sturti

sturti

W. P. Carey Inc. (NYSE:WPC) offers income investors a lot of value right now, in my opinion.

The trust has a growing real estate portfolio after completing a $2.7 billion acquisition with Corporate Property Associates 18, covers its dividend with funds from operations, and has properties outside of the United States that help investors diversify real estate exposure.

Importantly, W.P. Carey has a lot of potential for dividend growth due to its very low payout ratio, which I believe investors will appreciate.

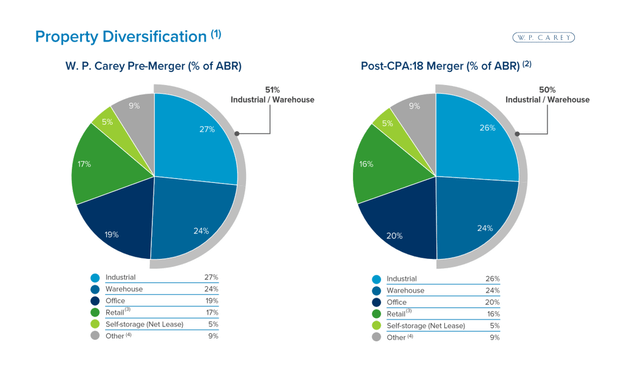

W.P. Carey is a net-lease real estate investment trust with a diverse portfolio of industrial, warehouse, office, retail, self-storage, and other properties. The trust’s portfolio included 1,357 properties totaling 161 million square feet.

In August, the real estate investment trust completed its acquisition of Corporate Property Associates 18, which it paid $2.7 billion for. The acquisition adds 1,390 properties and 170 million square feet to the trust’s portfolio.

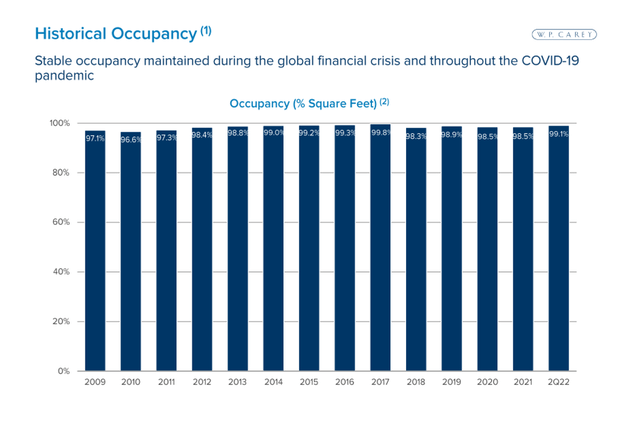

After integrating Corporate Property Associates 18’s properties, the trust’s occupancy will be 99.1%, the same as it was before the merger. W.P. Carey has acquired over 65 self-storage operating properties, and the trust expects the transaction to be immediately accretive to funds from operations.

The acquisition does not significantly alter the composition of W.P. Carey’s portfolio. Industrial and warehouse properties will continue to dominate the asset mix in W.P. Carey’s portfolio following the merger, accounting for 51% of the trust’s rental income (up from 50% pre-merger).

Property Diversification (W.P. Carey Inc)

Property Diversification (W.P. Carey Inc)

A high occupancy rate is critical to W.P. Carey’s strong portfolio performance. At the end of 2Q-22, the trust’s overall portfolio occupancy rate was 99.1%, and W.P. Carey has historically had extremely low vacancy rates.

Historical Occupancy (W.P. Carey Inc)

Historical Occupancy (W.P. Carey Inc)

The portfolio’s strength and resilience stem from the distribution of investment funds across different property types such as offices and industrial properties, as well as the trust’s international real estate exposure.

The trust generates approximately 65% of its rental income in the United States and 33% in Europe. With a third of its revenue coming from outside the United States, W.P. Carey provides investors with greater diversification and lower risk than U.S.-focused real estate investment trusts.

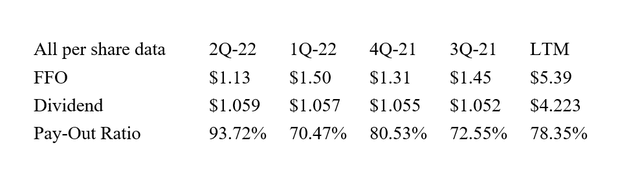

W.P. Carey’s US and international real estate assets generated $5.39 per share in adjusted funds from operations over the last year while paying out about $4.22.

W.P. Carey paid out only about 78% of its cumulative funds from operations in the last twelve months, implying strong dividend coverage. Because of the trust’s low pay-out ratio, the company can easily raise its dividend.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

Management raised its adjusted funds from operations guidance for 2022 from $5.18-5.30 per share to $5.22-5.30 per share. The forecast assumes that the real estate investment trust will complete acquisitions worth between $1.75 billion and $2.25 billion this year.

The stock, which is currently trading at $86.02, has an AFFO multiple of 16.4x based on the new AFFO guidance. Realty Income Corporation (O), a competing net-lease REIT, trades at a 17.9x AFFO multiple.

W.P. Carey’s stock may trade at a lower AFFO multiple if rental income and cash flows fall significantly, which could be caused by an increase in vacancies during a recession.

A downturn in the U.S. real estate market, and to a lesser extent in Europe, could have a negative impact on the trust’s ability to grow its rental income, cash flow, and dividend.

Given W.P. Carey’s historically high occupancy rate, I don’t believe investors should be concerned.

I’m buying W.P. Carey’s 4.9% dividend yield because I believe the trust represents good value for investors who value a safe dividend as well as the possibility of dividend growth.

The funds from operations of the real estate investment trust easily covered W.P. Carey’s dividend pay-out in the second quarter as well as in the previous year, and I see a lot of dividend growth ahead for the trust.

While not a total steal, the stock multiple and dividend yield make WPC an appealing income investment.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.