Nina Shatirishvili/iStock via Getty Images

Nina Shatirishvili/iStock via Getty Images

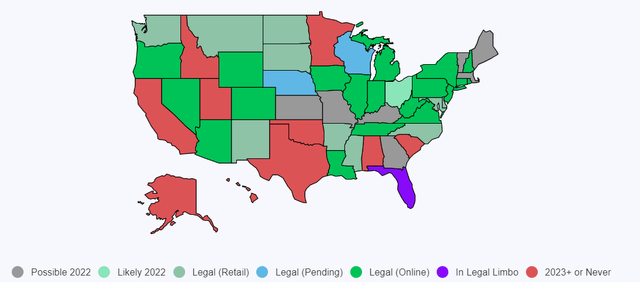

Gaming REITs performed well during the pandemic, thanks to the triple-net lease structures (a lease agreement where the tenant is responsible for paying all the expenses of the property like property taxes, insurance, maintenance, in addition to the cost of the rent), and the resilience of the domestic gaming industry with the Las Vegas market showing strong robustness driven by leisure and corporate demand growth. A performance that is likely to persist going forward supported by the ongoing legalization of sports betting that in turn will benefit casinos in generating more income, improving their balance sheets, and thus, their ability to pay rent to the leaseholders.

actionnetwork.com

actionnetwork.com

Casinos have access to a large amount of capital, which makes them a good type of tenant to have because those operators carry a lower risk of not paying their bills when they come due. Currently, there are three U.S. public gaming REITs: VICI Properties (NYSE:VICI), MGM Growth Properties (MGP), and Gaming and Leisure Properties (GLPI) (each of those REITs was a spun-off of big casino owners that separated the physical assets from the operations). However, in August 2021 VICI announced plans to acquire MGM for $17.2 billion (with the transaction expected to close in 1H2022), which means that now we will only have two big public players: VICI Properties and Gaming & Leisure Properties. Furthermore, prior to the acquisition, all three REITs were focused on competing for casino assets, now, the acquisition will not only make VICI a big whale (and likely an investment-grade company) but it also poses real questions, that the management will need to address, on how it expects to grow. Personally, I believe that VICI is likely to invest in non-gaming assets in the future.

VICI Properties is triple-net gaming REIT that was spun out of Caesars Entertainment (CZR) and that after the acquisition will be the biggest U.S. player in the gaming REITs industry. VICI owns a large portfolio of assets consisting of 28 market-leading properties comprising over 62 million square feet, featuring 25,000 hotel rooms, and features over 250 restaurants, bars, and nightclubs. After the close of MGM’s deal, expected in the 1H2022, it will have 43 market-leading properties, consisting of 117 million square feet, featuring 57,500 hotel rooms with over 400 restaurants, bars, and nightclubs across VICI’s portfolio.

VICI’s tenants include high-quality companies with Caesars being its largest tenant (after the close of the MGM transaction, MGM and Caesars will be the two largest tenants). When it comes to REITs two key metrics to look at are the leases structure and the lease term. VICI structures their leases through the so-called “master lease contract” which shields VICI from a tenant to close one specific property and, as of December 31 – 2021, it has the weighted average remaining lease term of 36.8 years.

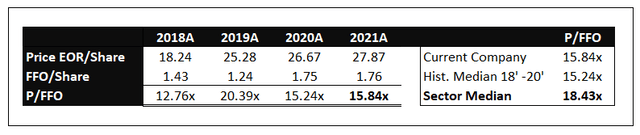

Currently, VICI trades at a P/FFO of 15.83x. If we compare this multiple to the sector median of 18.43x (-16.08%), we may conclude that the company is currently undervalued as compared to peers, however, it is slightly overvalued when compared to the historical median multiple.

Author’s Estimates

Author’s Estimates

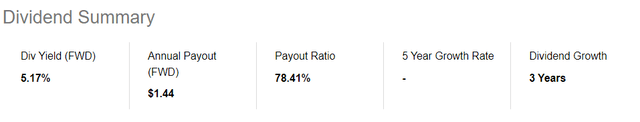

For what concern dividends, VICI carries a dividend yield of 5.17% which makes it an attractive investment and even if it went public in 2018 it was able to grow its dividends three years in a row.

Seekingalpha.com

Seekingalpha.com

In particular, VICI’s attractiveness comes from its cash flows which are relatively secure, justified by a mix of Las Vegas and regional gaming assets (with income coming from regional assets being relatively defensive), and is further driven by the tenant diversification that the MGM acquisition will bring (currently there is a high rent concentration coming from CZR). Furthermore, the company is trading at an attractive valuation that may be considered “extremely” attractive if we account for new opportunities that can be found if it decides to expand into the non-gaming space.

However, we must also analyze the other side of the coin, the risks. I believe that a potential recession poses a serious risk since casinos operators are more exposed to economic downturns (which translates into revenues and earnings drops). Moreover, with 35+ year leases VICI (and in particular triple-net REITs) is highly exposed to changes in long-term interest rate, which make longer duration REITs less attractive as compared to other categories of REITs that re-price on a more frequent basis. Furthermore, a high level of inflation could hurt its growth in real terms (most leases have an inflation match that is capped at 3%).

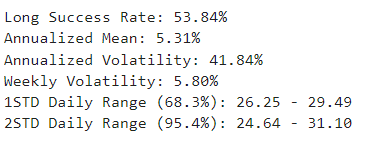

I rate shares as a HOLD because, even if trading at an attractive valuation, I believe that in the near term it will be possible to purchase them at a greater discount mainly driven by macro-dynamics.

In particular, I will be a buyer once the price enters the area close to $24.44/share or a P/FFO of 13.88x.

Tradingview.com

Tradingview.com

Given VICI’s weekly realized volatility my entry point falls within the lower boundary of two standard deviations from the mean (note! I am making the assumption that returns are normally distributed).

Author’s Estimates

Author’s Estimates

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.