Frederick M. Brown

Frederick M. Brown

Dear readers,

Journalism, broadcasting, and Media in the USA is a political firestorm, it seems like – and this is coming from someone looking in from the outside. While other nations have politically tilted news and broadcasting services, the two sides seem far clearer in the US than elsewhere in the western world.

In this article, I’m going to look at the investment appeal of Fox (NASDAQ:NASDAQ:FOXA) following a near-20% decline since I last took a look at it.

This will, however, be my first article on the company.

I’m a big fan of investing in communications companies, and that includes broadcasting businesses. There is, to me, a lot to like about them. They connect people and people grow to depend on the connections, meaning charging money for them is entirely possible. Just look at the way that a phone subscription has changed things in terms of what people are now almost universally paying “first” among their bills. That was not the case when I grew up (even though people did, of course, have a landline).

Broadcasting and news are a little different – it too has evolved.

Fox IR (Fox IR)

Fox IR (Fox IR)

Fox Corporation is an interesting one. It’s a mass media company owned in part by Rupert Murdoch – at least he has almost 40% of the voting power – and headquartered in NYC. Its formation goes back to 2019, when 21st Century Fox was M&A’ed by Walt Disney (DIS), with the non-acquired assets spun off into a media company known as Fox Corp, which began trading in early 2019.

Going through all of the company’s various operations and media libraries would be an article series, not an article, so I’ll try to keep things concise here.

The Fox Corporation is a media company in the News, Sports, and Entertainment segments in broadcasting/media.

It works in the following three operating segments:

There is also a Corporate/other segment.

The company is the owner of plenty of premium brands and programming such as Simpsons, Family Guy, Bob’s Burgers, Hell’s Kitchen, MasterChef, and Next Level Chef. The company is also a sports leader, enjoying leadership around news, sports, and entertainment.

It’s one of the few legacy television companies that despite legacy TV decline, seems to have found a mix based on so-called appointment-based programming, that seems to work. The company has been on the leaderboard for 20 years straight based on Monday to Friday primetime numbers (Source: Nielsen), and finished 2021 as the #1 Cable network in Mo-Fri primetime and total day viewers, cementing its track record for the 6th year running.

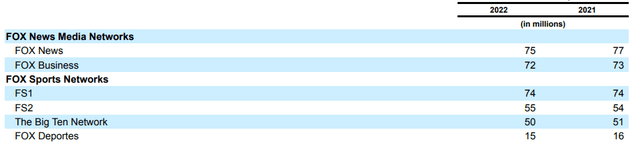

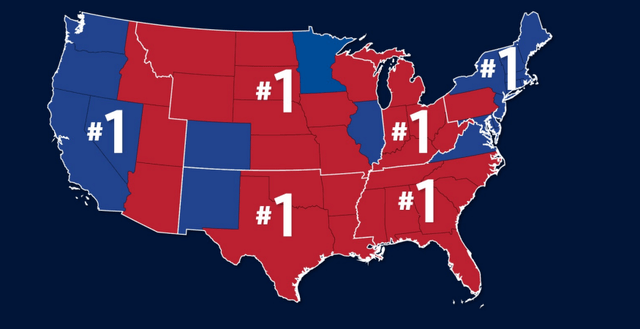

Fox Corp is primarily a US-based network. While I personally follow Fox News (as well as other US-based news outlets), most outside US only know the company peripherally or from hearsay. However, within the US, it has availability in 70 million households, for News and Business, with FOX Network being available essentially in every household in America.

Fox has been able to deliver close to double-digit revenue growth rates, which is impressive in the communications industry. The company has low debt, with 39.94% debt/Cap, and a credit rating of BBB. Fox news has a current market cap of $19.1B after the company’s share price drop from around 15x P/E to around 11-12x P/E.

What’s more, growth is expected to continue. While viewership is somewhat down across most sub-segments and networks, these numbers are down from top-levels back in 2021.

Fox IR (Fox IR)

Fox IR (Fox IR)

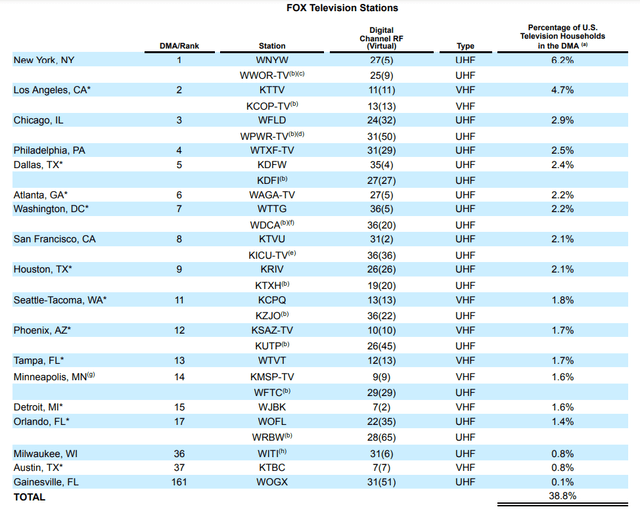

Through its television station, the company has the ability to reach close to 39% of American households.

FOX IR (FOX IR)

FOX IR (FOX IR)

These are fundamentally appealing numbers. The company also pays its shareholders a dividend – albeit a low one for the communications sector. This is perhaps one of the bigger challenges for the company. The yield is barely 1.5% even after the drop and the growth in that dividend has been low. Understandably, of course – a communications company has massive amounts of CapEx as it needs to stay on top of programming and content, all of which require capital.

The depreciation of assets is faster than in nearly every industry when we look at broadcasters and streamers. That’s part of the reason I generally don’t like owning them. If you own a blockbuster show, sure. But for every blockbuster show, there are 10 or more that don’t meet the criteria and are essentially wastes of money, forgotten, and essentially worthless after a short time.

The broadcasting segment requires a high amount of foresight and capital/cost control to avoid overspending and keep quality high.

Despite lower viewership in 2022, the revenue (considered years ended on June 30th) is actually up 7%, with advertising up nearly double-digits for 2022. This can be combined with understandable increases (double digit) in OpEx & SG&A. Affiliate fees were up, advertising and other incomes were up as well, weighing up the lower average subscriber amounts – but sports programing right amortization and production costs were higher. Technology costs were up as well. Net income so far is down significantly, but this was mostly due to the FV of the Flutter Entertainment investment, and Disney paying back a substantial amount in settlement fees in the comparative period, meaning it’s a hard one to compare fairly to.

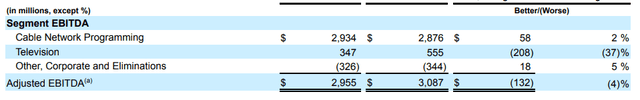

On a segment basis, Cable network programming steals the show with 2% EBITDA increases, while Television is dragging things down with a 37% EBITDA drop, 4% on a broad basis.

Fox IR (Fox IR)

Fox IR (Fox IR)

The Cable Network programming segment is the one thing to keep in mind here. For the past few years, the company has done really a stellar job in growing not only revenues and sales, but the bottom line as well. Volatility is still part of things here – as it is for most of these content companies – but it’s far from as bad as, say, Netflix (NFLX).

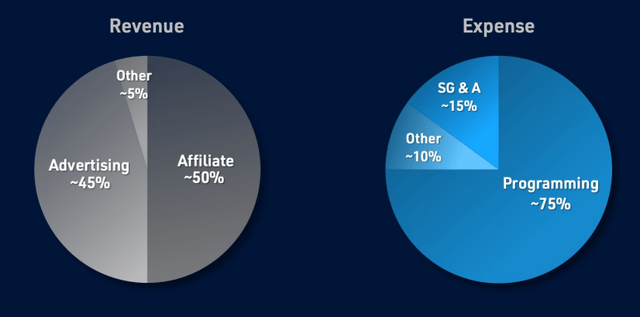

Expense segmentation and revenue incomes are typically fairly clear – and as we would expect them to be.

Fox IR (Fox IR)

Fox IR (Fox IR)

Most programming expenses (over 65%) is from Sports – entertainment and news don’t actually cost that much compared to the sports programming costs (the 75% above), so FOX is heavily sport-dependent. Of course, the company also covers virtually every major news event in the nation. The company has key strengths and growth levers that it can and intends to pull going forward.

And unlike some other players in the industry, Fox owns 100% of its content, controlling its costs and monetizing on every platform.

Fox IR (Fox IR)

Fox IR (Fox IR)

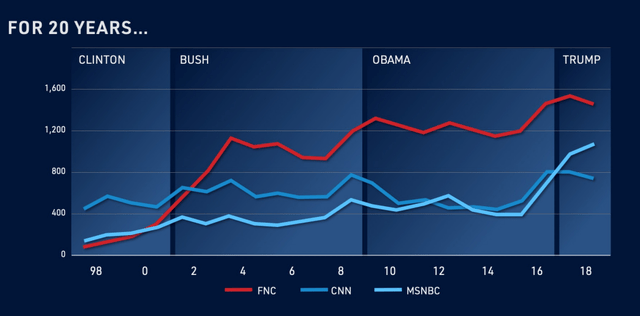

People might think that Fox news audience “ownership” began with the Trump era, but the fact is that this has been the case since the very early 2000’s. The trump era really only cemented this.

Fox IR (Fox IR)

Fox IR (Fox IR)

It’s clear to me – Fox news (and its channels) is speaking, and large parts of the nation are listening. It’s not just a matter of political allegiance either – FOX has great viewership in both democratic and republican-run areas.

Fox IR (Fox IR)

Fox IR (Fox IR)

Fox, therefore, has the “right stuff” to be a good investment, all things considered. It’s qualitative, it has a history of being able to gain viewership, it has loyalty from its viewers that seems to transcend political dynasties and terms, and it pays an appealing dividend. I really don’t care much for the politics involved here – I’m just interested in good business.

And it’s clear to me that Fox Corporation does good business.

Let’s look at valuation.

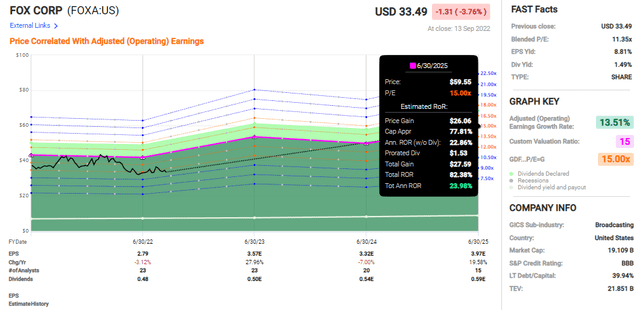

Fox at this valuation is, no matter how you really slice it, appealing.

This is because the business trades at a multiple of 11.3x P/E normalized while expecting to be able to deliver average double-digit EPS CAGR until the 2025E Fiscal. And this forecast accuracy, despite its short period, is 100% with no failure.

Based on the company’s fundamentals, it’s history, credit rating, and its management, I would not bet against FOXA abilities to deliver at least part of this growth which, in the context of the drop for the latest 6 months, should act as a catalyst for higher valuations.

If we assume that the EPS growth is solid, then just a 10x-11x P/E would result in a 9-12% annualized growth rate. Assuming full normalization to around 15x P/E, which would be fairer given the overall company growth rate, that expands to 24% per year.

Fox Upside (F.A.S.T. Graphs)

Fox Upside (F.A.S.T. Graphs)

This forms most of the bullish thesis for FOX here – good fundamentals, mixed with a good valuation. The yield isn’t great, nor is the DGR, but Fox might be able to offer stability in a communications market that’s otherwise marked by churn. Fox doesn’t have the same amount or sort of churn.

Given a choice between broadcasters, I would go for investing in Fox Corp – without question – especially at this valuation.

S&P Global considers the company a solid “BUY” with a $30-$50/share PT, coming to an average of $41.3, implying an upside to a normalized 15x P/E of around 23.2%. Out of 20 following analysts, 13 give the company a “BUY” or equivalent rating. Yield isn’t why you buy Fox – but the relative stability and growth prospects of owning one of America’s largest television networks.

While net profit numbers are mixed overall and while there are things to keep an eye on, the overall targets for Fox and the overall expectations for the company are positive, going into this. Peers include things like Nextstar (NXST), Paramount Global (PARA), and others – but none of them come all that close to comparing to this one.

All of this means that I’m initiating coverage on Fox Corp with a “BUY” and a price target of $40/share, implying a conservative mixed upside at a 13-14x 2025E level.

My thesis for Fox Corp is as follows:

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicized).

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

36 year old DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in FOX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company’s domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.