South_agency/E+ via Getty Images

South_agency/E+ via Getty Images

tonies SE (OTCPK:TNIEF) is currently undervalued by ~50%. I believe TNIEF’s intrinsic value will crystallize as it continues to grow its base of customers overseas while sustaining its leading position in its core markets. The growth momentum in the U.S. market has been anything but stellar so far, which reinforces that proven business concept that TNIEF has. I believe TNIEF can hit its FY25 guidance and the stock price should reflect the business value overtime.

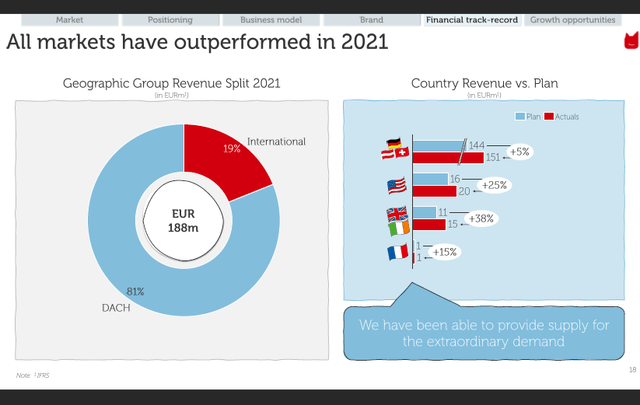

The TNIEF works on creating audio platforms for preschoolers (age 3+ years). The main products are the Toniebox and Tonies. The Toniebox is an interactive music system, while the Audio files can be stored on these Tonies. TNIEF distributes its products through a wide variety of online and offline channels. As of 1H22, TNIEF has 75% revenue derived from Germany, Austria, and Switzerland, collectively known as the DACH region. The remaining 25% is split between the US (15%) and the rest of the world (10%).

tonies’ business revolves around the eponymous smart connected Toniebox. Based on the small figure (Tonie) on top of the box, it is a screen-less audio player that can play a variety of content. It is suitable for small children as young as three years old due to its shock-resistant and child-friendly design. The few buttons and motion control make the box easy to use and encourage kids to use it on their own.

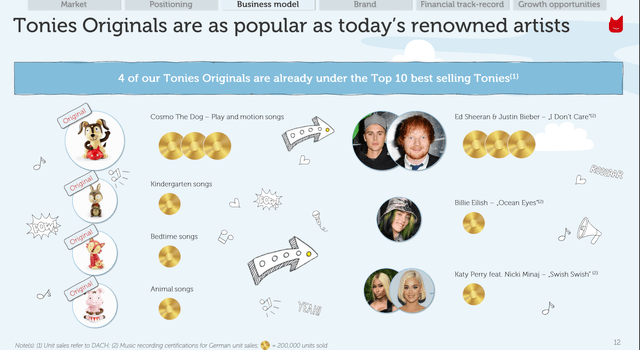

The beauty of being in the content business is that there are no hard constraints on how far you can go in terms of content (for instance, think about the Marvel and DC universe). Some of the many topics into which Tonies can be sorted by their creators and viewers are: adventures, animals and nature, children’s music, education and learning, fairy tales, and Falling Asleep. It makes sense to have the themes depend on the website’s location, as some degree of localization is necessary. That’s why you might find some contrast between the topics covered on other site and those covered on the DACH-region site. The company currently sells over 300 Tonie figurines but hopes to add more characters for kids in the future based on market trends, kids’ preferences, and new partnerships with different licensors. TNIEF can expand its product portfolio, including accessories, headphones, and bags, in addition to expanding its content universe. These may not be the core products, but they do provide TNIEF with additional monetization options.

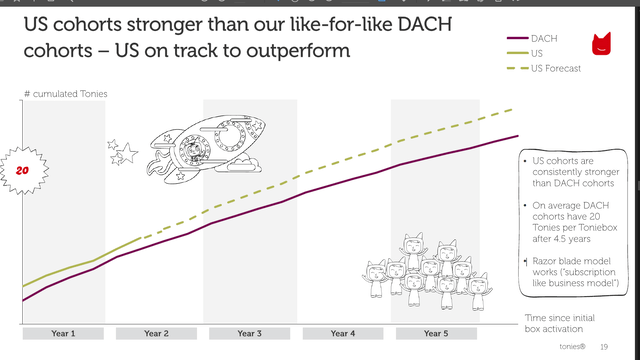

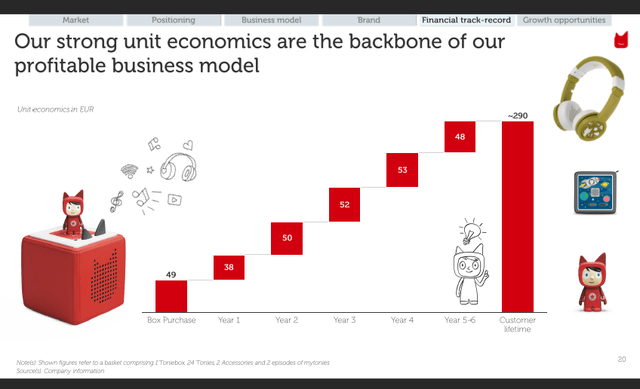

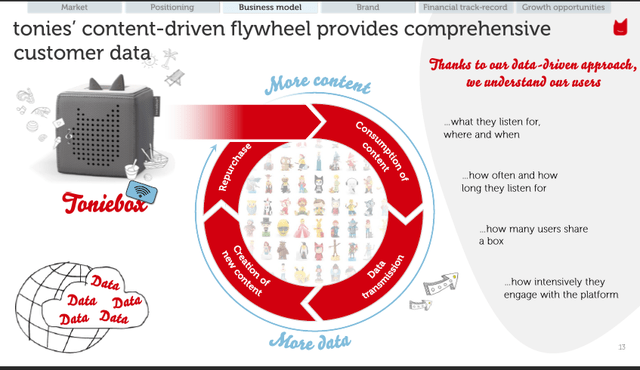

Like the razor-blade business model, TNIEF’s whole ecosystem encourages repeat use and purchases, from downloading audio content to buying more figurines and accessories. This makes people more loyal to the brand.

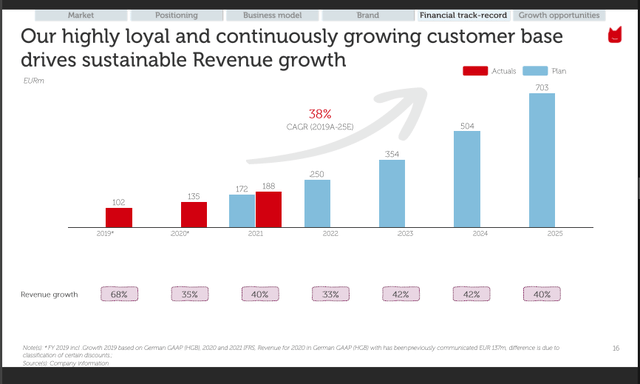

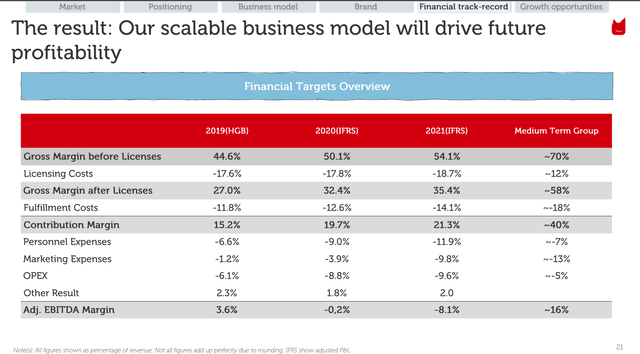

In financial terms, this means that today’s sold boxes will drive profitability in the coming years. Tonies’ journey begins with the box, the company’s lower margin product. However, past experience shows that each additional Toniebox results in 20 distributed Tonies over the next 4.5 years, implying that TNIEF begins a subscription-like revenue stream with each sold Toniebox. Furthermore, Tonies are the company’s high-margin product. As a result, today’s box distribution ensures profitable growth in the future.

FY21 earnings

1Q22 earnings

FY21 earnings

1Q22 earnings

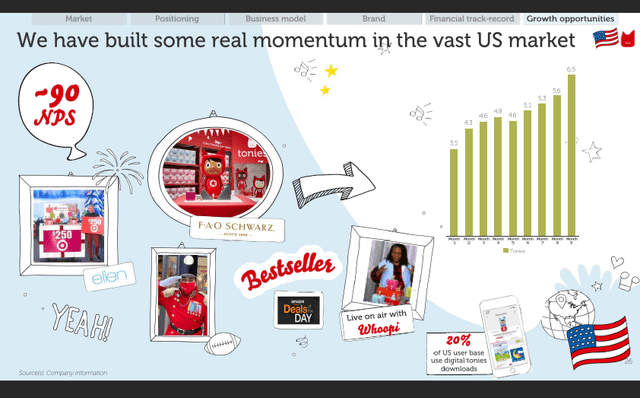

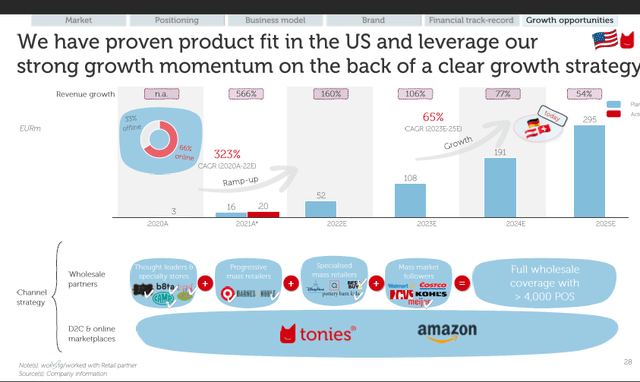

I believe TNIEF can maintain its growth momentum in the United States, which has a massive TAM – as of 2021, there are 48 million kids under the age of 11, and if we assume half of them are between the ages of 3 and 6, that is an additional 24 million potential opportunities for TNIEF to target. To gain confidence, we must examine TNIEF’s track record in the DACH region. Since its market entry in the DACH region, TNIEF has been able to increase market penetration to 35% in 2021 (1Q22 earnings presentation). To put that 35% figure into context, it means that nearly one in every three children aged 3-6 owns a Toniebox. This success in the DACH market, I believe, serves as a proof-of-concept for the company.

In fact, TNIEF has been beating its own planned guidance internally. The U.S. market was originally planned to hit EUR16m of revenues in 2021 but has outperformed by 25% (1Q22 earnings presentation). Growth momentum in the U.S. market has been stellar thus far. The brand has a NPS score of 90 and has almost doubled the number of Tonie unit sales from 3.5 million to 6.5 million after 8 months.

1Q22 earnings ppt

1Q22 earnings ppt

1Q22 ppt

1Q22 earnings ppt

1Q22 earnings ppt

1Q22 ppt

The ability to acquire content is crucial for TNIEF because it is the content itself that serves as the foundation for the company’s operations. TNIEF is able to show international blockbuster content from studios like Disney (DIS) and Warner Bros. thanks to its extensive network of international partners. On the surface, this may seem like a simple task, but it actually presents a significant challenge for a newcomer. Think about trying to get a major content provider known worldwide to license its content to a brand-new company. Because of the lack of scale, it’s nearly impossible for a new player to buy the content and make money from it while also convincing DIS to put its reputation at risk by letting that player sell its content.

TNIEF recognizes the significance of original content for content providers (think Netflix (NFLX)) as it is essential for both short-term cost and long-term survival (content providers might pull content off TNIEF’s platform). TNIEF’s in-house content creation helps it save money on media while also protecting us from the whims of third-party distributors.

1Q22 earnings ppt

1Q22 earnings ppt

TNIEF’s data-driven approach enables the collection and analysis of vast amounts of data, allowing the organization to better understand its non-verbal customer base (be mindful that they are preschoolers). Gaining insight into the tastes of these preschoolers is crucial for upselling to their parents. Simply put, TNIEF knows exactly what is being downloaded and how popular it is. With this information, it can meet the needs and wants of its customers, keep an eye on industry trends, and take advantage of a powerful flywheel.

1Q22 earnings ppt

1Q22 earnings ppt

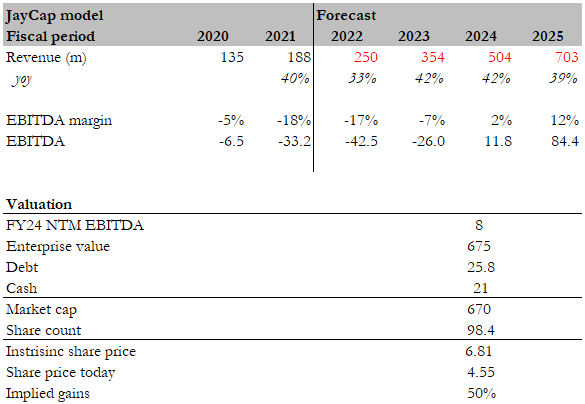

Based on my investment thesis, I expect TNIEF to continue to sustain its leadership position in the DACH region due to its brand and huge head start and be successful in its international expansion. Since this is a relative new company (IPO-ed via a SPAC) with a lack of in-depth financials, my forecasts are based on management’s FY25 guidance. I expect TNIEF to hit EUR700 million in revenue in FY25 and 12% EBITDA margin, a slight discount to its EBITDA guidance. The reason for the discount was that there is a fair bit of uncertainty in TNIEF’s expansion in the US. Hence, there are not many direct comparables in the market for TNIEF. Hence, I looked at Nintendo’s (OTCPK:NTDOY) (which sells hardware and games) as a guide. Nintendo is trading at 10x NTM EBITDA (as of 2 Oct 2022), and I believe TNIEF should trade at a discount given the lack of scale and international brand awareness.

Based on the above assumptions and an 8x NTM PE, I came up with an intrinsic value of EUR6.81. This is 50% more than the current share price of $4.55.

Author’s estimates

1Q22 earnings ppt

1Q22 earnings ppt

Author’s estimates

1Q22 earnings ppt

1Q22 earnings ppt

TNIEF provides its clients with access to only one category of goods. However, sales might suffer if children stop using electronics without screens or if competitors begin offering more cutting-edge alternatives. TNIEF does not have anything else to offer in the way of protection against this risk because it only sells one product.

Now that TNIEF has established a strong foothold in the DACH market, the company’s growth strategy is to expand into the United States. Even though the company has been doing well and growing quickly so far, there is still a lot of doubt about whether or not management can reach their goals.

Typically, TNIEF pays licensing fees in order to use third-party audio content. If TNIEF doesn’t increase its in-house production content to account for the bulk of its sales, it will always be at the mercy of content providers. As demonstrated by NLFX, content providers can successfully withdraw their content when going direct to consumers.

TNIEF is undervalued at its current share price as of the date of this writing. TNIEF has a proven business model in the DACH and has also demonstrated that it can gain a foothold in the U.S. based on its growth momentum so far. TNIEF’s business is based on a fundamental razor and blade model that brings in a stream of recurring revenue as it sells to more customers. Hence, as TNIEF accelerates its growth today, we can expect a continuous stream of income from this base of customers in the future, effectively an annuity.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.