THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

In many ways, this is still the most overstimulated economy ever, and it’s not wanting to come down because there is still all this cash from the Fed’s and the government’s stimulus floating around. So here is an example.

California has so much cash right now it doesn’t know what to do with it. So it’s throwing money around left and right, including directly at consumers. The state will start sending out stimulus checks, I mean inflation checks, in October for up to $1,050 per household. In total, about $10 billion are expected to be sent to consumers just in time for shopping season, and folks are going to spend this extra $10 billion.

Other states – and cities– too are flush with money, and they’re spending it in a million different ways either directly or by subsidizing one thing or another. And Congress just passed massive give-away legislation that douses corporations and consumers in all kinds of incentives, cash, rebates, and what not.

And this kind of stuff just keeps on keeping on – because states and cities are flush with pandemic cash, and cash from tax revenues, and they’re going to throw this money at their businesses and consumers. And Congress is still living in an era where money was free, and it acts like it.

This comes when the Fed is trying to slow demand by hiking interest rates to slow purchases by businesses and consumers, to take pressure off prices and allow for the raging inflation to cool. All this stimulus still going on from the other side of the equation is counteracting what the Fed is trying to accomplish. And the Fed is gnashing its teeth.

So is it any surprise that consumers spent with abandon in August, even outspent the renewed flareup of raging inflation? Nope, it’s not a surprise.

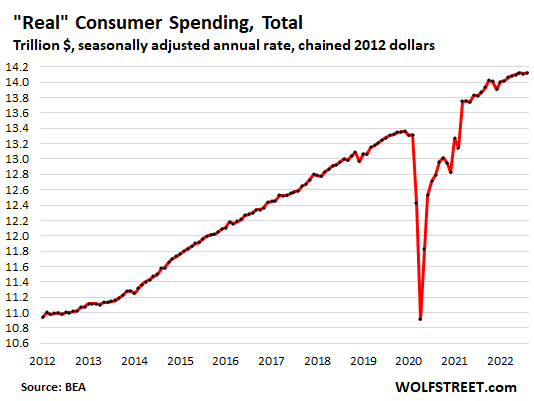

Total consumer spending on goods and services, adjusted for inflation – so “real” consumer spending – ticked up by 0.1% in August from July, and by 1.8% from a year ago, to another record, despite raging inflation.

This was driven by increased spending on services (adjusted for inflation), even as spending on goods (adjusted for inflation) continued to dip from the huge mega-stimulus surge last year. Clearly, the Fed’s message about wanting to slow demand hasn’t gotten through to consumers just yet:

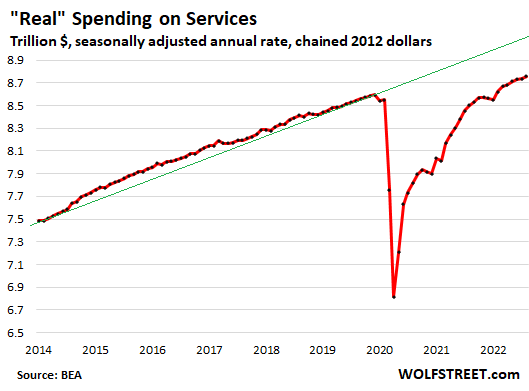

Spending on services, adjusted for inflation, ticked up 0.2% for the month, and rose by 3.0% from a year ago. Services include healthcare, housing, education, travel, sports events, haircuts, repairs, subscriptions, streaming, etc.

Services accounted for 62% of total consumer spending in August, the highest since pre-pandemic times, but was still below the share of around 64% during normal times as spending on services still runs below pre-pandemic trend; but spending on durable goods, as we’ll see in a moment, still hasn’t come off the stimulus bubble.

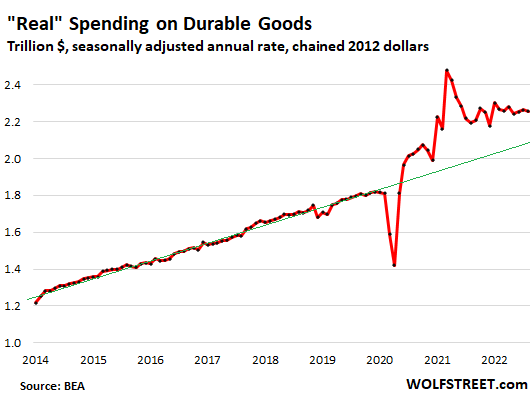

Spending on durable goods, adjusted for inflation, continues to run substantially above pre-pandemic trend. This is where the most overstimulated economy ever manifested itself in an explosion of spending in 2020 and 2021, that is now slowly and reluctantly reverting to trend.

Inflation-adjusted spending on vehicles, appliances, electronics, furniture, and other durable goods fell by 0.4% in August, but it didn’t even undo the jump in the prior month. Compared to the stimulus-driven durable-goods spending last year, August was up by 2.9%. Compared to August 2019, spending (adjusted for inflation) was up by a still astounding 25%!

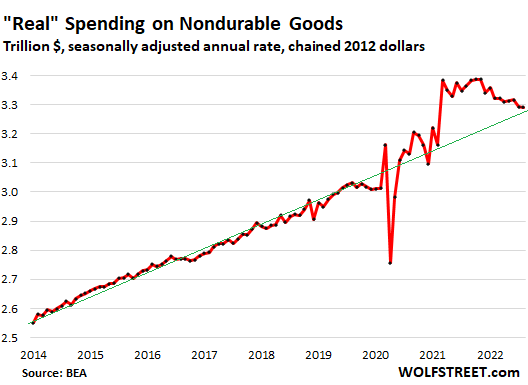

Spending on non-durable goods, adjusted for inflation, which was also boosted during the stimulus era, is reverting to pre-pandemic trend and is almost there. In August, spending on food, gasoline, household supplies, etc. ticked down 0.1% from July, and was down 2.2% from the stimulus-fueled level last year. It was still up 9% from August 2019 (adjusted for inflation).

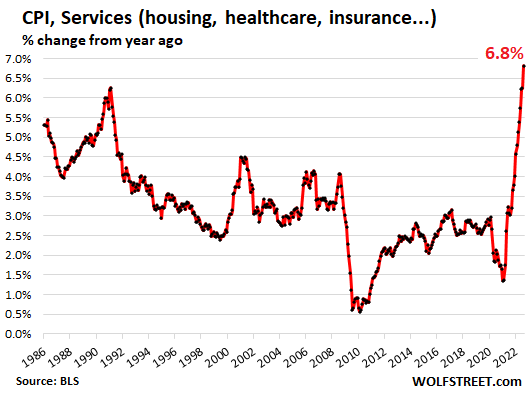

It is now inflation in services, ironically, that is shooting straight up, while inflation in durable goods is beginning to vanish. “Ironically” because inflation-adjusted spending on services is still way below pre-pandemic trend. And you’d think that this would be a difficult segment for inflation to take off in. But no. Inflation has been on a tear.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

You’d think California would want to take that money and do something about their water situation or homelessness.

Water or homelessness, either way, the money will be stolen by the elites. It’s not like they plan to build a Hoover dam, or the highway system using these freshly printed $Trillions. There will be nothing, nothing to show for it.

My commute in the capitol city has 5+ miles of roadwork going on…

And you’ll pay for it as it was paved with gold. Then they’ll dig it up every year.

Or high speed rail. Too bad we can’t do large scale public works and public benefit projects any longer in this country.

Why not reduce state taxes?

Like another Amtrak?

It’s bottomless money pit, loses money every year with very few routes profitable.

Lots of money being thrown that way too. Lots of money being thrown in every direction, as I said. Rainy Day fund is chock-full. I mean you cannot imagine the amount of money that is out there now.

Wolf, you wrote, “Compared to August 2019, spending (adjusted for inflation) was up by a still astounding 25%!”

Is it possible that the FED is under representing the real rate of inflation?

1. The Fed doesn’t calculate inflation. Two government agencies do.

2. The CPI inflation measure may undercount inflation a little — but not by a lot. But back in 2018, when CPI inflation was in the 2% range, and some people out there said it was 12%, well, that’s total BS, but those people are selling subscriptions and they will say whatever BS to sell subscriptions. I won’t name names here, but his inflation figure is a total idiotic fantasy for people who cannot do compounding math, and I have mathematically proven this many times here in the comments.

The housing and shelter component of CPI is grossly understated, Wolf. I am trying to find anything in my life that is only up 10% in the past year. Considering that’s typically the number one expense in households, that alone is a major issue. I happen to think the BLS is engaging in “tortured statistics” to try to minimize the inflation reading as much as possible.

“I mean you cannot imagine the amount of money that is out there now.”

‘Anyone’ tried to estimate the amount?

It’s pretty easy to imagine actually. Public schools got almost $200 million in aid to “reopen” from COVID, as though that takes much any money at all. State and local governments got $350 billion, all to replace $35 billion in lost sales tax revenue.

It’s no wonder there’s so much cash out there.

We’re gonna need that Rainy Day fund money later. Badly.

A smart government with foresight and long term planning? You kidder…

Just got a check for $100. bucks from the state of Illinois, must be an election coming up?

That money should have been used to pay down our debt.

All these states and other entities pissing away their present surpluses will be screaming for federal support when the economy gets to the other side of this present labor shortage and unemployment is equal to the current inflation rate. Will the Fed be able to withstand the pressure to backstop the fiscal stimulus that CONgress will liberally provide? Look to the BoE for guidance.

Look for currency for guidance, not BoE. Look at the Pound’s fall, look at the Euro.

A currency crisis will eventually take care of the fiscal stimulus that these Western governments “liberally provide.”

The new sport of some state governors is to send out the unspent COVID relief money to voters prior to their reelection efforts.

Even though, as you note, they are still in “real time” fiscal imbalance.

Power….anything to retain power.

Wolf,

How much money do you think consumers are still throwing around due to forbearance? Many of those programs have ended due to Covid being over, but the courts are still packed with people who have not paid rents but cannot be evicted yet.

As for the extra money, so much of it came from extended unemployment benefits, but all that is gone now.

Mortgage forbearance is largely finished. Student loan forbearance continues through the end of the year, and then there’s student loan forgiveness.

Remember when Mr. Bernanke then Mrs. Yellen said they want congress to do some fiscal spending post great recession? It took awhile but the pandemic gave them their wish. Oh I know- the Fed engineered the coronavirus! – sorry the conspiracy theory sarcasm got to me. Too bad the Fed and Congress don’t coordinate spending in terms of inflation. But here we are. The global economy is unknowingly complex. But I do see (finally) some yield prospects. So there is a silver lining. Thanks for analyzing all of this so we don’t need to wait 10 years to understand it.

In addition to age, residency, and citizenship requirements there should be a requirement for any individual running for Congress, that they be able to show a passing grade in macroeconomics from an accredited college or university. Wonder how many of the current 535 could show that.

“passing grade in macroeconomics from an accredited college or university.”

——————————-

a passing grade in macro won’t fix corruption.

You just need an Insider Trading PHD . Like Pelosi and her ilk.

That would disqualify some 60% of the current members from one party and some 97% from the other.

If the requirement to teach the economics is imposed on those running for the congress, the crooks will just corrupt the syllabus being taught in school to fit their needs. As, if education itself is not corrupt already! Economics is pseudoscience designed to suit propaganda needs.

In this wonderful tech age, capturing and manipulating attention is the WHOLE game. It has nothing to do with valid content, everything to do with easily digestible bumper-sticker memes, and extravagant promises to squander other people’s money. It is “infotainment.”

Those who benefit have zero incentive to change it. The lazy masses’ votes have to be corralled somehow, and it isn’t done by anything that will make the masses actually richer, or threateningly smart. They can skim their cream, and retreat by helicopter to their third homes in the rockies.

They understand economics quite well. They end up with pockets full of donor/lobbyist cash before, during and after every election.

Political candidates should have taken courses in Finance, so they will understand how cheap money creates asset bubbles. Though understanding supply and demand is very important as well, too much of what I learned from my economics professors is BS.

I have been saying for years that we should have some kind of test or educational qualifications to be in a position to govern. I think Congress and above should have to pass difficult tests in a variety of subjects, Econ, History, Science etc so that the people that make decisions governing us are at least educated people.

It’s crazy we have tests for everything else but for governing us any crackpot idiot can get elected by the mob.

The “Presidential test” should be one of the hardest tests there is … a masters level test in all major areas.

Savings earn only 0-4%. 401K funds are all tanking. Inflation is 6% to well above that. There’s a clear message being sent to consumers:

“Buy whatever stuff & services you can, right now, even if you have to pay ‘whatever’, to avoid paying more later.”

Until that incentive structure changes, inflation will reign supreme.

I just got an email from my bank a couple days ago informing me that they will now be adding a monthly service charge to all checking accounts which don’t maintain an average daily balance of $15,000 or more. It used to be $1,000. This seems counterintuitive to the current times. I will be moving my accounts to a new bank.

^^ Same. I am consolidating three accounts banks down to one. The fees got out of hand. Monthly fee are bleeding the accounts.

That’s insane.

Any company that raises rates on me is getting the boot. This is more based on principle than anything.

This seems like an effect of an economy awash in cash.

The bank doesn’t really want your money! Normally, a depositor who keeps a couple thousand dollars in his account would probably give the bank the same profit as the depositor who failed to do that and paid the monthly fees.

But if the bank is awash in cash and can’t find borrowers who need the money, the cash not only fails to make the bank money, it shows up on it’s results as a reduced profit margin!

Your (old) bank is defending it’s margins to keep investors happy.

Move your accounts to a credit union.

The bank doesn’t want these accounts. Why would they?

If a bank customer isn’t borrowing money, most likely the bank is losing money on them.

In your example, someone with a balance of $1,000 possibly doesn’t cover the cost of the technology, even if the account pays zero interest. Technology to provide retail banking services is expensive and isn’t economical with customers who are mostly broke.

If you shop for it, you can make more interest. It takes a little bit of effort.

Yeah that’s been my take on it. Can’t figure out where to hide cash from inflation so in durable goods for my business mostly. The rest is sitting on the sidelines taking the inflation hit because markets are even worse – losses on top of inflation.

Anybody got ideas on where else to productively invest cash in this environment?

Deez Nuts!

Not just California. Every adult taxpayer here in Colorado recently received a check for $750.

We have something called TABOR, which limits most government spending increases to inflation plus population growth. Any excess must either serve to reduce the following year’s income tax rate (flat) or be refunded. That’s where the checks come from.

We had a referendum recently to gut much of TABOR, and despite CO turning bluer every year thanks to Californian immigrants, it failed, and it wasn’t that close.

Now I won’t complain about the check, and it was a flat amount so benefited the poor more than the rich. But it certainly won’t help any quantitative tightening efforts.

Yup! As a Coloradan, TABOR was the first thing I thought of reading this article. Republican free market theorists can’t stand the idea of government making sound long-term investments with cash on hand (or any money, in fact), so here we are. My $750 check is intellectually being spent on a new master brake cylinder for an old car. Most people I know are treating it like “found money,” so it will end up in restaurants, or maybe even paying down credit cards.

That’s because government has an almost perfect track record of not making sound long term investments. And I’m not even a Republican.

What most voters and politicians call government “investments” is money thrown down a bottomless rathole. “Education” is one of the best examples.

Never let a good crisis go to waste. It takes relentless leadership to run the world’s largest economy into the ground. A willful ignorance on the part of its inhabitants to stand by Silently and watch it happen. God speed to Gen Z and Millennials, there will be nothing left to savage if the geriatrics are allowed to keep running this country.

Just one look at the faces of Nancy Pelosi, Mitch McConnell and Maxine Waters tells me everything I need to know about our “leaders.” We’re f**ked.

My daughter’s generation might be the most clueless on the planet. They are so self absorbed with selfies and the lastest “equity” issue that they are ignoring the massive deficits we are handing them.

Older generations should be ashamed of the wrecked planet and finances we leave to the kids.

Indeed.

It’s remarkable the advantages that have been and are still being squandered the last 40 or 50 years. That’s my entire lifetime so I am not immune from blame.

Our grandchildren are being hurt while many older, supposedly sober wise heads live well with second houses and new cars and nice vacations.

From what I can see and have read, it will be worse once Millennials and Gen Z take over. The ones likely to be in charge believe in even more activist government than their predecessors.

November elections are round the corner. So, simply spend and give money to the poor. Cali has a very big economy more than several independent countries. How this is different from QE or Reverse repo (I know the difference just rhetoric). Fed might pull another rabbit out of the hat like ZIRP or NIRP again to calm the markets. Fight fire with more fuel. Government lost their visionary thinking and long term projects. The real reason for the might of US is the rise of the middle class. At a point of time, US was the only country where middle class joe can buy a car, home and afford luxuries. Gone those days. Now, rental or some monthly payments are a problem.

Indeed. If I were a politician, I would talk of little else than the strength of the U.S. middle middle and lower middle classes.

That’s what keeps a country unified and successful.

Their jobs were too readily sent overseas for consultancy fees and investor marginal profit. One doesn’t have to fight a trend head on to buffer the trend’s victims from its worst effects.

Hmm– is there a pattern? A logic? Create a stealth guaranteed income (buying votes), keep the consumer economy hot (weed gummies for all and maybe this fall, online gambling), and cheapen government debt. Meanwhile suck everybody into dependency on the system, and whatever it doles out. Seems to (supposedly) solve a lot of things. But it deepens other problems like inequality, housing affordability, and homelessness, staring us all in the face now. Having a nice condo in a good spot, for me means means awaiting the wrecking ball and being removed to some Stalin-esque housing complex, warehoused alongside a freeway. At least I did get to see and enjoy a beautiful California, close up.

While CA governor, Jerry Brown had the state build a surplus for hard times. That was the opposite of the usual, here. The state spends like a drunken sailor in “good times,” nowadays meaning Fed looseness times. The programs and giveaways multiply like crazy.

The new slavery is economic.

California’s finances will turn on a dime this coming year. Massive stock market losses this year and then massive real estate losses next year.

Gavin Newsome wants to run for President, but will go down in flames as Calfornia turns into a cesspool. The rest of the country will vote against the elitist Newsome.

California is on track to turn into a third world country. Small pockets of affluence surrounded by a sea of increasing downward economic mobility and later poverty.

It will be widely evident once consumer credit tightens noticeably where the public can’t live above its means.

Not much different in much of the rest of the country.

People are spending like there’s no tomorrow. Ever heard that saying? Well with climate disasters, runaway inflation, nuclear war threats, pandemic lockdowns etc. my take is people have given up hope on any future, and are saying I’m going to enjoy what time is left. They’re spending savings, earnings, freebies and stock gains like it’s the end of the world. Certainly not prudent financial decisions for those looking to the future. Now is the time to be saving, not spending. But I guess some live for today, others for tomorrow. Nonetheless with how utterly bleak the road ahead looks, I totally understand the spending mentality for many. I prefer a better future myself than a great day today.

I’ve been wondering for a while about where all that excessive panda money went especially that given to municipalities with no strings attached. At the height of the health scare I cynically thought that the money would be used to fill budget gaps and now here we are.

Government pensions got funded. The entire budget of a comedian led country got funded, instead of, you know, local green initiatives and humanitarian efforts.

I’m not sure of the total amounts given to the Ukraine by globalists and their jetset friends in Washington, to fund two sides of a conflict: $65-$100 billion?

The number of homeless in the US is estimated at 552,830 by your most accurate government bean counters.

$100,000,000,000 {$100 billion} / 552,830 {admitted govt number of homeless}= $180,887.43 Per homeless citizen! This $65-100 billion is just this last few months in misplaced expenditures for a proxy!

Stop complaining about diarrhea on the sidewalk. The money is ther to fix the problem. Other countries have done it.

Let’s talk about priorities. Don’t complain that people are howling in the street when some transgender comedian in a far away land is getting more than enough money to wage war than it would take to solve homelessness for those here on our doorstep for the next five years at least and also provide drug treatment. If you shame those who resorted to drugs to deal with desolation. Well, shame on you.

And don’t begin to tell me “they” don’t want treatment.

Try giving unsheltered residents the option of being verifiably sober in exchange for having a small efficiency unit and some food stamps, versus living on the street. See how many takers they’d have then!

Surely it would cost far less than the current financing of a far away proxy war for the benefit of globalists in a place that no one with a high school diploma in the US can even locate.

I am so damn tired of the victim blaming here in Portland. It’s disgusting. I don’t buy all the rhetoric about the best and tightest labor market ever. People better get real or buckle down.

Get cash, Patton might attack satellites in space, shutting down the GPS…

Wolf,

The last sentence in the article got cut off. “Inflation…”

Don’t think it was cut…Wolf’s leading in to the graph in service inflation which acts as its’ own [exclamation point]. Artistic license for the author, nicely done.

Thanks!!

The British Pound might have plunged after admiral Tony Radakin

warning leaked that the global GPS system might be impaired.

I can understand and sympathize with all the comments bemoaning the fiscal recklessness of all these state and federal government entities throwing money around without concern for the consequences. But the positive side of all this excessive spending is that it just gives the Fed even more runway to slowly draw the air out of the asset bubbles.

Most of this excessive fiscal stimulus is going into the “real” economy, supporting the tight labor market and fueling CPI inflation. Which means the Fed can continue to run QT in the background, starving the equity and housing markets of fuel, without worrying too much about seriously damaging the real economy.

Call me an optimist, but every time I read about high CPI/PCE inflation numbers, all I can see is more asset price deflation. Please sir, I want some more.

Would love to see the data behind your claim regarding the real economy. I’m just not seeing it where I live. Where are all the charging station projects?

The idea that the biggest asset mania in history will burst without a noticeable impact to the real economy is a complete myth.

Years from now, the end of the asset mania will ultimately lead to an economic depression, a real one with visibly falling living standards.

Once sentiment moves decisively against policy, there is also absolutely nothing any government or central bank can do to prevent it. These entities don’t create or produce any real wealth and creating more financial claims isn’t a substitute for real production.

The UK this week is one example and it isn’t an outlier either. Confidence hasn’t evaporated yet, but when it does, it’s checkmate.

The not-based-on-science lockdowns and the reflexive CARES(less) Act, PPP loans, and PPP loan forgiveness – where is the accountability?

Bottom line, key statement:

“Congress is still living in an era where money was free, and it acts like it.”

Say BUDGET, you will get laughed out of DC. The future solution, print more money.

Looking at the charts relative to the long term trendlines, I really dont see where massive demand is pushing prices higher. Durable goods is the one area that is still running way above trendline. I think that is related to the housing bubble. Deflate the bubble and watch durable goods spending evaporate.

So it all boils down to services and I imagine that some of the largest portions of services are healthcare and education. Both of those areas are not operating on free market economics.

I think that healthcare expenses will eventually be solved by technology. Get rid of doctors for most treatments – send me a good AI bot that is fed with the latest scientific information and it will do a much better job than a doctor who went to medical school 20 years ago and mostly updates his knowledge with pharmacy company brochures.

As soon as we see housing prices really plunge, the inflation will be gone. That is my thesis.

You have way too much money when you can throw $500B to fraud in unemployment and PPP programs, and not be concerned about it.

1) God punished NDX and the toxic internet.

2) We are blesses with oil, natgas, wheat, corn and rare earth minerals,

but Jatya, Jundar and Juk split us to enrich themselves, make us angry and hateful. We have never been so divided before, but they don’t care.

3) The Zoomers assets are hugging the zero line at the bottom of the chart. When the boomers expire – and they expire fast – they will leave behind millions of vacant apt, houses and cheaper stock markets, waiting for for the thirty years old.

4) One of Scott Galloway charts in – “Adrift” – 30 years old making more than their parents decline for fifty years, since 1974, reaching nadir. But the bottom of this chart is loosing thrust, falling less than the downtrend. 5) The sticky inflation will correct it. Charts speak for themselves. When the thirty years old find jobs, or open their small businesses, their wealth will rise, they will busy with god, family, work and business ==> they will be less angry, and commit less crimes…

Still waiting on the new wave of inflated oil prices to hit once the SPR flow is stopped or they run it dry. Then there is the OPEC reduction in output to be absorbed. They too watch Putin’s leverage moves with gas that increases his revenues. Fuel will once again be a raging inflation factor that will massively impact crop inputs and consumer costs.

All this plus the mindless “Green Movement” that is burning the only bridge as they force humanity to chase a utopian mirage. The EU winter should warn about just how delusional it is. Banning nitrogen? It is 78% of the air we breath! Farmers being banned from fertilizers? Look at Sri Lanka’s results doing the same. Virtually bankrupt and in famine.

OPEC is pumping almost 3m bpd below current quotas already. A cut of 1m does exactly nothing to the real world.

Banning commercial nitrogen (anhydrous ammonia, etc) will shut down half the world and most people will starve in 5 years. Hah!

Any payments from state or local governments to individuals are not inherently inflationary because those governments must borrow that money. They extract it from one sector (private investment) and distribute it to another, with interest. The Fed does not buy California state bonds.

So a state like Colorado refunding a surplus is not inherently inflationary.

However, to any extent that the state and local governments distribute funds received from the federal government that were most likely funded by indirect Monetization through the Fed and its primary dealers (which was a lot when you look at the balance sheet expansion during the last two years), then THAT is inflationary.

California estimated that it received $20 billion to the state government and $8 billion to the local governments from direct payments during the pandemic.

It estimates its “inflation relief” package will cost $17 billion.

To the extent that the various governments continue to hand out this monetized debt, the inflation will continue.

The economy absorbed this massive cash infusion. It continues to slowly release it.

There was an unparalleled increase in the money stock. States and cities should be concerned with future pension liabilities.

Disagree, Pancho. If the money is reallocated to people who are likely to spend it, there will be an increase in demand for goods and services, and if supply does not keep pace, price inflation.

Not to creat more work, but how does the “real” spending on these things look per capita?

I only wonder because total real spending should always be going up with population, if its going up but slower than the population that is an actual reduction in how people are spending.

Is it my imagination or are the comments deteriorating into the same politicized delusions that plague other financial sites? I used to learn a lot from the comments but now it’s one political rant after another.

agreed. Wolf’s articles are great. but the comments run the same across all.

Bobber: “You have way too much money when you can throw $500B to unemployment and PPP programs……..”

Correcting it for you: You CREATE way too much money when you can throw $5 TRILLION to covid programs…….

So does this mean they won’t raise property taxes any time soon?

Your email address will not be published.

This inflation shock finally goosed the ECB out of its reckless NIRP policies.

The giant’s footprint reduction to cut costs sinks Commercial Real Estate.

It’s already playing a key role in every one of Powell’s press conferences.

The model of “growth at all cost” has been taken out to the dump.

It wasn’t big hedge funds that blew up, but £1.5 trillion in leveraged pension funds. BoE stepped in to bail them out and prevent further contagion.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy