, DIS was trading at 41.97 times enterprise value to operating earnings, signaling the stock was undersold by the market.

Weighting the preferred valuation multiples suggests the market overvalues Disney’s stock price to sales, earnings, cash flow, and enterprise value. Therefore, based on the fundamentals and valuation metrics uncovered in this report, risks and potential catalysts notwithstanding, I would call DIS the fully-priced stock of a legacy entertainment provider emerging from a global pandemic.

My valuation rating for DIS: Neutral.

When assessing the downside risks of a company and its common shares, focus on five metrics that, in my experience as an individual investor and market observer, often predict the potential risk/reward of the investment. Hence, assign a downside risk-weighted rating of above average, average, below average, or low, biased toward below average and low-risk profiles.

Alpha-rich investors target companies with clear competitive advantages from their products or services. An investor or analyst can streamline the value proposition of an enterprise with an economic moat assignment of wide, narrow, or none.

Morningstar assigns Disney a wide moat rating.

We assign Walt Disney a wide economic moat rating. Its media networks segment and collection of Disney-branded businesses have demonstrated strong pricing power in the past decade. We believe that the addition of the entertainment assets from 21st Century Fox should help the firm continue to generate excess returns on capital despite operating in the increasingly competitive media marketplace.

– Neil Macker, CFA, Senior Equity Analyst, December 7, 2021

A favorite of the legendary value investor Benjamin Graham, long-term debt coverage demonstrates balance sheet liquidity or a company’s capacity to pay down debt in a crisis. Generally, at least one-and-a-half times current assets to long-term debt is ideal. Notably, as reported on its July 2022 quarterly financial statements, Disney’s long-term debt coverage of 0.68 times was below the threshold.

In theory, the company couldn’t pay off 100% of its longer-term debt obligations in a crisis using its liquid assets such as cash and equivalents, short-term investments, accounts receivables, and inventory.

On the contrary, in a further test of its leverage, Disney’s long-term debt to equity was 51.44%, significantly below my 200% ceiling. In other words, investors should become concerned only when a company’s debt is more than twice its equity.

Current liabilities coverage or current ratio measures the short-term liquidity of the balance sheet. Target higher than 1.00, and Disney’s short-term debt coverage was 1.02 times. Thus, its balance sheet provides just enough liquid assets to pay down 100% of its current liabilities, including accounts payable, accrued expenses, short-term borrowings, and income taxes.

As a long-term investor, use a five-year beta trend line and screen for stocks lower than 1.25 or no more than 125% volatility in the market. DIS’s 60-month trailing beta was at the 1.25 ceiling. However, its shorter-term 24-month beta was at a less volatile 1.07. With price volatility just above the S&P 500 standard of 1.00, DIS presents as a market perform-type holding.

The short interest percentage of the float for DIS was 1.14%, well under my suggested 10% ceiling. So perhaps the near-sighted bears view the stock as a relatively safe staple in the movies and entertainment industry with a propensity for famous content creation and provider-favorable pricing that generate tons of cash flow.

Despite its insufficient longer-term debt coverages, typical of a capital-intensive theme park, cruise ship operator, and television and movie producer, Disney is a fundamentally sound, wide moat company with an appealing risk profile.

My downside risk rating for DIS: Below Average.

Catalysts confirming or contradicting my overall neutral investment thesis on The Walt Disney Company and its common shares include, but are not limited to:

Although its stock is down almost 100% from its pre-COVID-19 high, I believe Disney is a prime example of an enduring company whose bull market-induced super-premium stock price was exposed by the global pandemic.

Nevertheless, Disney has a storied history of worldwide popular content supported by strong theme park attendance, cruise bookings, movie attendance receipts, and streaming subs. As a result, the Magic Kingdom should successfully return from its pandemic-related decline, retaining its seat on the entertainment throne for generations to come.

I rate the stock a hold for current investors and suggest that new investors wait for better shareholder yields and valuation multiples during the endemic. However, consider adding to an existing low-cost basis holding or initiating a cautious new position if you believe DIS will perpetually trade at a premium.

Regardless, for legacy core holdings such as The Walt Disney Company, remember to buy low, hold high, and only sell when you die.

The market-beating portfolios and course modules comprising Quality + Value Strategies on Marketplace are available exclusively to subscribers. Become a member today, and take advantage of the low-cost, high-value annual subscription backed by Seeking Alpha’s 14-day, risk-averse, free trial.

Try it free to see if Quality + Value Strategies is a good fit for achieving your personal investment goals and reward yourself with the founding members discount.

For questions and to discuss the benefits of membership to Quality + Value Strategies, send me a direct message any time.

This article was written by

David J. Waldron founded Quality + Value Strategies on the Seeking Alpha Marketplace, where he outperforms the market by investing in current value instead of speculative growth. David invites followers to join at a special 50% discount on an annual subscription vs. month-to-month, including a guaranteed recurring lifetime subscription rate as a founding member. A Seeking Alpha contributor since 2013, David is the author of the international selling Build Wealth With Common Stocks. The book explores the principles, strategies, and practices for discovering outstanding companies whose common shares are temporarily trading at reasonable prices. Remember, you can now preview Quality + Value Strategies and take advantage of a two-week free trial at a special 50% discount on an annual subscription. Join today.

Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: David J. Waldron’s articles are for informational purposes only. The accuracy of the data cannot be guaranteed. Narrative and analytics are impersonal, i.e., not tailored to individual needs nor intended for portfolio construction beyond his family portfolio, which is presented solely for educational purposes. David is an individual investor and author, not an investment adviser. Readers should always engage in their own research and consider (as appropriate) consulting a fee-only certified financial planner, licensed discount broker/dealer, flat fee registered investment adviser, certified public accountant, or specialized attorney before making any investment, income tax, or estate planning decisions.