THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

Volta Inc., which went public via merger with a SPAC in August last year, sells EV charging stations with big billboard-like media screens that allow or force people to watch ads while they wait for their vehicle to be charged. The media screens also face passersby, and so there are more eyeballs.

The company earns revenues from its EV charging network and from selling ads on these billboards. But not a lot: It’s infamous for having lost $276 million last year on $32 million in revenues, based on the unassailable Silicon Valley strategy of “growth at all cost.” In 2021, its revenues grew by $13 million; and its losses grew by $206 million. You get the idea. That kind of growth model.

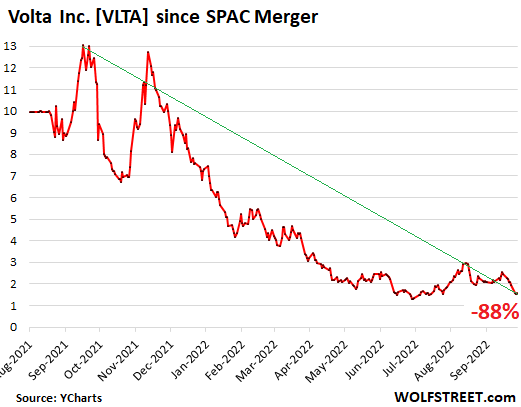

Headquartered in ultra-expensive San Francisco, it burned about $100 million in cash in Q2, at the end of which, it had $105 million in cash left on its balance sheet. That’s not a lot of runway at this cash-burn rate. Earlier this month, it filed a prospectus with the SEC for an “at the market” share offering to raise up to $150 million by selling shares “from time to time.” Which will be kind of a slog because the shares have collapsed by 89% from the post-SPAC-merger intra-day high of $14.34, and by 88% from its closing high of $13.04, which gave the company an absurd market cap of $2 billion – almost exactly a year ago, on September 19, 2021, to $1.55 today (data via YCharts):

In March, the company announced that CEO Scott Mercer resigned but would stay on for a transition period, and that President Christopher Wendel resigned “effective immediately.” They both resigned as members of the Board, “effective immediately.” That kind of company.

#1, The model of “growth at all cost” has been taken to the dump, and it’s time to cut costs and lay off people, and cut “outside consultants,” and consolidate “its three San Francisco offices into one,” and cut “marketing and administrative costs.”

As part of these cost cuts, the company announced today afterhours that it would lay off 10% of its full-time staff going forward, after it had already shed 18% of its full-time staff since June 1 “through other workforce reductions and organic attrition.”

Volta is “taking difficult but important steps to align the business with current market dynamics and position the company for long-term success,” it said.

#2, The company cut its revenue guidance for Q3 by roughly 20% to a range between $13.5 million and $14.5 million. And it withdrew its full-year guidance, blaming: “the advertising environment, particularly as automotive brands delay advertising spend due to inventory shortages; limited electrical transformer availability affecting DC Fast charger installations; and the impact of the Q4 shopping season on construction availability at commercial properties.” It didn’t blame the strong dollar tho – unlike most of its big brethren – which would have been a hoot.

The thing is the “growth at all costs” model works great if you have enough cash to pay for all the costs forever. But if you run out of cash, not only is the growth over, but the entire show is over, and everyone goes home. And now cash is running low, and it’s time to pivot, like toward a new model… And you know what’s coming.

#3, Congress threw hundreds of billions of dollars in all directions, including some of it at companies that build EV charging networks, and so Volta announced today that it is scrambling to get its slice of the federal pie.

Under the section in its announcement, titled “Competing for Federal Funds,” the company said that its “dedicated team is well-positioned as a public-private partner for state and federal government funding.” It said that it “intends to continue prioritizing EV charger installations that qualify for government-provided funds.

It wants to “leverage” its infrastructure planning software PredictEV, it said: “By analyzing multiple data sources, including local economic and equity data, PredictEV can identify locations within the company’s pipeline of more than 8,200 EV charging stalls signed or covered under master service agreements (MSAs) that satisfy the government’s requirements.”

Sure, but everyone and their dog has been installing charging stations for years, from Tesla on down, and they’ll be competing for federal subsidies. In California alone there are already over 79,000 charging stations, compared to 7,572 gasoline stations, according to the EIA. Everyone is going after it. The little parking lot of the Walgreens in my neighborhood has had them for many years.

It’s not like Volta invented anything new. What’s new with Volta is that its charging stations have media screens that show ads. And the government doesn’t care about that.

Corporate America has long been doing it. This includes the richest semiconductor makers such as Intel and Nvidia, and even foreign companies with a presence in the US, that are just now getting $52 billion in federal subsidies poured into their end of the trough. So compared to them, whatever crumbs Volta can get, if any – squeezed between the big charging-station companies – will be small, but they better get money into the door soon, or else the show is over and everyone goes home.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

“What’s new with Volta is that its charging stations have media screens that show ads.” I wonder if the people at Volta were proud of how innovative this was as they were thinking outside the box to come up with that idea. It may be new to Volta but near me gas stations have had screens showing ads for years… I get it with a gas pump as you have to stand there for a couple minutes while you pump your gas so you are a captive audience. But are you really hanging out by the charging station while it is charging for 20+ minutes? I imagine most people are sitting it their car or going to the nearby coffee shop or whatever other amenity is nearby.

Correct. I usually get half-caff half-decaf latte delivered via Uber while my Tesla is charging. Maybe Doordash some avocado toast. Trying to manage my time effectively.

I miss the good old days when a business became sustainable based on its profits rather than government subsidies and cash burn.

What year was that?

Harrold, think 1953.

Yet another bunch of Grifters who will leave (with a pile of money) a pile of human wreckage behind. They will say, “we just used the laws of the land”. And move on to the next “entrepreneurial opportunity” and create some more “independent contractor” jobs.

Until there are changes in present corporate and financial laws, tax law, etc, even the Fed won’t be able to change things much.

Yeah, 1953 would be about right as a reference.

Set up an empowered committee with Liz Warren in charge, she knows that stuff, and get it done. And what the hell, as long as I’m in what is presently fantasy land, start a Comprehensive Green New Industry and make the IRS a full part of the Military. It’s not so different from Coast Guard Customs enforcement.

“Doordashing my avocado toast” is the ESG generation’s term for self-pleasuring with other people’s capital.

Had to look up ESG. Sorta looked good till I saw using AI and heuristics which translates to me as BULLSHIT, as I see it all the time in biochem/molecular bio, which at present is just all the businesses involved selling snake oil (I mean newer and better life saving/changing drugs). You think parsing Fed talk is complicated….HAH! This is really well disguised horseshit that I read. I get a kick out of disease creation, too.

Magic bullets MFA! I’d like to revive and torture to death Erlich’s corpse almost as much as Reagan’s.

Sorry, for rant but Pharma does count as financial scamming…think Theranos.

Amazing someone actually got caught and might even get a hand slap if they can’t afford to buy a lot of “Justice”….another joke.

The number of zero revenue Biotech IPOs that have historically come to mkt (and successfully raised tens/hundreds of millions) is frankly mind-boggling.

(A rough estimate is that those zero revenue biotech-experiments-disguised-as-a-going-concern might make up 15% – 25% *of all IPOs!*)

Which is frankly insane.

My only guess is that Drs. (median income = 200k per yr) are attracted to these promise factories and just don’t have the time for decent due diligence.

hahha, better hope there is a toilet near by

Is that kinda like taking a stationary bike (been around forever) and bolting a tablet to it (been around forever) and calling it a high tech disrupting exercise experience company?

2banana, your comment gave me a wry smile which then progressed to outright snickers.

A slew of people at my work bought these exercise bikes at top price (~$2500) as I watched on in utter disbelief. They were hot and heavy for about 2 months with their virtual competitions or whatnot and then it faded from sight.

Now you can pick them up for much less $$$, but I still think they are way overpriced.

This fiasco (our current economic status) is a direct result of our vaunted Fed and .GOV’s mismanagement and quite frankly their malfeasance.

“They were hot and heavy for about 2 months with their virtual competitions or whatnot and then it faded from sight.”

Yeah, sounds like a FAD to me. 🙂

“Now you can pick them up for much less $$$, but I still think they are way overpriced.”

From what I understand they’re essentially landfill debris because it’s based upon a subscription service which is not transferable from the original purchaser – part of that corporate greed model where they attach themselves to a consumer’s pocketbook for life.

Depth Charge,

“From what I understand they’re…based upon a subscription service which is not transferable from the original purchaser”

I guess this is true for such things as those huge John Deere tractors. No DYI or other shops can repair them. Isn’t this true for Tesla too?

I literally avoid those gas stations with the crunchy little displays playing ad after ad. Avoid them like the plague.

…crunchy?

Fun tip. Most of the ads displayed on pumps can be muted by pressing on one the corner softkeys while the pump is running. They aren’t labelled but it works on most pumps.

Yesterday I drove by Daimlers big new Semi-Truck, Truck and Car sized charging station near their headquarters in PDX. Three trucks were there charging ( one semi, two vans) and there were three guys with lawn chairs pulled up in a little circle between the trucks. They seemed to be drinking beverages and watching sports on a Pad, on the clock. Kind of like the old days when the teamsters could sit in the shade while the mules watered and fed.

Drivers are required to take breaks. For example, the Daimler over-the-road truck they sell in Europe has battery and charging characteristics to where it can drive with ease for the period that the driver is allowed to drive, and when the driver has to take a required break, the battery gets recharged. Whether the driver takes a shower, does pushups, and eats dinner, or sits in a lawn chair, during that required break makes no difference.

Wolf, I’m thinking to buy couple of calls today. In something like Verizon, dividend is north of 6%. It is catching falling knife, and I am biggest bear on this site. But need to start balancing out heavy puts positions. Probably way too early as usual. Bought couple of calls in Chinese internet etf KWEB today. It is retesting lows from 6 month ago, and already down to like 2014 level.

What kind of break is that where a zillion pound battery gets charged? Are these chargers fast? What kind of power source charges them? Nat gas? Coal? Nuke? Hydro?

Daimler is German as in Germany…..solar? NOT.

Help me Wolf. This sounds silly.

I know folks get all fuzzy over the thought but have ya Ever seen how many trucks there are at one Flying J stop on I15 near Las Vegas?

The grid couldn’t handle this in a dozen years.

Keith Matthews,

Don’t worry about it. This is not for you. No need for you to know any of this stuff. It’s the job of fleet managers that procure vehicles to know this stuff and make decisions based on this. It’s not your job.

I have yet to encounter an ad on a screen that made me buy something right away. This whole advertisement model is a scam. Next time you are on any big company’s website, hit F12 and inspect the number of “beacons” going out to multitudes of ad companies, on the network tab. This not only makes the page heavy but exposes that company to issues should the ad company make a coding mistake. And if the mistake happens on a page where PCI or PII data is captured, all kinds of fun things can happen. Seen it!

It’s this kind of crap that forces our central banks to choose the wrong options. BoE had 2 options to arrest the crash of pound:

1. Raise interest rates by 600 basis point that would keep inflation in check. If Russia can raises rates by 1000 basis points in a week, the so called 5th strongest economy can do it as well.

2. Start QE again thereby releasing hyperinflation.

Russia chose the first option and BoE chose the second option to protect this crap.

BoE feels that it can keep giving pain to its 99% but not to its 1%.

If market interest rates increase by 600bp, UK housing market will crash evaporating most middle class “wealth”. Virtually no one who needs to finance a purchase will be able to afford it.

5th largest (6th now I believe per accepted rankings) doesn’t mean stable.

I agree with you though that it’s the better option.

Lower house prices would be a good thing.

Sure those needing to finance a purchase could afford it, after prices fell enough.

“Lower house prices would be a good thing.”

Exactly. Lower house prices are great for the people and also great for the economy. More disposable income allows people to spread their money around and more businesses prosper.

It’s time for crooked central bankers, politicians, and all talking heads to start having honest conversations about shelter. And it’s time to completely end the NAR and their whole lobby. They are a blight upon humanity and a disgusting leech, siphoning money from house sales for doing nothing.

The bond bullies used to take care of the punters and pigs.

Not any more.

No market clearing mechanisms allowed.

No pain for the irresponsible.

BOE says it had pressure for a bail out from pension funds who had purchased interest rate derivatives and were betting on lower or stable rates. PUT ASIDE HOW THAT COULD FULFILL THEIR FIDCIARY DUTIES…. Can you believe that happens? As Buffet said, when the tides goes out you find out who is swimming naked. Apparently, in England it is the pension funds. If that is the same in the USA, we are doomed. And the problem with a short bet, it is like Fermi’s bet on whether the first nuclear reaction would run out of control and end the world. You won’t be around to collect on it.

He did have a REAL dead man switch to gravity drop control rods and shut it down, just in case. It was an extremely simple reactor.

And he knew there wasn’t enough radioactive stuff there to do more than kill everyone nearby and maybe blow up the stadium or campus. Nobody would be yelling at him for it, anyway.

Pages heavy? Yes. Costly for us without high speed data. Work to keep our company pages light because of consideration for customers in the sticks like we are. I say the sticks even thought we’re in the greater Orlando metroplex, DSL is the best we can have (although neighbors across the street have fiber, AT&T ignores our request and have for years, sigh). But it’s worse for others, so I am glad with what we have. What a nation.

So what can you do to protect yourself from advertising and where they’re being served from? If you use Firefox as your browser, then obtain uBlock Origin and that gets virtually all adverts, even ones on YouTube. Yes, Google, Facebook, et al are going mad trying to figure out how to defeat this but so far, so good.

Wouldn’t it be great if there was a technology that allowed users to block ads? Oh wait there’s many options available already. Use them! Also for privacy, trackers, social media blocking 😉

Don’t need to see an ad again.

The model “growth at all cost” was used in the land leases business for shale co. Wall street bankers didn’t care about shale co profit. They care about buy today sell tomorrow, until the music stopped.

To prolong the game oil co built thousands of incomplete holes in the ground to fool investors. It sent WTI to minus (-)$40.

That isn’t why DUCs (drilled, uncompleted wells) were drilled).

DUCs ultimately get used – they are initially created, 1) to take advantage of when the drilling contractor is on site or nearby, 2) to take advantage of economies of scale with said drilling contractor, and 3) to take advantage of slow times for drilling contractor and therefore get better rates.

There are plenty of scams in corporations (although a fraction of those in governments) but DUCs ain’t one.

Another reason DUC’s are drilled is that in many cases, a lease or a drilling permit, will expire if a well is not drilled, completed or not, in a specified period of time.

I was watching NBC news about the hurricane in Florida.

They actually had a segment on how to charge your EV when the power goes out.

Did it involve tiny Pelotons for gerbils?

OK Boomer

2banana,

Did they have a segment on filling up ICE vehicles when the gas stations that still work are out of fuel? And when the power goes out, it goes out for a lot of stuff including the communications network and the payments system, so did they have a segment on how to pay for your gasoline at a gas station that is out of gasoline with a credit card over a communications network that is down in the entire area? That episode should be a hoot.

Having cheap and easy QE money with zero percent interest rates helped too.

“The thing is the “growth at all costs” model works great if you have enough cash to pay for all the costs forever. But if you run out of cash, not only is the growth over, but the entire show is over, and everyone goes home. And now cash is running low, and it’s time to pivot, like toward a new model… And you know what’s coming.”

Another joke on the taxpayers is that the subsidized charging stations that will go in over the next couple of years (at huge cost) will all have to be replaced by super chargers (at huge cost) a few years later, all so that (subsidized) well heeled EV buyers can “save money”.

It increases GDP and therefore the all-important “growth”.

“It increases GDP and therefore the all-important ‘growth.’” The classic broken-window economic fallacy. It’s amazing how many politicians use this and how many people are fooled by it.

“growth at all costs” = “growth for the sake of growth”, which as Edward Abbey said, is the ideology of the cancer cell.

“… ideology of the cancer cell.” In addition to the world being flat (it is for 22 miles) I’ve long thought that living things, from cells to trees to even conspiracies, have ideologies. Modern science just hasn’t figured out their dynamics yet.

“The force that through the green fuse drives the flower”

– Dylan Thomas

Wolf, correct me if I’m wrong, but if you repeatedly use a fast charge on the EV’s battery system, don’t you shorten its life-span?

The best way to charge your electric vehicle is to do it at lower voltage and current for a longer time, no? Like overnight in the garage at 115 volts & 10 amps.

BMW just revealed their new XM “plug-in” hybrid SUV. A 483 horsepower turbo V8 and a 25.7 kilowatt-hour battery pack that feeds a 194 horsepower electric motor. The batteries can be charged at up to 7.4 kW and filled from empty in 195 minutes. But, you need about one-sixth of a million bucks to get one of these next year when they’re built.

” 1/6 of a million dollars” . Expressed that way is even more scary than $150K+. Well said 👍👍💸😬💸😬

And at that cost, there will be a lease fee for your heated seats, certain music stations, GPS service and use of the internet hotspot. Oh, and if you don’t keep up with the periodic payments, BMW can “turn your car off without notice”.

Anthony A.,

Yeah, good point(s). BMW and others, including Zero Motorcycles, want to sell you a product and lease you services to be provided by that product. Services that are already built in when leaving the showroom, but not usable until paid for — monthly — under contract.

That is a business model that needs to be avoided by consumers, and stopped dead in its tracks.

And Anthony, thank you for the reminder on how BMW is driving down the dark side. But, don’t worry,”Headlights are only an extra $29.95 per month. Of course to use the hi-beams also, you do need to add $9.95 per month to the service agreement. Sign here, please, and you can drive it home.”

And into your 401(k) it went.

Americans outsource everything else…why not investment stupidity.

Volta has definitely lost it’s spark.

Shorted out by a faulty reality fuse

Wolf, Sorry to refer back to the splendid housing bubble article, but Im guessing you dont look at comments to two day old articles.

Do you or any other commenters know of a market traded hedging mechanism for residential real estate, that ISN’T an ETF of homebuilder stocks or a product that tracks the S&P 500 builder index etc. Looking for something to hedge against Case Schiller Index, for example.

Im planning to hold on to a portion of my investment properties and my home, but prefer not to ride the price cycle down to the bottom again like 2008-2011.

Short Zillow.

CCCB,

I don’t see the comments in the way you do. I see them in my commenting software in reverse chronological order. So if you post something on an article from a week ago, and right that minute I look at my commenting software, your comment is at the top. So don’t worry about it. I see all comments, no matter when they were posted.

In terms of your question: the best hedge is to take care of your properties and coddle good tenants to keep them so you can ride out whatever storm might be coming. Rentals are a conservative income-producing investment. If you got them for purposes of capital gains, well, that was a gamble that may or may not work out.

In terms of trading to hedge against home price declines: You can trade futures of the Case-Shiller home price index, but that hasn’t worked either because everyone already knows where the Case-Shiller will go months before it goes there, and so there are not enough traders on the other side of the trade, and you don’t really have a market, if there is any trading at all, and it’s not anything I would do or recommend. Just one more way to lose money.

Much appreciated

Curious what the total compensation was for these two who are leaving. Guessing they did alright and probably walking (or running) out the door with a chunk of cash.

One thing about modern capitalism, succeed or fail, those at the top usually end up with a boatload of cash.

That was disclosed in the SEC filing, things like 6-month pay, healthcare for a year, and some deal with their stock options (vesting and other issues). I don’t remember the details. You can look it up.

We may agree about the Pivot but I do love these articles 🙂

I don’t know if this will work on Volta systems, but on the gasoline pumps with the screens/commercials you can usually squelch the audio by pushing one of the buttons on the right side of the screen. ‘Round these parts, it’s second from the top on the right side.

The screens of the Volta systems are the billboard-type screens that you might see at bus stops etc. They’re big. The images I saw, it seems some of them are six feet tall, and they’re designed for pedestrians to see. I don’t know if they have audio.

Invasive mental, spiritual and societal pollution. Time to contain this virulent thing before it grows.

This article exemplifies the wealth gap and the cause of it. I conjecture half or more of these BS companies are started and funded by Trust Fund Babies and their benefactors. They use these vehicles to grift from the taxpayer. They are the most vile of welfare recipients.

These connected conmen have the connections, the support, the time and the morality to slopp at the public trough, while holding themselves out as important and as job creators.

Congress is complicit in a lot of theft. This country has been practicing class warfare for a long time.

Wolf said: “Congress threw hundreds of billions of dollars in all directions, including some of it at companies that build EV charging networks,”

Well said. That rang a serious bell in my mind. I hope the reasonable public finds a way to correct this sham capitalism.

We may have too many monopolies and oligopolies, but at least companies still work hard “Competing for Federal Funds.” Who says competition isn’t alive and well in the US?

My 300 stock list of deSPACs recently made a new low at an average of $ 4.09 per stock. So the category lost almost 60% so far on average. Almost all of them will fade away I think.

When SPACs came en masse it was a sign that the bubble was huge.

The mania was obviously huge, long before SPAC or SPAV.

Most who see the current environment don’t know historical precedent. They haven’t read accounts such as those in “Extraordinary Popular Delusions and the Madness of Crowds” by Charles McKay written in 1841. Mine covers the British South Sea Bubble, French Mississippi River Scheme, and Dutch Tulip Mania.

For SPAC specifically, it’s the equivalent of the South Sea Bubble purported IPO “An undertaking of great advantage, but nobody to know what it is” which sounds so stupid it can’t possibly be true.

Well, it’s no dumber than SPAC, NFTs, or crypto. In fact, considering the number (one) and scale (a measly 5,000 GBP), it’s nothing compared to what’s been happening. These idiocies are multiple trillions of dollars.

No precedent is even close to the utter absurdity, either now or the entire 21st century.

If there are any honest historians around when this mania collapses, it will be written about for centuries. So much to choose from.

You could say all central banks went on a money printing spree, refusing to allow recession, papering over structural problems in the economies for decades, until the speculation, greed, phony profits, media hype, government spending, mal-investment, moral hazard, and consumer spending orgy reached a crescendo, at which point the obvious became clear – you can’t solve a debt problem by encouraging more debts; trickle down theory is a mirage; and money printing is no replacement for work and productivity.

Yes, pretty much sums it up.

I would like to see any of these grifting idiots grow an actual apple, build a fence, or wax a car. In what passes for government or business, these folks are way too slick and “innovative” for that.

“so Volta announced today that it is scrambling to get its slice of the federal pie”

I have a feeling we’re going to be reading about a lot of Solyndra-like operations in the future. And the ones we read about will only be the tip of the iceberg… The lack of oversight tied to these various government “investments” is nuts.

How about the speculative operations within the big tech companies that have thrown away hundreds of billions on buyback of plummeting shares. Facebook alone spent $45B on buybacks in 2021 and threw away 2021 profits. Apple, Google, Microsoft also throwing away huge capital.

Yes indeed! It’s PAYback time!

Not really nadella,Zuckerberg musk they all got out early

KMX or carmax folks woke up 22% lighter, has to be tied to used vehicle inventory price level

Tied to my “buyers strike.” People aren’t eager to pay prices that spiked 40% in 12 months … that’s been going on all year … but dealers don’t want to cut the price, and if they do, their stocks get killed. And if they don’t, their stocks get killed.

No wonder the money has gone crazy.

These SPAC Zombies should at least be able to show a “projected realistic” profit to get the gubment grub. It seems like the market share some of these companies need to be profitable is like 174% of the 100% of the available market……yet……they live on as the walking dead ??

so who was on the wrong side of the trade for this crap?

A. Regular Retail

B. Reddit / Meme

C. Pension Funds

D. Sovereign Wealth Funds

E. All of the above

I’ll go with ‘E’. Dumb $.

who was on the right side of the trade?

F. VC

G. IB’s

H. Hedge Funds

yeh, I’ll go with F, G and H.

their playbook: early funding rounds, lot’s of hype, exit (at or shortly after the IPO, SPAC, etc.,, then short & cover the long slide. the zombies just keep giving and giving.

So, SPACs ain’t working. Here’s an idea…

The “rehab” facilities are making money while they warehouse our our old, useless and unnecessary population.

It doesn’t matter how fast they churn them into the after world. They have have no supply of problems.

Probably a good investment.

But, not for me. I’ll never want money that bad.

Your email address will not be published.

The giant’s footprint reduction to cut costs sinks Commercial Real Estate.

It’s already playing a key role in every one of Powell’s press conferences.

It wasn’t big hedge funds that blew up, but £1.5 trillion in leveraged pension funds. BoE stepped in to bail them out and prevent further contagion.

The Case-Shiller index, which lags by several months, is starting to flip market by market, including in Phoenix, Dallas, Washington DC, and Boston.

Wealth of the “Top 0.1%” drops by $12 million per household; the wealth of the “Bottom 50%,” who have nearly nothing, rises.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy