THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

Earning 4% without taking on credit risk would in normal times sound like a great deal. But these are not normal times, and the rate of inflation is over twice that rate. The Fed has stepped back from the markets for Treasury securities and mortgage-backed securities as part of its QT, and it has raised its short-term policy rates to over 3%. Treasury yields are now 4% or higher for maturities of one year to five years.

And banks are now having to compete with that, and are now offering “brokered” CDs at rates above 4% across maturities of six months to five years. For yield investors and savers, if they take advantage of those rates, their money is getting wiped out by inflation only half as fast as it would be wiped out in their regular bank account. But if you have to borrow money, such as to buy a house, that’s now getting a lot more expensive.

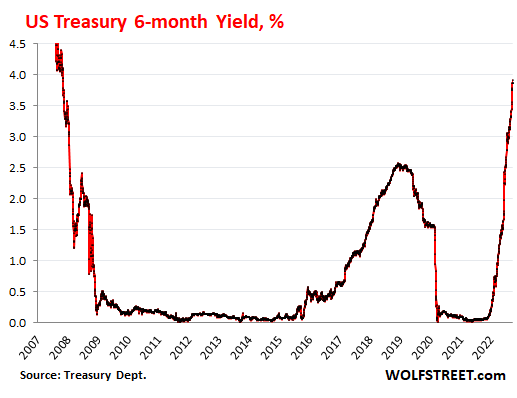

The 6-month Treasury yield today inched up to 3.9% at the moment, the highest since November 2007, up from near 0% less than a year ago:

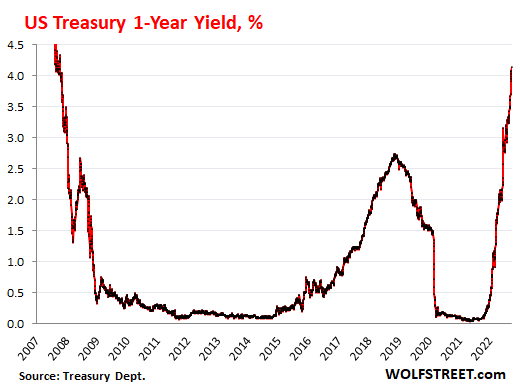

The 1-year Treasury yield rose to 4.14% at the moment, the highest since November 2007, up from near 0% less than a year ago:

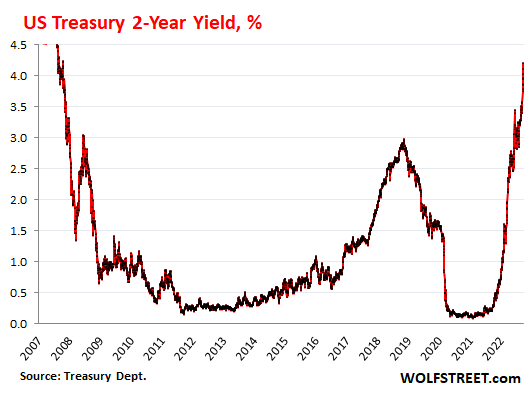

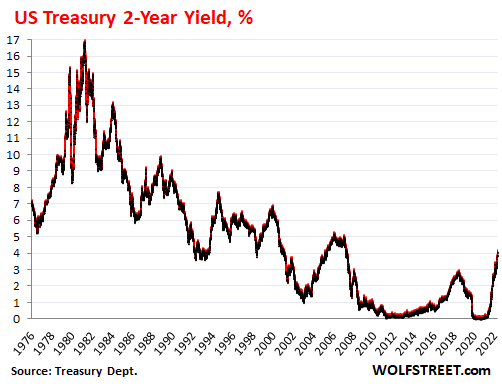

The 2-year Treasury yield rose to 4.21% at the moment, the highest since September 2007, and up from 0.25% a year ago.

The two-year yield started rising at about this time last year, as it began pricing in the Fed’s “pivot.” By the end of 2021, it had risen to 0.73, when the Fed’s policy rates were still at near 0%. But the Fed had already started “tapering” its asset purchases and was talking about rate hikes in the future.

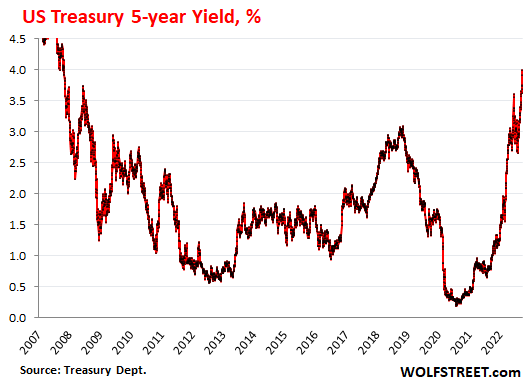

The 5-year Treasury yield nudged up to 4.0% at the moment, just barely there:

Buying Treasury securities is now easy. People can buy them through their broker in the secondary market or sometimes at auction. And people who open an account at Treasurydirect.gov can buy them directly at auction from the government.

And the yields that Treasury securities with maturities of up to five years are offering is what banks have to compete with if they want to attract new cash.

Banks have noticed that their customers are moving money out of their bank accounts into Treasury securities and Treasury money market funds because they get near 0% at the bank, and they get around 2% in a Treasury money market fund, and 4.14% on one-year Treasury securities.

So banks are starting to compete for deposits. And they’re doing it with “brokered” CDs, which are FDIC-insured CDs that banks don’t offer their existing customers (they still get near 0%), but offer to new customers through brokerage accounts where these CDs can be purchased like stocks.

Banks offer these CDs through brokers, and not to their own customers, because they don’t want to pay all their existing customers 4% interest on their deposits, but they only want to pay 4% on the new money that they attract, while they continue to pay their loyal customers near 0%.

For banks, brokered CDs are a form of “hot money” that comes and goes, unlike regular bank deposits, which tend to be stickier.

So I checked with my broker today. And this is what they offer in terms of brokered CDs. These are the highest bank interest rates I have seen since 2008:

Some CDs are “callable” and might offer a higher rate but with the risk of being “called” if interest rates drop. It’s good to check so that there are no surprises.

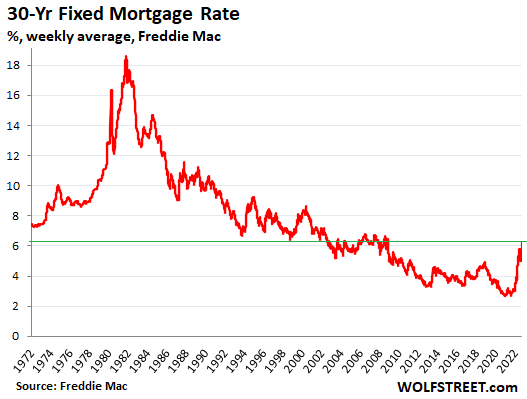

The average 30-year fixed mortgage rate jumped to 6.70% today, according to daily measure by Mortgage News Daily. This is the most immediate measure we have of the mortgage market.

The weekly measure by Freddie Mac, released on Thursday, and based on mortgage rates earlier in the week, jumped to 6.29%, the highest since November 2008.

But Freddie Mac’s weekly average was based on mortgage rates in effect before Wednesday afternoon — before the Fed announced a 75-basis-point rate hike and projections of an additional 125 basis points in rate hikes this year, which could bring its short-term policy rates to around 4.4% by the end of 2022.

For people who took out mortgages in the 1980s and early 1990s, something like a 6.7% rate might still seem fairly low, or incredibly low, given that inflation is over 8%, but home prices are now in the ionosphere, inflated by years of the Fed’s interest rate repression and QE, including the Fed’s purchases of mortgage-backed securities. And financing a home at those ionospheric prices today at 6.7% is an entirely different affair than financing a home in the 1990s at this type of interest rate.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

While I’m glad things are finally happening fast, I’m worried that something might break causing the Fed to reverse course. Rapidly declining bank deposits,rapidly spiking yields, if something big like corporate debt not being able to be rolled over, or repo financing drying up happens, the Fed may have to pause.

Otoh, I’m waiting with popcorn to see which hedge fund blows up on their interest rate swaps. Couldn’t happen to a nicer bunch of people. 🙂

Plenty of zombie companies are going bankrupt.

And that’s just the beginning.

Prize discovery has blown up already.

Housing has become completely unaffordable as mortgage rates have doubled thereby significantly increasing EMIs while house prices are still higher than last year.

Fed is too late in the game with its “Inflation is transitory” procrastination.

Lune,

The biggest thing that the Fed is in charge of has already broken: price stability (inflation).

It’s a HUGE problem, something enormous has broken and it cannot just be put back together with a little intervention. Anything else that breaks that the Fed could deal with is going to be a minor inconvenience by comparison.

I’d like to know if the Fed governors use crayons for their dots plots games.

darts

FED broke all kinds of S$$$ goosing the market and housing market to the moon so it’s only fair they break S$$$ all the way down too.

As for banks still treating their existing customers like crap by still offering insulting level of interest rate, I say you have to be stupid not to just buy some T bills, even 4 weeks T bill would be multiple times better than .00005 interest rate in normal savings account.

Ibonds are another good investment option. Last I checked ibonds were paying almost 10% interest. The maximum you can invest is $10,000 per year.

Some “normal savings accounts” are paying up to 3% APR

look it up on bankrate.com

Great post Wolf… some people still don’t understand inflation is a issue that affects EVERYONE, other issues such as liquidity issues, housing/stock market crash, inflated unemployment, etc… only affects a subset of people, in fact the only way for the Fed to break the inflation cycle is to pop at least one of the bubbles maybe even more than one is needed to tame inflation.

Some people don’t know how to add and subtract. So, inflation, for them, is like quantum physics to most of the rest of us.

A $500,000 30 year mortgage, with 20% down, is $2,017/month at 2.7% (January 2022 rate) and is $2,976 at 6.7% (September 2022 rate). The payment has increased 48% in 8 short months…wowza!!! This is going to hurt the debt addicted global economy, as the new “Housing ATMs” get paused until rates come back down…and that could be many years from now, or not…HA

Wolf – can you email me what bank/brokerage where you are seeing 4% plus brokered CDs? I’ve been buying muni, treasury, foreign, corporate, mortgage, and even risk EM bonds hand over fist this past few weeks as I’ve been 90% cash for the last six months and getting back into “the game” in a big way. I’m thinking the Fed funds rate has a hard limit at 5%-65, and beyond that I don’t even think is mathematically possible in America…

I’ve been buying TIPS as there are some rare opportunities in Tips right at the moment, as the 10 year TIPS are yielding 1.29% currently so if you hold until maturity, you are “guaranteed” to make 1.29%, or higher, above inflation. Got this “TIP” from Jesse Felder, a genius investor IMHO…

Also if you run the math on EM bonds, with the current FX rates, if/when that pivots, there is a gigantic amount of possible gains due to both yield and FX mechanics. Bigger risk, bigger reward…but I like to put 10% of my money into higher risk gambles as only 1 out of 10 needs to hit my goals to break even. Yet who would have thought “bonds” would be so high risk just a few short years ago? The game has changed, so we try as we can to change with it…

Thanks for your website Wolf, I get a lot of very profitable ideas from pouring over your articles and the forum posts…

Good Luck with all your investments!

Hey Yort, I am seeing the same rates that Wolf is posting on my TD-Ameritrade brokerage account website. They have a “Bonds and CDs” portal.

Yort,

Just to clarify for everyone here: TIPS can be a good deal. But they’re not that straight forward.

You pay federal income taxes on the inflation compensation every year, though you do not get paid this inflation compensation until the bond is redeemed. This can be a lot of taxes you have to pay without getting the cash income. So for individual investors, it’s good to have them in a tax-deferred account, such as an IRA.

Another complication is that, in the unlikely and rare event of deflation, you will lose some of the accumulated inflation compensation that has already been added to the principal. So you paid taxes on the inflation compensation, and during deflation, you lose that inflation compensation after having paid taxes on it. But given how rare deflation is, and how mild it is even if we get it, I wouldn’t worry about it too much. Just something to remember.

Also TIPS can be very volatile if you try to sell them, and there can be liquidity issues — in other words, you might get a terrible price if you try to sell them. So it’s best to plan to hold them till maturity.

My personal belief is that the Fed is acting tough only for the election cycle that ends in November. Keep the dirty rats on the ship.

In truth, the Fed has done very little compared with that they could do. They have barely started to liquidate the assets they added to the balance sheet since the pandemic. The rate at which they bought assets is NOT being mirrored by a rate at which they are selling them.

Even with this minor amount of selling bonds, the stock market and the bond markets are going crazy.

The truth is that our economy is very fragile and the extreme amount of bond purchases that have goosed all of the major economies have created a very fragile global economy, where there is the real possibilitie of a coordinated global meltdown of assets. Or it could reverse and have another global melt-up before a bigger melt-down.

My core point is that we have created an extremely volatile situation, because the foundational underpinnings of the financial markets is so distorted by MMT policies and massive government deficits and asset bubbles.

Home asset bubble will really start to melt over the coming 4-6 months. Look for a total decline of 20% in home values over this time (from now, not from the peak). And that is just the beginning. 2-3 years to bottom. Home prices down 50% or more from the peak.

Re “The truth is that our economy is very fragile”

Disagree. The economy is just people, working to survive and thrive as best they can, with the land, tools and equipment that they have available. That “real economy” is not fragile, it’s very nearly the strongest it’s ever been.

The financial system is fragile though, in a self-inflicted “we are greedy and stupid” way. To the extent that finances muck up the real economy, that’s a problem. But it’s a financial problem, not a “real economy” problem. Let the assets change owners and let’s get on with the business of humanity again.

i mostly agree. however, what i don’t see is the modern equivalent of victory gardens. people using their land, tools and equipment for their own benefit.

back then, people knew how to garden and tighten belts. it was part of their dna.

nowadays, not so much. there is a learning curve to growing your own food, and hoa’s and their ilk throw another wrench into that particular machine.

the pmc types that lose their jobs in the coming crisis are unprepared to do anything but fall back on “the system” which already is showing signs of not being up to the task. the rending of garments and gnashing of teeth will make the past several years of discontent look like a picnic.

PMC — Professional Managerial Class, like yuppies.

The economy have become mostly finance and finance rule. Large interweaved corporations control much of what is produced.

With a financial crash, these corporations may as well shut down work on the land and in the factories. To let it go and allow people to work and factories to operate on their own is for finance not an option.

The population is too enormous to go back to rural communities, and the plutocrats have already captured all the land. This is the beginning of the decline back to Middle Ages and subsistence economy.

Humanity is anti-fragile…ask any species on the planet.

I think the other way around. They’ve gone slowly so far and will until the elections are over. Then speed up. The only chance they will get to increase the pressure is right after the elections. A year later and they will have pressure not to because there will be to much focus on the next elections.

*IF* they actually intend to bring housing prices down to affordability then they will have to act at that time. If they don’t there will be an enormous increase in the homeless population. A huge percentage of the homeless population becomes physiologically damaged from stress and humiliation. Mental illness and drug use are exacerbated. People that function fairly well become unstable and are no longer a viable part of the work force. Nor do they even make a functional army.

To let both the working class (in the traditional sense) and allow an increasing homeless population to fall into chaos would be incredibly expensive and utterly demoralizing. We’re not just talking excessive amounts spent on medical and welfare programs but also police services and security etc. both public and private

Not to mention pitchforks and targeted arson, vandalism etc.

This is an excellent comment.

We’re still all in the thrall of mamon. It’s the way our brains (have been conditioned to) think (in the west). Individualists til death.

Lynn – agree with your post, but I don’t believe that their intentions are to mitigate homelessness. Like redefining border invasion, it’s too politically handy to bear close scrutiny. They read The Camp if the Saints like everyone else did a few decades back. The principle persists because it works.

rick m, I didn’t read that book, now I’m curious.

For a government to not mitigate their homeless population at this point is not only *really, really* trashy and vulgar but also dangerous. You would think that a government employee at that level would not just think of themselves but also of *policy*. What else does policy mean? They might be thinking more about other people by this point.. The FED is in the news and on the lips of everyday people more and more. By now I’m sure they have bullet proof glass and armed security guards. They’ll be thinking of others now even if it’s only thinking about redecorating at some point with concertina wire.

Many Southern states have recently outlawed homelessness. Camping on public lands and living in cars is a crime. They are not going to immediately do a 180 and provided services to the homeless.

Huh, I had the opposite opinion. That in part the Fed isn’t being tougher because of the coming election and a desire to minimize impacting the election. So I figure if inflation still runs hot at the end of the year get ready for them to crank harder.

I watched one of the founders of long term capital management give his synopsis of the problem with his fund. He spoke as if the amount of risk they were taking was negligible when in reality it was through the roof. He blamed the banks for cutting credit when they needed it. He praised the fed for stepping in. No lessons learned it looks like

It will be interesting to see which mid-level HF’s get margin called.

Unfortunately, the only big boys I see running into problems are Goldman, Citidel, and BofA.

Goldman because they are ridiculously leveraged and being investigated from top to bottom. Usually this doesn’t mean much but if this does turn into a historic crash then there will need to be a head on a spike.

Citidel – based on Griffin donating bags of cash to DeSantis and moving the HQ to Miami isn’t a good look (for either). There must have been a string of microwave towers built to keep their Algo’s moving at lightspeed to NY.

BofA – Citidel’s Prime Broker, if I’m not mistaken.

Then we might see some of the “financial runs” Janet Y was mentioning a while back.

While these treasury and cd rates look appealing, it smells fishy to me.

It’s almost like banks are saying “retail investors are not buying stocks. The stock market is bleeding market cap. How do we get out collateral back? Ah! bonds and CD’s!

Maybe there is currency play out there?

Fed seems to be incompetent, but maybe it’s the plan.

Mistake #1 Keeping rates too low for a decade.

Mistake #2 Doing too much for too long during pandemic.

Mistake #3 Inflation is transitory.

Mistake #4 Tightening too

hard into a no growth economy to make up for Mistake #3. Good chance this will be the biggest mistake ever as this can be the one that crashes the real economy.

Mortgage rates have more than doubled within a year.

Which, when you do the math, means housing prices need to come down 30% to match the same “howmuchamonth” amount. Which were already stretched beyond sanity.

And, no, housing prices have not decreased 30%…yet.

And more to come as rates keep rising.

“The average 30-year fixed mortgage rate jumped to 6.70% today, according to daily measure by Mortgage News Daily.”

Those who have to “hit the bid” will begin to reveal the depth of the real estate market. And likely the sale prices might be “disguised” so as not to create a panic. There goes the neighborhood.

How would they disguise it?

Things like making the official sale price higher, but providing in the contract for cash-back to the buyer. Or having the seller pay points to buy down the mortgage rate. Or providing the home in a more-finished condition than normal. The homebuilders have a playbook.

Maybe one of our realtor readers can comment but I think this can easily mask 5-10% of the “actual” price. But when the offer is $300K on a house asking $600K, the gimmicks won’t work.

Lucca,

Cash back at settlement.

To those below, not Lucca. wouldn’t cash-back at settlement be a RESPA violation? Doesn’t cash back have to be applied to settlement costs only, with a maximum of $2000 cash back after all settlement costs are paid?

Besides the seller receiving cash back due to equity this seems like a definite RESPA violation.

I suppose you could “pad” the settlement costs with repair costs for upgrades and such? Not sure.

“Things like making the official sale price higher, but providing in the contract for cash-back to the buyer.”

That’s illegal. It’s called bank fraud.

Even so, they are still well below historical norms. People need to stop thinking the last 18 years were “normal”.

That should be 14 years, oops.

Mortgage rates have been historically (and logically) abnormal since about 2002.

Countries with debt-to-GDP ratios growing uncontrollably don’t get lower interest rates (due to increasing default risk) unless the G buys its own debt with unbacked, printed money.

Leading inevitably to inflation.

The US has been using heroin as a “medicine” for 20+ years.

I bought my house less than 5 years ago. Current zestimate at current interest rates with same downpayment would be more than 3x my current payment.

Prices are going to come down, a lot.

It’s not just housing prices relative to mortgage rates that are unsustainable.

Housing prices seem unsustainable also when compared to rents, in many high-priced areas. In my area, houses are selling for $2M but can be rented for $40,000/year. Thus, the gross annual rent is only 2% of the purchase price.

Would you pay $2M for a home that provides rental income of 2%, before any maintenance and RE tax expense? Instead, why not buy a US Treasury that pays 4% (twice the return), with no effort, default risk, or price reduction risk whatsoever?

I wouldn’t, Bobber, but plenty of FOMO types have over the last year, especially along the coast.

Odds are those rentals for $40K a year paid nowhere near $2M for the property. To them, it’s probably a good return if they paid half or less for it and are holding the property to return to live in at some point in the future.

The $40K per year is better than leaving it empty as empty homes deteriorate far faster than one that is occupied.

Replying to El Katz:

It does not matter how much they have paid. Bobber has raised good point.

Bottom-line is: Even with current rates, ( assuming rates wont go up anymore ), home prices have to go way down.

2-3% is pretty accurate across many markets if you take the value near the top of the housing bubble.

Another factor to consider is replacement cost. I think were seeing a decline in the market where many custom properties cannot be replaced after you factor in the cost of land, development and building fees.

During an inflationary crisis the new replacement cost continues to rise.

4-5% on bonds seems like a better return if real estate collapses, but it’s not risk free if the currency continues to loose its purchasing power.

I took out a 4 year fixed rate mtg on one of my properties just over year ago for 1.79% to finance a business expansion, the business has now recouped the principle. I’ll be looking for a 2 year bond very soon, I’m hoping the yield on the Canada 2 year reaches 5%.

So far the yields are climbing faster than what I’m loosing between my deposit rate and my mtg rate (dollar for dollar)

Cost of land can and will plummet during the coming years.

Yes, the labor cost of building a home should increase with inflation, but the cost of materials and land are highly speculative and prone to severe deflation in bad times. In Seattle, the land value is usually higher than the cost of building a dwelling, so there is much speculation built into the price of a typical home.

This is also why we see multi-tier houses in Seattle built on postage stamp lots. The entire main floor is the garage, with living area above that, and bedrooms above that. I think they call them skinny homes.

Same as thewillman here, < 5 years in my home, current estimated mortgage from Zillow is about triple. Plus my homeowner's insurance has gone up quite a bit between inflation adjustments and that huge grass fire up near Boulder destroying a thousand homes over the holidays.

I gave serious thought to selling and renting because of the differential, but the problem is that aside from the PITA that moving would be, it's hard to find places to rent. But they're busily throwing up a huge apartment complex less than a mile from me, looks pretty spiffy, lots of nice amenities. Not sure where all the residents will come from, there are a lot of homeless down by the creek next to the new construction, but I don't think the builder is targeting Section 8 housing.

I used to do property management and looked hard at doing RE investing but I concluded about 5 years ago that it was too rich for my blood and that given the climate on boards like BiggerPockets and talking to people at their happy hours that a lot of people were going to need to lose a lot of money before RE became investable.

Think of housing supply (or supply of *anything*) as a stack…any additional supply at the top of the stack (at top prices), pushes the existing stack *down*…the items at the bottom have to become comparatively cheaper in order to accommodate the additional supply (assuming demand remains relatively constant).

The house next door to me rented for $2,500/mo and the value to a builder to tear it down for the lot is about $700. The retail sale price would be around $850 if it were fixed up. The place is a slum. The only reason the owner doesn’t sell is he doesn’t want to pay the capital gains tax. I believe investment properties don’t get the $500K exclusion from the tax. The basis is around 35K.

I bought my house about 39 months ago, going back another year or about 4 years, and Zillow says my house double in price. 4 Years. That’s outlandishly crazy. But, that’s the mentality that mortgage investors & the Fed are still fighting against. It may take until next spring before they are broad / national price declines across new & existing homes. We’re not there yet, but nearing 7% 30YFRM is certainly going to push the correction deeper towards a real housing recession.

I wish your treasury charts went back further than 2007 for a better historical perspective.

Brooks, there are several sites that allow you to make your own graphs interactively. Wolf does a great job of putting up the most important data, but when I want to explore further, I often go to

FRED . StLouisFed . ORG

where, for instance, the 1-year Treasury bond yield is dataset “DGS1” (just type it into the search field). The basic data often goes back to the 1960s, sometimes further.

Brooks,

Every chart is a trade-off between the details in the current period and ancient history. I don’t want you to focus on what happened in 1980. You should have known this for decades. I want you to focus on what is happening NOW, and how that relates to things a reasonable time ago.

In the ancient history chart below, you cannot even see what is happening “now.” It’s just a straight line.

There are lots of readers and commenters here that weren’t even alive when this chart began.

I post these charts a lot. But ancient history never changes. Constantly throwing these ancient-history charts at people is BS. And I’m not going to do it. If you want to study ancient history, go back to college.

Occasionally, for your amusement, I include an ancient history chart, such as with the mortgage chart, but only once every now and then.

I also include ancient history charts if I want to show something like, “worst since” or “highest since,” and then I might take the chart back to the last time this occurred. This is the case with the current CPI charts, which go back to the 1980s for that reason.

Wolf,

As one who lived through “ancient history” I remember what was happening in the 1970s and 80s. Having become a stockbroker in 1982, I feel like I am living through a rerun of those events.

“Ancient history”, also known as reality vs post-1983 financially engineered “reality”.

But great entertainment, VLT charts. BofA Global just posted one of interest rates going back to 1796. Rates topped out in 1800, fell for 146 years. Step into that and you just keep falling.

I saw a chart of interest rates going back to the Egyptians (BC). Thousands of years. I have no idea how they got the data. The Fed is only 100 years old. And there wasn’t a lot of data tracking 1,000 years ago. But over the period of thousands of years, the only conclusion you can arrive at is that interest rates went up and down, DUH. They were very low at times, and then they spiked for a long time, DUH.

All this long-term stuff is just for entertainment. If people want to goof off looking at this stuff, fine, they need to go where this stuff is, and while at it, they can regale themselves with log charts for home prices, temperature-adjusted inflation charts, heart-rate adjusted house price charts, silly-putty-adjusted stock price charts, etc. If that’s what people want to see to fog up their minds with, or to confirm their own bias, they’re in the wrong place here. They need to go where this stuff is. It’s like if you want to see porn, you need to go where porn is, and not tell me that you want to see porn in my articles.

We have reached the interest rate state where I am starting to wake up.

If I have an extra 50K in my savings account making 0.1% interest, should I:

1) Pay down my home loan (3.0%) by 50K to shorten my loan life and be more secure for retirement sooner?

2) Put the 50K in a 2 year Treasury at 4.21%?

3) Put the 50K in a 2 year CD at 4.2%.

Some things to note, it depend on you tax bracket and what state you live in for this decision.

1) For a 24% (or higher) Federal Tax bracket, a 4.2% rate would be equivalent to an effective 3.2% interest rate after taxes.

2) Some states have no state income tax and many states do not tax Treasury interest but they tax CD interest. Often 5+%. That would make the effective rate on CD’s at a 5% state tax rate be effectively 2.98%.

If you live in a state with no income tax and are in the 24% Federal tax bracket, you would effective make 3.2% in a 2 year CD or Treasury at 4.2%. Your mortgage is 3%, so do not pay off the mortgage and put the money in a Treasury or CD. Re-evaluate after 2 years.

If you live in a state that does not tax treasury bill interest, put the money in a Treasury and after tax, make 3.2%.

If you live in a state that taxes Treasuries and CD income and the tax rate is 5% or over, the effective CD/Treasury rate is less than 2.98%.

Pay down the house or continue waiting until treasury rates go higher.

These are my thoughts as these rates start to wake me up.

Bob,

First thing first. Are you working, and is your job secure?

If you are “working” from home, and 50k is all you got in savings, then get 1-year CD, forget about tax brackets, and go back to office.

You can buy a 6 month CD paying 4.04% and think about what to do next Spring (rates may be higher). I just did the same today.

Good idea. Made 80-100% on puts in under 2 months. Was worried there for couple of weeks. Started too early, had to average down.

Care to share where this CD is at?

Interest on US government debt is completely nontaxable at the state level. Every state, every type of debt — Treasury bonds, savings bonds, TIPS including increases in principal.

I don’t think the states can tax Treasury bills or bonds. Isn’t there some kind of intergovernmental tax immunity?

Everyone should open a treasury direct account and buy i-bonds now paying 9.62 percent. Max amount is $10k a year. Do that before worrying about CD rates.

It’s a pain to open the account. You have to have the paper forms stamped by your bank and mailed in. Some banks don’t do that. I have a chase account and they were very helpful.

Another great benefit is treasury direct doesn’t have a FDIC insurnance limit to worry about. I’ve had a couple of banks go broke. This is likely to happen again if home prices fall enought to eat up people’s equity.

The good news is that once you have opened an account and have purchased the 9.6% i-Bonds, you will have a Treasury Direct Account to purchase other Treasuries that Wolf mentioned above.

I agree, i-bonds at 9.6% should be purchased first.

That 9.6% rate will change, I think it’s fixed for only 6 months. So, consider that during the holding period of 10 years, it may not be yielding that 9.6% for the entire time. It’s variable.

Wow, worried about FDIC insurance limit? For multiple banks? Let’s hope Educated but Broke Millenial does not read this.

Also, max amount is 15K/year, if you play your cards right. We’ve been over this.

You can bump the limit on i-bonds from 10K to 15K a year if you overpay your taxes. You can then direct upto 5K of the overpayment into i-bonds, this is in addition to the 10K.

Wealthion had a brief explainer on ways to increase your i Bond purchases that they published about a month ago. IIRC, the 10k is per family member, and if you have an LLC, the LLC can also purchase 10k. In addition, I think their point was you can gift iBonds so even if someone’s purchased the max, you can give them another 10k as a gift, but the withdrawl rules get complicated at this point.

I opened a Treasury Direct account this year. Super easy, no paper forms.

I’ve bought Ibonds for a couple years, and here’s the downside I’m finding. First, it’s difficult to bequeath Ibonds to another. From what I read, Ibonds must go through probate after death. Second, Ibonds currently sold are yielding 9.6% for six months, but pay no additional interest for the life of the bond. Compare that to say 25 year FEB ‘46 TIPS which currently pay 1.624% annual interest in addition to inflation, or a premium of 40% more than Ibonds, over the life of the securities.

“Ibonds currently sold are yielding 9.6% for six months, but pay no additional interest for the life of the bond”

Wait, what? I think they continue to pay whatever the inflation formula is.

I Bonds continue to pay interest based on a fixed rate plus inflation. You can not touch them for 12 months, and if redeemed (cashed) before 5 years, a 3 month interest penalty is incurred. I bonds accrue interest for up to 30 years. You can cash portions of the bond at a time.

To clarify for Gattopardo, in addition to paying a semiannual inflation rate ibonds pay a “base rate”. The base rate for the current period is 0. Earlier periods include a base rate greater than 0, as will following periods, I suppose. For example, from May 2019 to October 2019 ibonds paid a base rate of .5% and an inflation rate of .7% for a composite rate of 1.9% (.5+.7+.7).

Paper I Bonds must be cashed in full. E I Bonds can be cashed in portion.

If you’re buying I bonds it will be a loooooong time before you hit the FDIC insurance limit.

Thanks for correcting me!

Treasury interest not taxable in any state for state income tax.

CD interest is taxable at your state income tax rate.

I’m going to purchase some short term treasuries.

I’m working. My job is secure for the next 6 months. Why not make 3.9%-4.2% on my cash fund? I used 50K as an example. Any unused cash should go to a treasury. The emergency fund goes into a 3.9% 6 month treasury. The rest can be laddered into 1-2 years.

It doesn’t make sense to pay down a 3% mortgage.

At least until 10 and 30 year treasuries rise above 7%.

“It doesn’t make sense to pay down a 3% mortgage”

Mathematically, you are probably correct. But, I hate debt. I view it like a plague that must be cured. I know I’m in the minority with this opinion, but I would focus on getting out of debt before anything else.

Peace of mind with a paid-for house is worth something.

Banks cannot take it away if it is paid-for. HOAs and the government still could take it away so you are never free.

“I know I’m in the minority with this opinion, but I would focus on getting out of debt before anything else.”

Yep, totally agree.

Halibut, I completely appreciate (and follow) the mantra that we should be free and clear of as many debts as possible for our own psychological peace of mind.

Having said that, though, I made it a point to study the business tactics of Ron and Raymond Perelman during my college years. They absolutely loved junk debt for LBO’s, considering it a useful tool. Amazing how they were able to carry around hundreds of millions or billions in debt particularly in Ronald’s case.

Some people sweat out the debt, while others carry it with confidence knowing it was being used for corporate breakups to harvest undervalued subsidiaries. It was just a fascinating study in money psychology for me at the time.

I agree on the “peace of mind” part of financing your home, but it’s not that peaceful. If you can itemize your deductions and beat the “standard deduction” on your taxes by writing off some of your house interest expense, you may end up having a borrowing cost maybe 35% less on that actual interest rate you’re paying. So, if you can do better on other investments, and, historically you can in the stock market, for example, I’d prefer the debt on the house.

But if you can’t resist buying some moon-shot stock investment, or can’t resist following the crowd, don’t borrow on the house if you can avoid it.

Couldn’t agree more. Debt free since 2003.

Halibut,

I agree debt free is the way to be, and was advised early in my career to get a 30 YFRM and pay it like a 15Y.

I read something later that I thought was interesting. This article pointed out that if you still owe $1M, $100k, or $10k on the mortgage and can’t make the payments the bank will foreclose. There is no goodwill afforded for being ahead of the amortization schedule. At least if you have the cash you can still make payments, even if you’re out of work.

Although now that foreclosure moratorium is out of the bag, who knows?

Like TOTALLY AGREE Hali!!!

After many mortgages on home and other houses, now with NO MORTGAGE is THE best feeling financially since dad cut off my allowance in 1955!!!

IMHO, any advice that doesn’t include paying off ALL debt ASAP is a function of the

brain washing/propaganda machine of the oligarchy doing its thing to keep WE the PEONs in wageslavery or how some ever one wants to call it…

Sure it’s great to be ABLE to buy that McMansion,,, but only until the true costs in $$ and headaches become SO clear, and so painful.

“But, I hate debt. I view it like a plague that must be cured.”

After watching work completely dry up in 2008 and innumerable friends and associates who were heavily in debt lose everything, I vowed to never owe a cent to anybody again. And then all of a sudden they’ve been rewarding debt junkies while savers like me have gotten nothing but screwed. It seems like if you’re in debt, you’re a protected class.

Worth a thought: Money-market yields will catch up to current 6- to 12-month yields in just a few months. If the Fed keeps raising rates, it might work out better to stay in the money-market fund vs. a fixed-rate CD or Treasury.

P.S. For those trapped in a higher tax bracket, municipal bonds are often a better deal than either Treasuries or Bank CDs.

P.P.S. Please consider who you’re enabling with your lending. Treasuries are loans which enable(d) Congress to spend us into our current predicament. Bank CDs to huge banks enable Banksters and their shenanigans. Avoid those if you can, and lend to institutions worthy of your funds!

The last time around when Fed was raising some people managed to lock in 5-year 4% CDs from some online banks. Those lasted for maybe a two-week window. Best I got was 2-year 2.75%.

Andy, just yesterday through my E*Trade broker (I also use Fidelity) while looking at treasury rates and CD rates, I came across a 4.75% five year cd rate. I didn’t recognize the bank though… It seemed like it was a smaller regional bank from Tennessee, but the next rate down was at 4.65% from Morgan Stanley. So I locked in for five years about 25% of my net cash. I feel pretty pleased with that. They are out there, some good rates maybe we’ll get a little better… I don’t know but I’m content with this investment in my situation.

Rosarito,

In Fidelity, do you do it in brokerage account?

Also, are those “callable” (as Wolf educated before) ?

I bought a house in FL for $1.5mm two years ago. The same exact model house sold in my development for $3mm a few months ago. Another one is now listed at $2.6mm… The prices rose so fast, that it shouldn’t come as a surprise if these houses trade off 30% off the highs. That will just mean things will be more normalied.

That’s probably why many people aren’t securing their RE gains by selling. The gains came easy, so it’s OK if they evaporate quickly (from an emotional standpoint). Some may call it complacency.

Yeah it’s so strange. I know people who literally refuse to sell high.

Ha. Not wanting to be offensive but if you use the words, ‘model’ , ‘Florida’ , and ‘1.5 million’ all in the same few sentences…

I assure you, it is not worth 1.5 million. You may be able to convince someone from up north it is, but it isn’t.

> it is not worth 1.5 million. You may be able to convince someone from up north it is, but it isn’t.

It is worth what you can convince anyone it is worth. That’s the definition of a market.

Two years ago was September of 2020, and an already insane bubble price. I’d sell that boat anchor pronto while he still can.

So normalize just north of $2 Million is what you’re saying? Did similar models normalize above $250K in 2007?

Wolf,

What are your thoughts on TreasuryDirect? Do you think it hassle free enough to transfer money from a bank account to a treasury account, and then transfer the money back to my bank after the treasuries mature (compared to brokered CDs)?

Thanks

We have three accounts. The money transfer is automatic (via ACH). You just log in, order the securities you want, choose the auction date by clicking on it, enter the dollar-amount you want, review, confirm, and you’re done.

When the security matures, the cash is sent back to your bank automatically. Same with interest payments.

The biggest hassle is logging in LOL

Wolf/anyone – how long do you think it takes recently to get the bank account added via form submission?

Anyone with recent experience?

I set up 2 accounts last spring. It too just a few minutes per account to set things up online.

Might’ve been the usual couple of days to verify bank account info.

The only hassle is remembering to check in periodically to either roll things over or extract your matured funds. TreasuryDirect doesn’t pay any interest on cash balances, so you don’t want funds sitting idle in there.

@ws -they don’t allow anymore to add banking details online. You have to fill and mail a form. Not sure how it takes them to add the bank account once they have the form.

@ws -they don’t allow anymore to add banking details online. You have to fill and mail a form. Not sure how it takes them to add the bank account once they have the form.

“…they don’t allow anymore to add banking details online. You have to fill and mail a form.”

That’s total BS. We set up three accounts in minutes online and NEVER mailed anything. You’re abusing this site to spread lies.

A month ago I set up an account at treasury direct, usually I mess something up but, with a bank account a social security# an address “success”, there was no mailing in of anything.

I’m now waiting to see if they will kindly return my money when my 4 weeks are over.

Same day in many cases

Wolf – “We set up three accounts in minutes online and NEVER mailed anything. ”

I messed up entering account details and to add a new account at this point I had to fill out a paper form, get a medallion signature guarantee, and mail in the form.

I know people spread a lot of lies and BS but this is the process. I spent an hour waiting on the phone with them to verify that Treasury really is living in the 1980s part time.

Wolf – I am not l lying. I have a old treasury account which has an inactive old bank account attached to it. I very recently tired to add my current bank account and the web page asked me to fill and send in a form. When I called treasury they told me this is the current process for adding new bank accounts. If you or anyone do not believe me, log in your treasury account and click on add new bank account button and I will show you the message to fill in a form and mail it.

OK, that’s the explanation you should have used in the first place — yours is a very specific situation, having an old account and trying to change the linked bank — rather than making this generic comment.

I setup an account with TreasuryDirect literally 5 days ago. All I had to do was give them account and routing number, confirm the 2 small deposits they made for a couple of cents, and the next day I bought the 10k I-Bond. No fuss, no forms, no issues. From opening account to I-Bond in 4 days.

Set one up in the last month or two when Wolf discussed it (thanks Wolf!).

He’s right, logging in is a bit tedious. Keep your account # handy, and use a stylus for entering your password to for sanity’s sake.

Setting up the bank transfer was quite simple, don’t recall it being too involved at all. Maybe 10 minutes. Plus the hour I spent shamelessly reading the Kids’ informational section and actually learning things, while feeling like Billy Madison.

I’m all for TreasuryDirect but for anyone who is buying treasury bonds or bills, just be aware I don’t see an easy way of selling these securities before they mature. You can transfer the bills or bonds to a traditional broker, but it appears you have to fill out paperwork to get TreasuryDirect to do the transfer and you may even have to snail mail this form in and who knows how long that would take to process (if anyone’s done it, I’d be curious how it went for you). For me, my conclusion was this: I’ll only purchase savings bonds or short-term t-bills that I expect to hold to maturity through TreasuryDirect. For longer term stuff that I may want to “sell out” of at a later date before maturity, I’m going to be using an online broker instead.

The economy was tipping over from already-bubbly levels in 2019 before the .gov types went full retard with lockdowns, stimmiez, QEs, ZIRPs, and MBS puchases.

The coming crash, now from even higher levels, will be epic.

Prepare yourselves accordingly.

1) Rent is rising. Cohabitation to avoid paying two landlords. Divorce rates will be down.

2) Higher interest rates are bad for buybacks, bonuses and executive perks,

protect innovative small businesses from being swallowed by whales,

on zero interest rates. SF will pay the price.

3) Mortgage rates are rising. Car loans % are popping. In NYC high end RE sales are down 50% and prices down 40%.

4) Savanna and Long Beach clogging are down to zero. Retail Inventories

to Sales ratio is rising, but still very low.

Is Macy’s doomed. M : SOT, Macy’s is shortening of the thrust for four months, since May, paying 4%.

Reverse Repo hitting highs as quarter end nears and as more folks move cash into higher yield money market funds

10 year at 3.68 and holding inverted yield curve . Will the 10 year hit 4 percent in next few weeks?

I’ve been waiting to purchase a house. And waiting. And waiting, saving, saving and saving.

I’d rather buy something priced correctly and owe the bank more than end up paying more for something I know good and well isn’t worth half of what I just bought with low interest rate.

If it takes an implosion then so be it. Last time real estate was even close to being priced correctly was probably 2010 or so.

Like our friend Mr. Frost is fond of saying, we’re all about to become poorer anyway. It’s time to rip some band aids off and expose this fraud of an economy. I can save faster than inflation… not much, but I can. Sorry, Coke & Pepsi- you just got dumped for store brand.

“Sorry, Coke & Pepsi- you just got dumped for store brand.”

Tea is a great alternative.

Water (aqua) is elixir of life, and it’s free!

Water is good but it takes a while for full withdrawal. Don’t beat your dog during the ordeal.

I let tap water sit to let the chlorine out, run it through a Berkey, and make coffee. Water is the elixir of life, but no coffee, no life. Tea complements both. I try to avoid living anywhere hot chocolate is a thing.

The banks won’t be able to separate new and existing customers for long. When the existing customers find out they’ve been duped at 0% while the newcomers are getting 4%, there’ll be major pressure to treat everyone the same — either 4% for all, or 0% for all. My guess is the banks will then play it safe and go 0% for all rather than shell out the profit-denting money.

GV: Do you really think the bulk of the American public is savvy enough to know about brokered CD’s? The banks don’t advertise it and neither do the brokerage houses. You’d have to read a financial site and then you’d have to have the time and funds to go set up a brokerage account to do so. Most people would rather eat glass.

I moved some money into a brokerage that I had a relationship with. The funds came from a credit union (who is so far behind the curve it’s ridiculous) and it took days for the funds to clear due to the scrutiny of large amounts of money moving around. I can only suspect that it’s the goobermint as the bank had more on deposit than the check I wrote and still wouldn’t clear it despite my being a customer since the 1980’s.

You need a better broker. I have fidelity and interactive brokers. The ECH transfers go thru same day if not started too late.

Greatvampire

The worst case scenario might be that banks may not be able to service their deposits (liabilities) with any meaningful interest and cannot afford not to attract new deposits to support increasingly compromised assets on their books, but have to compete for dwindling cash supply with a market rate via CD’s.

The extent and volatility of downward price moves in Treasuries, Commodities, CRE and Stocks, juxtaposed with the Fed’s assurance of a correction in Housing could be generating a liquidity vortex.

Could the spread between the rates on Bank Deposits and CD’s develop into a leading indicator of market stress?

I recall WaMu offering ~ 5% CD’s (much higher than average rate) in 2008 just before JPM acquired it.

I opened a 401k Self-Directed Brokerage Account because my options were making 1%-2% on a Stable Fund or crashing on every other fund. Unfortunately I also found out about the 90-day Equity Wash Rule, so I get to enjoy those 90 days in a Bond Fund losing value until I can throw it all into CDs. Hoping things are better in 3 months on interest rates to make up for the losses I’m about to take.

This period is getting me off my ass and getting more involved in directing investments, although I’m the dumb money that Wall Street craves. My parents outsourced everything, even their parental responsibilities, so all I ever learned about was compound intetest in savings accounts, and we’ve seen how savers have panned out over the last 20 years.

Yes, this Wolf update, and comment section, will motivate me to getting on my Treasury Direct account to likely put some cash I have lingering at brokerage.

Also, residing in Thailand, I keep converting modest tranches of USD into Thai baht (THB) in a ladder process, as the USD keeps surging up. The Thai economy got pretty desperate, because of a comatose tourist industry during covid. But tourism is on its way to thriving again. And now the Thai central bank finally lost its excuse to stubbornly maintain near zero rates. It’s now a johnny-come-lately in the process of raising rates, which may, along with a decent “Asian cub” non-tourist economy, help the baht recover.

“My parents outsourced everything, even their parental responsibilities, so all I ever learned…”

I can relate to that. My father returned from WW2 to be a 1950s “absent” type father — not much interested in the effort of imparting and actively guiding real life skills and navigation. The guiding principle of both parents was “natural is good,” and the liberal, natural way was to let your children grow up, well, … naturally (i.e, however they turned out on their own). This works great with some children. But a flaw in this theory, is that if a child has problems, it implies the child must be naturally inferior (not culture, or local environment, or the parents themselves). Looking back on it 50 years later, it seems like a lack of skills and responsibility on their part.

IMO, the parenting situation in this country has gotten much worse. It isn’t as though your parents or mine were unskilled. Today, with many broken family households, typically with a single, working mother raising children, the chances of increased “skills and responsibility” is nearly impossible. Add to that the explanation from that mother of how she ended up with tattoos up and down her arms and legs, or similar for a father, you get a fat chance of having the ideal upbringing that you feel you missed out on, drifterprof. We all have grievances about how we were reared. But our culture, where lying is now completely acceptable, is a much rougher road than when you were young.

Good thing you’ve got a haven in Thailand. Wish I were there…

Get them to understand the difference between quarterly or annual compounding of interest, or the amortization of a loan? Good luck.

It’s no wonder that there’s a growing interest in having a dictator who will tell do the thinking for them.

I am spoon-feeding personal finance, Constitutional law, and ethics to my college students. There is nothing I would rather be spending my time on. I am in my 38th year of this.

LK, no money market fund? You must be with Vanguard….

Vanguard’s default account is a MM. At least mine is.

am I the only one that makes the observation that the federal reserve is at war with the biden administration on this “inflation issue” ? two anecdotal examples – youg lady I know just purchased a home and was thrilled to be the beneficiary of a federal program that will provide the down payment – pay her closing costs and provide a $5000 grant for new items needed in her new home second example – young lady I know who works in the finance department of the city tells me very excitedly – ” we just received $59.000.000 more for covid relieve !

That’s why the Fed was created independent. But try to tell that to the conspiracy theory tin hats. The caving-in to politics, of Arthur Burns to Nixon, Bernanke and Yellen in the 2010s, and Powell to Trump (and mob rule pressure) over the last few years, are cited as lapses in this. So yeesm even though the institutional design provides for independence, not everybody always follows that.

Let me know when I can buy a car, new or used, for a reasonable price.

AS:

When captive finance company’s subsidized interest rates hit 5 or 6% for top tier customers / 10% for the credit criminals and few qualify because they can’t roll over their negative equity into a new loan. 150% LTV won’t be that attractive to the finance companies.

That’s going to be the real litmus test. The negative equity has to go somewhere so either the customer eats it or he tosses the keys back and has a ding for 7 years – and no automobile mfr. captive (well, maybe Nissan and Chrysler Credit because they’re still in fog-a-mirror mode) will touch them.

When the job losses begin in earnest. People without jobs don’t need a car to get to work. Discount bonanza!

I’m thinking Real Estate agents Audi or Merc because the one I brought for cash in the last Housing crash is getting pensionable.

However, I am so “tight” I boil the jug in the morning, fill a thermos to save power then walk to the City Library read the papers for free.

They might need their car to live in.

Rolled most of my Dec/Jan puts into March and June. Looks like it’s going to retest pandemic lows and may bounce temporarily. Junk bonds set new 52 week low, close to pandemic crash level. Many ‘blue chips’ are setting new 52-week lows daily.

We had 3 (almost) 1000-point down days. Now need to see some circuit breakers.

October ’87, baby! Tail risk tsunami! That would be Vegas $ for me!

Hike the rates some more!

Hike it ABOVE inflation!

Last year the FED and the BOC told us that inflation was transitory yet my grocery prices have doubled at No Frills the cheapest Loblaw store owned by the billionaire Weston conglomerate.

Some of the grocery inflation has nothing to do with interest rates. Crop losses, late planting due to rains, shortages/high cost of fertilizer, agricultural diesel costs, supply chain issues with repair parts for farm equipment (John Deere), bird flu, farmers culling herds because the cost to feed them is excessive…… then there’s the increased wages everyone applauded (gee, where did you think that was going to settle?), fuel costs for shippers, backups at the southern border and resultant waste (stuff rots in the heat)….. There’s also been several food processing plants that have sustained fire damage and closed over the past several months.

And if it weren’t for the billionaires owning grocery chains, where would you buy your food? Not too many truck patches during the winter and the bodega’s don’t have the infrastructure to serve mass quantities of customers.

Good list but you forgot good old fashioned price gouging

1) The judge is in love with an old blue zone prof who close his eyes

when he reach his anti Fed climax.

2) JP, thanks for keeping us alive, supporting our businesses, keeping

our restaurants open. We bite the hand that loved us.

3) SPX, higher low, with a large buying tail.

4) DXY weekly, this week, Sept 19, a trigger. Higher stock markets might protect us from inflation. Many small co are paying more than 4% dividends, with low debt, and rising retained earnings.

Those 4% dividends are likely temporary, and carry rish. Treasury rates last the life of the treasury and carry no risk to principal. Clear choice to me.

Also, as rates go up between now and Februrary, retail investors will continue to rotate out of stocks and into Treasuries. If you *still* haven’t sold your stocks, you are just begging to lose money between now and February.

I agree with your dividend comment. A lot of upcoming dividend cuts in store.

It also doesn’t help that most corporate balance sheets are mediocre to awful but only appear “sound” due to artificially low rates and very lax lending standards.

Michael, you buy the stock market now if you like, I will go elsewhere unless it is a very innovative inverse ETF like SRS. When some very smart people that have navigated no less than 5 major market cycles predict that the Desert of Equity Returns is before us, with a potential horizon before an oasis of some 10 years, I ain’t going to put a bunch of gambling chips on the table. What did Kenny Rogers sing, “Know when to hold ’em, and know when to fold ’em”? I’ve taken most of my financial asset chips off the roulette table and am sprinting to the cashier’s window.

Maybe somebody can help me understand this. Harry Dent says that the best place to be right now is in 20 and 30 year US bonds. Or the TLT.

I would think this would be the case if interest rates had already peaked and we knew that they would be falling. But wouldn’t buying those be premature at this point? He never explains his logic on this.

TLT year to date return is -26%. Could easily peel off another -25% reaching the 2006 low of 83. Buy when rates peak at the start of the next recession. Funds are dangerous….better to own the underlying asset which can be held to maturity (if the reaper doesn’t visit)

Yeah. He recommends ZROZ too. I never hear him explain it, nor can I figure out the reasoning on my own. He’s a genius or a flake. I dunno.

Wolf???

Yeah, that is probably the tactic he uses to get people to pay for his news letter.

Check Hulbert’s reviews of “financial newsletters” in general. They’re not much more reliable than flipping a coin.

I-bonds are zero coupon bonds. They’re good. It just depends on what they are.

I understand that some are buying 20 and 30 year bonds because they believe in the “deflation is just around the corner” thesis, but if you don’t believe this (you’ve been listening to Wolf, right?) then buying 20-30 year bonds yielding LESS than *6 month* T-bills (or bank CDs) is a bit on the “as illogical as it gets” side.

Harvey Mushman,

I have no idea what Dent recommended. But no one should ever buy TLT, that’s a bad product for long-term investors wanting a safe investment (it’s an interest rate bet that’s constantly betting on rate cuts). But 20 or 30-year Treasuries might be interesting in a year or two if long-term yields rise enough.

Got it. Thanks!

If the cycle turned in 2020, 20YR or 30YR would only make sense as a short to intermediate term interest rate speculation.

Held to maturity, it will still be a disaster. I am aware there are no certainties. Concurrently, the long-term fundamentals over the life of this hypothetical transaction totally “suck”. Actually far worse now versus 1981 when rates were at 14%. It’s just not fully evident because the mania’s end isn’t confirmed.

At or closer to the end of the presumably developing bear market, the negative fundamentals will be obvious.

That was a great expression for home prices: “ionospheric” Nice. I feel so rich. But losing $70k in the stock market today somewhat dimishes that “rich” feeling. 🙁

What a coincidence. I told my wife earlier that we *would* have lost 70k in the market this week… If we listened to our “advisor”.

So glad I put my money 403 in a safe 3% yield account at Voya

Well, you have to keep some money in stocks. Read Ben Graham. He says your stock allocation should vary between 70% and 30%, depending on age, valuation levels, macro conditions, etc., because you never know what will happen in the short and medium terms. Smart man. I don’t think Ben Graham envisioned the super-high valuation levels of today, so I’ve taken my stock allocation down to 20%. Glad I did, but the big down days are still felt.

I thought about having a higher stock allocation and hedging with options, but that requires a lot more analysis and monitoring. Plus, given the bid/ask spreads and quick movements, I assume Citadel and other vultures are taking scalps in the options market.

With mortgage rates between 6-7%, home prices near ridiculous all-time highs, and affordability half what it was a year ago, I’m surprised housing transactions are only 10-30% lower than prior year. Who is buying houses under these conditions, and how can they survive in this world without constant supervision and bailout support?!

* Bank of America is launching new zero down payment, zero closing cost mortgage products

* No minimum credit score or mortgage insurance is required.

* Under the BofA program, the lender is giving homebuyers down-payment grants of $10,000 to $15,000 so they have immediate equity in their homes.

If this is true:

BofA dancing on thin ice while they attempt to add REO’s as they foreclose on these. They must be putting these loans on their books too, perhaps their Holding Companies? Can’t imagine any other investor being interested.

Is BofA in so much trouble, that they are so desperate for collateral?

Something to keep an eye on.

That’s a limited mortgage program offered to Black and Hispanic communities in five cities. It appears to be some kind of public relations or charity offering, as opposed to a profit-seeking effort.

The mortgage program would obviously lose money, unless Bank of America is hiding profit-making provisions in fine print, which is a definite possibility.

We wont find out where the bids are in real estate until some desperation selling occurs. Seems that that is yet to happen.

And when it does, the sale price might be “protected” in some fashion as to not cause a panic in a new development for example.

What happened in the stock market today along with these rates will have a massive affect on the real estate market, even in my special, we’re different from everywhere else San Diego. Very little is going in a few days, most are sitting and dropping their prices a bunch.

They painted themselves into a corner and now Powell has no choice but to do what he’s doing and we’re all gonna pay the price.

The chickens have come home to roost.

not so fast … inventory is still extremely low (compared to 2018-19) … defaults are negligible … still plenty of liquidity for those that want to step up and buy something. i don’t disagree that the arrow is pointed down but the action is unfolding slowly. lot’s of people (still) have money. properties will continue to sell …

You’d have a very bad case of FOMO in order to buy a home after monthly mortgage payments have doubled in a year. There can’t be too many of these anxious uninformed folks. They are blowing the cash they have, plus all the cash they are ever going to have, right now.

Of course, it depends on the region. I wouldn’t hesitate to buy in the Midwest this year, if a deal popped up. On the coasts, it will take several years for deals to pop up.

Wolf. I have been looking at borrowing 1.5M to buy a nice beach side property in San Diego. Right now that kind of decision is on hold for the reasons you raised. If you do the math, the difference in mortgage burden has increased by $4,000 per month in the last year. Even for relatively wealthy people that is not sustainable because it means having to earn about $70,000 more in pretax dollars just to pay that added interest. Prices would have to drop around 30% at current interest rates to bring the mortgage back down to where it was when rates were at their low a year ago.

My nephew, a millennial, was looking to buy in San Diego. He quickly realized all he can afford is a run down condo so he stopped looking and is putting his money into an overlander. This won’t end well.

1) The DOW had a spring. The Stock markets are the best protection

from inflation. The best time to buy is when the media geiger is the highest.

2) Some econ writers, with their wonderful charts, and their spilled

brains, have reached their anti Fed climax this week.

3) The gov love the other side agenda. “F” ==> “A”.

4) The DOW might flourish for years, castrating the anti Fed orchestra.

5) JP, thanks for saving our lives, keeping our businesses alive, and our restaurants open.

What banks are offering these cd rates? I can’t find them online so far when I search for them. Thanks!

Like I said several times in the article, these are “brokered” CDs that banks only offer through brokers. So you have to have a brokerage account at a large enough a broker that offers brokered CDs in their “fixed income” trading section. All major brokers do.

Polly,

Check out Fidelity Investments. They have the CDs that Wolf is talking about. It’s easy to create an account. You can then link your Fidelity account to your regular bank savings or checking account. Then you can transfer funds between Fidelity and your bank, no need to leave your home to do this. It can all be done online. Fidelity has support people that will guide you through it all. Just start asking all your questions and then start moving forward.

1. The current season is FALL for the stocks until the rates are reduced.

2. Lot of people are happy that the banks currently offer double the rates, 0.02 from 0.01% an year ago.

3. 3-months US treasury is completely risk free but at this point lot of people do not have any money.

4. Retirement accounts cannot purchase US treasury. Bond funds may be. Not the treasuries directly.

5. Stocks may go up or down or stay the same, ten years from now. You can write this down today.

But, CP, one can purchase Treasury money market funds and short-term/ intermediate, and long-term Treasury note/ bond funds in retirement accounts until the cows come home. Just not through TreasuryDirect as you stated. Sure you can buy individual Treasury securities in the secondary market through your IRA brokerage account also.

Can I purchase T bills/bonds through my TD Waterhouse brokerage account and if so, is there any reason I want to open a Treasury Direct account to buy them instead?

Retirement accounts held in custody by the plan sponsor cannot buy bonds directly, if that’s what you mean.

Self-directed retirements accounts can do so, though not with Treasury Direct.

Maybe I should have asked you this question:

Can I purchase T bills/bonds through my TD Waterhouse brokerage account and if so, is there any reason I want to open a Treasury Direct account to buy them instead?

Correcton: It’s TD Ameritrade. Maybe it used to be the other.

Yes, from their website:

“Fixed income investments from TD Ameritrade include the full spectrum of bonds and CDs”

I don’t know if you can buy I-bonds from TD Ameritrade, you may have to buy from Treasury Direct for that.

Ok, I’ll stick my head out and say this:

With QT happening and the FED exiting the MBS market and easing off the purchasing of Treasuries combined with the stock market losing value it would seem like liquidity begins to funnel out – and it is.

However

Does this not result in killing collateral, bringing max pain, leading to the house coming down – so to speak – eventually.

From what I’m noticing, the financially educated crowd is rushing into the Treasury Security and CD market, which makes sense.

Could these attractive yields be, partially, by design? The market needs retail money for the wheels to keep turning, so collateral can be added, and the derivative market can keep speculating. It’s very hard to get that 40:1 leverage with little collateral.

Since nobody is buying the stock market, aside from some options folks who might grab some premium here and there, deposits and treasuries seem to be the only solution, right?

After all, a debt backed monetary system needs debt. Oh! almost forgot – we do seem to be experiencing some geo-political tensions.

On a side note, I’d be interested to hear thoughts on the Holy See moving all assets back to the IOR by 10/1.

What R? You want us to speculate on what the Pope, at least reputed to have somewhat of a direct connection to some or many things beyond WE the PEONs, has seen or heard to make this dicta???

Beyond any possibility(s) WE cannot,,, nor should we.

In spite of massive propaganda otherwise,,, ”just because you CAN do does NOT mean you SHOULD DO…

1) Silver don’t confirm gold. Gold made a new all time high, but silver didn’t.

2) In 1980 silver hit 50. // There was a young guy in east 45 St NYC trading room who short silver in Apr 25 2011 for fun and entertainment only :

3) Silver futures backbone : BB #1, Apr 17 2006 hi/lo : 14.707/ 11.572 //

BB #2, Nov 8/15 2010 : 29.327/ 24.992.

4) After rising to 21.45 in Mar 17 2008, silver was in a four months, congestion before plunging to 8.425 in Oct 27 2008.

5) This week silver dropped to the 2008 congestion area. Options :

5) A bullish option : silver will rise > BB #2 and reach the 50 area, misbehave for a while, before making a new all time high. Min target : 50 + [50 – 11.772] = 90.

6) A bearish option : DXY reached 113. If DXY cont to 115/126 area silver

will plunge.

Since Reagan took office, the federal debt has expanded 30 fold over approximately 40 years. This equates to a doubling period of 8 years which, in turn, according to the rule of 72, is equal to a 9% annual increase. Let’s try and place in context what rates have done between then and now.

Reagan doubled the federal debt twice whereas subsequent president’s doubled it only once. Reagan inherited a $1 trillion debt and doubled it twice to 4 trillion. Easily accomplished since the debt was so low. Now 1 doubling adds an additional 30 trillion over the next 8 years to a total of 60 trillion – 2/3 thirds the size of the global economy! It seems this next doubling is going to be accompanied with higher rates and high inflation.

The previous doubling, the one just completed, was the era of low rates, near zero rates or even negative rates plus low inflation. The doubling before that we’ll think of as “normalcy”. It appears each doubling has it’s own unique quality.

Lets keep in mind the Federal Reserve is lender of last resort(LOLR). This doesn’t mean to people like you and me. It means to the federal government. But for LOLR to be invoked everyone else must be unwilling to lend to government at least not to the degree to satisfy their appetite. So the federal reserve has to do the lending. But there’s a fly in the ointment. If the federal reserve were to lend in size to government at high rates or even “normal” rates the government would probably default but not before legislating the federal reserve out of existence. Therefore, whenever LOLR in size occurs it will be at low, near zero or negative rates. But borrowing vast sums of money at near zero rate is highly inflationary and can’t go on for long without causing inflation and much higher rates. Which appears to be where we are now. I don’t hold out much hope that this situation is resolvable when the next 8 year doubling will take the debt to 2/3 global economy without a Great Reset. And I don’t mean Klaus Schwab’s version.

What a shame the FOMO crowd fueled the higher prices, and soon will be missing dinner, but will be served their just desserts. 🤑

Thank you Wolf for the platform, and all the well versed comments.

I checked my TD account and see I can get a brokered 3 month CD from Ally for about 3%. I need to read up a bit more to see if I am missing on any other hidden charges.

Still losing money to inflation. But better than losing 3% a week in the market, or 0% that TD pays in money market.

Fourteen years of ZIRP has created a pretty significant housing bubble. This leaves me wondering whether higher mortgage interest rates will deflate things quicker than during the GFC.

For those who remain employed during the next recession (which is likely to be a doozie), perhaps that creates some good real estate buying opportunities.

Conversely, if stagflation rules the roost for the next decade, interest rates might remain elevated perhaps housing values initially crash and then flatline for a while.

Your email address will not be published.

But this time, there’s over 8% inflation.

It’s like a dam broke. And now higher interest rates and mortgage rates for much longer, with lower asset prices, as the Everything Bubble gets repriced.

The ridiculous price spikes now face Bank of Canada’s monster rate hikes, QT, and spiking mortgage rates.

“Housing market will have to go through a correction … to where people can afford housing again”: Powell

But these sales happened during the “Fed pivot” fantasy that pushed mortgage rates down to 5%. Now mortgage rates are near 6.5%.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy