ACSA, the state airport operator in South Africa, is the subject of an unsolicited offer from investors for a stake. That stake would only be in six regional airports, according to the entrepreneur involved.

The South African air transport industry has seen better days.

Both ACSA and South African Airways (SAA) were heavily impacted by the pandemic and SAA, which has recently been part-privatised, had long since become a loss-maker.

Even so, there is a possibility that others might be prepared to make a counter bid.

This is part one of a two-part report.

Summary

South Africa's Minister of Transport, Fikile Mbalula, said recently that the Department of Transport had rejected an unsolicited offer from private investors to acquire a stake in Airports Company South Africa (ACSA).

Mr Mbalula insisted, "ACSA is not only a strategic national asset with an important role to play in South Africa's economic reconstruction and recovery, but also in enabling the growth of the aviation sector in Africa. It is on this basis that the government has no intention to divest the equity it holds in ACSA, in favour of private shareholding in the foreseeable future".

“In the foreseeable future" is an intriguing addition to his statement, as it does not rule out the possibility entirely. Such decisions can be dictated by financial services, and ACSA is not in the best place in that respect.

In the year ended 31-Mar-2020, immediately before the pandemic, ACSA revenue was ZAR7.1 billion (USD444.6 million), which was stable year-on-year, and there was a positive EBITDA and operating profit.

By the end of the next financial year (FY2021), revenue had decreased by 70% and a ZAR2.6 billion loss was incurred where there had been a profit of ZAR1.4 billion in the previous year – the 1H2021 result being the worst in its history.

(ACSA will announce its financial results for the year ended Mar-2022 shortly after this report is published.)

ACSA is not unique in that respect. It had made profits in previous years but was hit by a second lengthy lockdown period in 2021.

ACSA had approached the government for a guarantee before the pandemic, and it was the government that indicated that assistance in the form of preference shares would be more appropriate to bolstering liquidity.

The company's financial position was stabilised a little by redundancy through voluntary severance packages, which saved ZAR300 million, and the containment of capex. Also the actual or anticipated disposal of assets in India and Brazil (investments in Mumbai and São Paulo Guarulhos airports) and the use of preference shares (as above, for funding).

However, ACSA admits that a full recovery will take a long time.

ACSA did manage to finish the year with ZAR2.3 billion in cash and a reasonably healthy balance sheet.

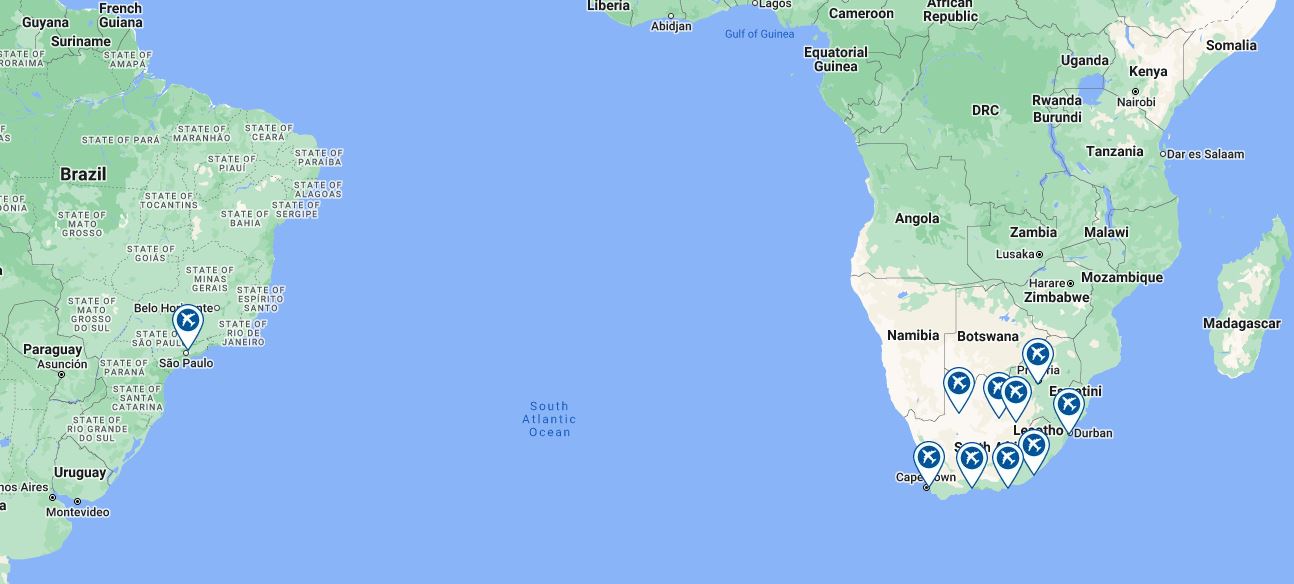

Active airports for Airports Company South Africa (ACSA)

Source: CAPA – Centre for Aviation.

Two scenarios were offered at the time the latest financial report was published: a baseline with 2023 recovery, and a ‘long road’ at 2024.

Recovery was led by domestic traffic, and international traffic remained a little behind, with recovery expected only in 2024.

Some traffic indicators still showed a return to pre-pandemic levels only in 2025.

Almost a year on from that prediction, matters have, if anything, actually gotten worse.

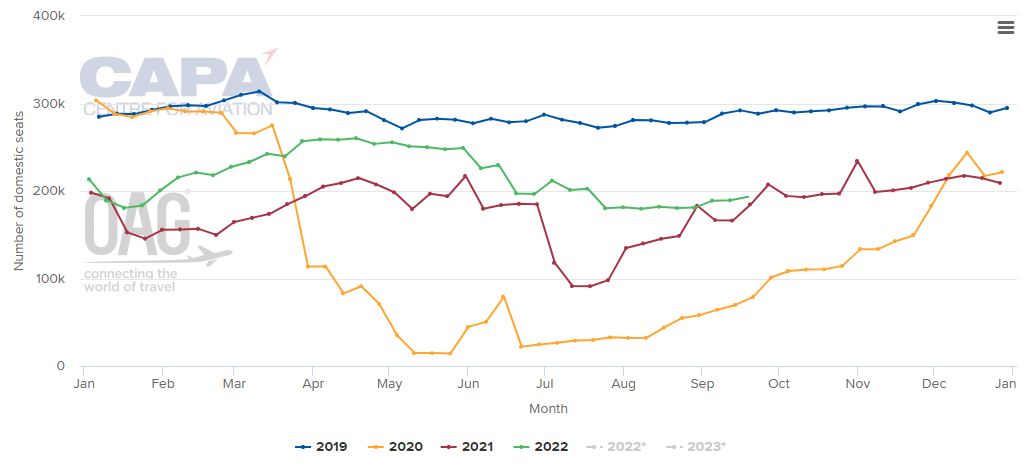

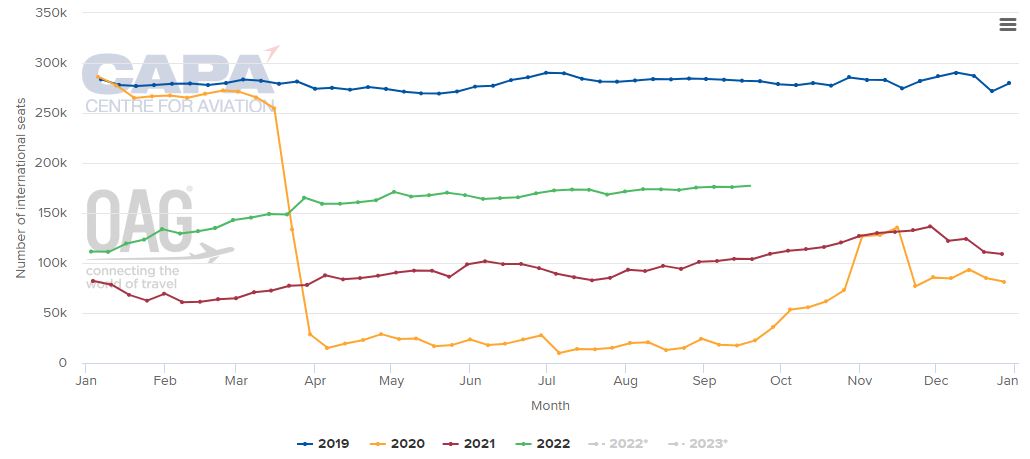

Taking South Africa’s (and the continent’s) busiest airport, Johannesburg’s O R Tambo International, as an example, the two charts below, for (1) domestic and (2) international seat capacity have much in common.

As of the week commencing 12-Sep-2022, international capacity is at 62% of what it was in the comparable week of 2019, but domestic capacity stands at only 65% – hardly any difference at all between the two measures.

Johannesburg Oliver R Tambo International Airport: weekly total domestic seat capacity, 2019-2022

Source: CAPA – Centre for Aviation and OAG

Johannesburg Oliver R Tambo International Airport: weekly total international seat capacity, 2019-2022

Source: CAPA – Centre for Aviation and OAG

ACSA is at least no longer dependent on a slimmed down South African Airways (SAA), which currently is responsible for only 7% of the seats at Johannesburg O R Tambo International and 6% of movements.

SAA entered business rescue proceedings in Dec-2019.

In May-2020 the South African Government outlined plans to create a 'new' South African Airways. SAA received a renewed operating licence from the South African Civil Aviation Authority on 04-Aug-2021 and resumed operations on 23-Sep-2021, with "a new business and operating philosophy" focused on customer service.

Then, in May-2022, SAA passed into majority private ownership for just ZAR51 (USD3).

The airline's new majority owners, the Takatso Consortium, purchased a 51% stake from the South African Government pending approval and finalisation. Takatso consists of a jet-leasing company and a private equity firm.

And that prompted the government and SAA to be sued by a little-known investment firm – Toto Investment Holdings Pty Ltd, which wants the sale of a majority stake in the airline scrapped and re-run, due to a lack of transparency. Toto described the transaction as “unlawful and constitutionally invalid.”

In exchange for that 51% stake the government says it would position the airline for future financial and operational success and bring in reliable, competent and commercially experienced aviation specialists to operate SAA.

The finance to operate this new airline will come from the Takatso Consortium with no contribution from the government, but the government will receive dividends as a preferential shareholder.

Other reports indicate that the government will have some funding responsibility and Takatso will decide whether any continuing liabilities need to be paid by the government – a suggestion that Takatso denies.

Whatever the ultimate outcome, it is going to cost the owners a lot of money to get SAA back to what it was long ago – the pride of African aviation.

The airline has lost money consistently since 2011. SAA was struggling in several ways before the COVID-19 pandemic, but as a result of the pandemic the airline was grounded and entered into provisional bankruptcy protection.

Eventually, after spending billions to bail the airline out over the years – the South African Government confirmed that they would be selling the national carrier.

Whoever is financially responsible, it is going to take more than USD3 to resurrect SAA.

The airline has come down to a handful of flights on just a few routes at the main airports, and doesn’t even have a presence now at large cities such as Gqeberha (previously Port Elizabeth), East London and George. There is a lot of talk about resurrecting old international routes and starting new ones, but that seems unlikely.

Like most private equity intrusions into the airline industry, Takatso's longer term plan is probably to list SAA on the Johannesburg Stock Exchange.

But the airline will need a lot of work doing on it before then.

All of this leads naturally on to the interest being shown in ACSA by external entities, and probably for similar reasons.

Going back over a decade there is a history of such external interest in ACSA’s airports.

When the old Durban International Airport closed down in 2010, to be replaced by the new King Shaka Airport, interest was shown by numerous parties, including airlines, in taking it over in order to continue airport operations.

It was acquired by Transnet, a state operator of surface transport facilities and a cousin of ACSA. Then it was earmarked as a container terminal before plans were drawn up to use it for commercial development, including a new port to handle containers.

As this report is published ACSA has revealed its FY2022 financial result (the 12 months ended 31-Mar-2022) and it was able to reduce losses to ZAR1.0 billion (USD67.3 million), less than half of those in 2021. Revenue: ZAR3.9 billion (USD262.6 million), +81% year-on-year.

ACSA has been awarded a contract to manage the recently reopened Richards Bay Airport by the City of Umhlathuze Municipality.