Thomas Barwick

Thomas Barwick

Simon Property Group Inc. (NYSE:NYSE:SPG) currently trades at a double-digit funds from operations yield of 11%.

The real estate investment is well-managed, provides international diversification, and is experiencing rapid growth in net operating income.

The trust is also aggressively increasing its dividend, implying that investors will benefit from higher investment yields in the future.

The payout ratio is low (54%), indicating that the dividend is very sustainable.

Simon Property Group’s diversified mall portfolio, strong FFO, and low valuation make SPG a top stock to buy before everyone else.

The Simon Property Group is the largest shopping center owner in the United States. As of June 30, 2022, the trust owned or had an interest in 231 properties totaling 186 million square feet, the majority of which were located in North America.

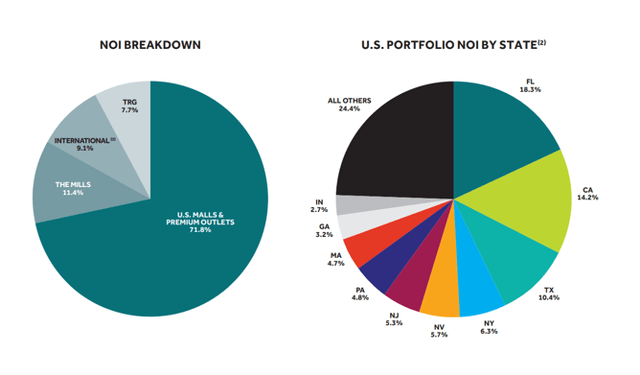

In addition, Simon Property Group owned 80% of The Taubman Realty Group, which owns 24 malls in the United States and Asia. In terms of net operating income, U.S. mall and premium outlets account for 72% of the trust’s total. Florida, California, and Texas are the three largest states with Simon Property Group properties.

Portfolio Overview (Simon Property Group)

Portfolio Overview (Simon Property Group)

After depreciation, the real estate assets of Simon Property Group were valued at $21.9 billion. As previously stated, the trust’s portfolio is primarily focused on the U.S. Mall and Premium Outlet market, which is home to the majority of SPG’s productive real estate assets.

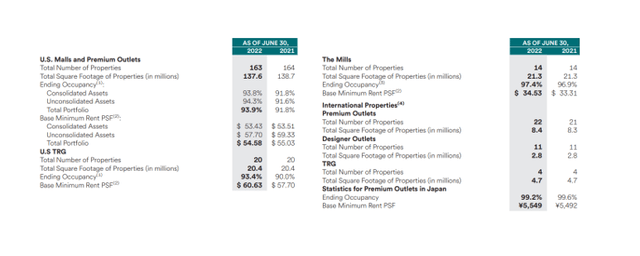

As of June 30, 2022, the trust owned 163 properties totaling 137.6 million square feet, with a total occupancy of 93.9%.

Simon Property Group owns 34 properties in the United States through its investments in other real estate companies (TRG and The Mills). The rest of the trust’s properties are in markets other than the United States (Europe and Asia).

Investments in TRG And The Mills (Simon Property Group)

Investments in TRG And The Mills (Simon Property Group)

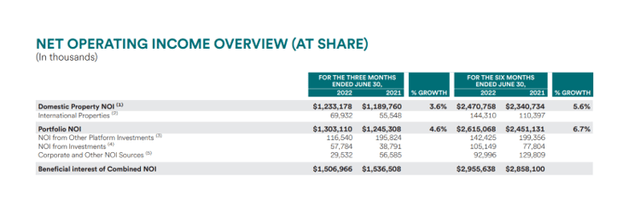

The portfolio performance of Simon Property Group was strong in 2Q-22, with the trust producing $1.30 billion in total net operating income, a 4.6% increase YoY.

Net operating income is a key figure for REITs and is a commonly used figure to evaluate the profitability of a real estate investment. In the second quarter, Simon Property Group’s real estate assets generated $1.51 billion in net operating income, including non-core investments.

Net Operating Income (Simon Property Group)

Net Operating Income (Simon Property Group)

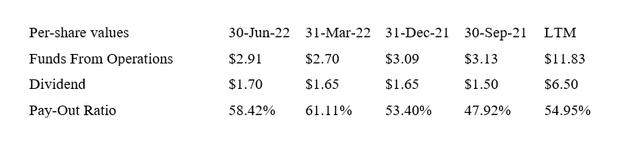

The pay-out ratio at Simon Property Group is extremely low. In the previous year, the real estate investment trust distributed slightly more than half (55%) of its funds from operations.

Simon Property Group earned $11.83 per share but only paid out $6.50 per share. In fact, the pay-out ratio has consistently been so low that investors need not be concerned about Simon Property Group’s dividend coverage.

Dividend Coverage (Author Created Table Using Trust Information)

Dividend Coverage (Author Created Table Using Trust Information)

Simon Property Group is also rapidly increasing its dividend. On August 1, 2022, the trust announced that it would increase its quarterly dividend to $1.75 per share, representing a 17% YoY increase and a 3% QoQ increase.

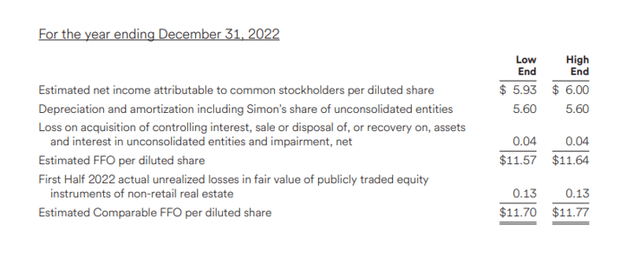

On a comparable basis, Simon Property Group expects funds from operations to range between $11.70 and $11.77 per share for the current fiscal year.

In order to facilitate a like for like comparison, the trust only considers funds from operations generated by the same properties on a comparable basis. Previous guidance for the REIT assumed funds from operations (comparable) of $11.60 to $11.75 per share.

Simon Property Group trades at an FFO multiple of 8.7x based on $11.70 to 11.77 per share in funds from operations, equating to a massive 11.4% FFO yield. The FFO yield suggests that the trust’s real estate portfolio and the income it generates are undervalued.

FFO (Simon Property Group)

FFO (Simon Property Group)

Simon Property Group is in a downward trend, with the trust’s stock down approximately 33% this year. SPG has yet to break out of its down-channel, but I believe the valuation is reasonable enough to justify the risk of purchasing Simon Property Group. A recession, an increase in mall vacancies, and financial stress for tenants are all risks for Simon Property Group that investors should consider before purchasing the stock.

Simon Property Group is a large, diverse, and professionally managed real estate investment trust. What makes SPG so appealing is its low valuation in relation to the trust’s expected funds from operations potential.

Income investors purchasing Simon Property Group are locking in a double-digit FFO yield of 11% (based on the trust’s 2022 guidance) with an FFO multiple of less than 9x.

The dividend of the real estate investment trust is secure, is covered by funds from operations, and is likely to grow in the future.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SPG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.