wildpixel/iStock via Getty Images

wildpixel/iStock via Getty Images

Things can get a bit nutty in both bull and in bear markets as we all know, these are usually periods when it would seem that 1+1 somehow equals 69 in regard to valuations. We certainly were at that point at the tail end of 2021, with bulls chanting “to the moon” and with a plethora of stocks and cryptocurrencies marching ever upward for seemingly no reason at all.

I wound argue that we are potentially getting into “WTF” territory in the opposite direction when discussing certain companies caught in the bear market of 2022. In this article, I would like to discuss Alexandria Real Estate (NYSE:ARE) and why I believe the current sell-off in shares has been overdone, even in a potentially recessionary and rising rate environment.

Alexandria Real Estate, by quite a wide margin, is the largest life science-based REIT in the world. The company is laser focused on the property and infrastructure needs of pharmaceutical, biotechnology and other life science focused entities.

The company uses a cluster model for its developments, believing that the vast majority of innovation, talent and capital in the life science market will be focused in attractive, talent rich hubs around the United States. The main markets for Alexandria currently are located in San Francisco, Seattle, Boston, San Diego, New York City, Maryland and the research triangle in North Carolina.

Alexandria Real Estate

Alexandria Real Estate

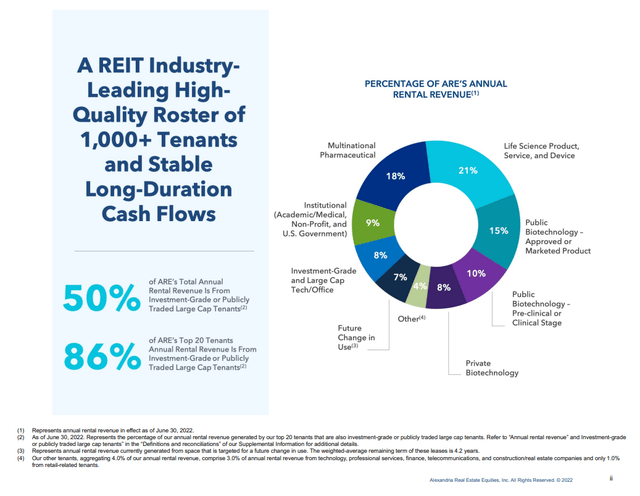

This singular focus on high quality and attractive locations for development thus far has landed Alexandria with a tenant roster that is the envy of the market as a full 50% of revenues is generated by publicly traded or investment grade tenants in one of the most recession proof industries on the planet.

One of the reasons why the company is so successful is the fact that they are firmly in tune to the evolving needs of its customers as the entire business is purposefully built for the life science industry. Alexandria can plan for and accommodate changing laboratory needs as new therapeutic modalities are developed. In addition, Alexandria knows what talented and in demand employees want in a workspace and can provide attractive and in demand features into its locations well in advance of these becoming commonplace.

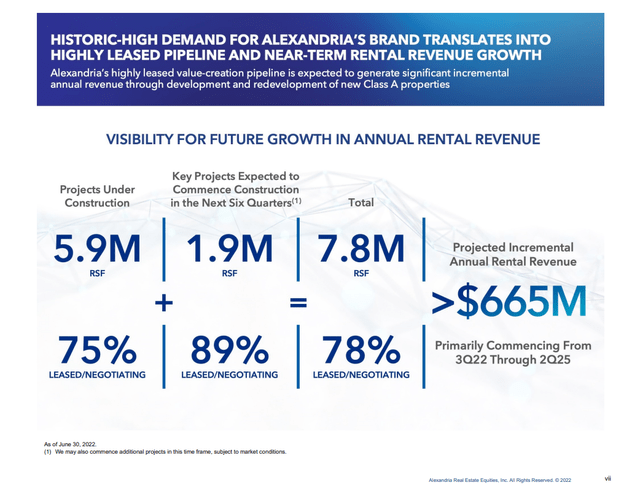

The company, thanks to its partnership like relationship with its tenants, enjoys rather unheard-of earnings visibility from its development pipeline as well, with a full 78% of its near-term development pipeline under lease or negotiation.

Alexandria Real Estate

Alexandria Real Estate

This near-term development pipeline is not small either, it is potentially $665 million worth of annual revenue, which, based off of the 2022 estimated base of $2.59 billion, equates to nearly 26% revenue growth from just these developments alone.

In addition to the development pipeline, the company’s rental rates for existing properties have been exploding of late, averaging, on a cash basis, a 33.9% increase in Q2 of 2022. This ability to both raise rents by over a third and to prelease near-term developments is a two headed monster for internal growth that is unlikely to meaningfully slow in the near-term, regardless of interest rates or a recession.

The life science market is notorious for its recession resistant nature and given the roster of tenants Alexandria leases to are generally not the speculative biotechs that may be wiped out in liquidity crunches, the company appears to have relatively calm waters ahead, even if the greater economy is struck by the hurricane.

So far in 2022, all of the above-mentioned attributes of tenant safety, internal growth and excellent execution provided by the company have apparently meant absolutely nothing to the stock price. As of today’s date, the company is down a whopping 36% YTD.

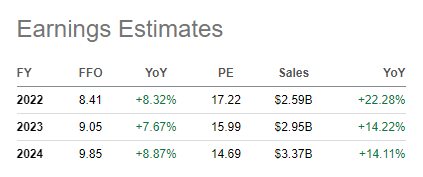

To be clear, the company for sure was a bit out in front of itself at the end of last year, the price to AFFO stood at an inflated 27.06 on Jan 3rd, 2021. but the resulting pullback, to go along with the continued growth experienced so far this year has taken valuations well below the company’s 10-year average of 21.75 P/AFFO.

Source: Author

Even if you exclude the exuberance during the bull run years of 2019, 2020 & 2021, the company, based on 2022 estimates, is still reasonably below the 18.23 P/AFFO average achieved from 2012-19, currently standing at 17.22.

Seeking Alpha

Seeking Alpha

Is the company absolutely dirt cheap? No, it is not. Frankly, it never has been, however this is not a company whose future is seriously in question heading into a recession either. Nor is this a company that will be forced to refinance debt in an unfavorable interest rate environment.

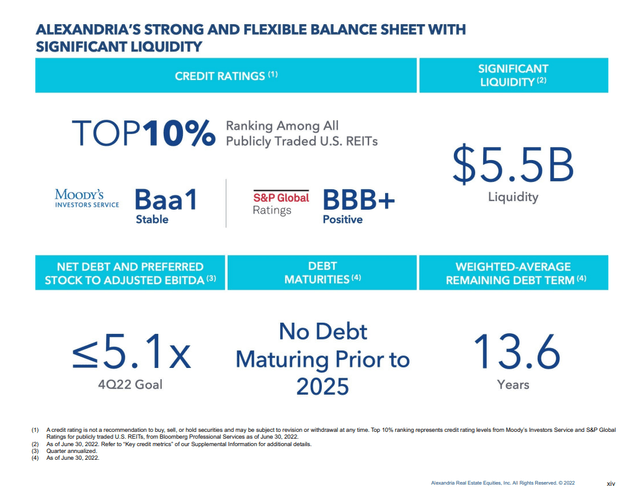

Alexandria Real Estate is arguably in the best financial condition that it has ever been in thanks to a highly disciplined management team and the continual reinvestment of its cash flows back into its developments.

Alexandria Real Estate

Alexandria Real Estate

This is the profile of a company heading into turbulent times in a position of extreme strength. With zero debt maturing until at least 2025 and a remaining debt term of 13.6 years, the company can be strategic when accessing the debt market over the next few years. This is a position that the vast majority of REIT’s simply cannot match, giving the company yet another advantage over competitors in the quest to dominate the life science market.

Alexandria has also exhibited an exemplary dividend growth history that shows no signs of ending anytime soon, averaging 6.8% over the last 10-year period. The dividend yield currently sits at 3.26% and while this may not seem overly attractive, please keep in mind that the yield currently sits at the highest point that it has been since 2016 and remains an important part of the total return the company provides.

High quality, growth focused REITs like Alexandria rarely go on sale and when they do, it is has historically been an opportune time to accumulate shares as a long-term investor. Yes, interest rates are rising fast and a recession may be immanent, but nothing in Alexandria’s profile indicates to me that either of these headwinds are likely to derail the company in a meaningful way.

A whole lot of things will have to go wrong in the world before the likes of a Bristol-Myers Squibb (BMY) defaults on a lease for their state of the art technology hub and lab spaces. Sure, the company has the potential to fall further and one of the company’s less secure tenants may default in a severe recession, however this REIT, in my opinion, has a safety net in its tenant quality, the industry’s historical recession resistance and its bulletproof balance sheet that is very hard to match.

Given the recent decline in shares, I have further built my position in this name using proceeds from the sale of STORE Capital (STOR), placing this stock in my top 5 holdings and currently have a cost basis just under $150. I firmly believe that over the long term, 11-12% total returns may be had even without a reversion to historical valuations.

I look forward to your comments below. Thank you for reading and good luck to all!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ARE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: “I am not a licensed financial advisor. This is not a solicitation to buy or sell a specific security nor is it to be construed as investment advice, please contact your licensed financial and tax advisor for advice to your specific situation.

This article is an opinion piece only and should not be construed as fact or be represented as such, please perform your own due diligence prior to investing in this or any equity.”