Justin Sullivan/Getty Images News

Justin Sullivan/Getty Images News

Hovnanian (NYSE:HOV) recently reported its fiscal Q3 earnings. EPS was $10.82, or $43 annualized. The stock? $39. Yes, that’s below a 1 P/E. The S&P 500 P/E is 18, meaning that Hovnanian’s multiple is 5% of the market. Have you ever seen anything like this valuation? Me neither.

Clearly investors are anticipating a looming disaster, for Hovnanian and its peer homebuilders. And yes, housing demand recently just shifted from booming to weak in a matter of months due to a major drop in home affordability. But I own and enthusiastically recommend this stock for three reasons:

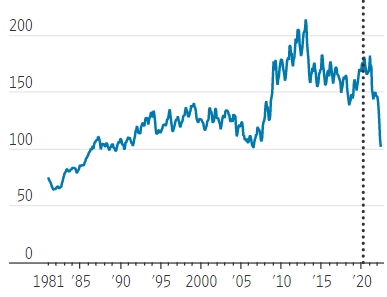

First, the bad news. Housing affordability clearly has plunged as this chart from the National Association of Realtors via The Wall Street Journal shows:

The Wall Street Journal

The Wall Street Journal

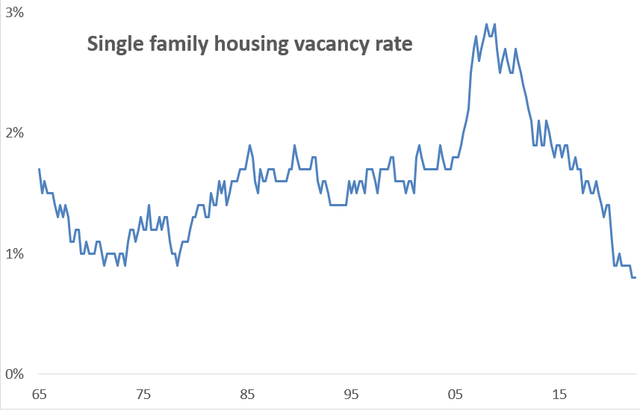

The affordability decline was due to a 40% rise in home prices and a near-doubling of mortgage rates. But a major driver of the price rise is the paucity of housing in the U.S. Here is a history of the single family home vacancy rate:

Census Bureau

Census Bureau

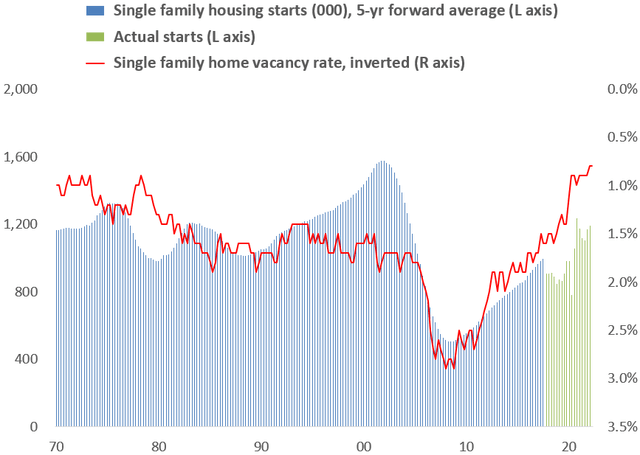

I estimate that the country is short 1½ million homes. Freddie Mac estimates that we are short nearly 4 million housing units. Do vacancy rates matter? Eventually, yes. Here’s a chart supporting this statement. It’s a little busy, so I’ll explain it before I show it. The chart has three data sets:

Here’s the chart:

Census Bureau

Census Bureau

You can see that vacancy rates clearly drive home construction. You can also see that over the last 5 years builders still were not keeping up with demand. Homebuilders, somehow and in some way, are going to need to build over 1 million homes a year in the not too distant future. And Hovnanian will benefit from that.

“Guaranteed”? That’s a strong word. But the data says that over the past 10 years, Hovnanian’s backlog predicts with 95% accuracy its home sales over the following year. And Hovnanian’s current backlog of $1.8 billion is at its peak compared to the prior decade. It suggests home sales over the next 4 quarters of $3.1 billion. That is four times Hovnanian’s FQ3 sales pace, during which it earned EPS of over $10. Hovnanian forecast FQ4 EPS of $10+. Expect next four quarter EPS of $30+, or over $200 million in cash because the company doesn’t pay taxes due to a large tax loss carryforward.

Homebuilders generally reinvest most, or even more than all, of their cash earnings in new land and construction costs in order to keep growing. For example, Hovnanian grew its homebuilding inventory by $331 million so far this year. But I expect that inventory to be lower a year from now, and probably a lot lower, as Hovnanian adjusts to the current housing recession. The company could therefore generate $300-400 million of cash over the next year. It will use that cash to reduce its high debt level and build liquidity, both good things.

Let’s me take you back to October 31, 2005, right near the peak of the housing bubble that led to the Great Recession. On that date, Hovnanian controlled 116,083 lots, of which it owned 30,388 lots and had options to buy the rest. Its housing inventory was $3.4 billion. Carrying this expensive land inventory into the housing collapse that followed drove Hovnanian nearly to bankruptcy and left it with a lot of very expensive debt.

Today? Hovnanian controls 31,913 lots and owns 10,083 of those. A third of the pre-GR level. Its housing inventory is $1.6 billion. Less than half the pre-GR level. And Hovnanian’s lot count declined by 1,588 during this past fiscal Q3; the company cancelled some options in response to the current housing recession. Here is why, according to management on its recent earnings conference call:

“Regardless of market conditions, we are always disciplined in underwriting new land transactions. But in today’s more challenging sales environment, there is an increased vigilance to our underwriting process. As of late, we’ve not been approving many new land transactions. Given the slowdown in sales pace and increase in incentives, it’s difficult to find land sellers willing to lower their expected sales price to a level that will meet our underwriting standards.”

This doesn’t sound like a company ramping up for growth. Rather, it sounds like one hunkering down for a storm. Which means paying down debt and building liquidity.

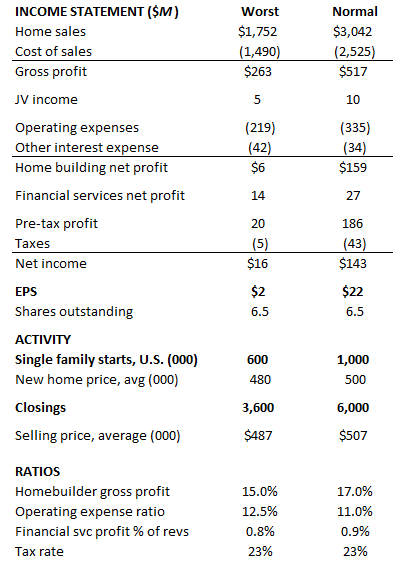

I’ve already given you my EPS outlook for Hovnanian for the next few quarters – $30+. But earnings will assuredly tail off after that before eventually returning to normal. I’ll therefore present estimates for (a) bottom-of-the-cycle earnings, and (b) normal earnings. I’ll define those two cases in terms of U.S. national housing starts. For bottom-of-the-cycle, I’m using housing starts of 600,000. They bottomed at 400,000 after the Great Recession, but housing was in excess then compared to a shortage now. And I’m using 1 million starts as normal.

Here are my earnings estimates for the two cases:

The author

The author

As you can see, it is reasonable to assume that Hovnanian might have a few breakeven quarters before the housing recession ends. But EPS should return to at least $20 a share when the housing market recovers. That assumes a gross profit margin of 17%, well below Hovnanian’s likely 22% margin this year.

Let’s look at two valuation measures. First, a P/E ratio. Homebuilders in normal times sell at 8-10 multiples. Applying an 8 P/E to a $20 EPS gives Hovnanian a $160 stock price down the line, four times its current valuation. Not tomorrow, mind you, but let’s say by 2025.

Second, a book valuation. Hovnanian’s book value at the end of this fiscal year should be $39 per share. A year from now it should be above $60. By the end of 2025 it should be approaching $100. Peer Toll Brothers’ (TOL) long-term (back to 1990) average price-to-book is 160%. Hovnanian may not be Toll Brothers, but a price-to-book of 125% gives Hovnanian a $125 price in 2025. That’s three times Hovnanian’s current price.

Do you have the nerve? This stock could be a very big winner for you.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of HOV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.