porcorex

Contrarian investing isn’t a popular strategy, because if it were, then it wouldn’t be labeled as such. However, time and again, picking high quality companies with the best assets on the cheap has proven to be a winning strategy over the long run.

In other words, past downturns look like bargains, while future downturns look like risk. This brings me to SL Green Realty (NYSE:SLG), which has gotten very cheap by nearly every metric, giving investors a rare chance to lock in a very attractive 9% yield.

SL Green Realty is well-known in the real estate industry as being New York City’s largest owner of office real estate. It’s an S&P 500 company, and is focused on owning, managing, and developing properties in Manhattan. At present, it has an interest 64 properties totaling 34.4 million square feet.

SLG has traded rather weakly since hitting its near-term high as recently as March of this year. As seen below, SLG is now just a few percentage points from its 52-week low, and is trading at a 52% discount from its 52-week high of $85.15.

SLG Stock (Seeking Alpha)

This material weakness appears to be related more to negative market sentiment rather than weak operating fundamentals. This is reflected by same-store net operating income growing by a respectable 6.7% and 7.8% YoY during the second quarter and the first half of this year. Manhattan same-store occupancy also remains strong, at 92%, including 1.1 million square feet of leases signed year-to-date, and another 1.1 million square feet of leases in the pipeline.

Moreover, there appears to be no shortage of international interest in prime New York real estate, as SLG recently closed on the acquisition of 450 Park Avenue for $445 million, in a joint venture with institutional investors from South Korea and Israel. This is a high quality Class A tower in Midtown Manhattan with 33 floors that enables SLG to further expand its Park Avenue presence. It totals 337K square feet of prime office and retail space.

Meanwhile, I believe market concerns around return to office as being overblown, as managers have shown a preference for in-presence work, and reports have acknowledged that remote workers are more likely to be the first in line to be laid off in this uncertain economic environment. These factors could spur more workers to come back to the office. Moreover, New York City has seen a strong rebound to tourism, as noted by management during the recent conference call:

Tourism is another bright spot. Visitors to New York City which had peaked at over 60 million pre-pandemic, were as low as 30 million during pandemic, are now 85% recovered, and that’s with fairly relatively low participation from international visitors, which are expected to rebound in 2023, at which point full recovery is expected next year. And that’s consistent with what we basically had discussed in our December investor meeting in terms of expectations because that drives so much in terms of retail expenditures and hotel nights and boost this economy in many ways.

Furthermore, I also see SLG as having the balance sheet strength to weather higher interest rates, with a respectable BBB- rated balance sheet with a reasonably low long-term debt to capital ratio of 39.4%. This lends support to the 9.3% dividend yield, which is well-protected by a 55% payout ratio based on forward FFO per share of $6.74.

Lastly, SLG appears to be dirt cheap at the current price of $40.26 with a forward P/FFO of just 6.0, sitting well below SLG’s normal P/FFO of 14.4 over the past decade. Sell side analysts have an average price target of $57.56, implying a potential one-year 52% total return including dividends.

SLG Valuation (FAST Graphs)

SLG appears to be an attractive play on the rebound in office demand as well as the recovery in tourism to New York City. It is trading at a significant discount to its intrinsic value, and offers a very attractive 9.3% dividend yield. I believe SLG is very undervalued and worth considering for patient income and value-focused investors.

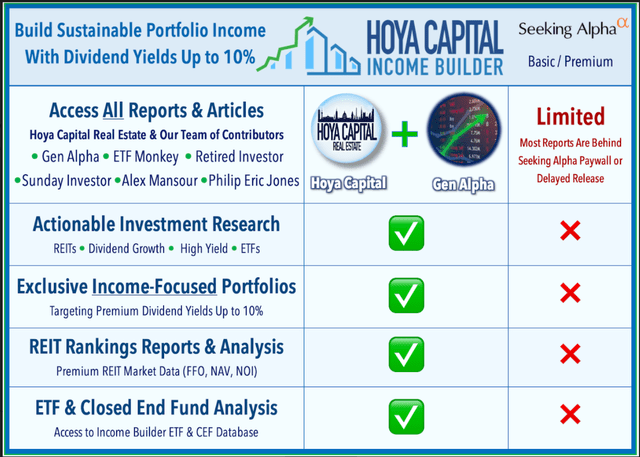

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I’m a U.S. based financial writer with a BSc in Economics and an MBA in Finance. I have over 12 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have a beneficial long position in the shares of SLG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.