THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

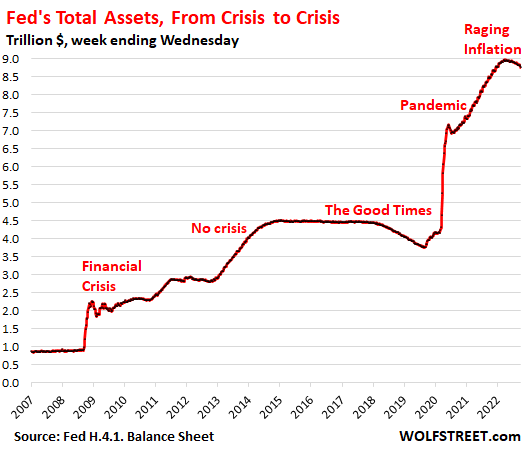

The Federal Reserve released its weekly balance sheet this afternoon, with balances as of yesterday, October 5, that contained the month-end roll-off on September 30 of Treasury securities, which completed the first month of QT at full speed, after the three-month phase-in period.

At full speed, the pace of QT is capped at a maximum of $60 billion per month for Treasury securities and at a maximum of $35 billion for MBS. During the three-month phase-in, the caps were half that level.

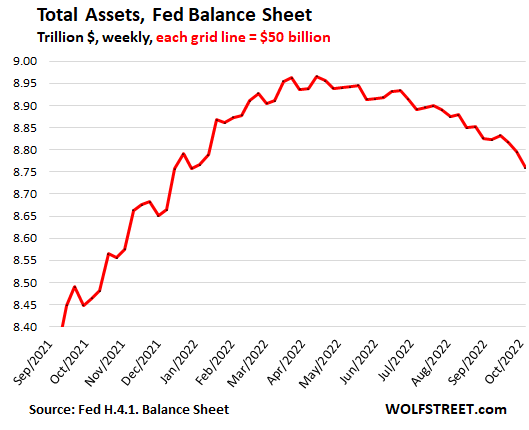

Total assets dropped by $37 billion from the prior week, by $63 billion from the balance sheet released on September 8, and by $206 billion from the peak on April 13, to $8.76trillion, the lowest since December 2021.

QT is the opposite of QE. With QE, the Fed created money that it pumped into the financial markets by purchasing securities from its primary dealers, who then sent this money chasing assets across the board, which inflated asset prices and pushed down yields, mortgage rates, and other interest rates. QT does the opposite and is part of the explicit tools the Fed is using to get this raging inflation under control.

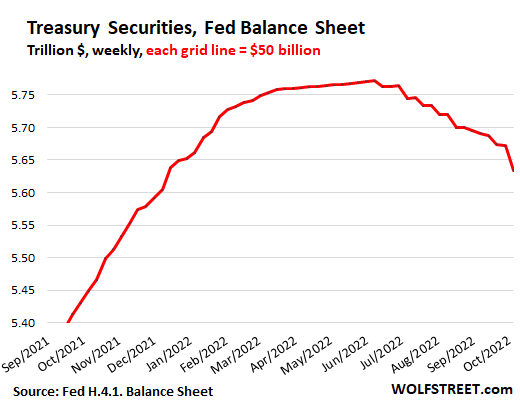

Treasury notes and bonds mature mid-month and at the end of the month, which is when maturing bonds roll off the balance sheet. Today’s balance sheet includes the roll-off on September 30.

Treasury bills. In those months when not enough Treasury notes and bonds mature to get close to the $60 billion cap, the Fed also allows short-term Treasury bills (maturities of one year or less) to roll off to make up the difference. And this happened in September.

Treasury Inflation-Protected Securities (TIPS) pay inflation compensation based on CPI. This inflation protection is income to the Fed, but it is not paid in cash, as coupon interest is, but it is added to the principal value of the TIPS, and the balance of TIPS on the Fed’s balance sheet inches up until the next TIPS issue matures, which will be in January.

In September:

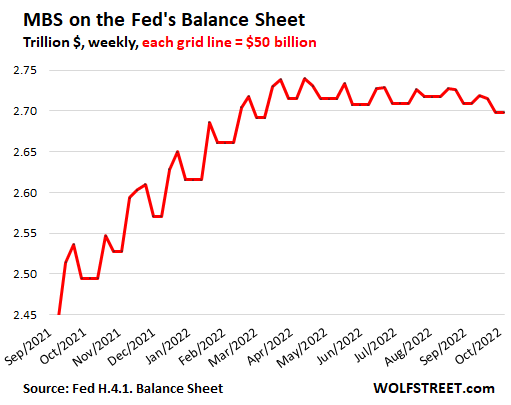

MBS come off the balance sheet mostly through pass-through principal payments. When the underlying mortgages are paid off as the home is sold or as the mortgage is refinanced, or when regular mortgage payments are made, the principal portion is forwarded by the mortgage servicer (such as your bank) to the entity that securitized the mortgages (such as Fannie Mae), which then forwards those principal payments to the holders of the MBS (such as the Fed). The book value of the MBS shrinks with each pass-through principal payment, reducing the amount on the Fed’s balance sheet.

But mortgage refinance volume has collapsed by 86% from a year ago to the lowest level since the year 2000; back then, the Fed had also embarked on a series of rate hikes, ultimately taking them to 6.5%. The collapse in the refi volume has turned the pass-through principal payments from refi into a trickle.

In addition, home sales have slowed, which further reduces the pass-through principal payments. Pass-through principal payments from regular mortgage payments continue at their normal pace.

The fading pass-through principal payments from the refi business is why the Fed is considering selling MBS outright sometime in the future in order to fill in the gap to the $30 billion cap.

MBS get on the balance sheet 1-3 months after the Fed purchased them in the “To Be Announced” (TBA) market. Those trades take one to three months to settle, and the Fed books them after they settle, which is when the trades show up on the balance sheet.

For a special geeky deep-dive into the Fed’s transactions of MBS in the TBA market and the delays involved, go to my analysis a month ago and scroll down to the section: “MBS, creatures with a big lag.”

So for most of the phase-in period, the MBS transactions didn’t reflect the phase-in period, but the “Taper” before it. In September and October, we’re seeing the transactions from the phase-in period.

The Fed stopped buying MBS on September 16 altogether, and so the inflow of new MBS onto the balance sheet, which is already small, will fizzle out in November.

The mismatch in timing between the days when the trades settle and show up on the balance sheet, and the days when the pass-through principal payments are booked and come off the balance sheet, gives the chart the jagged line, with flat parts in between when neither happens.

The MBS had one of those flat spots this week, at $2.698 trillion, down by $11 billion from September 8, and down by $42 billion from the peak on April 13.

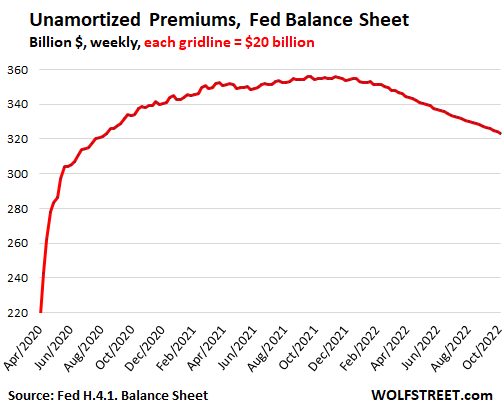

All bond buyers pay a “premium” over face value when they buy bonds with a coupon interest rate that is higher than the market yield at the time of purchase for that maturity.

The Fed books the face value of securities in the regular accounts, and it books the “premiums” in an account called “unamortized premiums.” It amortizes the premium of each bond to zero over the remaining maturity of the bond, while at the same time, it receives the higher coupon interest payments. By the time the bond matures, the premium has been fully amortized, and the Fed receives face value, and the bond comes off the balance sheet.

Unamortized premiums peaked in November 2021 at $356 billion and have now declined by $32 billion to $323 billion:

The Fed borrows money from the banks when the banks put cash on deposit at the Fed (the “reserves”). The Fed pays the banks currently 3.15% in interest on $3.08 trillion in reserves. They’re a liability on the Fed’s balance sheet, not an asset, and they don’t belong here. I just bring them up because…

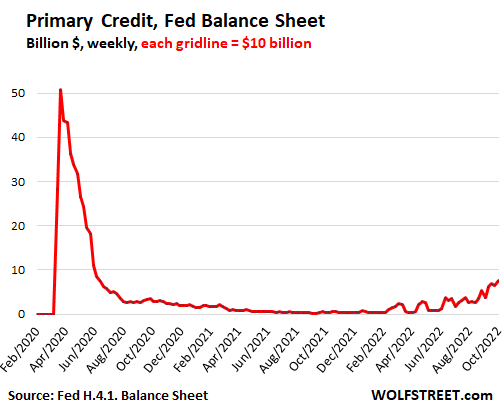

The Fed also lends money to the banks and currently charges 3.25% for it, charging more in interest than paying interest, as all banks do. The Fed does this through the discount window, called “Primary Credit” on the Fed’s balance sheet.

In March 2020, primary credit spiked to $50 billion but faded quickly and remained at very low levels. When the Fed started hiking rates in early 2022, Primary Credit began rising, though it has remained low. On today’s balance sheet, it rose to $7 billion, having doubled over the past four weeks.

It seems most banks have way too much cash and put some of it on deposit at the Fed (in total $3.08 trillion in reserves); but some banks don’t have too much cash, and borrow some from the Fed at 3.25% (in total $7 billion). In terms of magnitude, there is no comparison, but it’s nevertheless cute:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

Primary Credit’s punk ass needs to stop ‘staring’.

Good to see QT on Autopilot.

So…you saying a small size is cute?

“but some banks don’t have too much cash, and borrow some from the Fed at 3.25% (in total $7 billion). In terms of magnitude, there is no comparison, but it’s nevertheless cute”

Primary Credit is a measure of banks in distress. Be good to keep a close eye on it.

Also time to watch the FDIC and OCC regulatory reports on banks. They should be better off than in 2007-2009 when Bank Failure Fridays were a thing due to Housing bubble 1… except the Everything Bubble is much much bigger.

Lots of companies overborrowed on Legveraged Loan market at rates that won’t be rolling over nicely for a while. That’s going to start to leave a mark soon.

@Wolf –

Dumb question of the day: Is the argument that total assets at the Fed need to drop by roughly 50%, back to the trendline circa 2019 for us to be back in relative “health”? I would assume that total assets grow over time, so perhaps the figure isn’t quite back to $4.5, but is that a reasonable goal that officials may be aiming for?

…or, is that a completely arbitrary number to pick?

Yes, seems you’re about on target. I did some thinking and ballparking on this here:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

So…with QT:

1. It’s happening! It’s really happening!!!!

2. It will continue until at least the midterms

3. It will continue until something breaks

4. You may not need a prime rate greater than the rate of inflation with enough QT

5. We are never going back to “normal” until after a hard recession

QT will continue util they double up and print the next $9 Trillion.

Agree, same as inflation.

Mindset changed, why should we work or save when we can just print money ?

Fed changed the terms of their dual mandate in August 2020 to favor employment over inflation, financial stability over inflation.

The change was cover for the Fed making a pivot earlier than most expect.

Perhaps much earlier.

“3. It will continue until something breaks”

Something huge – the hugest thing the Fed is in charge of — has already broken: price stability (inflation). Everything else is a sideshow.

The day most folks realize this is going to be epic. Most do not seem to get it yet.

Elements of NFCI/ANFCI are going positive which is showing that QT is starting to work. But in both measures Leverage is still negative. That’s the genie in the bottle for the Fed, so there’s still a ways to go.

And here’s how we got to Raging Inflation… Wouldn’t that also be a function of the overall government spending and not just the Federal Reserve? The cares act for starters

Nope. The Inflation Reduction Act fixes that.

Inflation is expansion of the amount of money, simplified “money printing”.

Over time this will weaken the purchasing power of money and prices rise. Or rather the exchange rate between money and goods and services change to reflect the lower purchasing power of money.

Wolf, why do they cap QT or what’s the point of capping Treasury securities at $60 B and MBS at $35B? Why not roll off more?

I wouldn’t have, and they shouldn’t have, but they did in order to keep it predictable. There are some months when something like $120 billion in Treasuries might come off, and they think that markets might have trouble digesting that. Other central banks, such as the Bank of Canada, don’t cap QT.

Yeah, but the Bank of Canada’s QT has happened in fits and starts. You had that great article showing how they eliminated their most problematic assets first… but for market participants it wasn’t so easy to figure out what they were up to at the time because their QT started and then seemed to stall. Going forward I expect the BofC to do QT more like the Fed does.

I guess they are stalling on more aggresive QT until interest rate hikes stop? Seems like another catastrophic error on the part of the Fed. It seems like they should be going much slower on the rate hikes and much faster on the QT, despite liquidity being the problem. If rates weren’t being hiked so quickly, then removing liquidity with aggresive QT wouldn’t be as much of a problem, right? Am I missing something? It seems people are going to “pay whatever” as long as there is too much money in the system, so clawing back a good chunk of that money as quickly as possible should be job #1. If asset prices fall, some wealth holders get burned, but they are the ones with outsized gains, so they have nothing to justifiably complain about. What’s wrong in this analysis? Politics?

So let me get this right. I deposit cash in my banks money market account and they pay me 0.1% interest, they then deposit this excess cash at the Fed and get paid 3.15% ?

Think of it this way: You are saving the financial system by way of your generosity.

When the FED pivots deploy all your cash, will be at the bottom.

Your email address will not be published.

Underlying pension fund issues can now be dealt with in an orderly fashion.

Very different from prior recessions when the industry was caught with huge inventories and large production runs.

Carefully communicating this isn’t a Pivot to QE but a temporary “backstop” to calm a panic. And it calmed the panic with minimal purchases.

The Fed gets more rate-hike material. Only retail trade is back to normal.

“Expect more distress from some owners as loan defaults and relinquishing of assets could increase going forward.”

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy