THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

A miracle in American consumerism happened during the pandemic, the era of mortgage forbearance, student loan forbearance, and rent moratoriums, and free money sent to consumers via stimulus checks and PPP loans: credit score inflation.

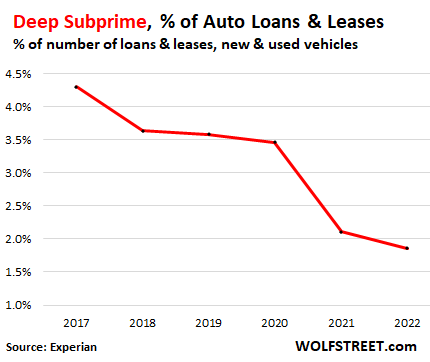

Of the total number of auto loans and leases outstanding in Q2, the share of borrowers with “deep subprime” credit ratings (credit scores of 300-500 on Experian’s credit score scale) plunged from 4.3% in 2017 to a share of only 1.9%, according to Experian’s State of the Automotive Finance Market report for Q2 2022.

This means that the majority of deep-subprime borrowers with auto loans improved their credit scores and moved into higher categories. For example, a deep-subprime borrower might have improved their credit score from 450 to 520, thereby moving up into subprime.

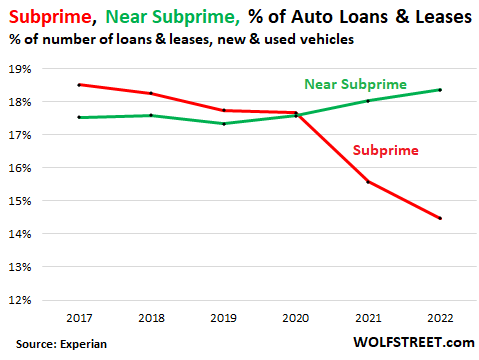

Of the total number of auto loans and leases outstanding, the share of borrowers with “subprime” credit ratings (credit scores of 501-600) has dropped from 18.5% in 2017 to a share of 14.5% in Q2 2022 (red line in the chart below). This means that many subprime borrowers improved their credit scores and moved into higher categories.

As you’d expect, the share of “near subprime” (credit score of 601-660), that many subprime borrowers and some deep-subprime borrowers moved into, rose from 17.5% in 2017 to a share of 18.4% in Q2, according to Experian (green line in the chart below).

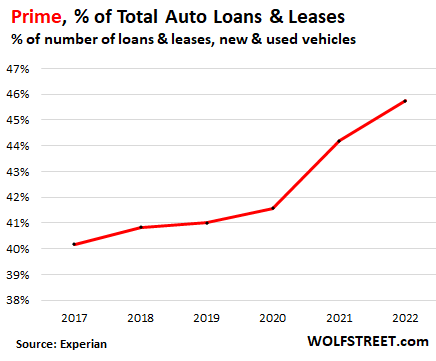

Of the total number of auto loans and leases outstanding, the share of borrowers with “prime” credit ratings (credit scores of 661-780) jumped from 40.2% in 2017 to a share of 45.7% in Q2 2022, as many near-subprime and subprime borrowers moved up into this category.

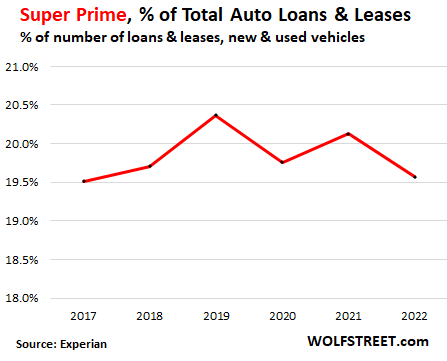

But the share of “super prime” borrowers (credit scores of 781-850) has been roughly flat with 2017:

Student loan forbearance. Starting in March 2020, all federal student loans were automatically enrolled in forbearance programs. Loans in forbearance no longer count as “delinquent,” no matter how delinquent they were. And the delinquency rate of federal student loans plunged from around 10% in 2019 to 0%.

In other words, as far as the credit ratings are concerned, those delinquencies among federal student loans were cured, and it improved borrowers’ credit scores, though they didn’t actually make any payments.

Private student loans didn’t participate in the forbearance, and the delinquencies still out there are concentrated among them.

In addition, since these student loans in forbearance were on ice, not accruing interest and borrowers not making payments, borrowers could use the money from the not-made loan-payments to get caught up on other bills, which would further improve their credit scores.

The federal student-loan forbearance program has been extended through December 31, 2022.

Mortgage forbearance. Same principle here. Millions of home mortgages were entered into forbearance programs. Delinquent mortgages in forbearance didn’t count as delinquent, which cured the delinquency on the credit reports.

In addition, borrowers didn’t have to make mortgage payments during the forbearance period and could spend the money on other stuff, such as getting caught up with their other debts and curing those delinquencies.

Most of the mortgages have now exited forbearance, and given the surge in home prices over the period, as a last resort, borrowers could usually sell the home and pay off the mortgage.

Rent moratoriums allowed renters to divert funds from rent payments to other causes and catching up with their bills and car payments.

In addition, waves of government cash, from stimulus payments to PPP loans, washed across the US, allowing people to get caught up on their debts.

As a consequence, delinquency rates plunged to record lows during the pandemic across auto loans, credit cards, mortgages, student loans, and other consumer loans. Third-party collections and bankruptcies also plunged to record historic lows. And credit scores began to surge.

But credit scores didn’t improve because American borrowers suddenly became vastly more responsible. They improved because of the dynamics that cured delinquencies on credit reports.

But those dynamics were pandemic-specials that cleaned up the credit reports of millions of Americans that now appear to have made their payments on time, and appear to have caught up on their payments, when in fact it was mass-forbearance that produced that effect, along with stimulus payments that aren’t scheduled to recur.

And that’s a problem for lenders. Lenders use credit reports and credit scores to evaluate the credit risk of a borrower – how likely they are to default on their debts in the future. The assumption is that past delinquencies are predictors of future delinquencies.

Lenders charge higher interest rates to compensate them for higher credit risks. Subprime rated customers borrow at higher rates than prime-rated customers because lenders face a higher risk of credit losses – similar to corporate junk bonds. But credit-score inflation is now throwing a monkey wrench into the equation and turning the already iffy credit score system into an even less reliable predictor of credit risk.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

We live in a time of rampant dishonesty. Heard this recently and it’s simple enough and I’ve found it sadly true. It’s everywhere.

We need to be 100% honest in everything we do in life and call out any dishonest behavior. Lead by example and from the front and things will get better. Mainstream Society is wavering on the edge of accepting lies as the status quo and that is unacceptable to me. Boycott sources of disinformation and stay off social media.

We are now at the point when we risk a civil war due to a lie perpetrated by someone’s ego. And, if you look at failures of empires from the past, civil wars (Roman, for example) weakened their ranks so much that barbarian tribes were able to overrun them.

If we are at risk of civil war than it is because there is no shortage of fools who actually pick a side between the two sided coin of corruption.

There is only one side talking about civil war.

Whomever wrote the current puppet’s speech is definitely gunning for a civil war. That was the most angry, divisive, hateful rhetoric I’ve ever heard from a so-called “leader” since the guy in Germany pre WWII.

I see lenders use distorted house appraisals to give zero downpayment loans that are backed by rotten properties in non-recourse.

These underwater loans will soon require bailouts!

We’ll to me the entire mess smells like what the ratings agencies did with toxic crap CDOs prior to the 2008 debacle. AAA ratings for everything, what could go wrong? And I get paid regardless.

Minutes,

Not to pile on the pain, but look who has paid for and is ultimately on the hook for the largesse…

Who would have known a pandemic would elevate so many people to a higher station in life than otherwise worked for…

During the GFC, we embarked on a new journey of moral hazard. More recently with forbearance, stimulus, rampantly defrauded hand-out programs (PPP, UE, etc.), and now outright “cancellation” of debt, we’ve crossed the Rubicon to complete our journey. There is no going back. Moral hazard is now the standard. Precedents have been set which change the way one must calibrate their crystal ball. The old indicators don’t mean what they used to mean. Moving forward, those who can best anticipate and position themselves to benefit from government bail-outs will prosper. Honest savers will be destroyed. Does anybody really believe the Fed will sit back and hold their tight monetary policy even as asset prices collapse and 10M job openings turn into 10M layoffs? And even if they do, does anybody believe politicians – both D and R – won’t step in with ever more preposterous hand-out programs? How far are we from cancellation or restructuring of these sub-prime auto loans and big mortgages in the name of helping the little guy (actually to save the banks that own the politicians)? Maybe we’re not as far away from that as many people think.

So prepare yourself for hyperinflation then. Because that’s the choice – either take the medicine now, or destroy the country. The FED is finished if they destroy the US dollar and country. They get to cling to power if they cause a massive recession/depression. Guess which door they will choose?

Depth Charge, how has every past economic super-power ended up (especially those with a reserve currency)? The typical pattern is to build power through productivity and ingenuity, then once the country becomes too wealthy and their labor too expensive to compete on a world stage (often coupled with war expenditures), they maintain a relatively high standard of living for a while by borrowing and also printing in the case of fiat currencies. They always cross some point of no return where their productivity can no longer keep up with their debt and/or inflation. We are a classic empire in decline.

Drive through your nearest big city, Anywhere USA… There’s likely to be some area in the city (if not a large part of the city) that is infested with impoverishment and depravity easily on par with any 3rd world country. We’re broke, but many Americans are not willing to admit it.

Everybody else has also been feverishly printing currency, often in the form of monetized debt too. That’s a wildcard that could suppress the rise of a proper competitor for a long time, but it won’t stop the juggernaut of a growing wealth gap that drives ever-deepening debt slavery.

If I have to guess which door the Fed will choose, I’d say they’ll probably choose the same door every other central banking power has chosen since the dawn of money. Sovereign debt crises have been around for thousands of years. We’ll eventually experience one.

Not at all. The loss of reserve currency status will mean a return to sanity, honesty, and an economy that works for the Americans, not for Empire. No more hegemony funded wars and waste.

Thee Fed can’t beat inflation.

Currently, borrowers are being rewarded with interest rates that are extremely low. Savers are being penalized. That has to change in order to stop inflation. You need people to defer gratification by realizing they’d be so much better off by just putting their money in the bank and waiting a month or two before buying that shiny new thing they want.

That’s how you end inflation. Recessions don’t end inflation, otherwise, the recession of the 1970’s would’ve ended it. This recession was CAUSED by inflation, as consumers are cutting back on discretionary purchases due to higher costs of living.

The Fed can’t raise by enough to reward savers due to $30.8T in federal debt. It’s the world’s biggest adjustable rate mortgage.

I am very seriously researching my options to leave the country very soon and take my very hard earned money with me. The collapse wont be pretty.

The big issue now is probably a war with China. Can you imagine the supply chain issues if we can no longer buy things from China?

That is some strange voodoo economics, because I thought that increasing interest rates increase the risk of bad debts and delinquencies.

Here in Toronto:

Compared the second quarters of 2021 and 2022 shows an interesting pattern — personal bankruptcies have fallen by 7.5%, but debt settlement proposals have gone up by 22.8% in Toronto.

For more context, Q2 2021 saw a higher number of personal bankruptcies (720), but fewer proposals (2,307).

[Number of personal bankruptcies in Toronto up by 22.2% in just three months

Imaan Sheikh Aug 10 2022, 5:52 pm]

My credit score fell about 100 points during the pandemic and has now rebounded. There doesn’t seem to be any logical reason that I can determine.

As a lay person, I’ve considered credit scores a bit of snakeoil. Consider all of the variations of scores. Consider the obtuseness of the calculations of the components of the score. Consider how lenders weaponize it in consumer purchases especially loans on vehicles. Then the borrower’s score can be further victimized by identity theft.

You can “freeze” your credit information on all three major credit agencies and unfreeze them, as necessary. It’s all done online, so you can open and close access, temporarily or indefinitely, using your own password. Don’t lose the friggin’ password.

Real estate “experts” keep saying that we’ll never have a housing crash this time because the lending standards are much better than they were before the Great Recession.

However, this ground-breaking analysis completely changes that assumption…

Yes, lending standards are only in the basement now instead of sub-basement. That’s really impressive, isn’t it?

I think under financialization, bank mortgage loans are funny:

The loan is secured by the value of the house

Which is to say, by the market value of the house

Which is to say, by the amount another buyer will pay to buy the house

Which is to say, by the amount a bank will lend another buyer to buy the house.

So the mortgage loan is secured by the prospect of another mortgage loan. When this fails, as in 2008, everything falls apart.

And in the end the value of the US dollar can be said to be backed by the real estate housing.

When the prospect of another mortgage loan fails, the security of existing mortgages fails and the backing of the US dollars secured by those mortgages fails.

The future may prove a little bit to interesting.

Good points, but isn’t the mortgage loan also secured by proof of income and good credit score?

Wolf, in addition to the factors that you pointed out, it’s important to note that higher average credit scores have a strong positive correlation with simply the length of a credit expansion cycle.

2001 –> 2008 was a shorter cycle than this one. We’re in year 10 to 12 of expansion depending on where one defines the previous bottom. Average FICO in 2008, was almost bang-on equivalent with average FICO score 7 years into this credit expansion cycle.

By 2019, nearly all of the bankruptcy fallout from irresponsible borrowers in 2008’s ensuing fallout had cleared the books. Did these people learn their lesson? As we all know, of course most of them did not. They’re still out there, but their FICO scores no longer represent their risk to lenders. If the cycle had not lasted as long, their FICO scores would have represented the risk because they would have been washed out again.

I think that any time an expansion cycle gets to the average length of bankruptcy processing time plus seven years, this kind of stuff starts to occur. And this time it was amplified by all the free money factors as you pointed out.

Thx, a nice lesson on credit risk and economic cycles.

I have a coworker that declared bankruptcy in 2009. Was planning on declaring bankruptcy in 2020. His house was going to auction, owed over $30k in back payments.

Pandemic hit. Foreclosure forbearance happened. He got to not pay his mortgage for 2 years and then submit for pandemic related relief and got his back payments covered by the government.

All the free money is probably going to keep him going for another year or two until the cycle continues. Yeah I would say it’s safe to say he didn’t learn anything from it, except hot to do it better the next time.

Did the bankruptcy degrade his living standards?

Would avoiding bankrucy have improved his living standards?

Could be that your coworker actually have learnt how to game the system for maximum profit.

I personally saved over $15k/year in daycare costs for 3 years now since WFH.

Two thirds of student loan holders are women.

Just saying.

Coming back cuz this sounds kinda obnoxious on re-read so to ellaborate:

Its still true and aside from the larger demographic of student loan holders being women, women were also disproportionately affected by lockdown with job losses. And disproportionately left their jobs because they already were paid less than their male spouse as childcare/home schooling became a huge problem during the pandemic (and chilfcare shortage persists at current).

So when people discuss moral hazard, please remember who benefitted more from these interventions.

The billionaires of course. They benefited the most.

Of course. But its clear I meant among us peons.

Two thirds of uni students are women. No surprise.

Positions typically held by women require professional training, degrees, certifications, ongoing credentialling, etc. Everything from nail tech to teachers to RNs. Nursing is the profession comprised of the highest number of women and now a hospital-earned diploma or ADN os no longer sufficient, you have to have a BSN (in 10 years in NYS) plus ongoing credentials.

Women make less than men, thus, take longer to pay off loans, and also more likely to have to postpone or abandon completion of a degree for family responsibilities. This is not new or radical info.

YES LVS,,, NOT new or radical, but sad and in fact shameful of the oligarchy to waste all the very very good and better folks out there of any and every gender, etc.

IMHO, at this pint in time,,, WE, in this case WE the PEONs who have put up with this ”stuff” from the oligarchs and their paid political puppets need it to stop…

OH, Wait,,, might that mean a truly ”merit based” society???

If so, and it appears to be just another supporting item of a merit based society,,,

FAR DAMN SHORE our clearly misogynist oligarchy will NOT allow such a thing that challenges their clear hegemony at this pint in time,,,

And, in conclusion, knowing Wolf very well ”might” edit this post away:

IMHO as a voter in every election since 1966, women,,, ALL women, will be much better off if the current crop of obviously competent WOMEN politicians would make a three some or four, consisting of skilled and experienced Republican AND Democratic women who will pledge to do their best to work out together,,, with total consensus WHAT SO obviously needs to be done sooner rather than later as will be the case if the ”politics as usual” continue…

I agree Vintage, but waiting on politicians or voting in general to beget progress is like waiting for thepublic education system to actually help prepare kids for life. The masses are so far behind on the financial education necessary to navigate this country, it directly contributes to the social inequality.

Having done everything I was ‘supposed’ to do: student loans, college, marriage, kids, and then having all of the above slam in my face hard only to be told by the same people who raised me “well why did you do that?”, my kids (one of each gender) are being raised to learn what I wasn’t taught: financials (hence, I’m *here*), education oportunities outside of formal college, and to either avoid or leverage debt.

The politicians are bought and sold, and average voters keep The Kardashians on TV. I wouldn’t trust any of them with my house plants much less my kids’ best interests.

Closer to 2 1/2 years* to be nitpicky.

Another aspect of the fake financial system.

The supposed credit worthiness of the American consumer is dependent upon an artificial economy of “printing” and borrowing. Look at what happened during the GFC when so many supposedly “prime” borrowers defaulted at the first hint of economic duress.

I’m also expecting the USG to use more forbearance and moratoriums in the future. It didn’t appear to have any adverse impacts the last time so it supposedly can’t have any in the future either.

They don’t know that the supposed success was psychological. When market psychology no longer accommodates it, it will fail, just as it would have if tried earlier.

It didn’t succeed because the economics profession and those running government are so much smarter or more sophisticated than their predecessors.

It’s the same psychology which makes it possible for aggregate credit quality to be the lowest ever, even as intertest rates were also the lowest ever.

The major credit rating companies will without doubt have to re-work and re-tool their entire platform to accommodate this hedonic change in credit rating. This will require about $1.1T in funding from the government in order to avoid loss of staff during the rebuild. /s Don’t worry they won’t have to lay off any staff due to the infusion of fresh cash from the printers of the taxpayers

And along the way, life gets better for so many…hard to predict what comes next!

Yes, it’s amazing how prosperous a society can appear to be when credit standards remain in the (sub) basement. Equally for interest rates.

In a leveraged credit dependent economy, when one or both are no longer available, the wheels fall off or the economy falls apart.

If only the Fed had some savvy consumer marketing pros….

“An amazing miracle. But how did it happen?”

It happened because the scoring systems used by the ratings agencies are defective, designed as they are to weasel the general population deeper into debt slavery, and not to accurately model credit-worthiness or risk.

Meanwhile, Bloomberg reports that U.S. Mortgage Lenders Are Starting To Go Broke.

Coincidence? I think not. The distortions are enormous, the very sort of thing you can expect when the FIC gets addicted to cheap money and in the blind pursuit of its wishful thinking comes to believe that financial risk can safely be ignored.

What’s worse is that any ‘growth’ of the U.S. economy depends on an even faster increase in debt, regardless of how unproductive that debt may be, which is plenty. The failure of debt to continue skyrocketing by itself guarantees a severe recession, without even figuring in the ongoing political, supply-chain, military, and ecological disruptions, which hardly anybody seems to account for in economic projections. Certainly not over at CNBC, where all the teleprompters remind presenters to SMILE!, no matter what.

unamused,

“Bloomberg reports that U.S. Mortgage Lenders Are Starting To Go Broke.”

They’re going broke — well, one or two small ones did, but there are a LOT of layoffs in the industry — not because mortgage credit is bad, on the contrary, but because 70% of their revenues collapsed within a few months when people stopped doing refis because mortgage rates jumped to 5%-6% from 3%, and when home purchases plunged, which caused mortgage originations to plunge further.

They get paid to originate mortgages and then sell them. And when mortgage originations plunged, their revenues collapsed, and their expenses kept going, and they lost a ton of money very quickly. Then they had the other problem in May and June: they couldn’t sell the mortgages fast enough, while mortgage rates were spiking, so that they didn’t get for their mortgages what they thought they could get.

Excellent. I can see that this could be a rather large discussion, and I’ll be looking forward to it.

One can only admire the passion for financial rationality.

A quick google search (I know, not scientific) indicates that by the middle of 2021, less than 5% of mortgages were in forbearance.

If that alone affected aggregate credit scores materially, then I’ll accept the argument that the best description is score inflation.

But we don’t have that data yet. Or do we?

If student loan borrowers used the breathing space to pay down other debts, is this not an indication of broad-based credit responsibility? If the aggregate scores of student loan borrowers shot up, isn’t this more indicative of systemic issues, rather than individual irresponsibility?

MF,

I don’t see it, personally. If, like you say, people used their would-be student loan payments to pay of other debts than this is a good thing like you suggest. However, if I’m the banker, I’m not loaning except without higher rates for these folks. The fact that they were wise and paid down other debt is good, but it doesn’t address the behavior that got them into their debt obligations in the first place. Furthermore, if I’m that banker, I’d be very leery about the legality Biden has to simply make the edict and forgive the loans. Maybe he can, but if he gets reversed in court then that money is still owed. (And yes, it took me 19 years to pay mine off.) Fortunately for everyone here I’m not that banker. Just a regular shmoe trying to educate myself on business, finance & money.

Aggregate, systemic, individual, apples, oranges, plums.

Every time I hear people brag about their credit scores I roll my eyes. I too had a great score before the GFC and a terrible one afterwards. The terrible score did not keep me from renting or buying a car or keeping most of my credit cards. If there is a point to credit scoring these days, it escapes me.

BTW, one of the credit bureaus keeps emailing me with messages about my increasing or decreasing score. I never bother to check, it is irrelevant to me.

Petunia credit score

You need it to have a credit card often or a good income ‘

and you need a C.C. to rent a car like at the airport

( they don’t take cash)

Beyond that I think they are just a scam seems to fit right in these days

I am happy to be one of the many that don’t use credit or a Credit card or a bank. A few bucks in a credit union to manage cash flow.

All other money at vanguard and a little precious metals for insurance.

Not using debt teaches you discipline and improves sleep.

Agree and have the same philosophy. I just wish that my grown children would see the wisdom in why we do what we do.

Ref : credit card must for rental at airport

As a non resident alien when I landed in LA in 1997, CALFED gave me a credit card with $10k limit ( I had no ss nor driver license or state id at the time of opening sb account ofcourse with 250k tt & recommendation from HSBC PRIVILEGE banking dept. )

But I soon found out airport rental sometimes overcharged.

Best solution: Prepaid deposit credit card with $ 350/500 limits. I forget the name of the bank That usually deals with subprime customers.That credit card even worked in Birmingham uk & Sydney Australia Airport for car rental when I travelled on business exploration. I have to top up to meet the rental

Minimum hold. Can settle with cash also while surrendering rental if the desk is manned.

I am hearing from people who travel frequently, that some hotels do not want cash. They want a credit card. The reason for this (so I was told), was so that if a “guest” walked off with a towel or wash cloth, it could be added to their bill.

That’s weird – you’d think the organizations that issue credit scores would tweak their models a bit to underweight credit behaviors over the last two and a half years while all the pandemic era shenanigans were going on.

You’d think, but their models are defective. They did it before when they created the 2008 mortgage crisis when they were overestimating credit scores to fuel that bubble.

There’s big money in debt peonage, so they tweak their models to encourage debt peonage and ignore the risk. Short-term gain at the expense of future pain. That’s how the Financial Industrial Complex runs the world, and that’s how they’re going to run it into the ground.

Why, when numerous situations are so clear and alarming, does they remain so stubbornly intractable to change? It is because those who have power in the world want it to be this way.

The avg payment numbers per month on some of these cars look more like a mortgage payment of not that long ago than a car payment.

“That’s how the Financial Industrial Complex runs the world, and that’s how they’re going to run it into the ground.”

Yep, and maybe next time its not only “too big to fail,” but also “too big to bail out.”

This availability of credit will fuel additional inflation!

Great forecast for future credit issues that will emerge. I would assume most of the lenders for subprime are regional and local banks for the auto loans that will start as soon as the new car inventory builds.

Vehicle manufacturing will stay strong as the need to build up inventories is present for new car manufacturing.

Plus deferred sales and the credit score improves the amount and cost of the sales price f vehicles for the next year or so.

Please explain ‘alphabet soup’ as not all of us can figure them out. Google helps but it is an added step.

What specific alphabet-soup questions do you have?

Ok so the loan pauses have otherwise higher credit risks looking better and then able to borrow more or just enjoy being unencumbered. So the question is – what happens when loan payments resume ? Can we anticipate a surge in delinquency? My gut says half will half won’t. So we will likely see a delinquency rise in 2023. Thoughts?

What happens when loan payments resume ?

You know the old technique of sweetening up the wife with flowers before delivering the line I lost my job.

The loan pauses over last few years (agree with unamused – manufactured – same as 2008 crisis) intended to build a neediness, a dependency, sweetening.

Re Resuming Loan payments – plan is to disguise / replace with social credit score. Credit risk score exists in a made up location (socially acceptable after 100 years in play – except to the savvy such as Petunia ) that a bank uses giving it an air of validaty. Bankruptcy decouples the identity / person from debt.

In a social credit score system – your identity is the score and option of entering bankruptcy gone. Replaced by ? Your freedom. This is the plan.

They have to get it passed by human commonly acceptable concepts exam. Tough one. Current trajectory – no timeline exists where that happens.

Next few years as system reform takes shape, more articles like above will cite these weird behaviours. Measure of desperate to maintain power.

Resist. This too shall pass.

Nodal ‘banking’ based upon open ledger blockchain barter with no intermediaries other than a series of repeating programs – called robots or AI by some – is their very real competition for survival. Vanguard belongs to historic definitions of nuclear submarines – which also disappear in C21.

What is a node? For all of us to co-create and define.

Very difficult, almost impossible, understand.

Plandemic Jubilee.

So, if I have caught on here correctly, instead of allowing the rating agencies to inflate the ratings of MBS’s built on very insecure individual mortgages which caused the credit bust, they now go straight to source and finagle the credit score of the individual mortgage holders. Nice work.

Cas127,

“Plandemic Jubilee” haha Great one! takes irrational exuberance to a whole new level: the next stage of human atrophy!

The credit arm of my old alma mater (auto manufacturer / distributor) did not use FICO or other bureau scores as the sole basis of credit decisions. They had developed their own scoring profiles and used those to evaluate the credit apps. Certainly, the data from the bureaus was considered but they added some of their own hocus pocus to the equation.

The tiers were pretty broad and, of the five, two were prime. The third was what one would classify as high sub-prime and the bottom two were not supported by incentive financing as the cost was prohibitive.

Can this be true? I don’t get it.

According to this Bloomberg article dated Aug 29, QT will have no significant effect in the financial markets as the US Treasury will issue more T-Bills to replace the T-Bills/coupons maturing on the Fed’s balance sheet. Wouldn’t this be tightening financial conditions instead, by absorbing cash sloshing around in the financial markets?

[Snip]

“The expectation among Wall Street strategists is that as the path of the Fed’s interest-rate hikes slows and Treasury continues boosting the amount of T-bills it issues, it will draw those reticent investors away from the haven of the RRP and back into the market.

“…the week-to-week and month-to-month bill holdings will have no bearing on the market supply of bills as the Treasury factored the redemptions into its quarterly borrowing plans…

“From a cash-market perspective, nothing will change when the first bill runoff takes place on Thursday,…”

“…it will draw those reticent investors away from the haven of the RRP and back into the market.”

FYI. Individual investors don’t have access to the Fed’s RRP facility, only eligible primary dealers and other counterparties do.

Individual investors benefit from the RRP indirectly through money market funds, which utilize the RRP.

IF the treasury just issues Tbills to fund the $60B per month in treasuries that mature on the Fed’s balance sheet, then yes, in theory, this shouldn’t impact the liquidity available in the markets that much. The money to purchase these Tbills would likely come from money market funds that were invested in the Fed’s overnight RRP facility. And while the overnight RRP facility is technically more liquid than something like 4-week Tbills, it’s not that much more liquid.

Afterall, I believe the RRP facility was created specifically to put a floor on short term rates. Too much liquidity (that the fed created itself) would have driven the rates on Tbills negative, because there wasn’t a sufficient supply of Tbills to absorb all of this liquidity. Consequently, it would make sense that a growing supply of Tbills would just pull funds from the overnight RRP facility.

Thanks for the explanation, johnny5,

So QT will not reduce the liquidity in the markets then? I am confused. RRP, sale of T-Bills, Fed letting its assets mature without buying more (QT); none of these events actually constrain “loose financial conditions”?

I thought that was the point of QT. If not; then WHAT is being achieved with QT? And does this mean the stock market rally will continue?

Of course, QT will have an impact. The Treasury will have to sell new bills/bonds to cover the maturing bonds the Fed is not replacing. This cash will have to come from somewhere.

Rusty Blade,

“QT will have no significant effect in the financial markets as the…”

Hahahaha, they said this last time too, and 9 months into QT, the markets were plunging. Last time, QT ramped up so slowly that it wasn’t visible for the first few months, and it took a year to fully ramp up. This time the ramp-up is 3 months, and much bigger, and the cruising speed, which will be reached in Sep, is twice as fast. You can already see the effects in the market.

QE inflates asset prices (that’s why it was implemented to begin with), QT deflates the market. Simple fact. And everyone knows it. The rest is hype.

The kind of ridiculous BS these desperate hypsters on Wall Street are planting in the media is just hilarious. Don’t take this stuff seriously.

Thanks Wolf!

Can we say then that the banksters are outright lying — on Bloomberg, of all places? They are afterall on record claiming that 60 billion new T-Bill issuance PLUS QT will change nothing at all; that it will not drain liquidity nor worsen credit availability.

It’s not called “lying” in Wall Street terminology, it’s called “planting a story” and it happens all the time, everywhere, from the talking heads on CNBC to the WSJ … just Wall Street players promoting their book.

These kinds of articles on Bloomberg, the WSJ, etc. are just reporting this stuff, instead of picking it apart.

There are other articles in these publications that pick this stuff apart, and those articles can be good.

Housing is going to be interesting. Here is an scenario that may play out.

1) I know of several people who every time they moved the past 6 years, they just kept their old house, they renting it, and bought a new house. They never planned on being landlords, but because they got super low interest rates on their mortgage, plus housing kept appreciating, rent keeps going up, they by accident became mom and pop landlords and now have 2 or 4 houses. They bought each as a primary house and were able to score low interest rates in the 3% range new or refinanced.

They now have easily over 25% to 30% equity in each house, a fixed low mortgage rate on each house, and a very nice cash flow because of rising rents. If one house is vacant, the cash flow from the other typically covers the mortgage payments

It will take a recession and some tenants not paying rent to even come close to scaring them into selling. It will be about cash flow for them to be forced to sell.

2) I just read another story, where author was just commenting how he will probably never move because he scored a low interest rate in 2020, just thinking about moving cannot happen because he would not be able to afford the house he is living in. He was a bit sad thinking that he could not move. He said there are probably a lot of people in his same boat. I am guessing eventually he will realize that he can rent his current house and then move.

3) Roofstock and other crowd funding sites allow internet landlords. Click and buy. Many of these landlords are young techies from the West Coast buying up house in the South East. They have money for all cash buys or a big down payment.

I bring these stories up because if we have a soft landing, I actually see existing homes inventory shrink because of the three example above that will never want to sell. The buyers in these scenarios look for existing homes.

A lower percent of subprime auto loans may be the result of stricter lending standards. Lenders may not be doing as many deals with subprime customers.

David Hall,

Nonsense, you didn’t read the article carefully, if you read it at all.

1. This article is NOT about credit scores at origination of the loans, as you say with your “stricter lending standards” BS, but about credit scores on all existing and outstanding auto loans that were originated in the past and are still outstanding.

2. look at the surge in the share of near-subprime and prime, which means the subprime borrowers moved up into higher categories. Of course, to see that, you would have to actually read more than the headline.

4. overall credit scored reached another record high this month (not covered in the article) as subprime-rated borrowers improved their credit scores via the mechanisms outlined in this article.

Read my updated commenting guidelines, guideline #1 specifically about not reading the article but discussing things you imagine to be in the article. Commenting guideline #1 flagged your comment for deletion. It’s only because of my heroic personal intervention that your comment escaped the fate of the shredder.

https://wolfstreet.com/2022/08/27/updated-guidelines-for-commenting-on-wolf-street/

“I bring these stories up because if we have a soft landing”

Pure wishful thinking. There is going to be no “soft landing”, as that’s a belief in something for nothing.

I still think that the government will use mortgage forbearance when the economy and housing market weaken noticeably. That may or will be enough to prevent a GFC type crash, for a while. But it won’t do anything about interest rates “blowing out” if the cycle turned in 2020 as it looks like it did.

Nothing moves in a straight line, so neither the housing market, employment, or the economy will or may turn right away.

The biggest “X factor” is if the stock market and junk bond market crash a lot sooner, which is hardly improbable. That will change the job market very fast and with it, both housing and the economy.

A soft landing is easy, onto a steep, slippery slope, into a welcoming abyss.

I think you may be on to something. The last thing any politician wants on their hands is a bunch of foreclosures and a bad recession.

A recession puts the odd of an incumbent to be voted out of office very high.

They do need to reign in house prices which has leveled off and in many markets dropped. They have not dropped much but some.

I still think in certain regions there is a home shortage of affordable homes.

My city is contemplating letting home owners in the urban core build 2nd homes on the lots to rent out. I guess they would be tiny home unless you have a big lot. Thus they say the density will increase and there will be two homes per lot. Lots current home owners can become landlords or I bet wall street will start buying more homes in this area and build a 2nd home and get double their money per lot?

What does the city say about the doubling of cars on the street with all the second homes on each property? Will you be able to park on your lawn?

There is a certain logic (which I disagree with but it’s there) where it is theoretically cheaper to grant forbearance than clean up defaults. Problem is, it’s actually more “can kicking” which is why I think it will be attempted.

The political problem with making housing more affordable through lower prices is that it simultaneously destroys middle class household “wealth”.

I’m convinced the interest rate cycle from 1981 turned in 2020. If it did, I’m not sure what other gimmick government will attempt to make housing “affordable” since all “affordability” programs just make it less affordable and turn most “homeowners” into debt serfs.

The most obvious choice is tax credits and for those who don’t pay enough, make it refundable. Another one is politically motivated down payment grants but that’s going to result in noticeable “blowback” under negative economic conditions since it will be disproportionately directed toward specific constituencies.

Great gaps of income inequality are a sure sign of incompetent government. An honest, caring government takes very seriously its responsibility to prohibit widespread poverty. Socially responsible programs such as child care support, affordable public education and health care, environmental protections, and progressive tax rates are the hallmarks of competent governance. These priorities not only benefit citizens, they benefit commerce.

“ Great gaps of income inequality are a sure sign of incompetent government”

Yeah…. You shoulda stopped right there…

Cause the rest of that hasn’t worked in the last 60 years….

It’s pure ideological BS.

Say have not worked in the USA the last 60 years. Other countries may have different records.

On this topic of inequality, there’s an interesting op-ed in the WSJ today called “Income Equality, Not Inequality, Is the Problem

Those in the middle work much harder, but don’t earn much more, than those at the bottom. By Phil Gramm and John Early”

The TLDR, when you rightly include transfer payments and taxes paid in income calculations, the bottom 60% is surprisingly near equal.

The FICO score reporting is rubbish. One of the bureaus still shows me employed by a company, which no longer exists, that I left in 1977. I missed a payment on a CC last year when the annual renewal fee occurred the day after I did my monthly payments. That dropped my FICO score 13% for most of a year. I still have a 40 point spread among the various reporting entities. Plus they keep telling me I could improve my score by taking out a loan.

Exactly I canceled c c ,which wasn’t used in 5 years. My credit score dropped .Totally rediculios If your in debt up to your ass and pay your interest = excellent credit score

Flea, this society runs on debt. Why are you trying to do something differently?

Flea,

To creditors, not using a card or having any debt for five years is like you not hearing from a friend in five years which would lead most people to question the friendship. Having a lot of debt and keeping up with the payments is like a friend that calls you predictably and occasionally complains; at least you know the friendship is going strong.

A lowered credit score is just the creditors collectively questioning their friendship with you since you haven’t “called” in so long and so they don’t know as strongly what to expect if you do call.

And, of course, keep in mind that the credit score doesn’t reflect your amount of financial ability or the acumen that led you to not using the cards.

“Less reliable predictor”…Is the not the overall problem across the entire market spectrum at this point? Halloween Jack has borrowed all the lab equipment and applied the “scientific method” to examining each narrow sector of evidence. But it still begs the question, “What does it all mean?”. In all systems, instabilities arise and ultimately are resolved by “settlements”, and probably a heck of a lot of bad electrons flying off in all directions. But are we seeing a growing case where settlements are not being allowed to catch up such that instabilities are arising in too many places at the same time? And does this not make all predictors unreliable? Does the great Wizard of Wolf have an overall take on whether the balloon can get back to Kansas by dinner, or should we pack a lunchbag for a long ride in tornado volume winds?

I consider the outcome predictable but not with an outcome 99%+ want to or will believe.

Wolf does not make predictions nor give specific advice, but I’d like to see his take on these general conditions. Basically, he was in a “go to cash” mindset with watch federal paper as interest rises. He has dismissed the air coins and did not care for “aquiring” yellow metal under given situation…a bit vague but there it is. (Of course we now have all these damn “responsible” government bodies giving de facto “legitimacy” to air products by way of intervention and regulation. They’ve yet to concern themselves with the trade in old Twinkies and pneumatic widgets, but should be getting there soon enough.) Now, A.F., if you want to add a list of say ten pertinent bullet points of predictive wisdom of your own, go right ahead. But you know well how a can of worms works here.

I’ll just get to the “end game”.

The direction the financial system is heading toward is a “fat tail” catastrophic systemic failure. That’s what happens when risk is systemically mismanaged and mispriced due to moral hazard and lack of price discovery.

This article covers only one component of it. Other articles have covered the other pieces.

Also must be working toward a true merit based financial and employment system IMO AF.

Otherwise, as some of us might have seen in recent decades, the quality of almost everything either goes down hill, cannot be repaired etc., OR the quality remains about the same and the cost goes insane as we see now in vehicles, appliances, etc.

A durable computer that lasts five years is great fun, and wanted by all far shore; a durable refrigerator that lasts 20 years, as they all used to do, is much better, and NEEDED by all south of 55 degrees north or so, maybe even farther north these days,,,, especially if it uses less than half the energy of the last one.

Most large lenders nowadays use some form of machine learning model to generate credit worthiness scores or rankings, which use a bunch of different input features from the data they have for each borrower. I wouldn’t be surprised if these models are picking up on the fact that nobody has missed payments in the past 2 year and none of them have been adjusted to take these exceptional circumstances into account. Will be interesting to see how lending plays out when we inevitably revert to the mean… Also fun to remember that a lot of lending these days is almost fully automated.

It’s a very fair and valid point, but wiping the slate clean of delinquent student loans, mortgage forbearances, etc. changes the input into the AI. Those systems rely on accurate inputs, if the credit report is unjustifiably altered for the positive, the computer program is relying on garbage to make a “lending decision”

The auto company I worked for had “Instant approve” software that would assist a dealer in deciding what a customer could afford and what tier they fit into for rate quotes. However, human eyeballs went on those apps when they crossed a buyer’s desk. If something stank, the buyer could kick the contract.

One of the key elements (at least in the auto world) was if the customer with a marginal score religiously made his car payments. If they did, even at the expense of other obligations, they often got additional consideration as to tier/rate or whether to hock them at all.

Remember the saying: “You can live in your car but you can’t drive your house.”

Great stuff.

Time and time again we see who are the biggest losers in this centrally-planned economy: the most prudent.

Absolutely NOT true TR!

Some prudent folks of ALL ages and socio-economic situation are doing just fine these days, as several of them have commented on Wolf’s Wonder.

No debt, sufficient income, modest lifestyle, etc., etc.

Dad said many decades ago, ”better NOT to generalize on the basis of INSUFFICIENT INFORMATION.”

I love the lingo in this piece. “Deep Subprime” sounds like a genre of techno, with “Waves of Government Cash” the new streaming single by the artist “Iffy Credit Score.”

Keep ‘em coming, Wolf! 🙂

Nothing was learned in 2008, it seems. We are back on a slippery slope.

Moving the goal posts again? Redefining yet another benchmark?

So essentially we have redefined “reality” once again. Where due to the working stiffs who pay taxes and a massive spending government who sends those taxes to non productive people so their credit scores move up the chain?

What is nest phase? Lenders suddenly increase lending to the welfare parasites who live on the productive?

Is the end phase some crazy world where all incentive to be productive has been given up in favor of “why work to pay them for laying around when I can just lay around and have a nice subsistence”?

Am visiting Finnish inlaws and asked about credit rating system here. Seems a lot simpler – no private companies involved.

If I understand correctly, a rough summary would be that if you default on any type of credit arrangement, you go into a sort of automatic bankruptcy. So you’re rated either 100 or 0.

There is talk of making some type of positive rating system depending on the depth and nature of one’s debt, but that would be handled by a government department.

I like it a lot here. Everything seems clean and clear, from city streets to laws and rules.

The government is also responsible for filling boots on the Russian defense front. I’m already smelling a potential conflict of interest dependent upon whatever conditions may exist at any given future date. 🤕🤕💀😹

One of the boot camp exercises for Finnish universal conscription is to jump in a peat swamp, sinking up to shoulders and have your team pull you out.

If stupid young Russians want to try invasion again, they will end up like their comrads decades before – in eternal frozen restful sleep, deep in the Finnish swamps.

Wolf,

Excellent analysis which I don’t see anywhere else. Great job as usual.

This is like changing the definition of serial killer to humanitarian. I’m not falling for it.

Most Americans are conditioned to be comfortable with propaganda and fraud from Gov’t and the private sector. Jiggering inflation data and credit scores,student loans and taxable income cancellation or forever forbearance are expected. It does not mean that they condone it,they (we) just shrug our shoulders, roll our eyes and carry on. There is a price to be paid for this. Institutional rot is in progress. The Congressional Uniparty of grift are firmly in the drivers seat.

In China they call it Bai Lan (Let it Rot), China’s latest export.

Your email address will not be published.

The Case-Shiller index, which lags 4-6 months, is starting to pick up the price drops in Seattle, San Francisco, San Diego, Los Angeles, Denver, and Portland.

Historic-low layoffs, astronomical job openings, aggressive hiring, massive churn & job hopping: Weirdest labor market ever.

The BoC’s QT started much earlier and is way ahead of the Fed’s QT.

Powell quotes Volcker, promises to “use our tools forcefully,” take “forceful and rapid steps” to reduce demand until “confident the job is done,” though it’ll bring “pain to households and businesses,” but not doing it will cause “far greater pain.” Hawk city. Finally got through to the markets?

Spending on gasoline plunges due to plunge in price. “Real” spending on durable goods, amazingly, jumps for 2nd month. Services spending rises but stuck below pre-pandemic trend.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy

Powerful Wealth Building Resources