Mariakray/iStock via Getty Images

Mariakray/iStock via Getty Images

While the COVID-19 pandemic exploded the meal-kit and food delivery industry with rapid growth, 2022 has proved more difficult for meal-kit delivery companies like Blue Apron (NYSE:APRN). Down 55% from its 52-week high of $12.76, APRN has recently rallied following the company’s announcement of $25 million in potential share buybacks.

This is part of Blue Apron’s “Next Course” strategy, which is intended to lead the company closer to its goal of adjusted EBITDA profitability in 2023. While APRN is still struggling to become consistently profitable despite 10 years in operation, I believe its turnaround strategy has merit as the company works to diversify its business model.

Established in 2012, Blue Apron initially benefited from being the first meal kit delivery company in the US. While this may have given the company a first mover advantage, it has now found itself in a very competitive space.

Its market share has shrunk since 2019, leaving APRN with only 9% of the meal kit market as of 2021. Whereas its competitor – HelloFresh (HFG) – which dominated over half of the entire market in 2019 – held 69%. Although APRN is still outperforming Marley Spoon and Sunbasket, Home Chef – a subsidiary of Kroger (KR) – held 14% of the market at the time.

It’s worth noting that despite its market dominance, HelloFresh – a global meal-kit provider with a primary listing on the Frankfurt Stock Exchange – has seen a 64% decrease in its stock since the start of the year. Now trading at the same price level as it was in February of 2020, it’s clear that APRN is not the only meal kit delivery company impacted.

However, HFG’s constant expansion has put it in a stronger position to weather the storm. Thanks to its presence in 16 countries, HFG reported 8 million customers as of Q4 2022. It also has a strong presence in the US due to its acquisitions of Green Chef in 2018, Factor 75 in 2020, and the launch of EveryPlate in 2018. Despite its competitor’s dominance, I believe APRN could still capture a slice of the global meal kit delivery market, which is projected to grow from $17.86 billion to $64.44 billion by 2030.

For comparison, HFG has achieved profitability with a P/S ratio of .57 given its $3.896 billion market cap and the equivalent of $6.83 billion in sales. Whereas Blue Apron has a P/S ratio of .43 based on its $198.34 million market cap and $458.65 million in sales over the last four quarters. APRN’s lower P/S ratio shows that the company is not overvalued despite its setbacks and while it presents certain risks as an investment, APRN could have a successful turnaround.

Meal kit delivery companies must overcome many initial challenges due to the nature of their business. After all, mastering the logistics of shipping perishable groceries to thousands of customers nationwide, every day is no mean feat. But APRN’s problems have only compounded since its listing.

APRN brought on Linda Findley as its new CEO in 2019 to lead the company’s turnaround. Since then the company has made progress in engaging with high-value customers and offering greater menu variety, but much of the company’s plans were hampered by the unexpected COVID-19 pandemic which both helped and hindered its progress. Now with the pandemic behind it, it seems that APRN is finally able to make the changes necessary to achieve profitability.

Overall, APRN’s goals of reaching positive operating cash flow, at least 500 thousand customers, and at least $700 million in revenue by 2024 appear modest for a company founded in 2012. But this is a decisive moment for APRN which has quickly become a growth company with barely any growth.

APRN peaked with 1 million customers in Q1 2017 but has not reported more than 400 thousand customers since Q2 2019. As of Q2 2022, it had 349 thousand customers and 682 thousand active customers over the last 12 months.

APRN Quarterly Reports

APRN Quarterly Reports

For this reason, APRN has been focused on bringing in more revenue per customer which led to a slight increase in average revenue per customer QoQ though this metric is still down from a year ago. Its number of orders has also remained relatively stagnant ranging between 1.6 and 2.1 million per quarter. The most notable growth has been in its average order value and average revenue per customer which have continued to grow since the pandemic, though this is partly due to APRN’s recent price increases.

For the company to attract 500,000 customers and bring in $700 million in revenue, APRN will need to undergo major changes to its business model and strategy for attracting customers. But I believe that APRN can hit this metric as it incorporates non-subscription options in its business model through third-party platforms.

Shareholders appear to share my confidence in the company’s ability to diversify through non-subscription offerings since the stock rallied on news of APRN’s Walmart.com (WMT) deal. As it achieves next-day shipping capabilities, the company could form new partnerships or open a storefront on Amazon (AMZN). These platforms will reduce customer acquisition costs while bringing a new audience to the brand.

However, this is not a cure all. Blue Apron sold its meal kits at a discount on Jet.com from 2018 to 2019 and had even experimented with in-store offerings selling its meal kits through Costco in 2018. But neither of these strategies paid off at the time.

Despite its lackluster results in the past, this is likely the best strategy for reaching the 50% of consumers who have never tried a meal kit delivery service due to its subscription element. As Findley shared, APRN is an ecommerce company with subscription at its core. Defining and capitalizing on this market of as of yet untapped consumers offers a potential upside for the company moving forward.

Considering how fierce competition between meal kit delivery companies has become, diversifying its business to appeal to non-subscription customers as well could be the next step for APRN. Especially since many of APRN’s subscribers do not behave much like subscribers.

The median number of weeks between pausing and reactivation ranges from 75 to around 10. Customers are ordering on average 5 meals per quarter and many of APRN’s most valuable customers do not order regularly throughout the entire quarter. I believe the takeaway from this data is that customers are interested in high-quality meal kits but not necessarily on a subscription basis.

The subscription bubble that took off in 2011 will likely burst as consumers grow weary with subscription fatigue. The combination of additional subscription services added on during the pandemic and reductions in discretionary spending are key factors in what the Kearney Consumer Institute predicts will be a steep decline in the subscription market. I believe that pursuing non-subscription options will help APRN avoid the brunt of what could be the “great unsubscribe”.

APRN was also able to drive a 6% increase YoY in revenue thanks in part to a $10 million bulk enterprise sale in Q2. Enterprise sales appear to be becoming a focus for the company which sees the opportunity for revenue, customer, and brand growth through corporate portals, bulk gift card sales, sweepstake programs and the curation of custom boxes and experiences. I agree that enterprise and bulk sales are a new way for the company to reduce its customer acquisition costs and diversify its business further, but this $10 million bulk sale was a one-time deal and it will be up to APRN to prove its ability to secure additional sales in the future.

If APRN reports additional enterprise sales and new partnerships with third-party platforms in the coming quarters, I believe this would be a bullish sign indicating the company’s ability to diversify and branch out despite these economic conditions.

Overall, APRN is now in a better position to pursue its turnaround strategy having negotiated amendments to its debt agreement. Among these amendments is a provision giving the company the option to use up to $25 million in cash for future share repurchases. These share buybacks could only occur on the condition that APRN closes $50 million in equity financing which Joseph Sanberg has already agreed to personally guarantee.

Sanberg’s faith in Findley’s ability to lead the company’s turnaround is another cause for confidence. So far this year, Sanberg has assisted with a $40 million private placement investment by his affiliate RJB Partners and a gift card sponsorship agreement worth $20 million. Between April and August, he also purchased 11.7 million shares, increasing his holdings to 27.6 million shares. Sanberg is clearly very invested in Blue Apron’s success having considered taking the company private in May.

Based on his involvement, I believe Sanberg will be an important part of the turnaround process. However, Bed Bath & Beyond’s (BBBY) rally and unceremonious drop following Ryan Cohen’s divestment from the company outlines the risk that APRN could follow a similar path.

But it’s worth noting that the company is already taking a more proactive approach to improving its relationship with shareholders. As part of the New Course strategy, Findley has improved communication with investors through a series of recent interviews as well as hosting APRN’s first Investor’s Day. These moves along with the potential share buyback have reinvigorated interest in the stock as demonstrated by its latest rally.

As is, I believe APRN will show an improvement in its Q3 earnings since the company has been making investments in its ESG goals and other operations for the past two quarters. With these investments now concluded, APRN expects to significantly reduce its spending moving forward. Q2 was also a seasonal lull for APRN, and as customers return to their normal work schedules in Q3, the company could report higher revenues.

In Q2 the company reported a $.04 miss on its GAAP EPS loss along with a $774 thousand revenue miss. However, Wall Street is expecting a notable improvement next quarter with expectations of $129.6 million in revenue and a GAAP EPS loss of $.48. Although APRN reduced its expectations for revenue growth in the mid-teens to that of 7%-13% for the year, the company appears on track to achieve its goal for adjusted EBITDA profitability in 2023.

But not everyone has confidence in APRN’s turnaround plan as illustrated by its 44% short interest. This 12.36% increase from a week ago comes as investors’ excitement for the meme stock rally led to higher than average trading volume for much of August.

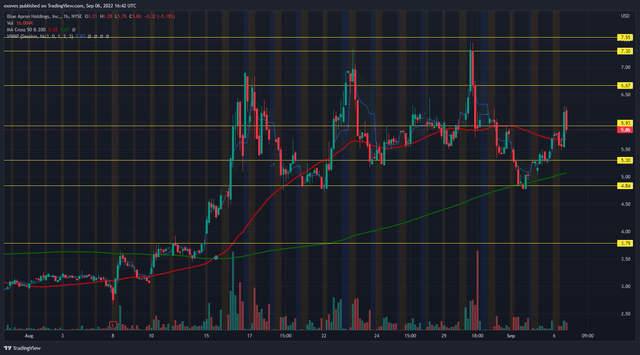

TradingView

TradingView

For most of August APRN was in a bullish trend as it made higher highs and higher lows. APRN’s test of the 200 MA led to a rebound and I believe the trend will likely continue since the stock continues to trade above the 200MA after forming a higher low. This confirms the structure’s integrity and reduces the risk of taking a position this far in the run.

As long as APRN maintains its structure, the trend should continue. However, an important level to watch is its $4.84 support. A break through this level or the 200 MA would be a sign to exit your position. I would take profit at $6.67, $7.30, and $7.55 if the stock continues its run.

For investors looking for an entry, I recommend that they watch for a retest of the 200 MA to reduce their risk exposure. But be mindful that APRN’s run is largely fueled by the company’s potential share buyback plans and it could have an explosive move in either direction depending on the company’s updates.

Companies pursuing a turnaround are generally riskier than others and investors considering APRN should be well aware of its risks.

If the company’s turnaround strategy fails, it won’t be long before VC funding is no longer available to keep APRN afloat. It’s not uncommon for companies in this sector to fall into bankruptcy, and this could be a long-term risk for APRN. Additionally, APRN is required to maintain a minimum cash balance under its senior secured term loan and there is no guarantee that its business will be able to generate that cash flow necessary. Shareholders have already been diluted in the past year as the total outstanding shares increased by 47.4% and this dilution will likely continue.

APRN is a beaten-down stock that has significant upside if its turnaround strategy is successful. I believe that diversification of its product portfolio will introduce it to a new audience and help it work towards EBITDA profitability in 2023. Given the inflationary post-pandemic environment, subscription services will likely take a hit and I believe that introducing non-subscription offerings will be key to APRN’s survival in the industry.

With the pandemic’s effects on the company’s operations lessening, now is APRN’s best opportunity to pursue its turnaround strategy and the Next Course strategy is a promising first step.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.