Vertigo3d

Vertigo3d

Broadstone Net Lease (NYSE:BNL) is a REIT with a focus on single-tenant commercial real estate. These properties are net leased on a long-term basis to a diversified group of tenants in five sectors: Industrial; Healthcare; Restaurants; Retail; and Office. At nearly 50% of total annualized base rent (ABR), Industrials account for the largest share of BNL’s total revenues. With no single tenant driving more than 2.1% of ABR, the company’s portfolio is well-diversified across 200 different commercial tenants.

As a net leased REIT, BNL benefits from durable cash flows and long-dated lease terms. In the most recent period, the weighted average lease term of the portfolio was 10.5 years, with recent acquisitions made at terms in excess of 19 years. With embedded escalators in 80% of their leases, the company is also afforded protection against broader inflationary pressures.

At nearly 100% occupancy levels and full collections, BNL faces limited near-term challenges. Shares, however, are down about 13% YTD. Though markedly better than the broader index, there is still room for upside. At a tight 52-week spread of less than $10 between its high and low, shares also provide protection against market volatility. For investors seeking a flight to safety, BNL is one REIT that offers protection at a discount.

For the period ended March 31, 2022, BNL reported total revenues of +$93.8M. This was about 13% greater than expected but just shy of estimates. FFO and earnings, on the other hand, were in-line. Driving revenues and earnings growth in the current period were contributions from recent acquisitions completed in the fourth quarter of 2021.

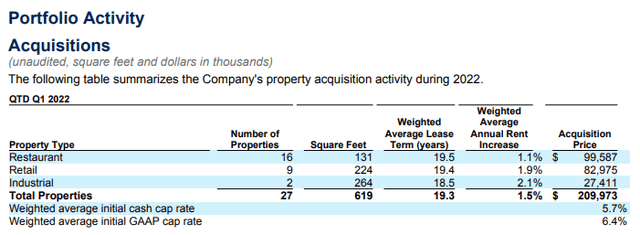

During the quarter, the company was highly active in the market, with Q1 marking the largest first quarter volume in BNL’s history. In total, the company invested +$210M in 27 properties with a weighted average lease term of 19.3 years and embedded annual escalators of 1.5%. The acquisitions were made, however, at slightly elevated valuations compared to prior periods, with an initial cap rate of 5.7% versus 6% in Q4 and 6.1% over the past 12 months.

The acquisitions during the period were concentrated in restaurants and retail, with the two accounting for nearly 90% of their total investment. Post-acquisition, the two sectors now account for 15% and 12% of total ABR, respectively, with exposure to restaurants up 200 basis points. With more consumers shifting their spending from goods to services, the enhanced exposure may be a timely move for the company.

Q1FY22 Investor Presentation – Portfolio Acquisition Activity

Q1FY22 Investor Presentation – Portfolio Acquisition Activity

During the period, BNL also acquired property in Canada. This would be their first targeted acquisition in the region. The properties are located in the premier urban markets of Vancouver, Calgary, Winnipeg, Ottawa, and Toronto and are purposed for high quality retail. As a percentage of total ABR, the region accounts for just 2.4%, which is in-line with the company’s diversification strategy.

Overall occupancy held strong at period end at 99.8%. Cash collections were also 100%. Additionally, substantially all their properties were subject to lease and were occupied by over 200 different commercial tenants. Continued strength in the portfolio supported the reiteration of full-year guidance, which calls for an AFFO/share range of $1.38 – $1.42, representing growth of 6.9% at the midpoint from the prior year.

As of March 31, 2022, BNL reported total assets of +$4.9B and total liabilities of +2.0B, comprised principally of total net unsecured debt of +$1.7B. As a multiple of annualized adjusted EBITDAre, net debt was 5.1x, which was consistent with the same period last year and in-line with an internal target of less than 6x.

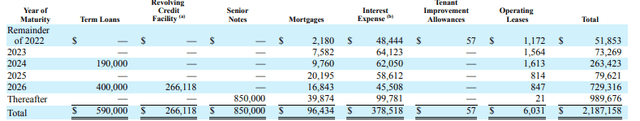

With nearly 50% of total contractual obligations due after 2026, BNL has well-laddered maturities that provide cushion against any near-term repayment risks and risks associated with the current rising rate environment. Additionally, the company possesses an investment-grade credit rating from Moody’s and S&P Global. The stable rating provides confidence of continued access to debt markets at rates comparable or better than the prevailing market.

Q1FY22 Form 10-Q – Summary of Contractual Obligations

Q1FY22 Form 10-Q – Summary of Contractual Obligations

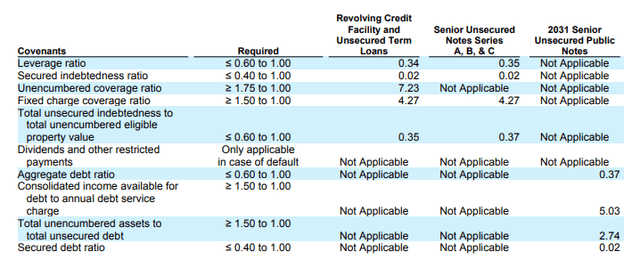

BNL is also comfortably in compliance with their covenant requirements. Unencumbered coverage and consolidated income, for example, are at 7.2x and 5x, respectively, which vastly exceeds the minimum requirement. Should the company require additional debt financing, breathing room within their covenants is certainly there.

Q1FY22 Investor Supplement – Debt Covenant Compliance Summary

Q1FY22 Investor Supplement – Debt Covenant Compliance Summary

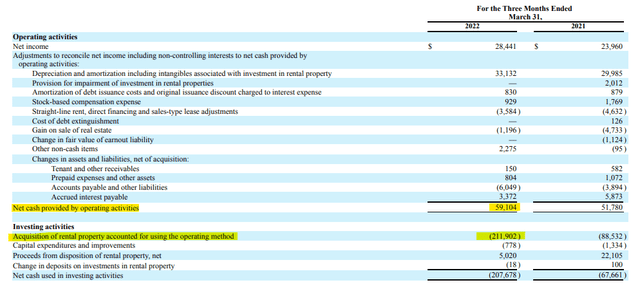

With liquidity of approximately +$1B at period end, BNL’s obligations are adequately funded for the next several years. Additionally, the company is generating stable cash from operations through continued earnings growth, aided in part by annual escalation provisions embedded in their leases. A diversified tenant base with cross-industry exposure provides protection against risks associated with greater concentration. This provides assurance to cash flow continuity.

While the company is generating positive cash flows, they are, however, burning through available cash on acquisitions. In the current period, they spent +$212M on investing activities. This is on top of the nearly +$150M spent during Q4FY21. Though these acquisitions have been accretive in the past, there is the risk the company is buying into a market top. Deterioration in economic conditions could thus have an adverse effect in future periods through declining valuations and/or increased vacancies.

Q1FY22 Form 10-Q – Partial Cash Flow Statement

Q1FY22 Form 10-Q – Partial Cash Flow Statement

For income investors, shares in BNL presently offer a yield of over 5% after having been most recently increased by about 2%. As a relatively newer REIT, the company doesn’t have a long public track record of growth. But it does benefit from the same characteristics of other net lease REITs, namely reduced risk and durable cash flows. At an operating coverage of 1.4x and an AFFO payout ratio of 74%, there does appear to be spare capacity for growth.

A focal point of BNL’s strategy is to invest in single-tenant, triple-net leased properties. While this structure does have advantages, there are particular and significant risks related to tenant default. Because there is only one tenant, BNL’s exposure to financial default is elevated. If default were to occur, BNL would not only lose the income on the property, but the value of that property would likely also decline. This could result in further issues in re-leasing or selling the property.

This risk is amplified in cases where the company leases multiple properties to a single tenant under a master lease. As of December 31, 2021, master leases represented just over 30% of total ABR. A tenant failure or default under a master lease could reduce or eliminate revenue from multiple properties and could significantly affect BNL’s results of operations.

Though the long-term nature of BNL’s leases is one advantage in retaining tenants and generating stable cash flows, the structure presents the company with limited opportunities to increase rents. In the most recent filing period, for example, BNL’s weighted average lease term was 10.5 years. Though substantially all their leases contain escalation clauses, these built-in increases may be less than what the company can otherwise achieve in the prevailing market.

BNL’s oversized exposure to Industrials, at 46% of ABR as of Q1FY22, could present headwinds in future periods. Recently, Amazon (AMZN) made a decision to sublease up to 30M square feet of warehouse space or renegotiate leases. The pullback in spacing needs put the hot warehouse sector on alert following the announcement. Further negative developments could create additional strain in the sector and negatively impact BNL’s operating outlook.

In the current period, BNL’s acquisitions were weighted more heavily towards restaurants and retail, with the two now accounting for a slightly higher share of total ABR. With inflationary pressures at record highs and consumers increasingly concerned about the economy, there is a heightened risk of a broader economic slowdown. Any resulting downturn would disproportionally affect these two sectors due to the discretionary nature of the industries. BNL, therefore, is exposing themselves to elevated risk by investing in sectors that may be at the tops of their business cycles.

BNL’s focus on the net lease model is a competitive strength that provides downside protection in challenging operating conditions. With extended lease maturities and embedded escalators, the net leased portfolio generates durable and predictable cash flows. Extensive portfolio diversification provides further insulation against concentrated risks in certain sectors of the economy.

Though the company has heightened exposure to the Industrial sector, BNL’s recent market activity were weighted more towards restaurants and retail. As consumers increasingly redirect their spending habits from goods to services, this move should prove timely. Though recession risks abound, there are no clear signs of tenant distress. Occupancy is nearly 100% and the company collected 100% of cash rents owed in the current period.

For investors seeking portfolio protection, shares in BNL offer a tight 52-week trading spread with an annual dividend payout yielding more than 5%. While shares are down 13% YTD, the performance is still stronger than the broader index, which is trading in bear territory. At an estimated discount rate of about 6% and a dividend growth rate of 2%, shares would be valued at approximately $27 using a dividend discount model with an estimated future payout of $1.07. In a flight to safety, shares in BNL are currently offering protection at a discount.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.