Darren415

Darren415

Co-produced with Beyond Saving

Today we are returning to our “how to” series. We’ve previously covered reading a balance sheet and the income statement. Today, we tackle the Statement of Cash Flows.

As income investors, we love cash flow. At the end of the day, cash flow is what determines how much a company can afford in dividends. In our prior articles covering the balance sheet and the income statement, we discussed GAAP accounting which uses concepts like “straight-lining” to smooth out revenues and expenses. While these concepts are designed to provide a clear picture for the long-term, they can sometimes muddy the waters if we want to know if a company can cover its dividend today.

The Statements of Cash Flows is an important data source when doing your due diligence. It has some benefits:

It also has a few drawbacks we need to be aware of. The Statements of Cash Flows only reports cash transactions after they happen. This means we need to be very careful about annualizing any of the numbers. Looking at the Statements of Cash Flows alone could result in misleading conclusions. We always need to consider the information in conjunction with the Income Statement.

The Statements of Cash Flows is always broken into three main sections:

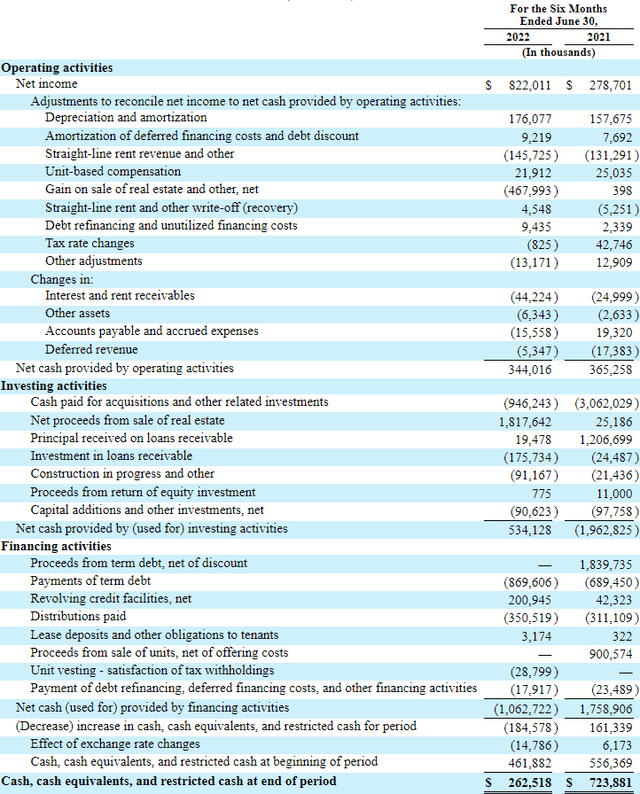

When you add all three together, you’ll arrive at the net change in cash from the prior period. We will continue to focus on Medical Properties Trust, Inc. (NYSE:MPW), which we used in our prior articles on the balance sheet and income statement. All images are from the MPW 10-Q for the period ending June 30, 2022.

MPW 10-Q

MPW 10-Q

Let’s look at each of these three sections individually.

Cash from operations or “Operating activities” tells us how much cash a company generates from its day-to-day activities. It always starts from GAAP Net Income, which was the final number arrived at on the Income Statement that we discussed in the previous article.

The statement then adds back non-cash expenses and subtracts non-cash income. Numbers in parentheses are subtracted, and numbers that are not in parentheses are added. We’ll detail each line item below.

MPW 10-Q

MPW 10-Q

Depreciation and amortization are generally substantial for real estate investment trusts (“REITs”), MLPs, and other companies with long-term real estate holdings. GAAP recognizes a charge every year based on the purchase price of the property, which reduces the carrying value of the real estate on the balance sheet. Yet real estate does not always depreciate. Real estate can often be sold for a higher price in 10, 20, or 30 years than it can be sold for today. In many cases, the underlying land will gain value even if the building itself becomes obsolete.

Amortization is similar in that it recognizes an already paid cost over time. For example, leasing commissions are often amortized. If a leasing contract pays a commission of $100,000 for a 10-year lease, the income statement will recognize a charge of $10,000/year during the life of the lease to tie the expense to the revenue it generates. However, the actual expense is typically owed upfront. The income statement will amortize expenses to smooth them out, and the statements of cash flows will recognize expenses as they are actually paid. MPW differentiates between amortization of real estate-related expenses and amortization of financing costs – the fees that MPW paid to issue new debt.

Since these are non-cash expenses, they are added back.

We discussed the “straight-lining” of rent extensively in our article on Income Statements. As a reminder, GAAP requires companies to report leases on the Income Statements as if rent were consistent throughout the life of the lease. In reality, most leasing contracts have rent that changes throughout the life of the lease. In MPW’s case, they have annual escalators that will increase the rent every year. This means the rent in 10 years will be much higher than it is today. As a result, there is a significant amount of rent that is recorded under GAAP rules that actually won’t be paid for many years.

The cash flows statement is where you go to find out how much that number is so you know how much cash rent MPW collected. The straight-line revenue will be subtracted when straight-lined rent is higher than cash rent. It will be added when cash rent is higher than straight-lined rent.

For most corporations, a significant portion of executive compensation is in the form of new shares. Since issuing shares is not a cash expense, this expense is added back here.

Real estate sales are recognized as a gain or loss based on the sales price relative to the carrying value on the balance sheet. The cash flow from an asset sale will be recognized in the cash from investments section. Therefore, the impact is backed out in cash from operations.

If the company recognized a gain, it is subtracted, if the company recognized a loss it is added. MPW recognized a gain on sale of $467,993,000, and that is subtracted.

Straight-line rent that is recorded through the income statement but not paid by the tenant accrues on the balance sheet. If you recall our article on the Balance Sheet we discussed “straight-line rent receivables.” In the event that a property is sold, the lease changes, or another situation occurs where the ability to collect previously reported straight-line rent is in doubt, an expense is recognized on the Income Statement to reduce receivables. Since it is a non-cash expense, it is added back here.

The cash-flows statement will recognize actual taxes paid, not non-cash adjustments that run through the income statement.

Backs out any other non-cash expenses/revenues that were recognized. This will include any loans that are “PIK” (payment-in-kind) where MPW is paid by the principal of the loan increasing and also fair value adjustments that flow through the income statement.

While itemized, these are all similar. They are changes in the balance sheet of money owed to MPW or owed by MPW where cash has not yet been exchanged. Remember, GAAP is accrual accounting, which reports revenue/expenses as they are earned, not when they are actually paid. This section accounts for the difference between GAAP and actual cash that exchanges hands.

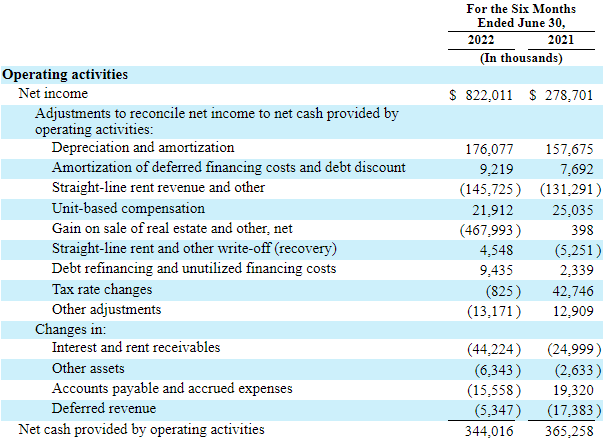

Cash from investing activities tends to be very lumpy. This includes acquisitions, dispositions, capital expenditures, and cash flows from other investments like joint ventures. This type of income or expense typically is not level month to month. So you will frequently see huge differences year over year. For example, in the first 6 months of last year, MPW’s cash from investing activities was negative $1.962 billion. This year, it was positive $534 million. Nearly a $2 billion difference!

MPW 10-Q

MPW 10-Q

Let’s look deeper at what we find in this section.

Both of these are different sides of the same coin. REITs both buy and sell properties most years. In the first half of last year, MPW had significantly more acquisitions and fewer sales. This is consistent with what management has been telling us to expect. They have guided for fewer acquisitions this year as they focus on deleveraging, although $946 million is still a good pace.

Note that these amounts are the actual cash paid for acquisitions or received from dispositions. It is not their profit or gains. With property sales exceeding acquisitions in the first half, this explains why cash from operations was slightly below last year’s pace.

The next two line items are similar to the last two, except they cover proceeds and investments in loans instead of real estate. The principal received from loans being paid off will include balloon payments, prepayments, and recurring principal payments on loans. Interest payments are not included. Those would be included in cash from operations.

Principal proceeds from existing loans are added, while MPW’s investment into new loans is subtracted.

Some REITs might call this “capital expenditures” and lump everything together. MPW differentiates between investments in new construction and additional investment in existing properties.

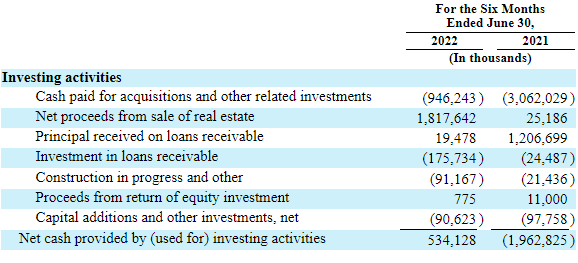

If we want to see when these investments will start paying off, we can look up “development activities” and MPW has a chart showing the estimated completion of their developments.

Development Activities

During the 2022 second quarter, we agreed to finance the development of four new projects. One of these development projects is a behavioral health facility in McKinney, Texas with a total budget of approximately $35 million. This facility will be leased to Springstone, LLC (“Springstone”) pursuant to the existing long-term master lease. In addition, we agreed to finance the development of and lease three general acute care facilities located throughout Spain for a total commitment of approximately €120 million. These facilities will be leased to our existing tenant, IMED Hospitales (“IMED”), under a long-term master lease agreement.

During the 2022 first quarter, we completed construction and began recording rental income on an inpatient rehabilitation facility located in Bakersfield, California. This facility commenced rent on March 1, 2022 and is being leased to Ernest Health, Inc. (“Ernest”) pursuant to an existing long-term master lease.

MPW 10-Q

MPW 10-Q

Note that MPW has already invested $149.5 million and intends on investing another $232 million for projects that will be completed over the next two years. This means MPW pays the money today, but the benefit of rent won’t be realized until the future.

As investors, we need to be aware that companies often invest capital and will not see an immediate return the next quarter. Investors who are staring at current earnings but ignoring future earnings from capital that has already been spent will be surprised when a company outperforms. HDO enjoyed a very successful investment in Iron Mountain (IRM) because we identified the future benefits from their significant investments that took years to start paying returns.

Looking at the cash flows and recognizing investment capital that is being put to work with a delayed return is one way to identify potentially underpriced opportunities.

MPW occasionally makes equity investments in the operators it leases to. When they receive cash from these equity positions it will be reflected here.

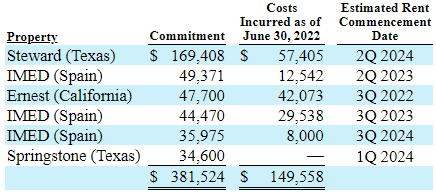

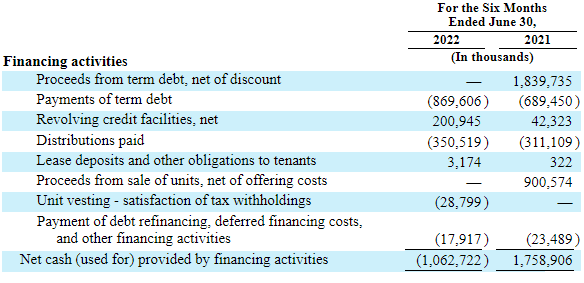

The final section is cash from financing activities. This will include cash flows from taking out or paying off debt, dividends, and other capital market activities.

MPW 10-Q

MPW 10-Q

These three are self-explanatory. How much did MPW borrow? How much did they repay? Some companies will have borrowings and repayments on the credit line listed separately. MPW chooses to consolidate it and report the net change.

This is a very quick way to see if a company is borrowing more money or paying down debt during the period. For the first half of 2022, MPW paid off $869.6 million, while it increased borrowings on its revolving credit by $200.9 million. So in the first half, MPW reduced debt by about $668 million. This is consistent with what management has said on the earnings calls, that they expect to reduce debt and any acquisitions will rely more on equity than issuing new debt.

Note that dividends paid reflect what was paid. It does not necessarily reflect future dividends owed if the share count is increasing.

As a reminder, the statement of cash flows shows all cash flows. Lease deposits are cash flow to the company, even though the company has no right to spend that money unless the tenant violates certain contractual agreements. When you rent an apartment and pay a deposit to the landlord, and the landlord owes that money back to you at the conclusion of the contract unless you damage the property or otherwise default on the lease. So MPW received just under $3.2 million but carries a liability to the tenants for that same amount.

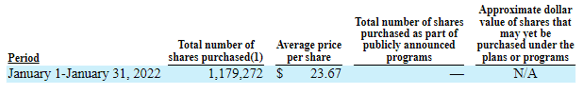

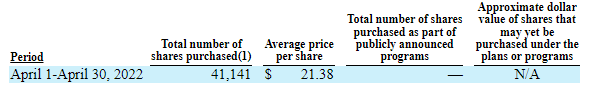

Every once in a while, you come across something that doesn’t make immediate sense to you. You’ll ask, “what is this?” When stocks vest, the recipient is responsible for selling shares to satisfy the tax obligation. So why would the company be paying it? This is where you can put your research skills to test. Search the 10-Q for “tax withholdings,” and you find your answer:

MPW 10-Q

MPW 10-Q

MPW 10-Q

MPW 10-Q

MPW opted to do a small “back door” share buyback. Instead of having the executives sell shares in the open market at low prices, MPW bought back the shares that were required to be sold to cover tax obligations. This prevented an additional 1.22 million shares from reaching the market and holds the share count down.

This category covers the cash costs that MPW pays for financing. Prepayment fees, origination fees, facility fees, and other financing-related charges will all be listed here.

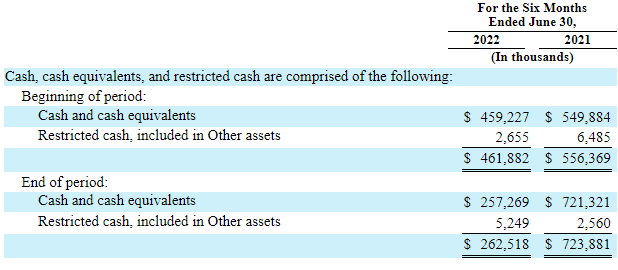

It all leads to the bottom line. How much cash MPW had at the beginning of the period, and how much at the end?

MPW 10-Q

MPW 10-Q

In the first half of 2022, MPW’s cash flow was negative $199.3 million. But before you run around in fear, we can see where the money went.

MPW received a positive cash flow of $344.016 million from operating activities and $534.128 million positive cash flow from investing activities. The negative cash flow for MPW was ($1.062) billion in financing activities. Specifically, a $668 million reduction in debt.

In our book, that is a good thing, and it fits with the story that management has been telling us for 2022.

Shutterstock

Shutterstock

On its own, we have to be careful in drawing conclusions from the Statements of Cash Flows. We can’t annualize the numbers because cash flow can be very lumpy. We also need to remember that this statement will frequently include one-time items.

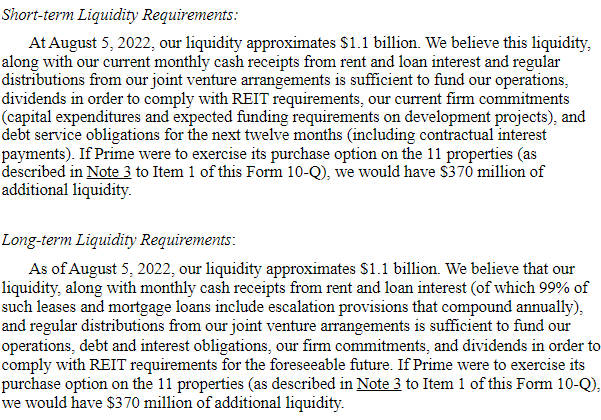

However, knowing where a company’s cash is coming from and where it is going is always useful. Whenever I read the statement of cash flows, I also like to look at liquidity. Searching “liquidity and capital resources” on a 10-Q will pull up one of the more important management discussion items that will provide a great summary of a company’s liquidity. Keep in mind that in addition to cash on hand, MPW (like most companies) has a revolving credit facility. Some companies operate with minimal cash on hand, choosing to rely on a revolver entirely.

Here is MPW’s statement on liquidity:

MPW 10-Q

MPW 10-Q

If you only read one section of a 10-Q, this is the one to read as it can give you a heads-up to potentially serious problems.

In our next article, we will cover what everyone has been asking about: non-GAAP metrics. Metrics like FFO, AFFO, Adjusted EBITDA, adjusted earnings, “core” earnings, etc. These metrics can be extremely useful because they remove one-time income or expenses, non-cash items, and artifacts of GAAP like “straight-lining” to provide a clearer picture of what is happening. These non-GAAP metrics are crucial to evaluating an investment, but it is important to be able to evaluate their quality. All non-GAAP metrics will stem from the GAAP metrics we’ve covered in these articles, which is why we’ve spent our time covering the basics.

Thanks for reading! If you liked this article, and want to be notified about the 4th part of the series, please click “Follow” to receive our future updates.

If you want full access to our Model Portfolio and our current Top Picks, join us for a 2-week free trial at High Dividend Opportunities (*Free trial only valid for first-time subscribers).

We are the largest income investor and retiree community on Seeking Alpha with over 6000 members actively working together to make amazing retirements happen. With over 40 individual picks yielding +8%, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale get 28% off your first year!

This article was written by

I am a former Investment and Commercial Banker with over 35 years experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. As author of High Dividend Opportunities, the #1 service on Seeking Alpha for the 6th year in a row.

Our unique Income Method fuels our portfolio and generates yields of +9% along side steady capital gains. We have generated 16% average annual returns for our members, so they see their portfolio’s grow even while living off of their income! 4500+ members have joined us already, come and give our service a try! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. No one needs to invest alone.

Click here to find out more!

In addition to being a former Certified Public Accountant (“CPA”) from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I am also a Certified Mortgage Advisor CEMAP, a UK certification. I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Seeking Alpha, Investing.com, ETFdailynews, and on FXEmpire.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side who invest in our own recommendations, you can count on the best advice!

In addition to myself, our experts include:

1) Treading Softly

2) Beyond Saving

3) Philip Mause

4) PendragonY

5) Hidden Opportunities

We cover all aspects and sectors in the high yield space! For more information on “High Dividend Opportunities” please check out our landing page:

High Dividend Opportunities

High Dividend Opportunities (‘HDO’) is a service by Aiko Capital Ltd, a limited company – All rights are reserved.

Disclosure: I/we have a beneficial long position in the shares of MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities.

Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.