THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

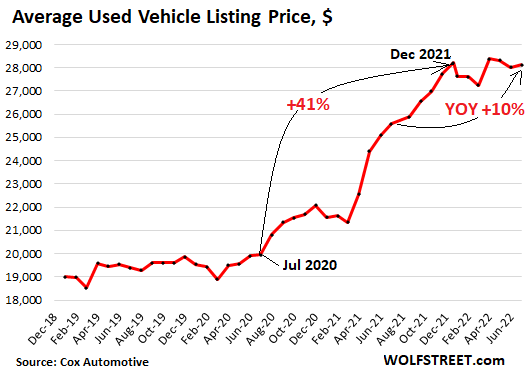

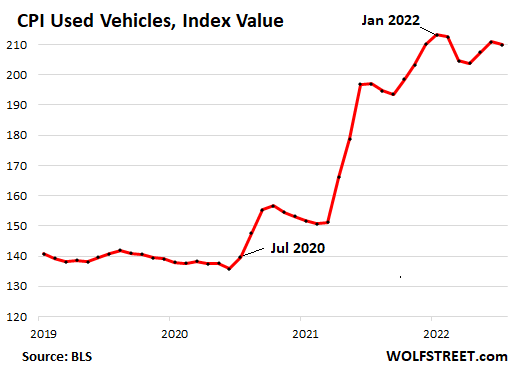

Used vehicle retail prices skyrocketed from August 2020 through December 2021. The “average listing price,” tracked by Cox Automotive, was up by a mind-blowing 41% over that 17-month period. The Consumer Price Index for used vehicles, which is seasonally adjusted, maxed out a month later, in January 2022, due to seasonal adjustments, up by 53% over the 18-month period.

But since the beginning of this year, the average listing price and the CPI for used vehicles have meandered up and down from month to month, with a downward bias. By July, the average listing price was down just a hair from the December peak (-0.3%). And the CPI for used vehicles was down by 1.5% from the January peak:

This flat spot over the past seven months has whittled down the year-over-year spike in the average listing price to 10%; and the year-over-year spike of the used vehicle CPI to 7%.

So the mind-boggling used-vehicle price spike ended in January. But the influx of used vehicle from rental fleets into the used vehicle market – usually 2-3 million vehicles per year – continues to be constrained as rental fleets are having trouble getting new vehicles in sufficient quantity due to the ongoing production shortfalls by automakers. And they’re hanging on to their vehicles longer.

Inventory in used vehicles is adequate for the lower sales levels. And sales are down because buyers are balking at the still crazy-high prices, but dealers don’t want to cut their prices to boost sales because they’re facing limited supply. So the market is hobbling along with still sky-high prices, lower sales, frustrated potential buyers, and tight inventories.

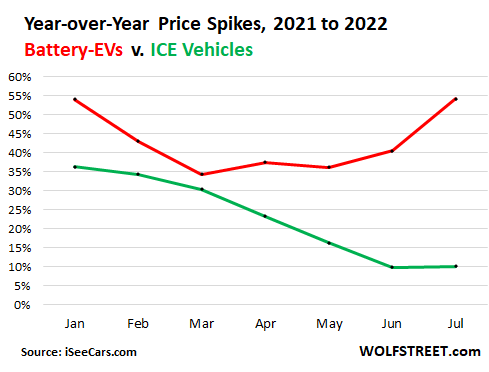

A study by used-vehicle search engine iSeeCars.com found that prices of used vehicles with internal combustion engines (ICE), which make up the vast majority of the used vehicle market, trended flat to lower this year roughly in line with the “average listing price” and the CPI for used vehicles.

But prices of used EVs – battery EVs only, not hybrids – after following the trajectory of ICE vehicles earlier in the year, surged again since March amid strong demand from buyers, and very little supply since EVs are still just a minuscule portion of the used vehicle market, with now supply from rental companies as they’re just now starting to incorporate them into their fleets.

For this study, iSeeCars.com analyzed the listings of 13.8 million one-to-five-year-old used vehicles between January and July of 2021 and 2022, by model, and calculated the average listing price for each model and compared it to the average listing price of the same model a year earlier. It excluded low-volume models and models that went out of production by the 2022 model year.

This chart, based on data from iSeeCars.com, shows how the year-over-year price spike of used ICE vehicles was whittled down over the seven months this year, in line with the overall data, to +10% in July; and how the year-over-year price spike of EVs followed the same trend until March, but then headed higher again and in July were up 54% year-over-year.

Biggest year-over-year price spike: Nissan Leaf, which not too long ago was a dud in the used vehicle market. But the price took off, likely due to its relatively low price and “the heightened desirability for the redesigned 2018 model that offers increased range and is now coming off lease to enter the used car market,” according to the report. The average price jumped by 45%, or by $8,930, to $28,787.

Number 2 biggest year-over-year price spike: Chevrolet Bolt, which got a lot of bad publicity. But it’s the cheapest used EV out there, and gasoline is expensive, and “its relative affordability plus heightened interest in all-electric vehicles have led to its steep used car price increase,” the report said. The average price jumped by 29% or by $6,417 year-over-year, to $28,291.

Tesla models are in the middle of the pack in terms of percentage price increases, but given the huge red-hot price of used Teslas, those percentage increases make for big dollar increases.

The luxury imports – the Audi e-tron and the Jaguar I-Pace (made by contract manufacturer Magna Steyr in Austria) – have seen much smaller year-over-year price gains. And the Porsche Taycan has seen the only year-over-price decline among the EVs, but is also by far the most expensive model on this list (from biggest percentage gainers to smallest).

If you’re breathlessly looking at the right column above, the prices of used EVs… One of the most astounding aspects of the past 12-18 months is the crazy situation of many used-vehicle prices – EVs and ICE vehicles – being higher than prices of the same model as a new vehicle. Which is just nuts.

If there had been a solid buyers’ strike when used vehicle prices started going crazy in late 2020, none of this would have happened. Most people can just drive what they already have for a year or two, and if 70% of the buyers stop looking because prices are crazy, sales collapse, and prices come down, until they’ve fallen enough to where sales revive.

People did that during the Financial Crisis. It worked. It pushed GM and Chrysler into bankruptcy, along with much of the component industry. But this time around, people had all this pandemic cash and they went crazy with it, buy-buy-buy.

For prices to come down, people need to balk at these prices and not even shop for a used vehicle, and keep driving what they have, until some form of reason returns to this crazy market. And we’re seeing some balking now, but not nearly enough.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

It looks like I got lucky. I had been dreading finding out what my manual transmission civic would be worth a couple years ago when I started thinking it was time for a new car, but given the outrageous demand for used cars last year I was able to trade it in on Chevy bolt when no body wanted them, I am glad I did not wait. I would also add the bolt is a way better car to drive then leaf.

NVDA and a lot of semis are in the tank but my semis EV linked are making new highs. Shows that EV market is expanding while many sectors of the economy are contracting!

A manual transmission is the best anti carjack strategy in Chicago.

That’s funny. Why? Because thieves can’t drive them?

A less than couth Leisure Suit Larry-esque relative in the car biz once told me dealers consider manual transmission-equipped vehicles sitting on their lot as being metaphorically afflicted with a certain 1980s infamous virus that causes a disease that attacks the human immune response. More bluntly stated of course, but the jist was buyers really don’t want them.

I wonder/hope demand comes back for stick. The more recent claims were automatics are just as fuel efficient or moreso than manual. Don’t care; not the same. Manual indeed kept my car from getting jacked living in a very, very rough neighborhood in college. Well that, and it was a Ford.

Bread is too expensive..let them eat cake

Gas is too expensive…let them drive EVs

Lol

Electricity is too expensive, let them buy solar panels.

I expect that today’s $300-$500 Billion dollar announcement will fuel high vehicle CPI in particular. It isn’t really enough per borrower to transform student debt holders into house hunters overnight, but it’s effectively a direct injection of just the right amount of money toward would-be consumers who might have been holding off on changing cars for fear of adding to their debt burden. It could also prolong the Fed’s tight monetary policy as they now have to counteract a big shot in the arm to loose fiscal policy. If the Fed won’t open their firehose of moral hazard back up, then politicians surely will. Just unreal.

Indeed, it’s ridiculous. I’m less certain about its immediate inflationary effect, though, unless borrowers were planning on paying that back and now are free not to (and thus changing their spending).

I suspect WR will be posting on this, so will withhold my DepthCharge-level vitriol for that post.

A saver wouldn’t see it as a spending opportunity, but somebody with a borrower’s mindset may well see it as a $10k-$20k sized hole in their overall debt that they’re comfortable to refill. They can now fit that car payment into their monthly obligations. Lots of Americans live by how many monthly payments they can afford, not what they can actually afford in total. There’s a zero percent chance that this won’t apply some upward pressure to inflation, and vehicles are a particularly nice fit.

I bet many colleges ate already encouraging students to take bigger loans worry free because “you don’t to pay them any more!”

Rent a luxurious hostel on us, lease a Tesla and enjoy fine dining and open bar at uncle Sam sponsored party every night!

Just remembered how frugal I was in college despite going one of best engineering college.

Have no regrets, can enjoy now on my own hard earned dime.

Can the president cancel debt simply by an executive order?

Legal challenges possible?

SS,

I think you’ve hit on the worst part of this. I can hold my nose and accept the forgiveness (though I think it’s grossly unfair to many prudent borrowers and people who chose not to attend college) if the underlying system that caused the problem was actually reformed. Why have a Federal student loan program if borrowers now believe, with good reason, they will never need to repay the loans? Student loans allowed college costs to inflate beyond all reason and now we have forgiveness with nothing being done to force colleges to rein in those costs. It’s basically a redistribution of wealth from taxpayers to college administrators. I say administrators because over the years the student/faculty ratio is pretty stable, it’s the administration that’s expanded relentlessly.

I will add that I agree with Wolf’s previous article and bankruptcy should be an option at some point for student loan borrowers. The 2005 bankruptcy reform is a big reason this mess exists, and had the added benefit of inflating college costs for everyone.

SS, if you read the WH Fact Sheet, the 10 years of payments then forgiveness will only discharge debts if original loan amounts were no more than $12k. Same fact sheet says the average person graduates with $25k in debt (the number has widely been reported closer to $50k), so, sucks to be them average folks then.

I can’t imagine that many people are financially drowning by a mere $10k-12k and under in loans, but if they are in that bad of shape I’m not gonna begrudge the leg up, they probably have much bigger problems than you or I.

All I’m seeing in this plan is, sucks to be you if you took out a standard bachelor degree’s worth of loans, you Middle Class so-and-so. Still no bankruptcy protection for you, either. Enjoy the interest and fees.

I’m gonna have to dig into the math to see of its worth repaying my $50k ($30k? Had Pell’s but his wording is suggesting it won’t necessarily be a full $20k forgiven) on income driven repayment plan of 5% of descretionary income for 20 years and pray the promise of discharge holds up this time, or to just throw as much at it as I can if the interest doesn’t continue to eat me alive (the same interest that was 1.5% & 3.5% once upon a time).

DepthCharge-level vitriol…I lolled.

Not Sure,

In terms of CPI inflation: That $300-$500 billion is money that borrowers don’t have to pay over the next 10 years. BUT THEY ALREADY STOPPED PAYING IN 2020, and so there is no change from where we are now, in terms of inflation.

It’s just that they don’t have to restart making payments on that $10,000. So there is no impact on the economy from where we were. There might be a change from where we would have been hypothetically without it going forward, spread over 10 years. But since most of these folks deferred payments, and minimized payments, etc. the change is very uncertain.

I don’t see how this is impacting CPI or anything since these people weren’t making payments to begin with since March 2020.

In addition, student loan forbearance was extended through the end of the year, further maintaining the status quo.

But taxpayers will lose an asset of $300-$500 billion that they thought they had and now don’t have. It’s their money. And it’s gone.

They also extended the moratorium to Dec. Ya know, after the election. Not quite a chicken in every pot. Of course if you never went to college this policy says you deserve no chicken. Ironic from a party said to represent everyone.

Question, I am guessing the student debt was counted towards how much additional debt (e.g. mortgage / car loan) people were eligible for, even if the payment was paused? If thats the case, that will increase the borrowing power and increase inflation, no?

We’ve already seen FICO scores across the board improve because of the forbearance of delinquent mortgages and student loans. This started happening last year. Banks know this too, and now they don’t trust those FICO scores anymore because they’ve been inflated by forbearance.

$10,000 really isn’t a lot of money these days 😁 The average listing price of a used vehicle is $28,000. So I’m not sure if it will change much in terms of getting a loan.

Wolf, I feel that this attitude can start encouraging people to buy houses and cars that they cannot pay for, by assuming that they will be bailed out (no emi either).

So I feel all this would add to inflation mindset. Inflation will increase toll December atleast.

And when the repayment starts (if ever) for the part of the student loan after forgiveness, how many will keep making payments? It is only rational now to expect and prepare for a bigger forgiveness before future election (2024) and you do not want to be the person who just repaid their loan before the forgiveness was announced!

Wolf, I maybe wrong but I thought a few years ago you said that they would never forgive student loan debt? They still might not given the forgiveness might not be legal.

Not sure I made that kind of statement with regards to student loans.

But at that time, people were clamoring on this site for a “debt jubilee” in a much broader sense. And I probably said that that would never happen.

I’m sure I said that one person’s debt is another person’s asset. And this student loan debt is an asset owned by US taxpayers.

But there is a debt associated with this asset: The US government borrowed this money, and then paid students and the educational-industrial complex this money, expecting to get this money back, plus interest, to service the debt it incurred to fund the student loans.

Now part of that asset has been officially destroyed. But the government still owes the money it borrowed to fund the student loans. That didn’t go away. Taxpayers will have to pay for that for the rest of their lives.

Waiting for everyone to get their own $1,000,000,000,000 platinum coin autographed by Paul Krugman.

I’m a little confused. Which is typical. If this is simply revenue that gov doesn’t have anymore, what is the effect of the 500 billion hole? Wouldn’t that mean raising funds by another means? Which would pull that money out of the system somehow or another. Does this actually reduce inflation?

It’s not just revenue (interest) that the government doesn’t get. It’s the ASSET of $500 billion that it gave away. It means that governments transferred a $500 billion asset from taxpayers to student loan borrowers. Taxpayers got robbed of $500 billion in this deal. They’re the losers. It was their money. Now student loan borrowers got it — and of course by extension the educational-industrial complex.

It’s not inflation that’s the big issue here; it’s the robbery of taxpayers.

Just like it’s robbery of taxpayers to give hand chip-makers $50 billion – and that’s probably more inflationary because this $50 billion is going to get spent which creates demand which causes all kinds of stuff to happen.

Cha-ching! goes my over generous University of California pension. Where are the pitchforks?

“But taxpayers will lose an asset of $300-$500 billion that they thought they had and now don’t have. It’s their money. And it’s gone.”

My $18k loans (paid down to $12k) were sold twice, both times immediatly after two very brief defaults (divorce/homelessness– haters gonna hate but I got to live and learn the hard way, I now consider it better-valued education than college was in a dark way). Both times, the newly contracted servicers tacked on $10k in ‘administration fees’ more than doubling the initial loan amount (with interest they’re now $50k).

I saw nothing in the President’s plan to stop such activity by servicers going forward, although I may have been eye rolling too hard while reading it. But can’t imagine the ‘administrative fee’ shananigans passing as a part of the expected assests by tax payers, in all this debate I’ve never even heard it discussed, yet given the general default rate perhaps it is more common knowlege and considered a deserved hand slap (or kick’m while they’re down, perspective depending)?

Then again, if the economy does soil the bed in 2023, and defaults rise, maybe the administrative fees are how his plan will nullify itself and we can go back to blaming the poors and homeless/unemployed for their bad education/financial decisions.

“So there is no impact on the economy from where we were”.

Oh, there certainly is. Tons.

As you may or may not know, “the economy” is all about psychology. So there is a huge difference between “just not paying any more” even though you should and not even thinking about paying down a loan because it’s free money anyway, they just call it a “loan” to keep up appearances, wink wink. It’s called “moral hazard”. And once you go down that road, there’s no stopping. And it destroys economies and societies.

Very good observation about the lack of student debt payments already. I had a 3 hour drive last night and listened to a news channel and zero ‘experts’ thought of this. Still, a overall bad idea.

This is really just a benefit to banks that hold these loans,which have not received payment in 2 years .Always look at both sides of the coin and don’t believe a politician

My mortgage identifies as a student loan.

Priceless!

What about your car loan while you’re at it ?

During the pause, I asked the bank mortgage rep to factor a monthly student loan repayment of $500 into my DTI to calculate how much mortgage I could really afford once the President was done wasting everyone’s emotional energies and time, but the rep said the Monthly Student Loan Payment input field on their calculating software was ‘blank’, they’d apparently been calculating DTIs as if student loans completely disappeared on someone’s monthly debts, although they assured me the loan officer still sees the total debt on the credit reports.

Still, makes me wonder how many mortgages during this bubble were approved without truly factoring monthly student debt, because that may start to matter to those buyers come January 2023.

I don’t drive all that much and filter on <100,000 miles, <10 years old, < $6000, manual transmission, low maintenance brand. Not a lot changed in that department the last few years.

Used EV buyers beware. Batteries don’t last forever and the cost of replacing a battery pack might come close to what you paid for that used EV.

Depends. Batteries with active liquid cooling (Tesla, BMW, and others) seem to be doing surprisingly well

100k+ miles out. Cheaper air-cooled batteries (Nissan Leaf) do not fare so well. The type of cooling system is definitely going to affect resale value. As EVs are thrust upon everybody like-it-or-not over the next decade, we’ll see a stark difference in battery life between house dwellers who can slow charge overnight and apartment dwellers who will have to fast charge regularly, which is hard on batteries. Cold weather is also harder on batteries. EVs are properly excellent in suburban commuter applications or where the owner can slow charge, but problematic or even useless in other applications. House dwellers with 1 gas car and 1 higher-end EV in warmer states are generally going to be very very happy EV owners. And their EVs are probably going to last 200k-300k miles if they don’t trade it for something newer in that time period. I’ve read that a lot of Teslas are only down about 5% in range by 100k miles.

We are getting some real battery life data. The original Tesla Roadsters are now 12+ years old. Failures seem common around 13+ years. Not bad. These batteries exceeded their design life of 10 years. But they now have a significant number of unrecoverable single cell failures. Bad news is that there are no replacement batteries available from Tesla for any price.

There is one company that manually disassembles the battery and disables the faulty cell block for $$$ reducing range but that is just a temporary measure once multiple single cell failures occur.

I’m sure newer Tesla model owners will have better support but it shows that after 10+ years you are skating on thin ice. The battery pack will likely cost more than the car is worth.

“Cheaper air-cooled batteries (Nissan Leaf) do not fare so well. ”

“Cold weather is also harder on batteries.”

I think you’re confusing two different issues. Batteries do not function well in the cold. Cannot deliver the same amperage for as long. But it is not damaging that I am aware of. Heat kills batteries. Either while charging, discharging, or just sitting. So those in cold climates will have poor performance all the time but it shouldn’t affect the resale value. Those parking and charging in 135F degree garages in PHX are in trouble.

EV Lithium batteries use a small amount of charge to internally heat the batteries in freezing temperatures, to prevent damage to the cells. You certainly need to keep your EV battery charged in cold weather.

I mean, you should not attempt to charge a frozen lithium battery, so you should keep a charge on them.

David H, cold weather comes with all kinds of negative effects for EVs just like it does for ICE cars. Polymers are less flexible in cold weather and likely to fail earlier after years of vibration. Not just the polymers in the cells themselves, but gaskets, seals, and hoses related to the battery pack and cooling system. This is exacerbated by wider swings in temperature during thermal cycles from cold to warm to cold. And since batteries are less efficient in the cold, they will experience more charging cycles over their life in places with cold winters. Not to mention more contact with water year round, salted roads in the winter, more humidity in the summer. None if that is good for battery packs or all of the added copper in an EV. Region is going to affect resale value of used EVs as much or maybe even more than ICE vehicles.

I finally gave in a bought a used ICE car at a dealership a few weeks ago.

My out-the-door price ended up being below what they had it listed as. I honestly didn’t think we were going to make a deal and I was not desperate to purchase the car so negotiated very hard. They somehow got to a number I liked.

Miserable experience (ha!) but pleased with the car.

This is everyone’s complaint ,last car I bought they quoated 7500$ and my trade, final price 3200$ and one pissed off manager. If you are dumb enough to pay the 7500$ they’ll gladly steal your money

I took my 21 Expedition into the dealer yesterday for its spontaneous combustion recall. The salesman we deal with there was sitting outside in front of the dealership with most of the showroom employees, and he told us how much the used car sales had slowed down.

He pointed to individual cars and mentioned how much they had into each car from the auction and how they were stale already from sitting on the lot.

Also on the lot was the $78K 2022 Platinum F150 Powerboost Hybrid F150 my brother ordered 11 months ago. It had been on the lot a couple of weeks with no interest, and they want only MSRP for it. Our business bought my brother a 22 Tundra from an east coast broker back in April because this F150 showed no signs of life.

In December the used car dealers are going to be freaked out by the high ad valorem taxes they are facing in’23 and will be dumping inventory. The best deals will be made in high value cars in late November. Human nature is fairly predictable in retail.

Briefly looked for a Nissan Leaf and realized that these – as well as all other EVs – are disposable cars, because once the battery runs out, the car is worth nothing – due to the cost of battery replacement.

What’s a used Tesla worth when it needs a $14,000 battery replacement?

All cars are disposable at some point. That’s why some repairs are not worth doing on old ICE cars. We bought a 2016 leaf in 2017 for a little over $13K. We’re very pleased with it. We’ve driven it for almost 5 years and it should be useful for another 7 to 10 years. At a range of 40 miles it’ll still be useful to us. Of course not everyone can do that, but there’s certainly a niche for cheap and reliable transportation from a low range EV. You just need to factor in the battery issue when you buy the car. In addition to saving on gas right now, it’s cheap to maintain and we actually get a preferential rate on all our electricity because we have an EV.

California is gonna ban future sales of ICE cars, and presumably the 87 octane they all crave. It’s down the road a bit though.

Took a ride in a friend’s 2011? Leaf the other day and he’s the original owner and told me the range was 100 miles when newish, but is now more like 40 miles.

EV’s have come a long way, but seem still far out as far as big rig trucking goes.

“Batteries with active liquid cooling (Tesla, BMW, and others) seem to be doing surprisingly well 100k+ miles out. Cheaper air-cooled batteries (Nissan Leaf) do not fare so well. The type of cooling system is definitely going to affect resale value.” From Not Sure post above. You get what you pay for.

What energy loss, if any, is there when trying to get a maximum charge on a battery capable of only 40% of it’s original charge?

Where I live the Chinese all drive the same car and buy the same phone. I have seen the Chinese buying and driving the Tesla so most of them I surmise will transition from the white Mercedes Benz to the Tesla.

Are there really that many wealthy people in this country that can make a monthly payment on these EVs? So many of these EV prices seem unrealistic for the majority of Americans. So many of my nurse colleagues are bragging about their new EVs with 1,000 monthly payments. All while going out to restaurants and spending a couple hundred dollars every couple of weeks.

Many Americans are awash in money that came from all kinds of directions: pandemic cash, huge price gains in stocks, crypto, and real estate, leverage of those gains, pay increases, etc. Consumers are spending a HUGE amount of money. I’ve been documenting this here. It’s astonishing how the money just flies around.

Exactly.

The Fed is “raising rates” and “getting tough on inflation” while the gubment is handing out free money.

It’s a shitshow.

If you want to go buy an EV, it’s gonna cost you ~$50K and there is one year wait on these.

People are flushed with money and there is absolutely no slow down in spending. Unless, consumers feel the pinch, I see no slow down and hence no recession.

I have to agree. It’s like Christmas in the stores and restaurants around here. Every day and night. No recession here.

“The “average listing price,” tracked by Cox Automotive, was up by a mind-blowing 41% over that 17-month period. The Consumer Price Index for used vehicles, which is seasonally adjusted, maxed out a month later, in January 2022, due to seasonal adjustments, up by 53% over the 18-month period.”

Only with Jerome Bowell’s monetary diarrhea was this possible. Shitting money all over the country with reckless abandon has consequences. And this filthy, corrupt old a-hole had the audacity to spout “transitory” for over a year while inflation was raging out of control. Why does he still have a job?

Because our government and corporations needed him?

The dealer I bought my last 2 Toyotas from in Bartlesville Ok, north of Tulsa doesn’t have a Camry or Corrola new or used on the Lot. Lots of SUVs and pickups though.

I can’t see how people will continue to buy low MPG vehicles unless they have unlimited funds to blow.

Another FOMO person?

“.. doesn’t have a Camry or Corrola new or used on the Lot.”

Yes, that’s near-universally the case.

https://wolfstreet.com/2022/08/13/new-vehicle-inventory-dips-near-record-low-fuel-efficient-cars-vanish-but-supply-of-full-size-pickups-suvs-rises-discounting-sets-in-to-move-the-iron/

Say hi to Brad D there, if you run into him.

LOL, Next time I’m there sure will.

This morning I noted my nearby used car dealer has moved the full sized quad cab pickup trucks back to the front row, putting the crossovers behind them.

I guess gas is cheap at only $4 a gallon.

A couple weeks ago the lot was half empty. Now mostly full. They carry only newish looking used vehicles, I’m guessing rental or fleet vehicles.

Florida Joke…

How do you turn a Tesla into a Ford…

Order a hurricane evacuation…

FORD…. Found On Road Dead….

More seriously, FL DOT eyeing hurricane evacuation with EVs as a serious problem from south FL with range running out in central FL…

Infrastructure to handle this is years away…

Bigger problem is gas stations running out of gas, and then cars running out of gas and stalling on the road. That’s a classic problem.

If you top off your EV in your garage every night, which most people do, you have a full battery every morning. You don’t do that with your gasoline-burner. So you have a quarter tank when you want to evacuate. And so do lots of people, and they all head to the gas stations, and people wait in long lines, and then the gas stations run out of gas. While the guy in the EV is already 120 miles down the road and still going strong for another 150 miles.

Only new arrivals in storm country think they’ll top off on the way out of town during an evacuation. Locals know what to do, affordability plays a part in the evacuation decision. Panicking officialdom and draconian curfews keep people in harm’s way because they won’t be allowed home for days sometimes, so they don’t leave. Prudent motorists keep their tanks full in humid areas anyway to minimize water in the gas(ethanol is hydroscopic).

The object of evacuation is survival in the face of infrastructure that’s inadequate to assure survival in a storm to a place where the infrastructure is intact and likely to remain so and afford survivability. Gas stations are closed as they run dry and the tanker trucks can’t deliver, and the fuel-available line moves north.

But you can carry a gas can that you filled a month ago to a car that needs gas today. The technology will improve to independent refuelling of EVs on an emergency basis sans fixed charging stations. It’s not there yet, and anybody who relies on an EV to run from a storm is risking being marooned in a dead vehicle by the side of the road as a hurricane approaches. They’ll have company, there’s always some idiots or just flat broke people who will run away with a quarter tank as you suggest.

The first service stations came into existence around a hundred years ago, but there were ice cars running around before service with a smile. They made the stations viable before they became a “necessity”. Enough adoption of EVs will do the same.

The sail versus steam decision in maritime freight 150 years ago was about fuel bunkerage as a percentage of usable cargo space and the resultant range of a merchantman. Technology doomed commercial sail and will isolate ICE usage to the areas where it makes sense. There’s always going to be a few.

not saying a word about student loans, for another time.

Good post, rick…

SOP here is full tank, plus another 20 gals in safety cans for the back….

If I don’t evac, then the 20 gals is on standby for my generator in case of electric loss…

I am curious… during Irma, the interstates were running 10-20 mph…

How does going that slow, running AC and other electronics eat in the battery and thus the range of an EV…

I forgot to add I use a website called Tropical Tidbits to get a heads up in case something nasty this way comes…

They have the hurricane models up to two weeks ahead of time and is pretty good about giving a general idea of what’s coming…

COWG- i was wondering about power management prioritization in EVs too . You’d think that the ancillary systems would be shut down at a given level of charge depletion to maintain driving power, like doing without AC to save gas in the line of cars leaving town under feeder bands.

Tropical Tidbits? Thanks for the heads up. Used to use weather underground but I can’t figure out how to since they changed the site. Old age is a trainwreck.

Cowg, going slow generally increases efficiency of EV’s as air drag is the major reducer. AC on the other hand does cause a hit, but I would say if you rolled your windows down and were stuck going 10-20 you would probably actually make it 10% further on full charge then you would normally make it.

TT is a good, no BS site…

Under the hurricane tab, you can see GFS, American and HWRF, Euro models…

The host does really good technical analysis with videos…

Anthony A., you might get pretty wet around Sept 5… 🙂 Then again, that’s 10 days out so you might not, either…

Not so much a problem here in Tornado alley. Maybe time enough to hide under the bed and hope your car doesn’t land on you.

Yesterday I just bought a 1978 Ford F250 4×4 with the 351 from some dude in town.

Obviously, not gonna be a daily driver, and yes very much a specialty / unique item.

That stated, I got an 05 outback that just blew head gaskets. No way I’m paying these prices for used crap at the dealership. I’ll just fix my own used subaru. Count me as one of the buyers on strike.

How do you think the Inflation reduction act’s EV funding is going to affect EV supply and prices? It would be great to hear your perspective on the whole act actually. So much stimulus in there.

I hate these EV rebates. In 2022, they’re stupid. There is too much demand for EVs already, long waiting lists to get one, spiking prices. The last thing this EV market needs is more stimulus. It’s just stupid.

At first, these rebates might bring CPI down a little because they effectively lower the prices. But prices will soon rise to absorb the rebates. Manufacturers will get fat. CPI for new vehicles is then going to rise.

If they want to encourage domestic production of EVs and batteries – fine with me – they should just put a 25% tariff on imported EVs, batteries, and components. That would have done the job. And it would have raised some much needed taxes from the car companies. But no one has the balls to do that because the industry lobby is going to scream bloody murder.

But they also handed $50 billion to the richest companies in America (chip makers such as Intel and Nvidia), which is just as or more infuriating. That $50 billion was bipartisan.

I don’t have enough energy to get mad about all this stuff.

We need 10% yields and interest expenses out the wazoo so that Congress thinks a little bit before they throw money around.

Well said, and thank you Wolf.

They don’t even try to hide the corruption and theft anymore. They do it right out in the open. It’s almost like they’re laughing at us as they destroy the country. It’s too bad we can’t turn all of Congress into pet food.

This is a “Dark Age” period where rationality is being stoned to death by mobs in open air ampitheaters.

ALPO- all politicians.

Nothing but the best for me and my dog.

I see several used car dealerships that are selling Teslas with less than 100 miles on the odometer. Used car dealerships are buying from Tesla, inflating the price, and then reselling them. This allows impatient people that don’t want to wait 6+ months ordering directly from Tesla to get a car now. I believe this activity is causing a ton of inflation not just Teslas, but all EVs. Used car dealers are now Tesla dealerships.

Picked up a Honda PCX150 with 3700 miles on odo for $2650. That means I have two 100 mpg vehicles for about $5000 and big sedan ($6500) that I got five years ago for road trips. As economists say, we all are market participants with different preferences.

I started looking at EV trucks earlier this year to replace my 1998 k2500 6.5 L Turbo Diesel. After perusing the offerings on the market I became somewhat depressed. Apparently to drive a “truck” in 2022 you have to be the type of fellow who wears loafers or cologne. There is plenty of room for all your essentials to get to the office and back on the wild and dangerous commuter highways but they forgot to include a truck bed that will actually fit anything someone who actually works for a living would want to put in it. The last I checked sheets of plywood were still 4×8 not 4×4. While slightly disappointing, I’ve decided to re-embrace my diesel. Sure, it ain’t cheap but its loud! Sure, it ain’t fancy but it plows my driveway just fine. Best of all, when I need a new battery it’ll be 70 bucks at walmart and not 25k and half a world away in an eternally covid lockdowned China. When you’re all doing reverse mortgages to replace your batteries I hope to still be revving that ol’ Detroit Diesel.

So basically CPI will still be in the 8 to 9 percent range next month?

It depends on services. That’s now increasingly the driver.

Well with the 10K student loan forgiveness plus the continued deferment on paying student loans, I think it’s safe to say people will have money to pay for services.

The forgiveness is much more than just the headline $10k student debt. The sum includes up to $20k.

The other very special item included is that there are new super low limits to how much monthly payment are capped at. With the delta in interest payments being picked up by the tax payer. So this is much more than just a simple injection of relief. Without future tripping to much, how much and when will the next vote buying Student loan package include?

Until it jumps back to goods.

I’ve been entertaining the idea of trading in the Bentley for a Toyota Mirai, but I really wouldn’t get much at all for the Bentley. There are plenty of other H₂ cars around, but I don’t really need a 1,600 hp Koenigsegg that can do 0-60 in two seconds with a thousand mile range because I’m not in that big of a hurry and don’t travel much by car (or rocket), although my chauffeuse likes the idea very much, and no, she does not want to talk to you and besides, it’s rude to stare.

If you’re thinking Canada when the worst happens with the fall elections you might like to think again, because they’re going to be very iffy about hordes of political refugees.

A guy I see often at parties has a Hydrogen vehicle, and I admit it is super cool. The only problem is that the Hydrogen availability is spotty, so you become a bit of a slave to notifications about fueling.

Your email address will not be published.

Forget “housing shortage.” It’s about crazy prices: For sales to revive at these mortgage rates, prices have to come down a lot, and they’re starting to.

Meme-stock crowd got crushed, shares collapsed 69% in 4 days. Billionaire hedge-fund hero, who might have known about unpaid bills, got out in time.

Not all commodities are plunging: Game of Inflation Whac A Mole.

Overall supply at retailers still 18% below normal, huge shortages in some segments, gluts in others. Thankfully, grocery stores only a tad below normal.

San Francisco & Silicon Valley lead. Southern California catching up. In Los Angeles, prices fell in July from June for the first since Adam and Eve.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy