The COVID-19 pandemic did its damage on commercial real estate amid social distancing measures and work-from-home mandates. With more employees returning back to work, commercial real estate could once again be a viable option.

“The commercial real estate market was beaten, broken and left for dead by Covid-19 in 2020,” a Forbes article said. “It roared back to life in 2021 with record-breaking sales of $809 billion, but like cops pulling up to a rowdy frat house all-nighter, the arrival of unrestrained inflation and soaring interest rates may signal the party’s over.”

In the current market environment where inflation is rampant, commercial real estate offers a hedge for investors. Real estate investment trusts (REITs) offer a fixed but flexible income source in a time when rates continue to rise.

“Privately owned commercial real estate has historically offered a strong hedge against inflation,” the article added. “The owners of properties with short-term leases such as apartments, self-storage, and manufactured home communities can quickly raise rents to match inflation, as measured by the Consumer Price Index.”

One way to get unfettered access into the world of commercial real estate is via the Virtus Duff & Phelps Global Real Estate Securities Fund. The fund seeks attractive long-term returns by providing global real estate securities exposure, emphasizing companies with revenues driven by recurring rental income.

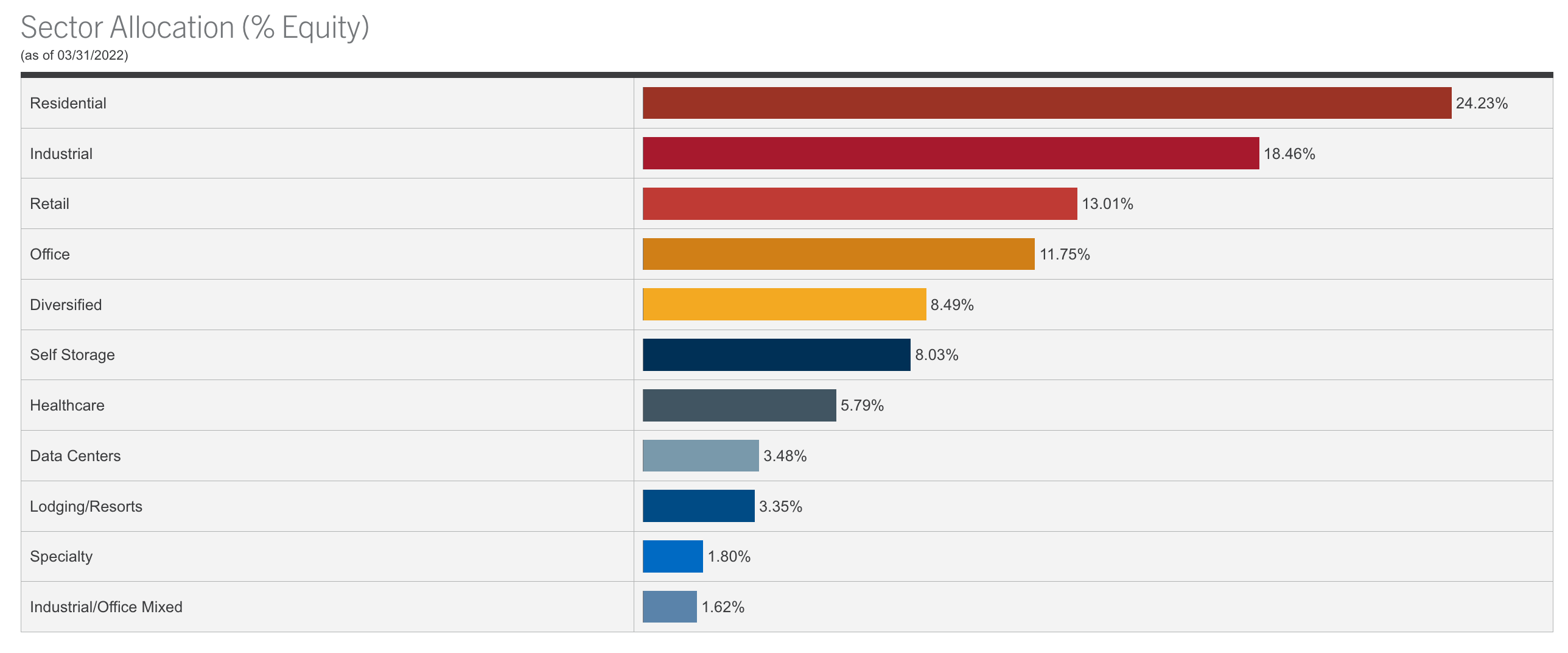

As of March 31, over 30% of the fund is tilted towards residential real estate. However, another 40% is sprinkled into industrial, retail, and office real estate exposure for a diversified portfolio mix.

Along with a plethora of industry experience, the management team of the fund utilizes a disciplined, bottom-up investment process, leveraging both qualitative and quantitative factors while focusing on high-quality commercial real estate owner/operators. This takes all the guesswork out of having investors do all the research themselves to pick individual stocks to get global real estate exposure with a commercial real estate slant.

Features of the fund per its product website:

For more news, information, and strategy, visit the Alternatives Channel.