Alexey_Lesik

Alexey_Lesik

One of the top reasons investors shy away from shipping stocks when compared to stocks in other industries is the notoriously cyclical and volatile nature of these stocks. Take the case of Genco Shipping & Trading Ltd (NYSE:GNK), a US based shipping company that engages in the seaborne transportation of dry bulk cargoes along worldwide shipping routes.

GNK operates a fleet of major and minor dry bulk vessels. Its major vessels, which consisted of 17 capesize carriers at the end of Q2 2022, are used to transport iron ore and coal. Its minor vessels, which included 15 ultramax carriers and 12 supramax carriers at the end of Q2 2022, are used to transport grains, steel products and other dry bulk cargoes such as fertilizer, cement, scrap, salt and sugar, among others. Overall, it operated 44 ships and directly employed around 1,000 staff at the end of the first half of 2022.

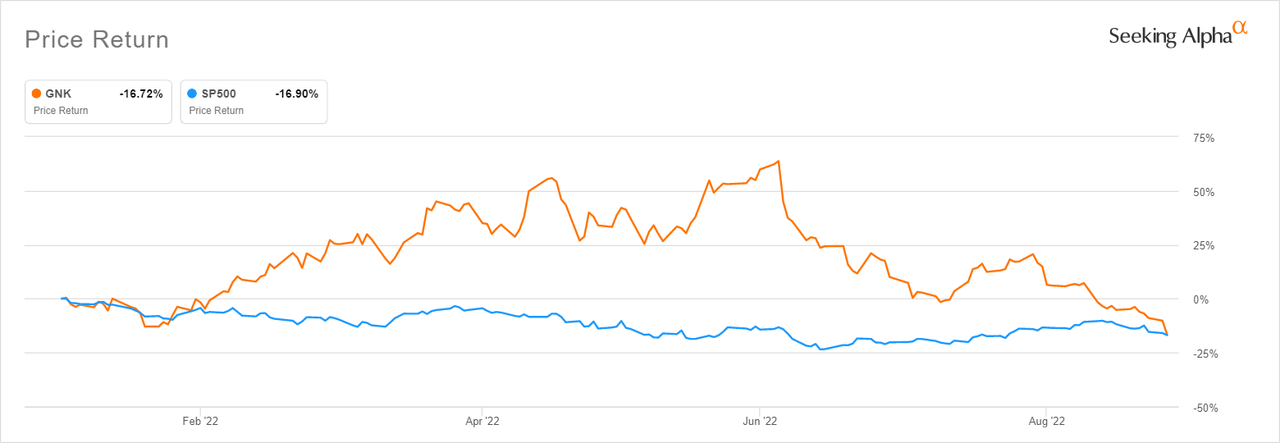

GNK’s YTD chart has lived up to the shipping sector’s reputation for being notoriously cyclical and volatile. It’s down 16% YTD, on par with the S&P 500’s decline over this period. However, if you zoom in and look at shorter time frames such as its YTD performance back in April and the YTD performance in May/June, it was up by more than 50% in both instances. GNK is clearly not a “set and forget” type of investment.

GNK year to date performance vs S&P 500 (Seeking Alpha)

GNK year to date performance vs S&P 500 (Seeking Alpha)

Earlier in Q1 of the year, GNK was ranked a hold in our previous article. We considered it a stock “worth watching” based on our view that dry bulk shipping rates would rebound. Rates rebounded, GNK rallied for some months, and then lost all its gains and slipped into loss territory when rates nosedived in May.

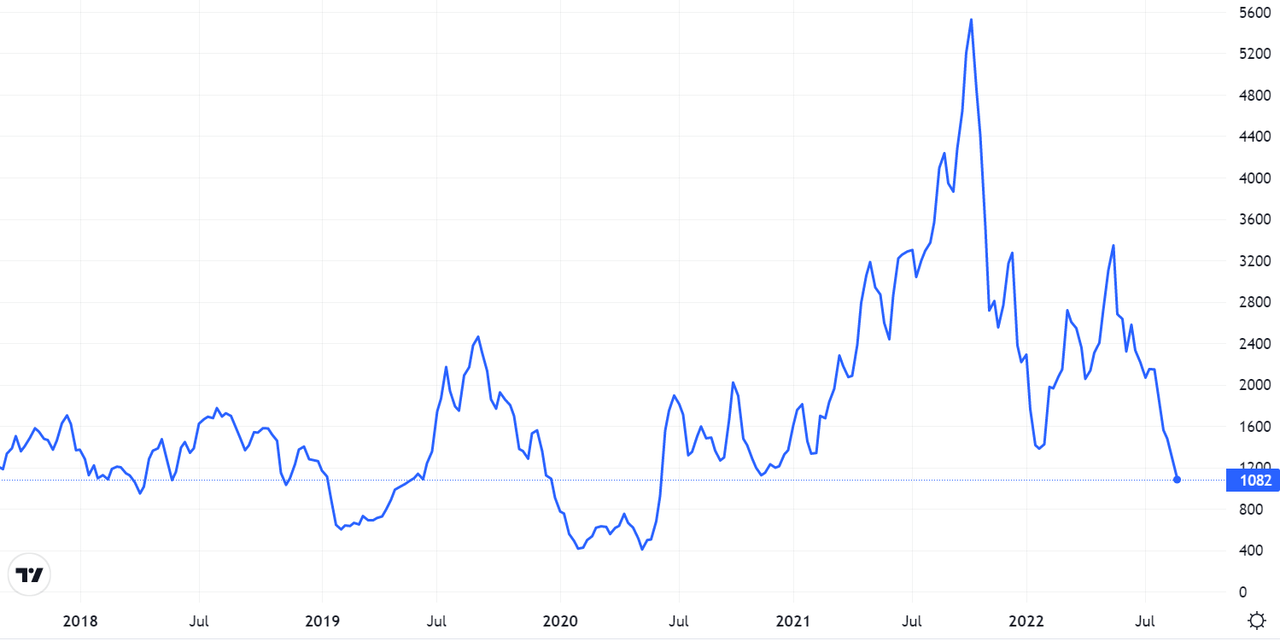

Like other dry bulk shippers, GNK’s stock price movement is strongly correlated to global dry bulk shipping rates. Dry bulk shipping rates are historically volatile. They have been in a downtrend since May, explaining the sell-off in dry bulk shipping stocks such as GNK.

The Baltic Dry Index, which provides a benchmark for the price of moving dry bulk cargoes by sea, is (at the time of writing) at its lowest point since December 2020.

The Baltic Dry Index (Trading Economics)

The Baltic Dry Index (Trading Economics)

The current low dry bulk shipping rates are pricing in the risk of a global recession, which usually leads to job losses, hiring freezes, lower consumption and consequently less demand for raw materials such as iron ore, coal and other dry bulk cargoes.

The fits and starts in China’s economic recovery, which has been slowed down by the country’s real estate bust and its zero covid policy, is also weighing down on shipping rates due to the fact that China is the main global importer of dry bulk cargoes such as iron ore and coal. Slow economic recovery in China means less demand for imported dry bulk cargoes.

If you believe the downturn in rates will reverse in a matter of months like we do, then the current negative investor sentiment towards the sector presents a good opportunity to build a position in GNK at a discount, increasing the potential for strong returns.

GNK is well positioned to deliver strong returns at current valuations. Here are three reasons why we are buying.

GNK was profitable on an annual net income basis for the first time in a decade in 2021 after dry bulk rates spiked in Q3 2021 and the BDI reached highs not seen since 2008. The company booked annual revenues of $547.1 million in 2021 compared with $355.6 million in 2020 and $389.5 million in 2019. The record 2021 revenue performance led to net income of $182 million and EPS of $4.27. This strong performance has continued into 2022. Revenues for the first half of 2022 came in at $273.9 million compared with $208.5 million for a similar period in 2021.

Getting profits after a long drought can sometimes lead to impulsive and potentially wasteful expenditures. This is true for both individuals and organizations. Fortunately, GNK has not fallen into this trap. After last year’s stellar performance, its management team did not splurge on ambitious capital investments to supercharge its growth. Instead, it unveiled a comprehensive value strategy in 2021 that is paying off.

GNK’s value strategy involves paying attractive dividends, cutting back on debt and growing the fleet using strategies that employ low amounts of leverage. In terms of the outcomes so far, GNK paid down $203 million of debt in 2021 and an additional $57.5 million of debt in the first half of 2022, as per its latest 10-Q. It had $189 million in debt at the end of H1 2022 compared with $449 million at the end of 2020.

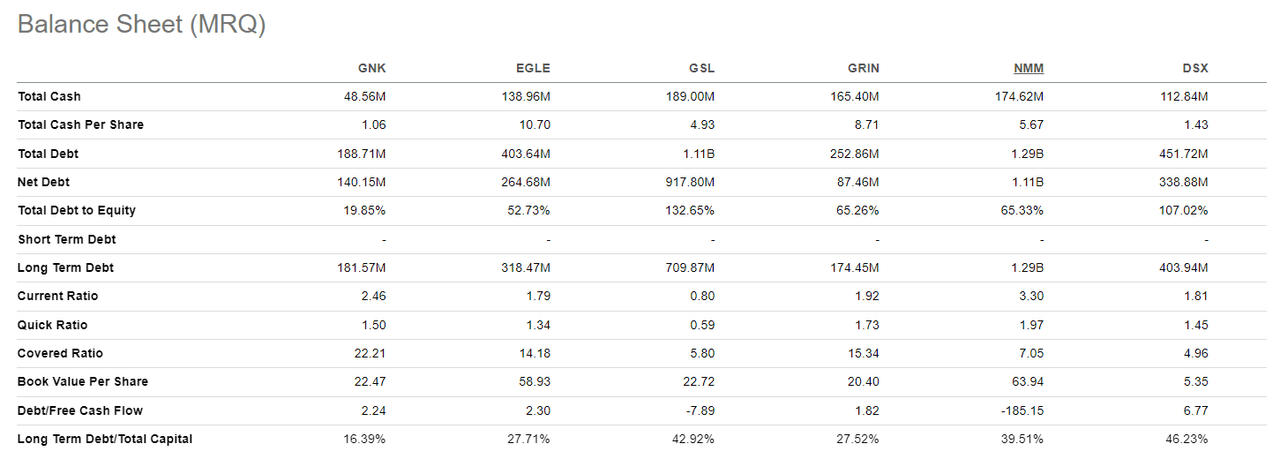

GNK’s interest expense of $15.4 million in 2021 was close to half the $28.5 million it paid back in 2016 when revenue was just $135.6 million. This underscores how the balance sheet has transformed in the past few years. GNK has the cleanest balance sheet relative to its peer set, which includes other US listed dry bulk shipping stocks.

GNK balance sheet vs peers (Seeking Alpha)

GNK balance sheet vs peers (Seeking Alpha)

Although GNK has no mandatory debt amortization payments until 2026, it plans to continue to voluntarily reduce debt with a medium-term objective of reducing its net debt to zero, noted the company’s CFO in the latest earnings call.

Reducing debt has enabled GNK to put in place an attractive and sustainable dividend that currently yields around 14% on an annualized basis. Cleaning up the balance sheet has also given GNK more room to acquire new ships using low amounts of debt. It, for example, expanded its ultramax fleet in 2021. Ultramax vessels transport minor dry bulk cargoes like grains, steel products and cement. GNK’s increased exposure to minor bulk categories will enable it to offset some of the weakness in major bulks trade flows caused by slow economic recovery in China.

The short-term outlook matters when investing in volatile stocks like GNK. It is therefore reassuring that 79% of available days for Q3 2022 had been booked at a Time Charter Equivalent (TCE) rate of $25,059 per day, according to management’s remarks at the last earnings call. This rate is historically high and shields the company from much of the weakness seen in rates in recent months

The company has also phased its expenses to free up as much cash to sustain its dividends. “Having front loaded the majority of our drydocking CapEx in the second quarter of 2022. We anticipate our third quarter dividend to rise substantially. The quarter-to-quarter variance in dry docking CapEx alone represents a $0.37 per share gain in Q3 versus Q2,” noted company CEO John Wobensmith on the earnings call.

Our view is that Q3 financial performance will be strong. The only worry is Q4, given the current low rates and the fact that rates are negotiated months in advance. That said, the potential slowdown in Q4 won’t be enough to negate the strong growth witnessed in Q1, Q2 and Q3. We therefore expect GNK to deliver a strong 2022 all things considered. This will help support the stock price.

GNK is also trading at a cheap valuation when you look at historical multiples. GNK is trading at a EV/EBITDA of 2.9x (‘FWD’) vs a 5 year average of 8.3x. This low valuation limits the downside risk.

The fact that GNK has an annualized yield of 14% could also provide price support as further dips in share price could lead to increased buying by income investors. This is of course assuming income investors are convinced it can sustain its dividend payouts for the next four to six quarters.

Dry bulk shipping rates are volatile and the current downturn could reverse in the near term, potentially triggering a rally in beaten down quality dry bulk shipping stocks like GNK. How soon this will happen is anyone’s guess, but if history is any indicator, it could happen in a quarter or two. The BDI index has in the past three years not stayed at readings below current levels for a period longer than six months. We are buying GNK to ride the reversal in dry bulk rates.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GNK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.