THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

Home prices in Sydney and Melbourne – among the world’s most glorious housing bubbles –– are tanking, after inflation in Q2 hit 6.1% and is expected to go higher in Q3, and after the Reserve Bank of Australia hiked rates by 175 basis points since May, including 50 basis points in August, to a still minuscule 1.85%. And look what housing is doing: It not only failed as the much-hyped hedge against inflation, but it’s tanking.

In Sydney, home prices plunged by 2.3% in August from July and by 5.9% over the past three months, according to CoreLogic. Since the peak in January, the Home Value Index has dropped 7.4%.

And shockingly, home prices are now down by 2.5% from August last year. I mean, what kind of horror show is this?

In Melbourne, the Home Value Index dropped by 1.2% for the month, by 3.8% for the past three months, by 4.6% from the peak in February, and shockingly, by 2.1% from August last year.

Nationally, CoreLogic’s Home Value Index dropped 1.6% in August from July, the biggest monthly decline since 1983.

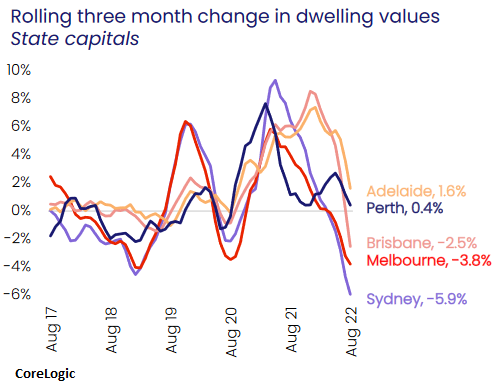

This chart shows the price changes on a rolling three-month basis for the big five capital cities (chart via CoreLogic):

“It’s hard to see housing prices stabilising until interest rates find a ceiling and consumer sentiment starts to improve,” CoreLogic said.

On a month-to-month basis, home prices fell in seven of the eight capital cities. Only Darwin hung on with a gain.

Over the three-month period, five capital cities have now booked declines, including Brisbane, which joined the club in August.

“It was only two months ago that the Brisbane housing market peaked after recording a 42.7% boom in values [since the beginning of the pandemic]. Over the past two months, the market has reversed sharply with values down 1.8% in August after a 0.8% drop in July,” CoreLogic said.

MoM

3 months

YoY

Median, A$

-2.3%

-5.9%

-2.5%

1,066,493

-1.2%

-3.8%

-2.1%

782,053

-1.8%

-2.5%

17.5%

762,284

-0.1%

1.6%

21.8%

652,959

-0.2%

0.4%

4.9%

561,781

0.9%

2.3%

6.3%

512,531

-1.7%

-2.6%

7.8%

909,748

-1.5%

-3.3%

5.8%

714,370

In Sydney, sales plunged by 35% over the three-month period through August compared to the same period last year; in Canberra sales plunged by 19%, and in Melbourne by16%, according to CoreLogic estimates. Across Australia, sales dropped by 15%.

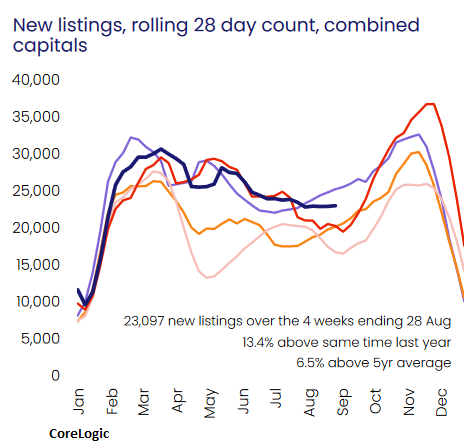

Going into the normally busy spring and summer season, “we are expecting to see less buying activity as higher interest rates and low sentiment continue to weigh on demand. Should this scenario play out, the net result will be an accumulation of advertised supply that could further weigh down values,” CoreLogic said.

And suddenly there’s plenty to choose from: “Sydney and Melbourne, where the housing downturn is more advanced, are already seeing total advertised stock rise to above average levels, and there is a good chance the other capitals will follow suit as listings rise through spring and demand continues to taper,” CoreLogic said.

Across the eight capital cities, the number of homes listed for sale was up by 11% from a year ago. New listings over the past 28 days in the capital cities where well above the prior three years, but down from 2018 (chart via CoreLogic):

This downturn comes after ridiculous price gains, driven by the RBA’s QE and interest rate repression. Price spikes from the beginning of Covid to the respective peaks earlier this year, according to CoreLogic data:

Home prices are down year-over-year in Sydney and Melbourne. But in terms of negative equity, most homeowners in those two markets who bought before August last year, and most homeowners in other markets who bought before 2022 still have positive equity in their homes, given the huge price spikes.

Across the eight capital cities, “a 15% peak to trough decline would roughly take CoreLogic’s combined capitals index back to March 2021 levels,” CoreLogic said.

In addition, buyers made down payments and paid down principal with their mortgage payments, which further increases their equity. And “the risk of widespread negative equity remains low,” CoreLogic said.

So no biggie – if the home-price declines stop magically at 15%.

Shane Oliver, chief economist at AMP Capital, a global investment manager headquartered in Sydney, told ABC News that this downturn may be the end of a 25-year housing boom.

“Residential property price downturns in the last 25 years have mostly been mild, with prices falling less than 10%, and brief, with prices quickly rebounding to new record highs as rates fell to new lows,” he said.

“This cycle may be different – both in terms of being deeper and taking longer to recover – thanks to a combination of high household debt levels, high home price to income levels, and an end in the long-term downtrend in interest rates,” he said.

If the RBA’s policy rate is raised to 4%, as the money market is projecting, he said, “this would more than double household interest payments and push total mortgage repayments to record highs relative to incomes and likely drive a 30% or so fall in prices.” But OK, it sure was fun while it lasted.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

“And “the risk of widespread negative equity remains low,” CoreLogic said.”

Is Australia similar to Canada, where a typical mortgage is 5 years fixed, then variable-rate after that?

Yes. Although before Covid, most home loans in Australia were variable, not fixed. Fixed found new favour in the past 2 years due to fixed rates falling below variable. Fixed rates spiked here late 2021 before variable rates rose in May this year with the RBA hikes.

So it looks like all Developed capitalist economies (US, Europe, Australia, Japan, Canada) played by the same playbook in pandemic.

Our central banks and administration clearly boxed themselves in without an exit strategy. Our symbiotic relationship with financialization of housing has yielded a parasite (asset bubbles) bigger than the host (real prosuctive economy) and there is no way to sustain it.

We can pretend to bleed this parasite slowly (deflate bubble with tiny rate hikes), but the host may not survive (economy will collapse as markets will keep lacking price rationale causing productionand businessesto remain unprofitable).

Or we can blow the parasite (Raise rate to Inflation + 2% instantly to kill financialization) and while host will suffer pain (all paper money would be lost, assets will correct 75% and many entities will go bankrupt), the host will survive (free markets will start working making production and businesses profitable again).

Happy Labor day weekend in the USA. This is the incorrect perspective. They did not box themselves in they boxed in everyone else. The plan is a plan and you ain’t executing it. It’s deliberate to crash the world economy. I know my views are inconsistent with the the nature of this article but … I am still correct and the sooner everyone wakes up the better. Stay in your home and do not leave if forclosure occurs. Tell the banks to take a hike down to Uluru. The banksters will not be sleeping in a duffel bags in San Francisco, so it’s time to make sure they did and that means we do not obey.

MiTurn,

Yes, similar. From my article a month ago:

In Australia, the most common mortgages for owner-occupied homes are mortgages with a “variable rate” that adjusted with changes in the market and mortgages with a “fixed rate” that are fixed for only one to five years.

The share of “fixed rate” mortgage origination of total originations peaked between July and August 2021 at 46%, according to the housing finance data by the Australian Bureau of Statistics, cited by CoreLogic.

“Due to record high levels of debt, indebted households are more sensitive to higher interest rates, as well as the additional downside impact from very high inflation on balance sheets and sentiment,” CoreLogic noted.

“Borrowers who locked into a fixed term mortgage rate through the pandemic growth cycle will be facing a significant refinancing burden next year,” CoreLogic said.

“RBA analysis is forecasting a surge in fixed loan expiries throughout the second half of next year,” CoreLogic said. “Many of these borrowers could be moving from mortgage rates around the high 1% to low 2% range to a mortgage rate closer to 6% or higher.”

Wow. Read that twice. That means that some of these economies have a hidden whammy coming to them. Any thoughts on if the government will intervene and change their mortgage lending operations to avoid catastrophe?

Their day of reckoning approaches. It doesn’t matter what the government does or doesn’t do.

Don’t worry if you own your own house and it is viewed as a place to live and not as an investment, what is the panic?

The only people who are freaking are investors.

> The only people who are freaking are investors.

Or people whose balance sheets will feel a rapid rate hike of five percent on the loan balance. Or people who rely on the previous ones to spend money to keep their own businesses going. It all spells a cascade of less spending money, in order to make the payment on an existing loan for the (same) house.

If you’re still paying a mortgage loan, and the rate triples, you may not be able to pay the higher rate – forcing a sale. If enough people are in similar situations, the housing prices fall – putting them underwater. This forces more sales, pushing housing sale prices still lower – and we’re re-playing the Great Recession.

Pity Alan Greenspan decided that a bubble-based economy would help get Republicans elected. Another gift from Ronald Reagan

The “Greenspan put” was a monetary policy strategy popular during the 1990s and 2000s under Greenspan. Throughout his reign, he attempted to help support the U.S. economy by actively using the federal funds rate to aggressively lower interest rates to fight the deflation of asset price bubbles.

At these prices, homes ARE the largest investment most people make and they are leveraged. In the US, we can walk away from mortgage debt, which allows the market to clear itself faster and tends to reduce bubbles. In Canada, those poor homeowners can be sued for the loan value when a home has negative equity. So those suckers bought homes where the interest rates will reset and they cant just walk away.

Very ugly situation. I’m not sure if Australian homeowners can walk away.

they bet on their housing market like a pony race? sorry i cant realize the time to understand this.

surly although there is a banking institute spreading its wings and laughing.

> there is a banking institute spreading its wings and laughing

Except if it goes far enough, it is sitting on a bunch of non-performing loans: its basic business gone bad. Maybe it laughs if it has a rich public bailout. I am still waiting for that magic hat someday to come up empty.

Thank you for another great article on the worldwide housing busts. It sounds like Australia is headed for a major housing crash when their fixed loans expire next year. By the time it’s all said and done, I wonder which country will have suffered the worst housing crash.

The major cities in Australia and Canada are among the most overpriced to my knowledge, relative to median incomes. England isn’t exactly cheap either.

China has the biggest housing bubble in the world. Maybe Japan was bigger in the late 80’s but I’m not sure about that. An outsized proportion of China GDP is tied to housing,

Chinese buyers have also been big buyers at the margin in numerous other countries: major cities in Australia, Canada, parts of the UK, and US west coast.

In the US, government is going out of its way to make as many enemies as possible.

The Chinese housing market is headed for a crash. Government can’t prevent it forever.

Many Americans think that Chinese won’t repatriate assets out of the west by selling houses in big volume but don’t be surprised if US foreign policy at some point motivates them to do it anyway.

Syd prices still 70% over fair value.

Nick,

How on earth can anybody determine “fair” value anymore…

I think that’s going to be tough metric going forward….

I think that generally “fair value” is related to mortgage payment versus income levels. My guess is that for a doubling of payment, the number of households that can afford a given home price has dropped by 75%.

It appears to me that most of the new housing sales are people who are trading equity from one home to another.

Once home prices have fallen for a year straight and are down 30%, then the psychology will change and people will expect another large downturn, which will result in homeowners demanding a very low price to put their money at risk.

I just wonder if the central bankers will be able to lick inflation and then bring mortgage rates down, because otherwise, home prices will not have a safety net under them and could really get hit hard. I think 2016 prices could be seen again. In worst case scenario, it goes back down to 2008 levels.

Depending upon the country, that’s where mortgage and foreclosure moratoriums come in.

It won’t solve the problem of spiking interest rates from the end of the 1981-2020 bond bull market which will eventually crush demand at anywhere near current prices, but it can alleviate supply to some extent.

How much of the DownUnder bubble is associated with Chinese investments of RE?

I am so glad (here in SoCal) I switched to a fixed rate in 2010. I expected inflation to surge then, never imagining this interest rate suppression would go so far, so long. I wondered show I could seemingly be so wrong, so long. Now the backwash is a global wave. How steep and fast and deep and quick to recede though, is a next interesting question.

Australians have never seen a genuine real-estate crash. The media here continues to pound on how Australian real-estate only goes up. The bubble here is tremendous, far greater than anything in North America. Even remote farm land is absurdly expensive.

The crash will likely be breathtaking. Probably will be greater than the Texas real-estate crash of the mid 1980’s.

Maybe Xi will show up with a bail-out bucket and a contract or two in hand.

Didn’t Australia go 29 years without a declared recession, from 1990 to the pandemic in 2020? That’s what I heard.

Australia also avoided the worst of the Great Depression in the 30’s from what I read.

It’s called the “Lucky Country” for this reason and a few others.

My opinion is that, for a variety of reasons, their luck is about to run out.

I’m a seppo that has lived, worked, and gone to school in oz over the past 4 decades, with my last visit being in 2016. Even back then it was obvious there was a massive bubble – everywhere I went RE was the topic of conversation. It would be interesting to calculate how much of GDP is related to RE – building and remodeling by the trades, plus sales and advertising. Has to be a huge percentage of their total compared to the US. Other than that, the economy sells it’s raw materials to Asia, primarily China. Aussies recognized this back in the mid 2000s, telling me they dig holes and sell the contents to China. If the west is moving towards a decoupling from China, then Australia will finally take a hit and with all the leverage things could get sporty.

And NZ is even worse. They have very little of an economy. Plenty of sheep though, including the kind that walk on 2 legs!

You can add New Zealand to the housing bust club. Extraordinary bubble popped by rising interest rates

Same thing in Sweden. I expect prices to fall more than they did in the last crisis, 1989-1991, when they were down by 50%. Additionally, all debts here are personal, so handing the keys to the bank is not an option.

The issue is that we have had a 30 year rally in bond rates and so the real estate markets have always had lower interest rates and lower payments to goose the bubble higher. Now that it has reversed dramatically, the home prices will plummet.

Real estate takes a long time to fall because sales prices are always built on comps. So if comps fall by 5% in a month, that is used as the new measure for a sale. It just takes successive months of comp declines to decrease the prices.

Anyone looking to buy a home should instead look at affordability of payments for a neighborhood versus the incomes in that area. You want to be buying a home at a price where other people can afford to purchase it, because is not what YOU can pay that matters, it is what others who want to live in an area can afford to pay that matters.

I notice that inventory on market seems to be falling as owners just pull homes off the market. This is the type of stupid psychology that prevents people from selling at the top price they can get. As comps fall, the price people will pay for a home only goes down from here. Unless the Fed lowers interest rates, which seems unlikely.

Bond bull market 1981-2020, almost 40 years.

I should also add that in Australia, being on a fixed rate invariably means the borrower is also paying interest-only, not principal and interest. Not sure if that is the same as Canada. So the sticker shock on repayments is magnified when the day finally arrives. In the current environment (rising rates, falling house prices), most borrowers will be forced onto principal and interest by their banks. Ouch.

The press here is spruiking “a severe skills shortage”, and it was just announced that they will be increasing the immigration cap by around 35000. I think the so called skills shortage is just a cover for getting some more of that sweet Chinese money, to try and keep the bubble inflated.

Mmmm. I think we are done with the yuan. Looks to me like we are now going after the rupee in a big way. I suspect that a lot of Indian immigrants have been suckered into the Great Australian Dream in the past few years by the big Australian banks (one in particular comes to mind) and will be over-represented in the casualty count.

The other ‘fun’ thing about here in Australia compared to the US is that you have to pay the full loan back personally even if you return the keys to the bank. If the property resells for less than the loan amount, the bank comes after you for the balance. Garnishee’d wages, seizure of other assets, even force you into bankruptcy. No such thing as jingle mail in Australia, and so people with big mortgages on recently purchased homes start to get very worried when rates rise and prices drop.

This is a misconception about the US that even many Americans have, to their own detriment. Only 12 states in the US have non-recourse mortgages. The rest of the 50 states and DC have full-recourse mortgages where the lender can go after all assets and income of a defaulted homeowner:

https://wolfstreet.com/2018/06/20/us-style-housing-bust-mortgage-crisis-in-canada-australia-recourse-non-recourse/

Both me and my brother went through foreclosure in Illinois in 2009, which is a full recourse state. The bank just took the houses and never came after us, probably because there were just too many foreclosures going on at that time.

Not sure that is accurate. There are states where deficiency judgments sometimes happen, or happen with certain property but not others, or are unavailable for non-judicial foreclosures (faster, cheaper) but available for judicial foreclosures.

Here’s a list done in 2010 on deficiency judgments. https://activerain.com/blogsview/2460281/deficiency-judgments–state-by-state-guide—how-to-avoid-a-judgment They are all over the place and states like Maine are known as recourse states but the recourse sucks as it’s fmv of home. Also it’s a 12 year chart.

Point being — I think the real question is how many states commonly have deficiency judgments as part of the actual foreclosures for owner occupied homes? I think the answer is likely less than 38 plus dc.

Nate,

You’re confusing recourse mortgages with the difficulties in some states to actually collect from the borrower anything beyond the collateral (the house).

It’s always difficult/impossible to collect bad debts, except from people with some wealth: What are you going to collect if they don’t have anything?

When you lose your job, and you burn your cash, and then you cannot make your mortgage payment, the collateral (the home) may be the only thing the bank can actually get because you no longer have anything worth going after. And if the bank goes after your other (non-existing) assets and income anyway, you can file for bankruptcy protection, and the bank will spend lots of money collecting nothing or nearly nothing beyond the house. That is the reality.

So, if there is a trickle of foreclosures, banks will go after people to harass them and to set an example, even if they don’t collect much or anything.

But if there are waves of foreclosures, such as during an unemployment crisis, banks will just go after the collateral but won’t go after the borrowers’ assets and income because it doesn’t make sense and banks don’t want to waste the resources.

In addition, loans in the 12 nonrecourse states mentioned by Wolf cost more (slightly higher interest and/or points) than loans in recourse states. Banks know when a loan is not recourse and charge accordingly. There’s no free lunch.

I’m in a non-recourse loan state but there’s a wrinkle: it only applies to the first 1st trust deed. If you have second TDs or more, or you refinance your first TD, you lose the non-recourse status.

Yes. And if one buys a house for cash/no mortgage and then later finances a mortgage it is considered by the lender as a ‘refinance’.

Yes but then the lender has mortgage cramdown concerns in BK Chapter 13.

This adds up to the mother of all nutcrackers. Sure does a lot to dampen to COVID era housing frenzy.

Wolf,

Looking at those goofy-high median (median!!) values for cities that likely make up the vast majority of Australia’s entire population, I cannot but reflect upon the fact that the *whole point* of central bank gutting of interest rates is to stimulate *primary investment* (like *building* of houses, among other investments in asset *creation* – which increases employment) and that valuation spiking in “secondary investment” (in *existing* assets, such as already built houses) is simply an unavoidably prod and byproduct (and one that doesn’t raise employment).

(It would be really great if you could do a primary v. Secondary investment post, explaining these different channels of interest repression effects).

But since there is no universe in which the true production cost to build big wooden boxes in the empty *continent* of Australia, come anywhere near those median values (unless *insanely* inflated by outside forces – building codes, gvt taxes/regs, union minimum wages at nosebleed levels) there is clearly some massive artificial restraint on increased housing supply in Australia.

At those stratospheric medians (medians!!) for the majority (majority!!) of the population, everybody and their dog (er, dingo?) would be going into the homebuilding industry.

Unless there is some massive artificial impediment to new *supply* (which is really the sole basis of interest rate cut legitimacy – higher employment, higher production, etc. Diddling speculators – entirely – is not much of a legitimate reason to expropriate savers. Let alone for decades on end).

Australia is gigantic and empty – it is the exact opposite of Hong Kong.

There is no sane explanation for production costs at those levels (how much did it cost to build an Australian house pre-ZIRP? One-fifth? One-seventh?)

Building a house in Australia is indeed absurdly expensive.

“In April 2022 the figures from the ABS suggested that, on average, building a home cost around $473,000 (including houses and unit data).”

Of course, the land is also insanely expensive.

Yes, but the question is *why*?

Australia is a friggin *continent* – huge…and with very few people for its size. Population density nationwide is tiny compared to many other less expensive locations around the world.

Does Australia have no wood? Lack the technology of the “nail”?

I am exaggerating…but the broad point is accurate…none of the standard cost inputs seem to remotely justify the cost to build a new house (which directly affects the possible sale price of existing homes).

Do three people own the entire continent? Not that I’m aware of (but there may be hugely concentrated ownership…perhaps even by the governments themselves…Aussies let us know.)

Do 75% of the workers go for into programming/gender studies activism/blogging/etc, so there are only six construction workers on the continent? Again, I don’t think so – at $750k *medians* (possibly *nationwide*) there are likely no industries more profitable than homebuilding…so construction workers should be pouring in to the industry. If not, why not?

When you see price distortions on this scale, in a central industry, there are always a *lot* of impediments to competition…and therefore supply.

Aussies…let us know.

In PHX, AZ, there is no shortage of land either. Houses are still overpriced and most housing lots are small or tiny, especially on newer homes.

I always assumed it was infrastructure costs and resource constraints. It isn’t viable to build housing just anywhere in AZ due to water supply if for no other reason. I suspect this is equally true in Australia. Most of it is at least as much of a desert (semi-arid), to my knowledge.

Housing sentiment has changed. Everything I read says housing crash and at least a 20% drop.

I would probably say a crash would be defined as 30% or more?

Bring it on.

I would like to see the stock market drop at least to pre covid values before going long.

Fascinating report. I have a friend that had been buying homes in Perth (5) since 2010 and kept looking in Sydney but never could pull the trigger. He used those as his savings and investment for retirement with 4 of them empty for years. So there could be even more supply that becomes available as investors try and beat the price drop.

Empty homes as an investment?

I am struggling for the words here…bewildered, gobsmacked, confused…

Why would he leave them empty? He is in Perth, so maybe he was the one being shorn, not the sheep down the street.

The somewhat real stock market price was around mid 2014. It’s been bubble ever since. Housing market true values were the ones briefly seen during the depth of 2010. That’s where it needs to be, and then any upswing justified by local economy’s productivity. Pensions for government employees need to be scrapped and everyone needs to be in the 401k wagon.

The median family income was $45k in 2008 and it is now over $65k. That does support some house appreciation. Of course, daily living expenses are higher too. Mortgage rates are also lower now than in 2008.

The US stock market has been in a mania this entire century, with temporary periods (2002, 2009) of “reasonable” valuation but not even close to “cheap”.

US Housing in 2010 was a lot more “fairly valued” than US stocks at any point this entire century, at least outside the more/most expensive markets.

I say a local store that used to advertise starting pay at $12 about 4 years ago is now advertising $20. That is over a 70% increase.

And when you factor in the inflation in rents and everything else, they are worse off than 4 years ago.

The only thing that saved me is locking in a good mortgage and avoiding frivolities and debt. I could not rent the home I now almost free-and-clear own. I would be sleeping on the sidewalks I now look upon peacefully, but for the harsh discipline of saving up for that down payment long ago. No new granite countertops, no new truck in 2007! No trips to wherever.

I love my job but it pays nominally flat for ten years now. That means down 20+ percent in real terms. My retirement account is a joke. So much for all the popular myths about government job free rides.

The scariest part: I am 80th percentile in household net worth in the USA. 80 of every 100 households are below me. What did Lenin say? “Every society is three meals away from chaos.”

QT will be interesting as they reduce Treasuries by 60 billion and MBS by 35 billion. I would not be holding stiocks right now.

Bank of America equity strategist Savita Subramanian says QT alone could lead to a 7% stock price drop as the boost from QE is reversed. Steven Major, global head of fixed-income research at HSBC, thinks the interaction of QT and the plumbing of the financial system is too complex for anyone to predict properly. “The truth of it is that no one really knows,” he says, including the Fed.

Glad to see Australia get a bit of coverage on WolfStreet! I’m an American who has lived in Australia for 15 years and bought here in Sydney in 2020 putting our 15 years of savings down as a 50% deposit (our 1 bedroom unit we were renting drove us nuts during the first lockdown).

There are a couple Australian peculiarities that might not be clear to Americans.

First – there is no ongoing land/property tax. Instead you pay all the tax upfront as the “Stamp Duty”. In our case in NSW it was 4.5%. But once you have paid that you never basically pay tax on the house again. You instead pay “council rates” which are like the fees to get your trash picked up – and they are a few hundred a quarter. This also dis-incentivises selling/buying houses (including downsizing as a retiree) as you pay this big upfront tax on the transactions.

Second – the government excludes the value of your house from any asset tests on your eligibility for benefits/entitlements in retirement. So if you have a multi-million dollar house fully paid off but little other assets/income they consider you as poor as if you didn’t have the house and you get all the benefits like the full pension etc.

So, the system incentivises buying the biggest baddest best located house you can afford before retirement. And if you don’t get it paid off by retirement our version of the 401k (Superannuation) lets you take a lump sum payout of that at retirement age to pay it off. Thereby removing all the assets you have rolling them into the “we don’t look at your house” blindspot to then qualify for the pension etc.

Basically the deck is stacked here soo strongly in favor of your house being your main asset that it is pretty nuts…

I forgot the other big one – there is no capital gains tax on your “primary residence’s” increases in value either.

Like I said it is like every policy lever you can imagine is favorable to putting your money into your house…

Sounds to me like the Aussie government is begging for a fiscal crisis somewhere up the road.

An interesting USA tangent on government subsidizing stuffing money into housing: I’m told Texas and Florida have an unlimited homestead exemption on one’s primary residence. So, there is an open invitation for anyone thinking of future adverse judgments to settle there and, say, buy a palace on the beach. A pal in debt collections said it was always hard to get anything out of there.

But I think those places have low income taxes but make it up in property taxes? Not sure.

Texas homestead exemption is not that generous. With the homestead exemption, your taxable value can’t increase by more than 10% in a year, and some taxing authorities reduce your value by an amount/percentage before applying the tax rate (e.g. $25k for the school district). The 10% cap is useful in a crazy year like 2021, but your taxable value will probably catch up to market value eventually given a downturn or some years of slower growth.

Clarify the homestead exemption:

The portion of value on which you are exempted from taxes or the part which is shielded from non mortgage holding creditors?

You’re confusing a homestead exemption (a property tax benefit) with state bankruptcy laws which allow the person to keep designated assets (not secured by a loan included in the filing) from creditors.

Nice summary…

And lets not get stated with all the cash handouts to home buyings in terms of first home owner grants etc….

The Australian share market mostly looks pretty sane compared to the US share market and its irrational exuberance. But we make up for it with our property market.

I have the popcorn out and will be watching the housing market implosion with interest. I did stop renting in 2021 and bought which would normally put me in high risk category, but I bought something fairly modest for my income and that was well below market price so I am safe. I could pay the entire mortgage off before my 4 year fixed period ends if I have to.

How did you manage to buy a property well below market price?

Luck. Nobody else had inspected it and my offer was the only offer on the table when COVID a lockdown occur banning further real-estate inspections for an unknown extent of time.

Other than that you’ll just have to take my word it. My property is fairly commodified in the area and like for like comparisons can be made. It isn’t anything special I did say that it was a modest home.

Thank you…that explains some of the insanity.

Tax preferences have hugely distorted the housing mkt by granting “homes as an asset” insane advantages.

And now the politicians are too terrified/cowardly to even dial back the doomed madness a bit.

Add in the leverage almost always used, and you have a recipe for a madhouse mkt.

What about restrictions on supply? Are there any? With these huge tax shelter biases, people should be building homes for dingos, koalas, and kangaroos.

– Even at the peak of the housing market (think: last year, 2021) there were some 800,000 to 1 million of empty dwellings in Australia. And this (hidden) inventory is now also coming out of the woodwork.

– Australian banks are putting their borrowers under gentle but increasingly more pressure to put their (investment) property up for sale. These banks have noticed that the financial position of a borrower hadn’t improved in the last say 12 months.

– 42% of australian households are in “Mortgage Stress”. I.e they have a mortgage and the household’s expenses are larger than their income. No wonder, more and more households want to sell their house.

16 Million Empty US Housing Units in the 2020 census.

16 million

“At a time when household units are forming faster than homes are being built and many Americans can’t find a home at all, it may come as a surprise that nearly one in 10 American homes — more than 16 million in all — were “vacant” when the 2020 census was recorded.Mar 10, 2022”

But unless you are really, really rich, an empty, unrented/unoccupied SFH is a huge cashflow drain.

Property taxes are actually a wealth tax (usually on leveraged debt…) so from a cashflow perspective, SFH ownership pretty much blows…*especially* if you keep the sucker empty.

(I tend to be a bit skeptical of the “hidden illuminati” of an army of empty SFH, cash bleeding billionaires keeping falling assets off mkts for years for kicks…there are plenty of cash flowing assets in the world for them to own.)

If anyone in the U.S. over the last decade purchased a house using a variable mortgage, it was because he wasn’t thinking straight. If you got a mortgage at, say 2 or 2 1/2%, where did you think the rates would go? But the U.S. had mind-bogglingly low interest rates long enough for an entire generation to think that they were the norm, when, of course, they aren’t. Smart buyers locked those low rates in for the duration, which, if you bought the house as a home, rather insulates you until you decide to downsize.

JoAnn,

Very true…

This “gotta buy a house” psycho mania has yet to play out but will soon…

I was severely chastised here ( Depth Charge) for saying that prior to the pandemic, if you didn’t have a house already, you either couldn’t afford it or didn’t want one…

Those of us who had been around a while knew that rates were bound to go up sometime and got while the getting was good…

Getting financially neutered by social media and fear should be a very painful lesson for the participating losers who should have absolutely no gripe with the winners… after all, you gave it to them…

There is a time to do and a time not to do…

These past couple of years has been a time not to do, just sit in the corner, eat your popcorn and watch the show…

This summer Robert Shiller predicted a housing downturn is likely in America, only not as severe as in the 2007-2011 Great Recession.

Yahoo quoted him:

“However, 10% declines, like Shiller suggests, are very rare. Only the Great Depression and the Great Recession have seen price cuts of that magnitude.”

With 6% real estate commissions and other buying and selling costs, it may be a good idea not to attempt to do short term trading in real estate. I will keep my home, I live here.

“I was severely chastised here ( Depth Charge)”

What, for being a house-horny, gloating speculator?

And the Chihuahua flies out of the house chasing the school bus again…

Knew that would get ya fired up…

Ya know, brother, some fish steadfastly refuse to take the bait…. )

COWG,

But how about the 16% of mortgage holders who got zero’ed out by foreclosure in 2008-12? (8 million families, out of 50 million with a mortgage)

I’m sure they had realtors telling them in 2004-2006 they “had to” get while the gittins’ good.

And now, *nationwide* (unlike Bust 1.0) median home “values” are significantly *higher* (although, thank god, on lower volume).

Fed ZIRP cycling has turned the housing mkt into a schizophrenic madhouse and *guessing* when it is a good time to enter the door will determine financial survival/destruction.

That doesn’t make for a healthy, stable society.

Canada Australia US and I’m would not doubt EU is experiencing the same phenomenon with raging inflation yet falling home prices. Interest rate suppression and the QE from the worlds central banks have created a mess . Speculators and miss allocation of free money lending across the globe. First the ridiculous implosion of Wolfs famous list of companies starting in Fed 2022. Now globally housing which takes years to unwind. China of course is in the same category. Well done. Do Australia and Canadian home owners have the same cash out refi like USA?

Shit got real:

“Bed Bath & Beyond’s chief financial officer commits suicide by jumping from New York City skyscraper, days after announcing job cuts and store closures”

Suicide of middle-aged men is a HUGE problem in the US. I personally knew two guys who did that, early 50s one, 60 the other. It’s a terrible issue. It’s often associated with years of deep depression. The brain-dead click-bait media is using personal tragedy to get clicks, and some morons then turn this click-bait media shit into viral headlines by spreading it.

Where do fixed-rate mortgages leave lenders, as their own cost of capital rises?

Policy and market rates could easily go above what mortgage providers are charging fixed-rate borrowers.

Is this very bad for lenders – and offering long-term fixed rate deals will turn round and bite them – or am I missing something?

“…or am I missing something?”

Yes. Most fixed-rate mortgages are securitized into MBS which are then sold to investors, pension funds, bond funds, insurance companies, and central banks around the globe. Lenders have thereby offloaded most of the risk of home mortgages to investors.

So losses are made, but by investors, not lenders? Got it.

Yes, just like regular bonds, no difference.

Things not looking good for the price decline deniers.

Your email address will not be published.

Interesting stuff happening in the labor market, suddenly.

It sticks to plan, QT like clockwork: What the Fed did in details & charts, and my super-geek extra-fun dive into the “To Be Announced” market for MBS.

Huge losses, but now revenue growth is slowing. Hilariously, executives refer to the huge losses as “profitability.”

“Temporary” inflation is suddenly runaway inflation. But the negative-interest rate idiocy and QE are finally over.

The Case-Shiller index, which lags 4-6 months, is starting to pick up the price drops in Seattle, San Francisco, San Diego, Los Angeles, Denver, and Portland.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy