Dividend-paying REITs have been knocked back by recession fears, but stocks including Simon Property Group, Welltower are looking cheap.

It’s been an up-and-down ride for real estate stocks over the past year, but there may be opportunities for investors among undervalued, high-dividend-paying companies in the sector.

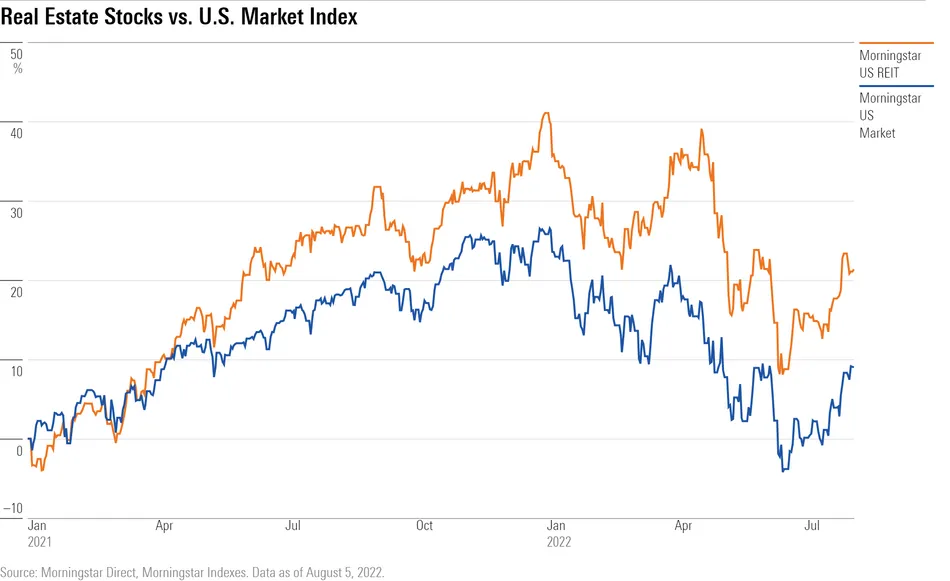

Real estate investment trusts, better known as REITs, had their best year in history during 2021. The bullish combination of a booming economy and rock-bottom interest rates was rocket fuel for the group. Not only was the rebound in the U.S. economy a boon for real estate, but yield-hungry investors also flocked to the hefty dividends REIT stocks offer.

The Morningstar US REIT Index surged 41.1% last year, and the Morningstar US Real Estate Sector Index gained as well, rising 38.3%, thanks to stocks like shopping center operator Simon Property Group (SPG), which gained 95.7%, and Prologis (PLD), which rose 72.3%. These returns made real estate the second best performing sector in the U.S. stock market after energy in 2021, even topping the 33.9% gain in technology shares. And at Vanguard, which runs the largest real estate mutual fund strategy with $71.1 billion, the Vanguard Real Estate ETF (VNQ) had the best year in its 18-year history with a 40.5% return.

But as interest rates jumped and fears of a recession spread, returns went from feast to famine in 2022. At its worst levels, the Morningstar US REIT Index was down 23.4% this year. Simon Property Group has fallen 35% from its second-highest all-time price in November, and mall REIT Macerich (MAC) is down 52% from its highs as well. VNQ, meanwhile, is down nearly 14% in 2022, its largest loss at this point in the year since the ETF’s launch.

The good news for investors looking to put cash to work is that, thanks to their steep share price declines, many of these high-yielding stocks are now trading at big discounts compared with where Morningstar’s equity analysts peg their fair value. Simon Property, which offers a yield of 6.6%, is 33% undervalued, and Ventas (VTR), a REIT focused on senior housing and healthcare properties, has a 3.9% yield and is 29% undervalued, according to Morningstar analysts.

The 10 Most Undervalued REIT Stocks

Jeffrey Kolitch, who has been managing the $1.5 billion Baron Real Estate Fund (BREFX) for nearly 13 years, says that while a rising interest-rate environment can be a “mixed bag” for real estate stocks, “looking forward over the next few years, the case for REITs is compelling.”

“Many REITs are attractively valued,” Kolitch says.

Real estate investment trusts are companies that own portfolios of properties: office buildings, shopping centers, hotels, apartments, and more. The properties generate income from rent and capital appreciation. REITs are then required to pay out at least 90% of that income to investors in the form of dividends, making them an attractive play for income-focused investors. The Morningstar US REIT Index carries a trailing 12-month dividend yield of 3.0%, which is double the yield of the broader equity market.

Though REITs come with high dividend yields, they are generally unable to carve out a durable competitive advantage, or economic moat. As a result, 82% of all REIT stocks covered by Morningstar analysts have a moat rating of none.

"You can almost always buy the building or land across the street and build a replica of an existing building to directly compete with any successful business,” Morningstar senior equity analyst Kevin Brown says. “However, we find that these companies add value through proper management, driving operating efficiencies far above industry norms, and through external growth, knowing when to acquire new assets, sell old assets, and develop at appropriate times.”

Brown notes that Morningstar rates many REITs as having an Exemplary capital allocation rating, a designation for companies with excellent corporate stewardship practices, related to their balance sheet, investments, and shareholder distributions.

Over the past 12 months, the Morningstar US REIT Index fell 4.4%, better than the broader market’s loss of 7.6% for the same period.

But that one-year return hides the extent of the up and down fortunes for REITs over the last two years. In 2020, REIT stocks were hurt by pandemic lockdowns, especially those with properties focused on retail, residential, or healthcare facilities. Even as the broader U.S. stock market staged a rebound from the pandemic-sparked bear market, with the U.S. market index up 20.9% in 2020, REITs finished the year down 4.7%. That dynamic changed in 2021, with REITs far outpacing the broader market until performance again deflated when interest rates began to rise at the start of 2022.

High inflation and rising interest rates are creating a mixed picture for REITs right now, says Baron’s Kolitch. “Several REITs offer inflation protection qualities because of their ability to reprice rents often,” he says. For example, hotels can set room prices daily, so their ability to offset rising inflation costs can be immediate. Leases for storage center REITs typically renew monthly.

“But for interest rates, the answer isn’t simple,” Kolitch says.

Rising interest rates affect REITs in two main ways, raising their costs of financing and making dividend yields less compelling relative to fixed-income alternatives, says Morningstar’s Brown.

“As interest rates rise, U.S. Treasury yield payouts go up, so the risk-free option becomes more attractive relative to REITs,” he says. “Investors shift out of REITs and into Treasuries.” In addition, he says, REITs add value by acquiring new real estate assets or building properties. “To fund expansions and acquisitions, REITs have to issue new debt. As interest rates rise, funding that growth gets more expensive.”

Brown notes that the macroeconomic impact can be worse for some types of REITs more than others. “Since malls are more sensitive to the overall economy, the negative impact is magnified.”

However, despite the current conditions and investor worries about the economy, a “short-term recession does not change my 10-year outlook on a company at all,” Brown says.

REITs that own data centers and cell towers are less affected by changes in the economy, says Matthew Dolgin, an equity analyst for media and telecom at Morningstar.

“Cell towers have rent escalators in their contracts to account for inflation,” he says. “In many cases, they provide benefits to the companies more than just offsetting rising costs.” And for some data centers, costs get passed directly to the tenants.

“Like most of the market, REITs are materially off from their latest highs right now, some more than others,” Dolgin says.

A screen of the Morningstar US REIT Index reveals the real estate investment trust stocks currently trading at the biggest discounts to their analyst-assessed fair value estimates. All of these undervalued stocks are REITs focused on retail, residential, or healthcare facilities:

Macerich

“Macerich’s repositioning of many malls following the Sears closures in 2019 is producing positive results and supports our estimates that Macerich can achieve 7.75% yields on future redevelopment projects.”

—Kevin Brown, senior equity analyst

Simon Property Group

“The high-quality properties [managed by Simon Property Group] will continue to provide consumers with unique shopping experiences that are hard to replicate elsewhere, and as a result, we think Simon’s portfolio will be sought after by retailers that are increasingly pursuing an omnichannel strategy.”

—Kevin Brown, senior equity analyst

Ventas

“We also like Ventas’ acquisition of New Senior Investment Group to expand its exposure to the sector ahead of what we believe will be a decade of strong growth.”

—Kevin Brown, senior equity analyst

Healthpeak Properties

“Healthpeak has high-quality assets in top markets that attract credit-grade tenants in both segments, so we believe it makes sense to strategically focus the company on the segments where it has an advantage. Despite the possibility of further changes to the Affordable Care Act, we think any changes will still result in a coordinated value- and outcome-based system that will provide Healthpeak’s current portfolio with strong tailwinds.”

—Kevin Brown, senior equity analyst

Kimco Realty

“As the retail environment faces long-term headwinds that disproportionately affect lower-quality assets, we believe Kimco’s efforts to improve the portfolio’s overall quality are essential to providing value for shareholders.”

—Kevin Brown, senior equity analyst

Welltower

“The coronavirus was a major challenge to Welltower over the past two years. The senior population was one of the worst hit from the virus, and a few cases led to quarantines of entire facilities, which dramatically affected occupancy. However, month-over-month occupancy improved through 2021 as vaccination rates went up, and we remain optimistic about the sector’s longer-term prospects given that the industry should eventually recover from the impact of the virus, supply has started to fall below the historical average and will remain low for several years, and the demographic boon will create a massive spike in demand for senior housing.”

—Kevin Brown, senior equity analyst

Equity Residential

“We do expect management to continue its patient and prudent capital stewardship, but potentially high supply puts a limit on [Equity Residential’s] ability to realize internal and external growth.”

—Kevin Brown, senior equity analyst

AvalonBay Communities

“We are concerned that high supply may limit the company’s ability to realize significant internal growth for a few years, but long term we think that AvalonBay should see higher than industry average growth as demand remains strong and the new development pipeline starts to produce significant returns on investment.”

—Kevin Brown, senior equity analyst

Invitation Homes

“Given that millennials typically lack the necessary capital for a down payment, many have chosen to rent single-family homes [Invitation Homes’ core market] when they move to the suburbs. This increase in demand combined with slowing supply due to high construction prices should promote solid fundamental growth for several years.

“However, the long-term outlook for this segment is not as rosy as the next few years may appear. The baby boomers are also aging and will eventually return their housing stock to the market. The increased supply will either lower housing prices to the point that renters can afford to purchase a home or create new rental housing stock that will compete with Invitation Homes’ portfolio. Ultimately, we don’t think the single-family rental market will support growth above inflationary increases.”

—Kevin Brown, senior equity analyst

Essex Property Trust

“Though Essex has a strong balance sheet and we expect management to continue to exhibit careful but strategic capital stewardship, we believe that there are still challenges from the pandemic to the company’s internal growth in the short term and the company’s exposure to the volatile tech industry presents real downside risk.”

—Kevin Brown, senior equity analyst

Lauren Solberg does not own (actual or beneficial) shares in any of the securities mentioned above. Find out about Morningstar’s editorial policies.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

© Copyright 2022 Morningstar, Inc. All rights reserved. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.