Kwarkot

Kwarkot

The stock of STORE Capital Corporation (NYSE:STOR) increased by 20% on Thursday as a result of the company’s decision to go private.

The going-private transaction is a watershed moment for the real estate investment trust, which has historically produced impressive adjusted funds from operations and dividend growth.

The transaction was announced yesterday by the real estate investment trust, and investors may want to sell the acquisition offer and recycle their capital into an equally impressive REIT with strong portfolio health and a low pay-out ratio.

STORE Capital announced in a press release on Thursday that it has entered into a definitive agreement with institutional investor GIC, which will acquire the real estate investment trust in a transaction valued at $14 billion in collaboration with Oak Street. The transaction will be all-cash, which means that investors will receive the full deal value of $32.25 per share in cash.

The transaction price is a 20% premium to the stock price of STORE Capital on September 14, 2022, and an 18% premium to the 90-day volume weighted average stock price.

GIC and Oak Street will take STORE Capital private, which means the trust will no longer be available for trading on a public exchange. Because of the transaction’s going-private nature, I advise investors to sell the deal and reinvest the proceeds in another equally impressive real estate investment trust.

STOR share price (Finviz)

STOR share price (Finviz)

Realty Income Corporation (O), a highly regarded, monthly-paying net-lease REIT with a very safe dividend and exceptional portfolio health, strikes me as a worthwhile replacement for STORE Capital.

Realty Income, in my opinion, is an excellent choice for investors seeking the dividend stability that STORE Capital will sadly no longer provide to public investors.

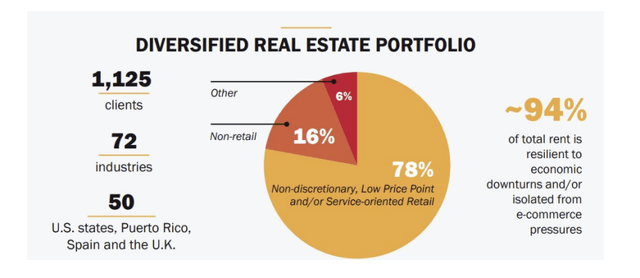

Realty Income has a well-performing, diverse, and recession-proof commercial real estate portfolio comprised of 11.4K commercial properties that has been proven to be immune to the ups and downs of the economy.

Portfolio Diversification (STORE Capital Corp)

Portfolio Diversification (STORE Capital Corp)

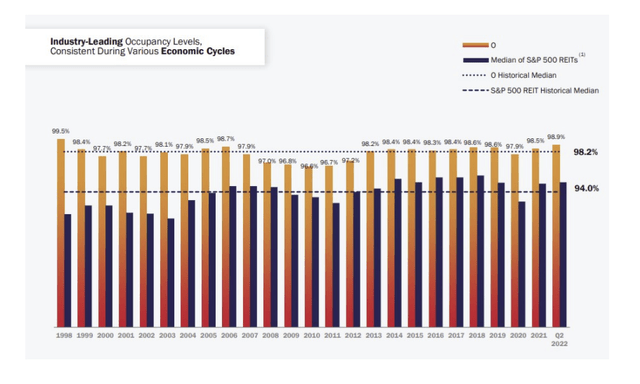

The fact that Realty Income has consistently achieved high occupancy for its properties is a key tenet of the company’s value proposition. Since 1998, Realty Income’s median occupancy has been 98.2%, which is significantly higher than the sector median average of 94.0%.

In essence, Realty Income has a well-managed, fully-leased portfolio that generates a consistent amount of funds from operations each quarter.

Occupancy Levels (STORE Capital Corp)

Occupancy Levels (STORE Capital Corp)

The main reason to buy Realty Income is the trust’s conservative pay-out ratio, which virtually guarantees that the trust’s dividend will continue to grow.

Realty Income’s funds from operations pay-out ratio was only 76% over the last year, indicating that the trust’s dividend has room to grow even if rental growth slows for a few quarters. STORE Capital had a marginally higher pay-out ratio than Realty Income of around 68%, but Realty Income’s dividend has proven to grow consistently over time.

What I believe works in investors’ favor here is that, while STORE Capital’s stock rose 20% following the announcement of the going-private transaction, Realty Income has recently seen some stock price weakness, making this the ideal time to recycle some capital from a STORE Capital stock sale into an equally safe, but slightly lower yielding investment in Realty Income.

Realty Income expects adjusted funds from operations to range from $3.84 to $3.97 per share in 2022, translating to an FFO-multiple of 16.2x.

Realty Income was trading around $75 in the middle of August, implying an FFO-multiple of 19.2x. Prior to the going-private announcement, STORE Capital was trading at less than 13x adjusted funds from operations.

The yield has risen to 4.7% as a result of Realty Income’s stock price decline. STORE Capital also provided a slightly higher yield, 5.6%, than Realty Income.

Given the safety of Realty Income’s dividend, I believe it would be an excellent place to reinvest proceeds from the sale of STORE Capital stock.

Realty Income has a fairly recession-proof, retail-focused investment portfolio comprised of high-quality commercial properties, but that doesn’t mean the trust will be immune to a larger market or commercial real estate market correction in the United States.

Given the trust’s historically high occupancy, the trust’s downside potential in the event of a recession is likely to be limited.

STORE Capital was an excellent investment for me, and I appreciated the dividends. However, with the recent announcement of a going-private transaction, this chapter has come to an end.

Fortunately, there are many other real estate investment trusts, such as Realty Income, that provide an alternative for income investors.

Realty Income is rated highly because of its long track record of operational excellence, strong portfolio health, and dividend growth.

While I will miss STORE Capital, I believe Realty Income is a worthy replacement that will provide dividend growth for many years to come.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.