deyanarobova

deyanarobova

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on August 25th, 2022.

In an ever-changing and volatile world of geopolitical tension, it’s a good place to be when you can produce your own energy. Being self-sufficient is ideal, but I think our European friends are showing that diversifying your sources of energy is important if you aren’t able to produce a high enough quantity.

Many industries are involved in getting energy from a commodity to our houses. One essential component is the midstream operations that provide transportation in the middle. One such company is DT Midstream, Inc. (DTM). This company is relatively small in the grand scheme of things, but that hasn’t stopped it from being interesting. The company has a market cap of $5.6 billion. That can be compared with Enbridge (ENB) at an $89.33 billion market cap and Enterprise Products Partners (EPD) at a $58.99 billion market cap, just to provide some context with other popular names.

DT Midstream (NYSE: DTM) is an owner, operator and developer of an integrated portfolio of natural gas midstream interstate pipelines, intrastate pipelines, storage systems, gathering lateral pipelines, gathering systems and compression, treatment and surface facilities. Based in Detroit, Michigan, we deliver clean, natural gas to gas and electric utilities, power plants, marketers, large industrial customers and energy producers across the Gulf Coast, Northeastern and Midwestern United States, and into Canada.

DTM was a spin-off from DTE Energy (DTE); I covered more of that last year shortly after the spin was completed on July 1st. This left two very interesting companies that were previously operating under the same umbrella. It left DTE as the pure-play regulated utility and DTM as the natural gas pipeline company.

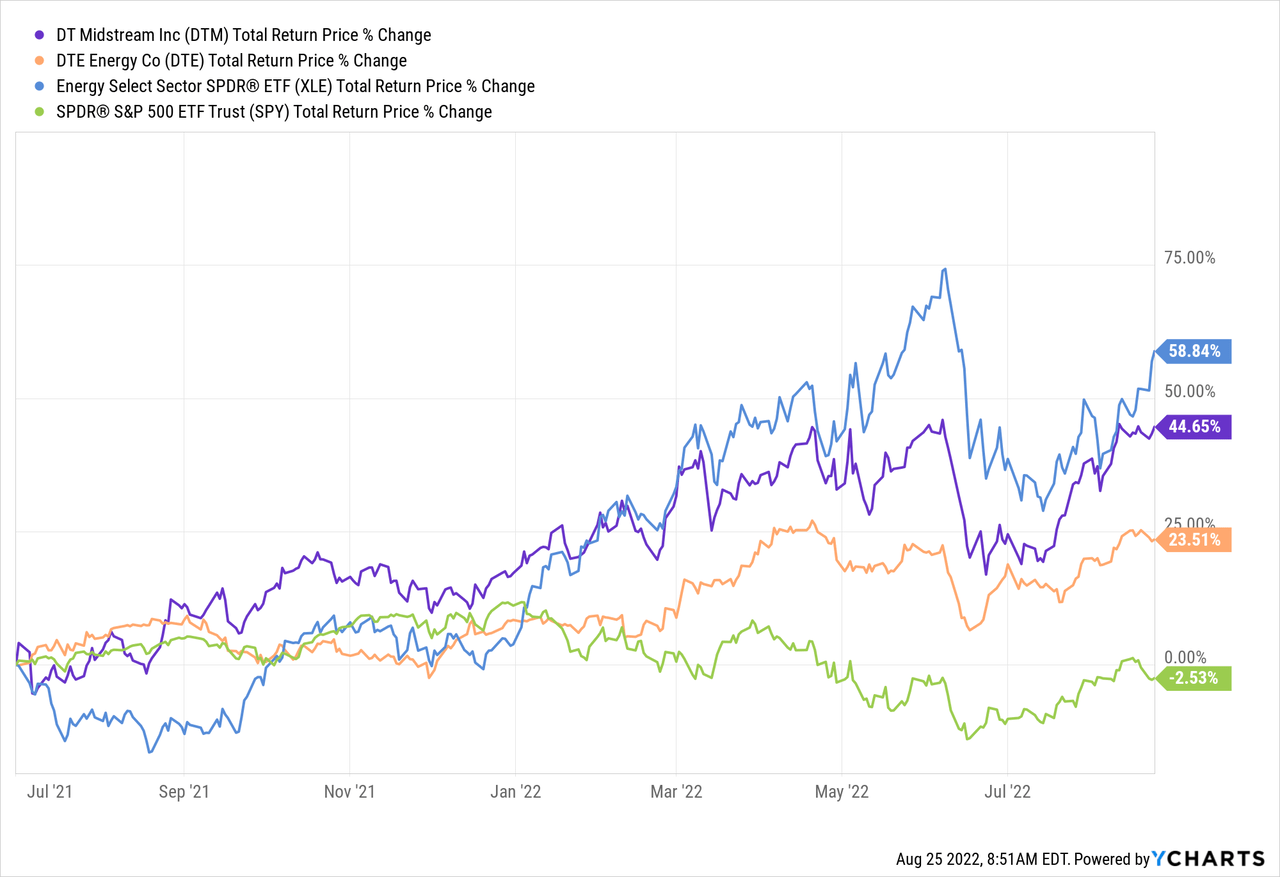

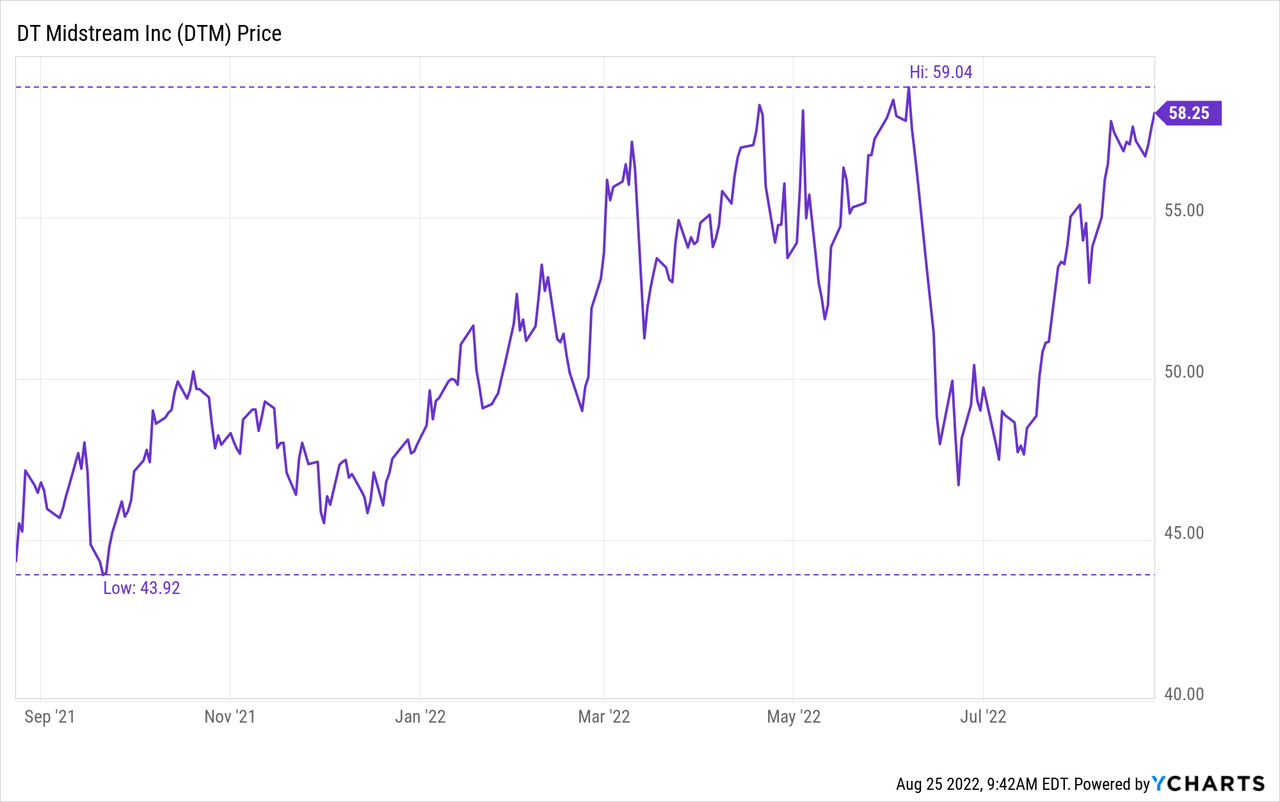

Since the spin, shares of DTM have provided attractive total returns as the stock’s price has ramped up higher on the back of higher natural gas prices. In the chart below, I’ve also included Energy Select SPDR (XLE) and the SPDR S&P 500 (SPY) for some performance context since the spin.

Ycharts

Ycharts

Since the spin, DTM has also delivered a solid dividend to investors. They took it from the initial $0.60 and bumped it up to $0.64 after just two initial quarters. That brings the latest dividend yield to around 4.43%.

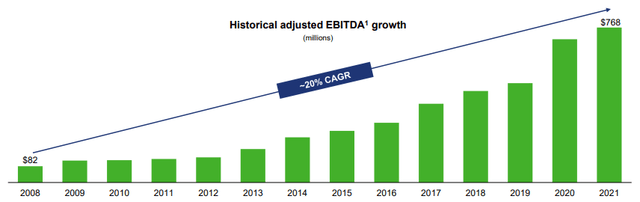

Since it was essentially a company operating under DTE’s umbrella, we have historical data showing how much adjusted EBTIDA has been growing over the years, going back to 2008. While the standalone operations have reported success more recently, this has been a recurring trend for the business.

DTM EBITDA Growth (DTM Investor Presentation)

DTM EBITDA Growth (DTM Investor Presentation)

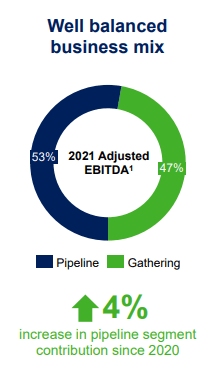

The company operates between pipeline and gathering divisions. The gathering pipelines come right off the commodity source, transferring the gas to a processing facility, refinery or transmission pipelines. As I said previously, many different components are involved, from getting a commodity from the ground to a person’s house.

DTM Operations (DTM Investor Presentation)

DTM Operations (DTM Investor Presentation)

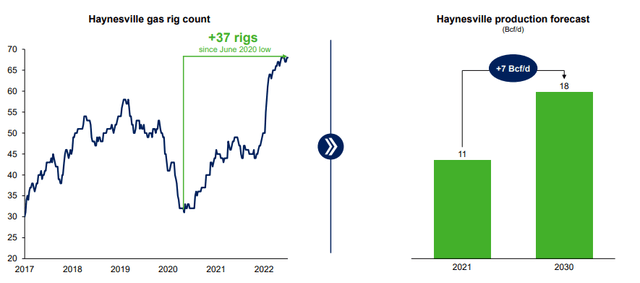

They operate in the Haynesville and Appalachia basins. Haynesville is a particularly popular area for new rig counts and has high production forecasts. That puts DTM in a great position to be an important player. In their latest investor relations presentation, they highlighted just how many rigs came online since the lows in 2020. There are now more rigs in operation than pre-COVID. The production forecast is also expected to increase by 7 Bcf/d from 2021 to 2030. That would be a 64% increase.

DTM Haynesville (DTM Investor Presentation)

DTM Haynesville (DTM Investor Presentation)

The world is shifting to more green and renewable energy sources. Natural gas certainly has a role to play, as does crude oil. However, it is the growth within these sources that is more interesting. The EIA is expecting U.S. energy consumption to only grow over the next 30 years through 2050. That includes record oil production by also natural gas production driven by natural gas exports.

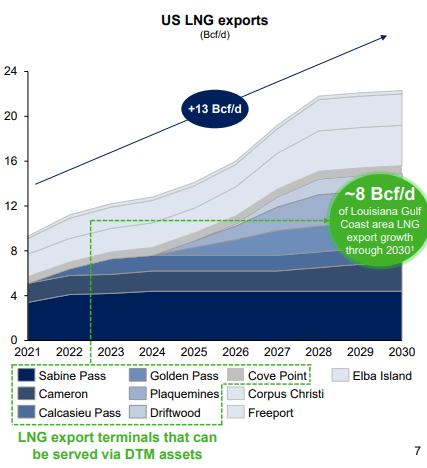

Those exports are an area that DTM is looking to play a role in. They service LNG terminals. They also expect exports to grow significantly over the next decade.

DTM LNG Exports (DTM Investor Presentation)

DTM LNG Exports (DTM Investor Presentation)

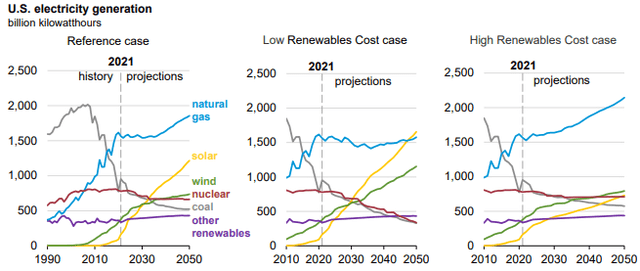

Even as renewables might be growing faster as a source of electricity generation, the EIA projects that natural gas grows too. That’s even included with low renewables cost cases where natural gas is estimated to dip but then eventually pick back up. A high renewables cost case would have the U.S. projected to rely even more significantly on natural gas.

As we saw above, the production for Haynesville is still estimated to grow through 2030, which can happen as different basins can perform differently. The below charts are also only factoring in electricity generation. Should inflation keep costs of renewable energy sources elevated, we could even expect a higher production forecast out of the basin.

EIA Electricity Generation Source (EIA Energy Outlook 2022)

EIA Electricity Generation Source (EIA Energy Outlook 2022)

Of course, all that growth should continue to benefit DTM. They are predicting that they should continue to experience a 5 to 7% CAGR on their adjusted EBITDA through 2023. They’ve recently provided an early outlook into 2023, where they anticipate adjusted EBITDA to come in at $810 to $850 million.

Their growth investments remain “on track” in both their pipeline and gathering divisions. This will leave the company with more capacity, which means DTM can serve more customers. I’d suggest that means we should anticipate the rest of their outlook remains on track too. They reiterated the same assumption in their latest conference call.

So with that, we had a strong second quarter, and our year-to-date performance is running ahead of plan, putting us firmly on track to achieve our 2022 guidance, and I am highly confident in our ability to achieve our 2023 early outlook. I’m very excited to announce that we have reached a final investment decision on a Phase 2 Haynesville system expansion. The expansion represents 400 million cubic feet a day of incremental capacity on LEAP. Phase 2, along with the Phase 1 expansion that is out way, will result in us expanding LEAP by 70% from its current capacity of 1 Bcf a day to 1.7 Bcf a day.

Phase 2 is fully underpinned by long-term take-or-pay commitments. This expansion highlights our ability to add timely and efficient increments of capacity to LEAP, providing a low-risk economic pathway for our customers to access the attractive domestic and LNG export markets on the Gulf Coast. We expect that we can achieve construction synergies with our Phase 1 expansion, which will allow us to have the full 1.7 Bcf per day of LEAP capacity and service by the first quarter of 2024.

Distributable cash flow estimates are shown at $575 to $625 million for 2022. That’s against the $247.5 million they should pay out based on the current dividend. The latest quarter of distributable cash flow came in at $139 against the dividends paid of $62 million. Operating EPS was $0.80 for the latest quarter. That’s enough to easily cover their $0.64 quarterly dividend.

With growth expected to continue growing, I’d have to suggest that the dividend itself will also continue growing. That should bode well for potential appreciation going forward.

While that’s mostly all good news, that does bring us to the current valuation. The high price of natural gas and their attractive assets have pushed the stock’s price considerably lately. There was an opportunity just over a month or so ago when energy joined the bear market. However, the stock has bounced off that level swiftly. We are once again near all-time highs for this stock.

Wall Street analysts have an average price target of $59.88. That could suggest that the stock is running fairly hot right now.

Ycharts

Ycharts

A more appropriate time could be to wait for the next potential dip. On the other hand, I don’t plan on selling my position either.

DTM seems to be succeeding as a standalone company post-spin-off. They are benefiting from the overall environment that has shifted heavily to relying on natural gas. A reliance that won’t soon be going away. With their growth projects underway, they are in an even better situation to take advantage of the opportunities going forward. Thus, growth in EBITDA, cash flow and earnings can translate into higher dividends and more share appreciation for shareholders.

That being said, we are looking at shares being at an elevated level, letting shares cool down a bit from here before nibbling seems like a logical move.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.

This article was written by

Cash Builder Opportunities provides high-quality and reliable dividend growth ideas to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

—–

Who are we?

Nick Ackerman is the lead author for Cash Builder Opportunities. Nick is an avid student of the markets and has been investing in his own accounts for over 10 years. He is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. His specific focus is on closed-end funds, dividend growth stocks and option writing as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long-term financial goals.

Stanford Chemist is a scientific researcher by training who has taken up a strong and passionate interest in investing. His members appreciate the analytical and agenda-free insight and analysis that he brings to investments. He has developed his own metrics and tools for understanding closed-end funds and exchange-traded funds and how to profit from them and will seek to apply the same logical principles to Cash Builder Opportunities.

Disclosure: I/we have a beneficial long position in the shares of DTM, DTE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.