After Gray’s latest deals, buying the shares would seem like a win.

Vertigo3d

After Gray’s latest deals, buying the shares would seem like a win.

Vertigo3d

When it comes to industries that can essentially print money, local television is one of the most attractive investment options out there. The problem, as we have pointed out before, is that many of the local media companies (television, radio, etc.) are all controlled entities; usually with a separate class of shares which are super-voting. Historically we tend to gravitate towards the companies who do not have controlling shareholders, as there is a greater likelihood that a takeover offer emerges or an activist investor pops up. However, from time-to-time, we have invested in companies that were controlled by a single family or a small group of investors, and one of our favorite names (in recent years) to trade has been Gray Television (NYSE:GTN).

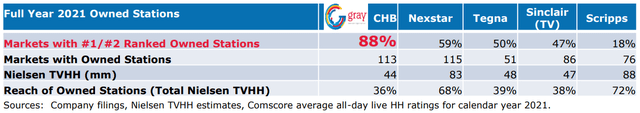

Gray Television has spent years consolidating various operations to get to their current footprint. With their latest acquisitions, the company is now the second largest broadcaster in the United States, and one that owns premier stations. Gray generally owns the #1 ranked local TV station in their markets, and in markets where they are not #1, they are usually #2. This is because of the affiliates that they own, which includes 57 NBC affiliates and 55 CBS affiliates – which happen to be the two networks that have dominated the primetime ratings for the last 30+ years.

Gray has focused on accumulating premier stations in markets that they want to be in, which drives reach/penetration within the market and allows for greater advertising/retransmission fees. (Gray Television Investor Presentation.)

Gray has focused on accumulating premier stations in markets that they want to be in, which drives reach/penetration within the market and allows for greater advertising/retransmission fees. (Gray Television Investor Presentation.)

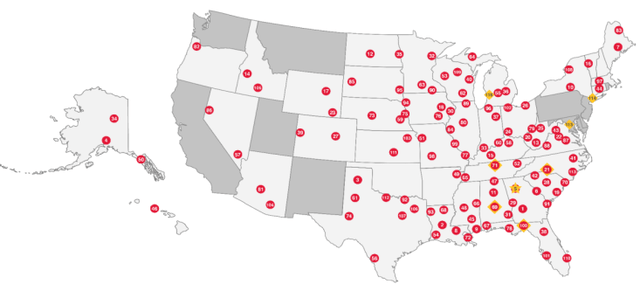

Owning the top stations in the markets which they operate in makes Gray a cash flow machine. When you factor in that they do not have stations in California, Maryland, New Jersey, Pennsylvania or Washington and that they do not own major stations in a number of the largest media markets, the cash flow that the company is able to generate becomes quite impressive. It is this cash flow generating ability which has enabled the company to leverage up the balance sheet numerous times in order to do large M&A transactions.

Gray Television Station Footprint. (Gray Television Investor Presentation)

Gray Television Station Footprint. (Gray Television Investor Presentation)

While many large markets are missing from the Gray Television portfolio, as is easy to see via the above station map, the company does a really good job of using their dominate position in many markets to charge premium rates and attract the top local advertisers. The large concentration of stations in the southeastern United States also helps with demographics and population growth.

Every two years many of the local media companies see revenues and EPS (or EBITDA if you prefer that number when analyzing companies for research) increase dramatically due to the election cycle in the United States. Every US House seat is up for grabs, one third of the US Senate seats and then every four years you have a Presidential election along with many major state offices. This is where Gray really excels and if you look at the map above, you can see that the company is positioned to benefit from elections with their large concentration of stations in states that participate early in the primary races and the company also has stations in many battleground states, or states that might be battleground states moving forward.

There are going to be some key races this year, with both political parties looking to spend heavily on Senate seats in Arizona, Colorado, Florida, Georgia, Nevada, North Carolina, Ohio and Wisconsin – all states where Gray has stations. Of the competitive US Senate races, the company only lacks stations in two of those markets, New Hampshire and Pennsylvania – although New Hampshire is covered by the company via out of market stations.

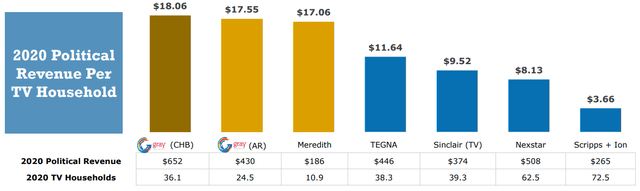

Gray does a really good job of monetizing ads during election season. They may trail some competitors on overall revenues, however their per user revenues blow the next closest competitor out of the water. (Gray Television Investor Presentation)

Gray does a really good job of monetizing ads during election season. They may trail some competitors on overall revenues, however their per user revenues blow the next closest competitor out of the water. (Gray Television Investor Presentation)

Compared to the last midterms, which occurred in 2018, Gray’s management team was estimating that they would bring in roughly $575 million in political advertising in 2022, which was an increase of approximately 55% over the last midterms. On the conference call to discuss the company’s quarterly results earlier this month, management explained that they believe this midterm season will actually rival 2020’s election cycle and increased their political revenue guidance to $652 million, over $75 million above their previous guidance.

Gray carries significant leverage after their recent acquisitions, however management, like they have done previously, is focused on paying down debt and lowering their leverage ratios. The target is to hit 5x this year, and in the next few years to be in the 3.5x to 4.5x range. While the lumpy political revenues help increase the top line revenue figures, Gray is focused on paying down debt which will help drive leverage down even faster. One item that investors need to keep in mind is that roughly half of their outstanding debt is floating rate, so interest expense is climbing (even with the current repurchasing of debt) due to the aggressive moves from the Federal Reserve.

While the focus is on deleveraging the balance sheet, the company has also been focused on returning capital to shareholders via share repurchases and dividends (the rate is $0.08/share paid quarterly, for an annual dividend of $0.32/share). Gray had $174 million remaining in their share repurchase program that was authorized by the board, which is almost 10% of its market cap.

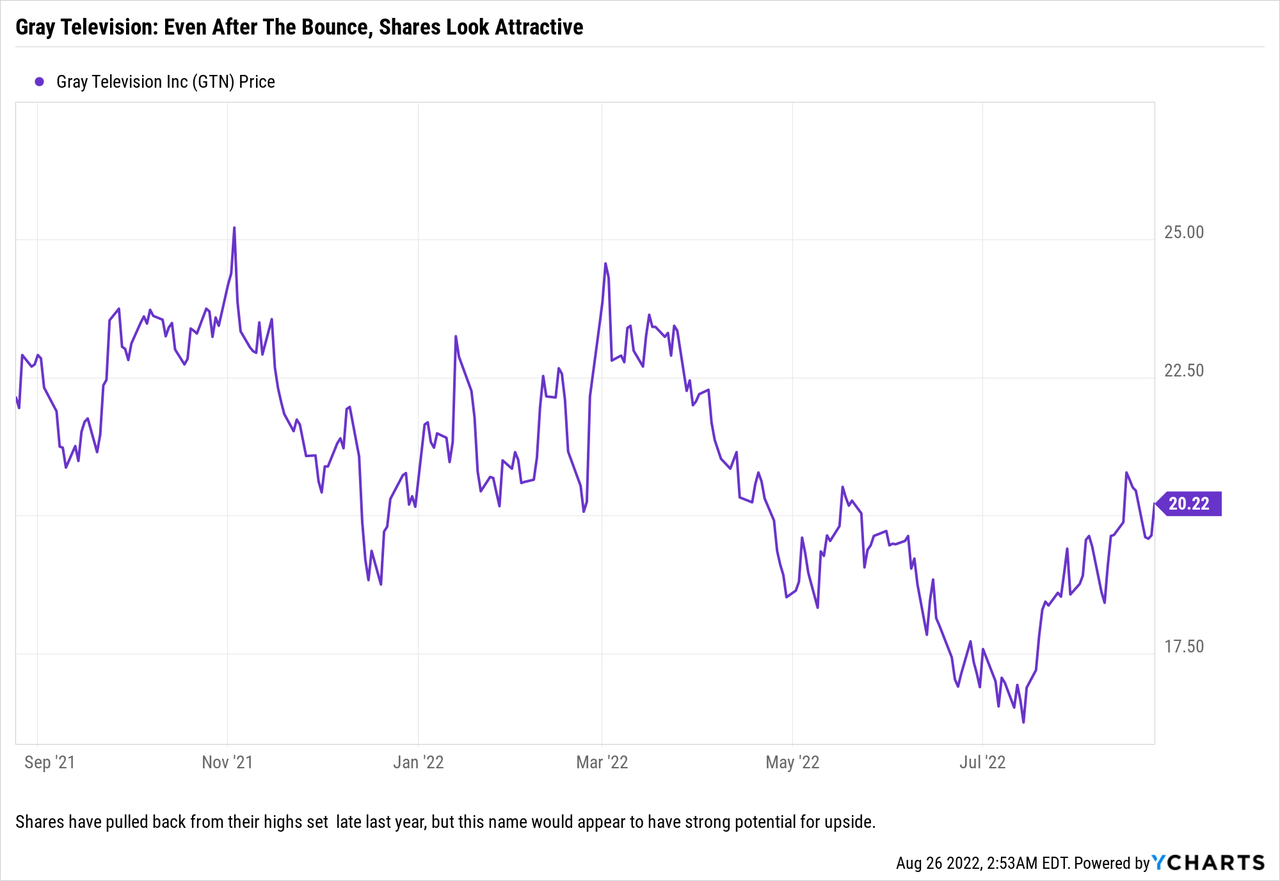

We think that Gray Television is a ‘Buy’ and has at least 20% upside from current levels. Any time that investors can buy shares below the $20/share level it would seem a win in our book as we think that shares can easily trade back up to the $24-$25/share level based off of earnings moving forward, continued debt reduction, and the company’s plan to repurchase shares via their share repurchase program. While it is our opinion that the company might have to have lumpier share repurchases (some quarters with very little while other quarters would be heavier) while management focuses on debt reduction over the next six months, we do think that ultimately the company will be retiring 10-15% of their shares outstanding over the next 12-24 months.

Share buybacks, coupled with the company’s planned debt reductions for the rest of the year of $450 million should be enough to justify a 20% move higher assuming that the economy is able to continue to chug along (however slowly). So if the company is able to repurchase shares over the next 12 months equal to about 10% of the current share count (and they are running around that rate), EPS would rise about 11%. Since we are not sure which debt maturity that management will choose to pay down (although we suspect it will be the 2024 loans which are floating rate) through the end of this year, we will be conservative and estimate that debt retirement will result in interest expense savings of a little over $20 million or around a $0.25 per share reduction in interest expense. (Note: this figure could be higher if management were to focus on some longer-dated paper, particularly the 7% coupon bonds)

We do not think that the options market needs to be used to create a position in this name, instead we think that this is a good candidate to just purchase in order to ride what should be strong results from the political spend.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GTN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.