Rick_Jo/iStock via Getty Images

Rick_Jo/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

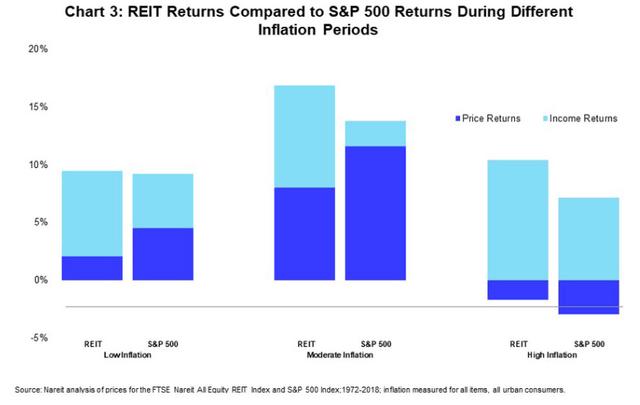

A big question investors might be asking is “Do REITs do well when inflation is very high?”, so I looked for answers to that potential inquiry.

www.reit.com

www.reit.com

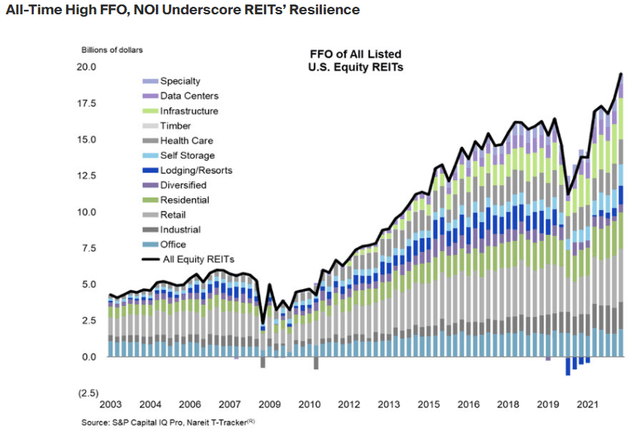

REITs currently show, based on FFO and NIO scores, that they are in a much stronger position today than during either the GFC or COVID. The next chart shows how they have done in past times at various inflation levels.

www.reit.com

www.reit.com

Seeking Alpha describes this ETF as:

The fund invests through derivatives in stocks of companies operating across mortgage real estate investment trusts (REITs), equity real estate investment trusts, financials, diversified financials, real estate sectors. The fund employs short strategy and uses derivatives such as swaps to create its portfolio. The fund seeks to track -2x the daily performance of the Dow Jones U.S. Real Estate Index. SRS started in 2007.

Source: seekingalpha.com SRS

SRS has $54m in AUM and charges investors 95bps in fees. A 25bps fee waiver expires on 9/30/22. Unless extended, the fee jumps to 120bps. SRS has not made a payout since March 2020. ProShares provides this description and warning about this style of ETF.

ProShares UltraShort Real Estate seeks a return that is -2x the return of its index (target) for a single day, as measured from one NAV calculation to the next. Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return and ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks. Investors should monitor their holdings as frequently as daily. Investors should consult the prospectus for further details on the calculation of the returns and the risks associated with investing in this product.

Source: proshares.com SRS PDF

Since SRS hold derivatives based on the index, here is what the Dow Jones U.S. Real Estate Index is about.

The index is designed to track the performance of real estate investment trusts (REIT) and other companies that invest directly or indirectly in real estate through development, management, or ownership, including property agencies.

spglobal.com

Source: spglobal.com

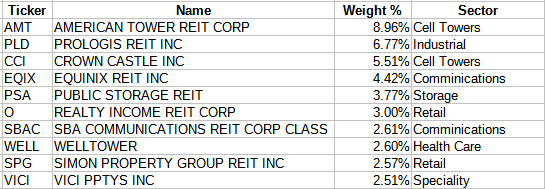

There is no US ETFs based on this index, but the iShares U.S. Real Estate ETF (IYR) uses the “capped” version of that Index. I failed to find any list (listing) that split the REITs into their sub-types, but I added sectors based on what I know about each REIT. Here are the Top 10 holdings of IYR, equating to 42% of the portfolio.

ishares.com; compiled by Author

ishares.com; compiled by Author

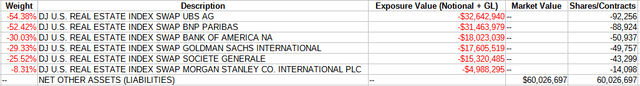

SRS uses a set of index swaps to execute its strategy.

An index swap refers to a hedging contract in which a party exchanges a predetermined cash flow with a counter-party on a specified date. A debt, equity, or other price index is used as the agreed exchange for one side of this swap.

Source: investopedia.com Swaps

proshares.com

proshares.com

To spread the default risk imposed by using SWAP contracts, SRS has their holdings spread across six major banks, including three international headquartered ones.

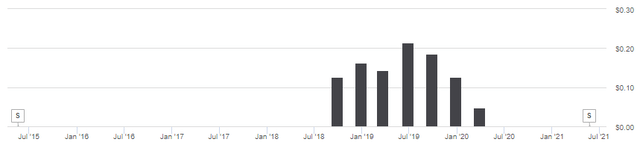

seekingalpha.com SRS DVDs

seekingalpha.com SRS DVDs

The two boxed “S” are reverse splits. The second occurred in May’21 as the ETF price dipped below $10/share.

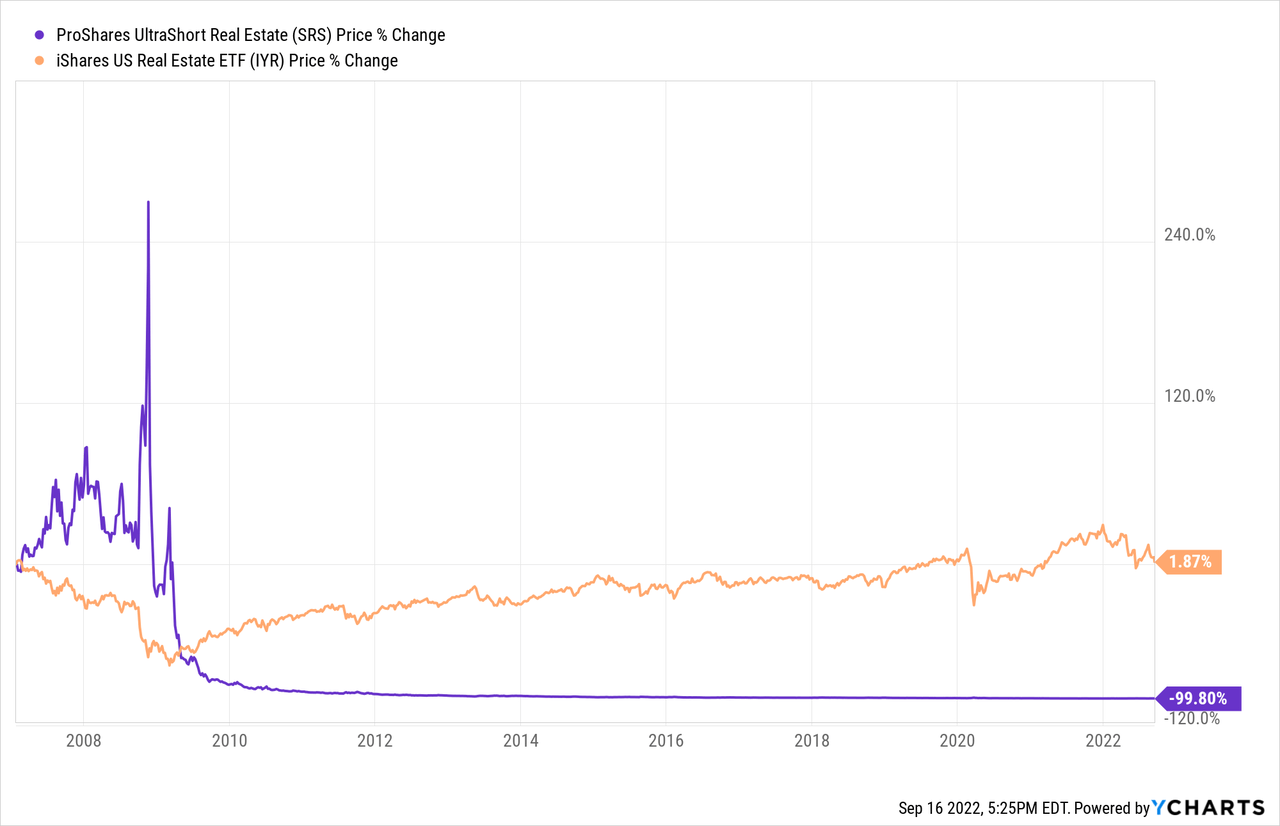

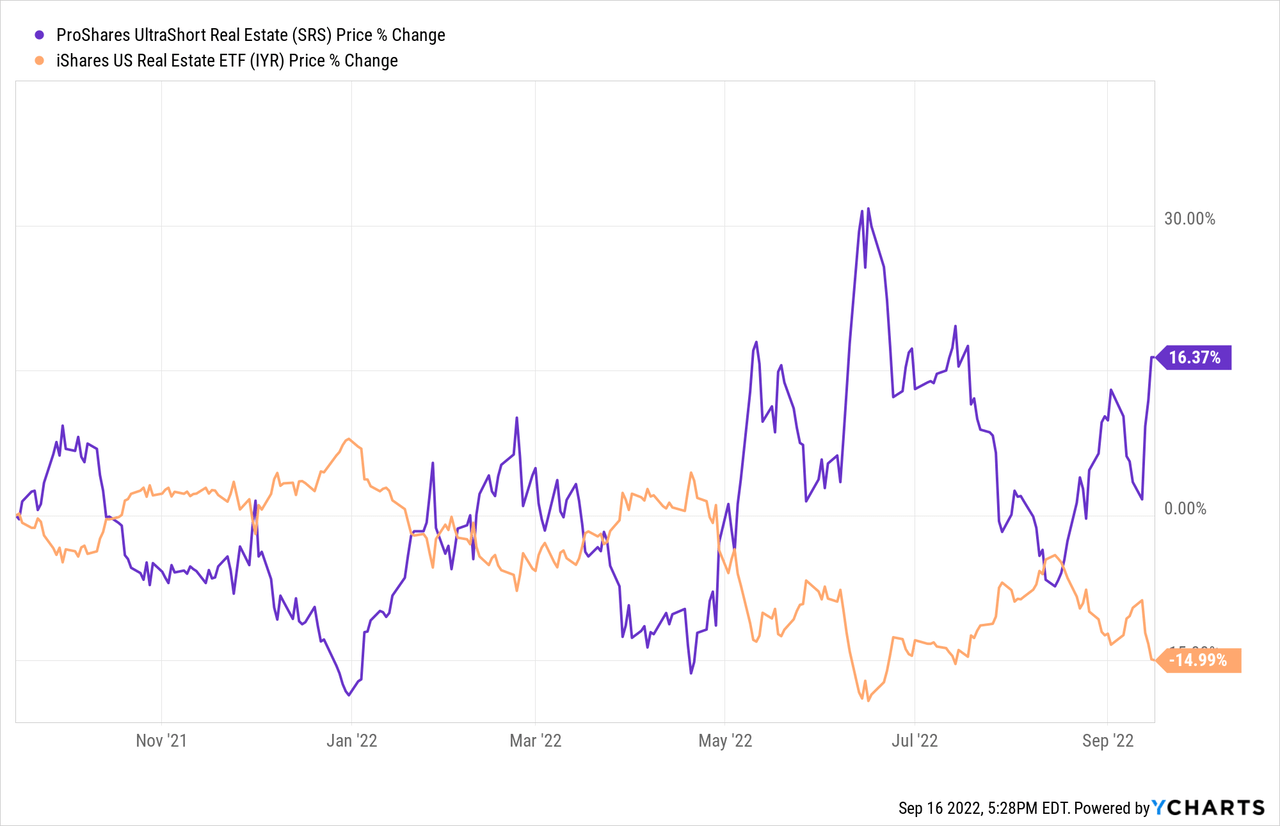

Since the GFC in 2008-09, with REITs rising, SRS is down almost 100%! Investors during that crisis and at the start of COVID made money, the rest, not so much, though SRS has done well over the past 12-months as the REIT Index has fallen almost 15%.

But please notice that SRS investors are not up 30% (2X IYR’s loss) but only 16.37%. This is due to the daily 2X calculations and the warning mentioned by Proshares. Leveraged ETFs are good short-term plays if one has a good market-timing model; the rest of us are probably better off putting the cash under the mattress!

For those who are negative but less so or want less risk, there is the ProShares Short Real Estate (REK), which is only 1X short. For those still positive on REITs, there is the ProShares Ultra Real Estate (URE), which is 2X on the plus side of the same index. For the more aggressive investors, there are two 3X ETFs:

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research – including reports that are never published elsewhere – across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.