JHVEPhoto/iStock Editorial via Getty Images

JHVEPhoto/iStock Editorial via Getty Images

Pitney Bowes, Inc. (NYSE:PBI) recently reported underwhelming Q2 2022 results. The bulk of this underperformance can be attributed to the global geopolitical and economic issues that are reducing demand for goods and creating higher input costs. Specifically the China Covid situation led to a decrease in packages coming into the U.S., the strong Dollar led to a drop in cross border business, and high fuel and labor costs upped expenses. These are issues that are beyond the control of the company but they will worsen the decline in the business if they persist.

But if the underlying business is sound, this uncertainty creates an opportunity for investors as economic fears take the stock price down. This possible opportunity is best revealed by breaking the business down into its main segments: Global Ecommerce, SendTech Solutions, and Presort Solutions. Through my analysis of these segments, I think there is a path to debt reduction and solid profitability when compared to the current valuation that can lead to upside for the stock. However the business still faces short and long term headwinds and is run by a management team with a history of questionable capital allocation decisions. This means that this is not a fat pitch investment but I see enough compelling reasons to give Pitney Bowes a buy rating.

I will go through the three main segments in some detail here. This is mainly to give some perspective on how I’m thinking about the business from a high level.

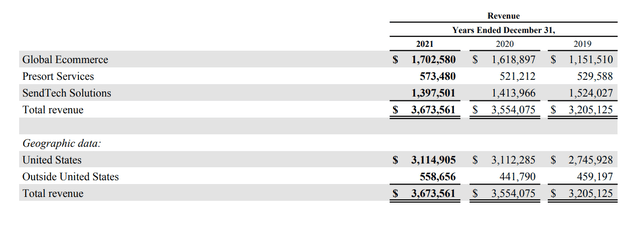

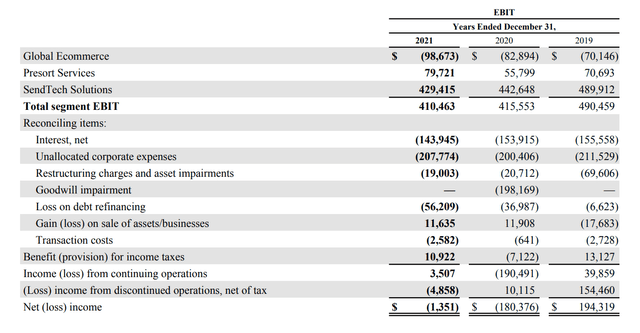

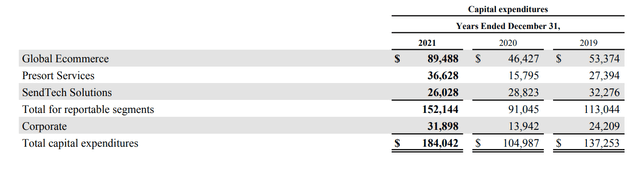

Global Ecommerce operates in a growing industry but it is capital intensive and not profitable. This trend has not changed course over the past few years and even during the ecommerce boom at the peak of the pandemic, losses accelerated. Yes, some of the capex for this segment is going into projects to increase efficiency that may boost profitability but right now the market has no patience for loss producing, capital intensive businesses. And there’s no guarantee that these projects will pay off with significant efficiency gains. All of this to say, this segment is not worth much if it continues on this course as a money pit. For reference, in 2021 the segment was unprofitable while capex was 5% of revenue.

Presort Solutions is a USPS partner that provides mail sortation services to its clients. Unlike Global Ecommerce, this segment operates in a declining industry as USPS mail volumes continue to drop every year. But also unlike Global Ecommerce this is a profitable segment that is not capital intensive. Additionally, revenue has been growing over the past few years due to its pricing power as a USPS partner. EBIT margin for this segment was 13% in 2021 while capex was 6% of revenue. I think of this segment as a sustainably profitable, capital light business with pricing power that operates in a declining industry. This brings the tobacco industry to mind, without the negative societal externalities.

SendTech Solutions primarily offers shipping solutions for packages and USPS mail via its shipping API. This segment is highly profitable and capital light but unlike the Presort segment, revenue has declined over the years due to a lack of pricing power. This is a very competitive space so prices drop as efficiency improves and more competitors enter the fold. Competitors include Stamps.com Inc. (STMP) and their many solutions (I covered Stamps.com before it was acquired in a private equity deal), EasyPost, Shippo, Shyplite API, etc. In 2021 revenue for this segment declined 1%, EBIT margin was 30% and capex was just 2% of revenue.

While some of these segments look better than others, it doesn’t really make a difference as long as they’re all wrapped up together in one business. When you own Pitney Bowes’ common stock you are owning all three of these segments along with all of the debt. And on top of this debt load you are inheriting a management team that has a history of poor capital allocation. For example in 2021 CapEx spend on the Global Ecommerce segment was far too high as CapEx doubled while revenue grew only single digits. The Borderfree segment also comes to mind. In 2015 Pitney Bowes purchased this business for $400 million hoping to expand ecommerce capabilities. They just sold it for $100 million.

These two factors mean that the whole is worth less than the parts. This leads to my main idea that selling the Global Ecommerce segment would be the best decision for shareholders. The ecommerce fulfillment game is difficult. It is a low margin business that involves many strategic investment decisions that the Pitney Bowes management team is not well qualified to make, in my opinion. The decision to sell Borderfree may indicate that they are coming around to this idea.

Selling the Global Ecommerce segment is the path that I think would unlock the most value for shareholders. This is not the only path but it is the one that makes the most sense to me. This is how I see it.

I am using the following figures from the 2021 annual report to make my calculations.

Pitney Bowes Revenue by Segment (Pitney Bowes 2021 Annual Report)

Pitney Bowes EBIT by Segment (Pitney Bowes 2021 Annual Report)

Pitney Bowes CapEx by Segment (Pitney Bowes 2021 Annual Report)

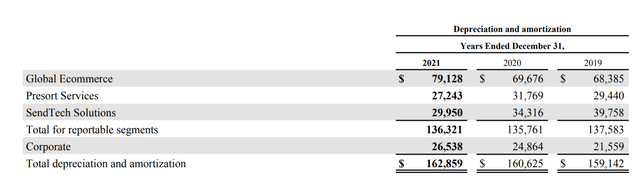

Pitney Bowes D&A by Segment (Pitney Bowes 2021 Annual Report)

Pitney Bowes Revenue by Segment (Pitney Bowes 2021 Annual Report)

Pitney Bowes EBIT by Segment (Pitney Bowes 2021 Annual Report)

Pitney Bowes CapEx by Segment (Pitney Bowes 2021 Annual Report)

Pitney Bowes D&A by Segment (Pitney Bowes 2021 Annual Report)

Using 2021 as an example year, I calculate that earnings before taxes would have been about $221 million without the Global Ecommerce segment. I get that figure by adding Presort and SendTech EBIT and subtracting the full interest expense, all restructuring charges, the entire debt refinancing expense and two-thirds of the unallocated corporate expenses. Unallocated corporate expenses primarily represent corporate administrative functions such as finance, marketing, human resources, legal, information technology and innovation so it feels fair to assume a one third reduction of this expense if the Global Ecommerce segment is sold.

For a “close enough” proxy to free cash flow (EBTDA minus CapEx) I will add back Presort and SendTech D&A expenses to the $221 million in earnings before tax, then subtract capex of the two segments. This comes out to $215 million. What kind of multiple can we assign to a declining business that generates $215 million in free cash flow per year? 5 times free cash flow seems fair.

The following chart lays out the calculations above. These are all FY 2021 numbers and all figures are in thousands.

But we can take it a step further if we consider the cash gained from the sale of the Global Ecommerce segment. How much is this asset worth to a buyer? This one is a bit more difficult to value due to it being unprofitable but I would put it somewhere between book value and 1x sales.

In 2021 the Global Ecommerce segment accounted for about 50% of D&A so I will call the segment’s book value about half of total property and equipment. For 2021, this comes out to $215 million. Revenue in 2021 was $1.7 billion so if we split the difference between our book value estimate and 1x sales, we can say the unit could be sold for $1 billion.

If this $1 billion was used to pay down debt there would be about $500 million in net debt remaining or $1.2 billion in total debt. This would be a 45% reduction in debt so if we were to reduce the 2021 interest expense by 45%, it would be reduced by $65 million.

Adding this $65 million to the $215 million free cash flow figure I calculated above brings us to $280 million of free cash flow in the year. If the business is valued at 5 times free cash flow it’s worth $1.4 billion. If it’s valued at 10 times free cash flow it’s worth $2.8 billion. Compared to the $500 million market cap today, this strategic path shows that an investment in Pitney Bowes could offer good returns.

As a highly leveraged turnaround story, there are risks to owning Pitney Bowes. I used 2021 numbers in the example strategic path I laid out above, but 2022 earnings are already worse in each segment. The general idea is still true even with 2022 numbers but the final numbers don’t look as good. If the global economic and geopolitical issues persist, Pitney Bowes may not achieve 2021 earnings anytime soon.

Management could also continue to make poor capital allocation decisions regarding the Global Ecommerce segment. Ecommerce fulfillment is a difficult industry and in my opinion the current management’s track record shows that they’re not cut out for it. Selling the Global Ecommerce segment could also go against their interest even if it is better for shareholders, as it leaves the management team with fewer responsibilities. Investors should keep a close eye on their decisions going forward.

It’s worth nothing that insiders have been recently buying shares on the open market. Most recently a director, Mary Guilfoile, purchased $87,000 worth at $3.47 per share and in May of this year, the CFO purchased shares at as high of a price as $5.13 per share. This doesn’t guarantee they will make the right decisions but it indicates that they are bullish.

If you are a bit more risk averse or more pessimistic about the global economic and geopolitical outlook, you could consider the Pitney Bowes Inc. NT 43 (PBI.PB). At today’s price it offers an 8%+ yield and more protection if economic conditions worsen and the company needs to take measures such as cutting its dividend. You won’t get as much upside if things go well but these notes offer a great yield for a business that, if the right steps are taken, is quite profitable.

Pitney Bowes has been on a steady decline over the past few decades but underneath the surface, the business has promise. The Presort and SendTech segments are both highly profitable and capital light, while the Global Ecommerce segment could provide the necessary liquidity to reduce debt to a reasonable amount if it is sold. Management has a track record of poor capital allocation decisions when it comes to the Global Ecommerce segment specifically, so it seems to me that it would be best for shareholders if they sold that asset, used the cash to pay down debt and only ran the highly profitable “easier” segments.

But this isn’t one of those investments that can bailed out by a long holding period. Management must make the correct decisions to create value for shareholders. The potential solution I laid out above is not necessarily the correct one but the current trajectory is clearly not working. For the sake of the shareholders, I hope that the management team figures out the correct path to take.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PBI, PBI.PB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.