Free Coaching Call ($150 Value) With Any Purchase

11 Min Read | Jul 13, 2022

According to the New York Fed’s latest numbers, America’s credit card debt is sitting at $841 billion.1 Yep, you read that right—billion. And Experian found that the average American carries a credit card balance of $5,221.2 Ouch.

So, if you’re carrying a balance every month and feeling the squeeze between meeting your minimum payment and trying to keep up with all your other bills . . . you’re not alone. But you don’t have to let yesterday’s purchases hold you back from winning with money today.

It’s time to drop that debt like a bad habit. And if you’re wondering how to pay off credit card debt fast, you’ve come to the right place.

Debt sucks. Especially credit card debt. If you’re not careful (and sometimes, even if you are careful), it can suck you in and keep you stuck in the cycle of debt for what seems like forever. But it doesn’t have to be that way—starting today. Here are seven of our favorite proven ways to pay off credit card debt fast, once and for all.

Money goals can’t become money realities without a budget. Why? A budget is a plan for your money—Every. Single. Dollar. If you don’t plan out where your money is going, you’ll never know where it went. It’s up to you to tell your money what to do and where to go.

Pay off debt fast and save more money with Financial Peace University.

And you want to tell your money to go toward paying off credit card debt, right? So, get on a budget! Start by listing your income (everything coming in). Then write out your expenses. Start with your Four Walls (food, utilities, shelter and transportation). Then list your other expenses.

Once you’ve got all your expenses accounted for, subtract them from your income. If you have money left over, put it to use paying off credit card debt! If you’ve got a negative number, it’s time to tighten up those other budget lines until you get a zero-based budget. (That means your income minus your expenses equals zero.)

If you’re finally ready to end that toxic relationship in your life (aka your relationship with credit cards), you’ve got to kick them to the curb. Yep, break up with them and never look back. They weren’t your type (and we heard your mom didn’t like them anyway). Just put them on the table and say, “It’s not me—it’s you . . . You’re bad for me, my finances and my future. Goodbye.” Then take those kitchen scissors and cut them up so you won’t be tempted to swipe them again.

Listen: If you stop using credit cards and finally pay them off, you’ll never have to worry about your credit card balance. Ever. Again. What does this mean? It means you get to start paying for things with your own hard-earned money in the form of cold hard cash (or your debit card).

If getting rid of those credit cards freaks you out because you use them “for emergencies,” then it’s time to come up with a new plan. Borrowing money for emergencies only leads to more disaster. It’s time to get yourself an emergency fund.

First step? Save $1,000 as fast as you can. Leave it in your savings account as a buffer between you and those “life happens” moments. And while no one likes to pay for emergencies, using your own money means you won’t have to pay interest on that brand-new A/C unit.

I know $1,000 doesn’t sound like a lot for emergencies, but it’s just a starter fund. After you pay off your debt (more on that in a minute), you’ll want to build that starter emergency fund into a fully funded emergency fund (3–6 months of expenses).

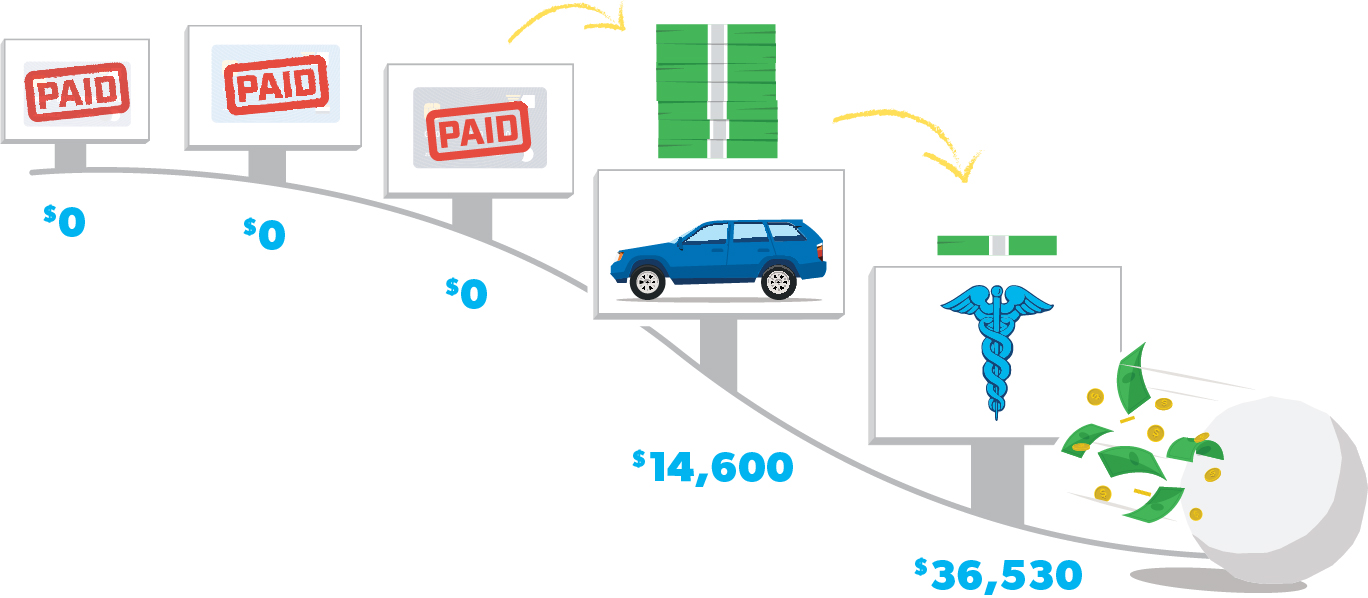

Use the debt snowball method to start paying off those credit cards, starting with the smallest balance. Okay, we know what you’re thinking—What about those interest rates? Listen: What you really need is a win. You need one of those credit cards gone . . . and fast.

The debt snowball method is all about motivation and momentum. You attack your debt one credit card at a time by going after the one you can get out of your life soonest. That’s why you start with the smallest balance first. That quick win will motivate you to keep attacking your debt with a vengeance—and that’s the key to getting out of debt once and for all.

(Don’t worry, we’ll dive into the debt snowball method how-to in a little bit.)

Now that you’re putting every extra dollar in that debt snowball of yours, it’s time to start freeing up cash by lowering monthly bills and cutting back on spending. You can do this by being more intentional with your electricity use, meal planning, buying generic, and so many other ways.

We should warn you: You’re about to feel like you got a raise. So, make sure you’re also intentional about putting this freed-up money toward paying off debt fast—not wasting it on unnecessary or impulse purchases!

Okay, it’s time to get a little radical. Are you ready? (Yes. Yes, you are.)

Look back at that budget. You trimmed it. Now cut off some branches. Sure, it might hurt a bit, but if you can take certain expenses out of your budget completely, that’s the real money saver.

What extras can you live without in this season? (And it’s just a season, we promise!) Remember, it’s not goodbye—it’s see you later.

Here are some common unnecessary budget lines you can delete (for now): restaurants, entertainment, subscriptions you don’t use regularly, cable, streaming subscriptions (like Netflix, Hulu, Peacock and more), and those trips to the coffee shop. Be honest with yourself and your budget. What things can you live without for a short season while you’re paying off that credit card debt?

You aren’t cutting all the fun. You just have to get creative with budget-friendly fun and rewards! Hey, these sacrifices you’re making right now will make a huge difference for your financial future.

With this tip, you aren’t freeing up and redirecting cash that’s already in your budget—you’re putting more money into the budget. Get yourself a side hustle! Drive for Uber or Lift. Deliver groceries with Shipt or Instacart. Resell your stuff on Poshmark or eBay.

Use the skills you have to tutor, give lessons, or take freelance gigs. You don’t even have to leave your couch. There are plenty of work-from-home jobs you can do full time (and save money on gas and the commute!) or part time. This is an investment of your time that pays off big down the road. With time and effort, you can make some huge progress toward paying off your credit card debt.

Earlier, we talked about the best way to pay off that credit card debt: the debt snowball method. Here’s how it works.

Step 1: List your credit card balances from smallest to largest. (Remember: Don’t worry about interest rates right now.) Pay minimum payments on everything but the smallest one.

Step 2: Use all the extra money you’ve got from those earlier tips and attack the smallest credit card debt with a vengeance. Once that debt is gone, take what you were paying on it and apply it to the second-smallest debt (while still making minimum payments on the rest).

Step 3: Repeat Steps 1 and 2 until your debt is completely gone! The more you pay off, the more money you have to throw at the next debt—like a snowball rolling downhill. It’s unstoppable. You’re unstoppable. That credit card debt doesn’t stand a chance.

Pro tip: Don’t forget to close your credit card accounts after you pay them off. Then you can start dancing like nobody’s watching. You did it!

Paying off debt is never easy (and anyone who says it is might be trying to scam you out of your hard-earned money). There’s a ton of buzz surrounding the idea of “quick ways” to get rid of debt. But here’s the truth: There’s no quick fix. Those tips we mentioned above are the tried and true route to debt-free success. All this other mumbo jumbo is just . . . well, mumbo jumbo.

So, let’s talk about the other methods to pay off credit card debt and why you should stay far away.

These debt reduction strategies are risky and really only treat the symptoms. You don’t need to consolidate, settle or borrow more money to deal with your credit card debt. However, you do need to learn how to change how you manage your money (using all those tips from above!).

When you’re in a bind, all you want to know is how to pay off credit card debt fast. Follow the tips in this article, and when you put in the effort, sacrifice, focus and time, you will pay off your credit card debt. Oh, and don’t forget about budgeting—that’s important! (EveryDollar is the budgeting app that makes it easy!)

Then, you can take your efforts to the next level with Financial Peace University—the nine-lesson course that teaches you how to pay off debt, save for emergencies, and plan for the future. Nearly 10 million people have learned how to pay off debt with FPU. And get this: The average household pays off $5,300 in the first 90 days of working this plan. Just imagine how much better you’ll feel when you put that $5,300 toward your credit card debt!

You’ve got what it takes to pay off credit card debt. Get started today.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Get a FREE Customized Plan for Your Money!

Get a FREE Customized Plan for Your Money!

Kiss debt goodbye. (For real.)

Kiss debt goodbye. (For real.)

Ready to be done with credit cards? Congrats! But cutting up the card doesn’t close your account. So, if you’re wondering how to cancel a credit card (without hassle), you’ve come to the right place.

Debt consolidation claims to offer relief by combining all your monthly payments into one. Don’t be fooled. Learn the real way to get out of debt for good.

The debt snowball method is the fastest way to pay off your debt. You’ll pay off the smallest debt while making the minimum payment on all your other debts, and gain momentum as each one gets paid off.

©2022 Lampo Licensing, LLC. All rights reserved.