While many U.S. equities are highly valued, German real estate stocks are currently very attractively valued. A good investor broadens his horizons and looks for opportunities outside the United States.

Why German (or European) stocks? Due to the interest rate hikes by the Fed, the dollar has risen sharply against the euro. Now, the ECB is raising interest rates evenly, so I expect the Euro/Dollar to remain stable or the value of the Euro to rise slightly. The rising euro is beneficial for U.S. investors who manage their money in dollars and buy European stocks. They then enjoy an additional currency return.

I have chosen 3 German real estate stocks that offer an attractive dividend. Real estate stocks are all down about 50% since the third quarter and thus offer a stable dividend of more than 5%.

The German real estate stocks I prefer are:

These real estate companies all focus on the rental, management, and maintenance of homes, mainly in Germany. The shares are available on the German stock exchange and have sufficient liquidity. Alternatively, the OTC stock can be bought, but be aware of low liquidity.

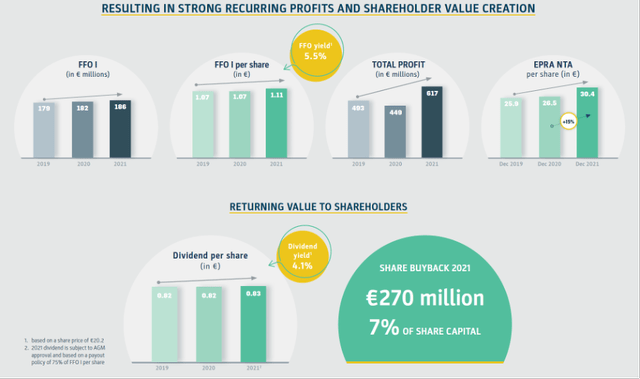

Strong recurring profits and shareholder value creation (GYC 2021 Annual Presentation)

Strong recurring profits and shareholder value creation (GYC 2021 Annual Presentation)

My 1st pick is Grand City Properties. The company rents, manages and maintains residential real estate mainly in Germany but also in the United Kingdom (London). The real estate allocation is divided between the areas as follows: the capital Berlin (24%), North Rhine-Westphalia (20%), London (19%), Dresden/Leipzig/Halle (13%) and other metropolises in Germany.

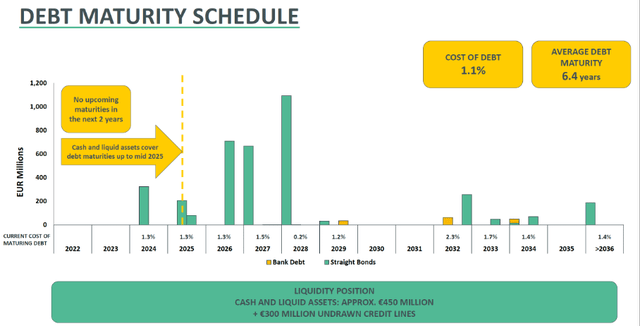

What I find important about real estate companies are leverage ratios and debt maturities. Grand City Properties’ Loan-to-Value ratio is very low at 35% and below their 45% target. The maturities of the debts and the size of the debts give a good idea of the growth potential of the company. The average debt maturity of Grand City Properties is 6 years, with 97% of the debt hedged at a fixed interest rate.

Debt maturity schedule (GYC 3Q22 Investor Presentation)

Debt maturity schedule (GYC 3Q22 Investor Presentation)

Adjusted EBITDA was €299 million for the year 2021. Adjusted EBITDA shows recurring operating profit before interest, taxes, depreciation and amortization, and excluding capital gains, revaluations and other non-operating income. If we compare their debt repayment schedule with adjusted EBITDA, we see that the company has to refinance its debt maturing in the years 2026, 2027 and 2028. There are ample opportunities to refinance the debt so that the repayment takes place after 2029. Interest rates are currently higher, which will affect the company’s profits. The dividend should be safe for years to come and new investors will enjoy their fat 7.1% dividend yield.

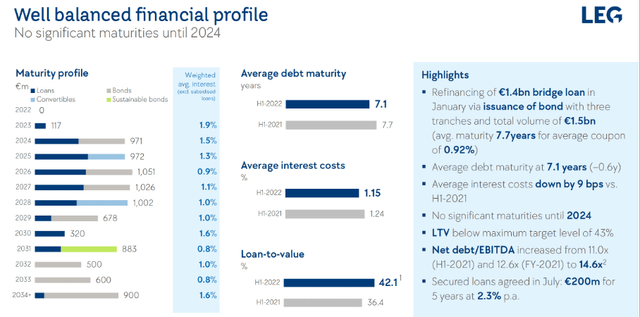

LEG Immobilien rents out, manages and maintains residential real estate and offers its tenants value-added services such as Wohnservice, EnergieService, TechnikService and LWS Plus. The company mainly rents out in Wilhelmshaven/Aurich/Norden/Bremen (48%) and other metropolises in Germany.

Here too we look at the leverage ratio and debt. The Loan-to-Value ratio is slightly higher than Grand City Properties at 42%, but still below management’s target of 45%. The average maturity of the debts is 7 years and significant maturities will only occur from 2024. 94% of their debts are debts with fixed interest rates.

Well balanced financial profile (LEG H1 Investor Presentation)

Well balanced financial profile (LEG H1 Investor Presentation)

Adjusted EBITDA for 2021 was €512 million. The debt repayment schedule shows that LEG Immobilien must refinance its debts for the coming years at a higher interest rate. Another option is to repay debt with proceeds from divestments. The investment portfolio is €19 billion, so there is quite a bit of room for deleveraging. A small caveat to the valuation of the investment portfolio is that house prices can fall if interest rates rise sharply. For now, I think their investment portfolio offers a strong margin of safety. I consider the dividend stable, investors can enjoy their return of 5.25%.

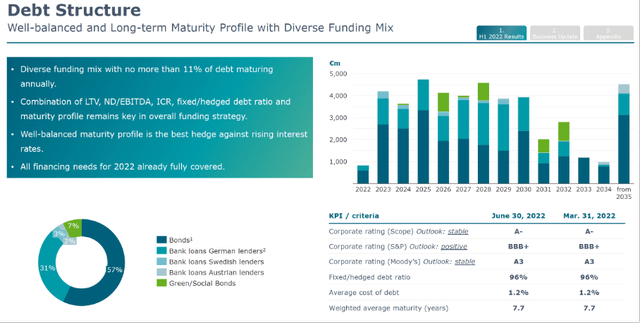

My 3th pick is Vonovia. Vonovia rents out, manages and maintains residential properties and offers value-added services for residential properties in Germany, but also in Austria and Sweden. The portfolio breakdown of the real estate is as follows: Berlin (9%), Rhine-Main area (6%), South Rhine area (6%), Rhineland (5%), Dresden (5%), Hamburg (4%), etc. The good diversification ensures stability in the property portfolio.

The Loan-to-Value ratio is 43%, below management’s target of 45%. The average maturity of the debt is 7 years and 96% of the debt is hedged with a fixed interest rate.

Debt structure (Vonovia H1 investor presentation)

Debt structure (Vonovia H1 investor presentation)

Vonovia’s total adjusted EBITDA after the consolidation of Deutsche Wohnen for the year 2021 is €2.269 million. After 2023, the debts can no longer be covered, which means that Vonovia will have to refinance its debts. This is possible at an interest rate of 2.5% for secured debts and 3.5% for unsecured debts for 8 years. Another option is to pay off debt with proceeds from divestments, or a combination of both. The fair value of real estate is €93 billion, which means there is plenty of room to pay off their debts. The first debt maturity will be in 2023 and Vonovia will sell some portions of its non-core assets to meet the obligations. As a result, I expect a stable dividend and new investors can enjoy their solid 6.2% dividend yield.

There are a few reasons why these stocks have fallen, including:

Own interpretation: Refinancing is indeed more expensive, if the rental yield is lower than the interest yield on debt, it is not economically justified to let through. Capital must be redistributed and properties with a low rental yield must be sold.

Own interpretation: This is not a landlord-tenant problem. People who live in their own homes are also affected by increased energy costs. This is a social issue and the German government provides relief by offering them subsidies, increasing housing allowance and other measures.

The three stocks are down 50%, but there is no need to panic. Yes, there can be a small drop in profits when their debts are paid with asset disposal. But it doesn’t seem logical that just for this reason stocks have fallen by half. Stocks fall so sharply when a recession is imminent. In most cases (for solid companies) this should be a perfect buying opportunity as we have seen in the years 2000, 2008 and 2020. So, enjoy the fat dividends!

Investing in Europe is beneficial when the value of the euro rises against the dollar. The ECB is gradually raising interest rates, making it interesting to take a closer look at European equities. There are 3 German real estate stocks that are attractive because of their high dividends combined with their solid dividend security.

Option #1 concerns Grand City Properties, the stock has been heavily penalized and as a result is trading at a strong 7.1% dividend yield, while their debt maturities and cash flows look good for years to come. Option #2 concerns LEG Immobilien, this stock is also heavily penalized and offers a solid 5.2% dividend yield. My pick #3 is Vonovia, the dividend yield of this stock is a solid 6.2%.

I see Grand City Properties as a very safe investment as it can easily meet their debt payment schedule. Both LEG and Vonovia will have to sell investment properties and shift their maturities. This can put pressure on the dividend, but the dividend is well covered by their large quality real estate portfolio. All stocks trade very cheaply and equity gains can still be made when the maturity of their debts seems more favorable causing the stock to rise. The shares are worth buying. Enjoy the fat dividends!

Blacqbook/iStock via Getty Images

Blacqbook/iStock via Getty Images

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GRNNF, LEGIF, VNNVF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.