lechatnoir

lechatnoir

Agree Realty Corporation (NYSE:ADC) is a well-managed, monthly-paying real estate investment trust that has established itself as a reliable REIT investment and dividend payer.

The net-lease trust’s portfolio is very healthy, and the dividend is fully covered by the company’s funds from operations.

Agree Realty gave investors a 7.8% dividend increase in July, and investors can expect long-term dividend growth with this REIT gem due to the trust’s low pay-out ratio.

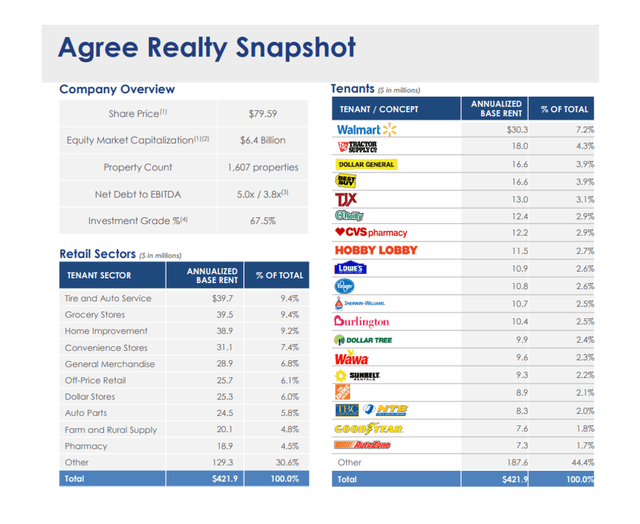

At the end of the second quarter, Agree Realty was a large net-lease real estate investment trust with a presence in 48 states.

As of June 30, 2022, the REIT’s portfolio included 1,607 properties totaling 33.8 million square feet. In the second quarter, Agree Realty’s property stock increased by 97 properties, or 2.8 million square feet, on a net basis. The portfolio of Agree Realty had an occupancy rate of 99.6%, which was unchanged from the previous quarter, and a weighted-average lease term of 9.0 years.

Other REITs, such as National Retail Properties Inc. (NNN) and Realty Income Corp. (O), had weighted-average lease terms of 10.6 years and 8.8 years, respectively.

Agree Realty is a retail-focused net-lease REIT, which means it leases its properties to major retailers like Walmart (WMT), Lowe’s (LOW), Hobby Lobby, and Dollar General (DG).

The emphasis on large-scale, necessity-based retailers ensures that Agree Realty’s tenants experience consistent and predictable demand for their products, resulting in a high degree of cash flow predictability for the REIT. Walmart is Agree Realty’s largest tenant, accounting for 7.2% of the real estate investment trust’s total rent.

Portfolio Snapshot (Agree Realty Corp)

Portfolio Snapshot (Agree Realty Corp)

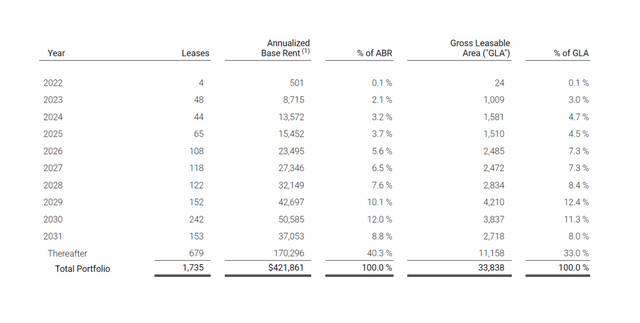

The lease portfolio of Agree Realty is well-structured and long-dated. In the next two and a half years, only 5.4% of the real estate investment trust’s leases will expire, and only 0.1% will expire this year.

Lease Expirations (Agree Realty Corp)

Lease Expirations (Agree Realty Corp)

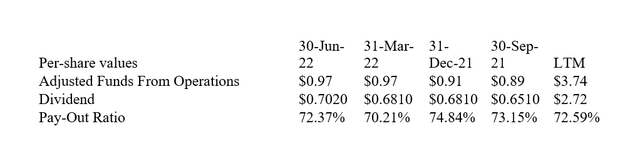

In 2Q-22, Agree Realty’s portfolio generated $0.97 per share in adjusted funds from operations and $3.74 per share in the previous twelve months. This means that the REIT distributed 72% and 73% of its total adjusted funds from operations in these two periods.

For investors, these low pay-out ratios based on AFFO indicate that the dividend is secure and that the trust can easily increase its dividend.

Agree Realty pays a monthly dividend of $0.234 per share at the current rate. The real estate investment trust increased its payout by 7.8% over the previous year.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

In my opinion, Agree Realty’s AFFO could increase by 5-6% in 2022 as the commercial real estate market in the United States recovers from the pandemic and lease performance improves.

Agree Realty earned $3.51 per share in AFFO in 2021, representing a 9.7% YoY growth rate in adjusted funds from operations. In the future, the real estate investment trust could generate between $3.69 and $3.72 in AFFO per share in 2022.

The trust’s stock is currently available for a 20.6x AFFO multiple. I believe Agree Realty is currently overvalued in comparison to other large-cap net-lease retail REITs on the market. Realty Income has an AFFO multiple of 17.5x, while National Retail Properties has an AFFO multiple of 14.3x.

Agree Realty’s valuation could rise even higher if the market continues to reward premium multiples to real estate investment trusts that are broadly diversified, have strong portfolio metrics, and can easily cover dividends with funds from operations.

Given Agree Realty’s high valuation based on funds from operations, I find it difficult to justify an even higher valuation.

Agree Realty is a well-managed real estate investment trust with a strong retail focus and strong portfolio health.

Agree Realty’s dividend is covered by funds from operations, and the pay-out ratio is around 70%, implying that investors can reasonably expect the trust to continue increasing its monthly dividend. The monthly dividend is appealing, and the yield is currently 3.7%.

However, based on AFFO, the trust’s stock is likely overvalued right now, and other large-cap net-lease retail REITs, particularly National Retail Properties, are currently offering income investors a much better deal.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.