Neilson Barnard/Getty Images Entertainment

Neilson Barnard/Getty Images Entertainment

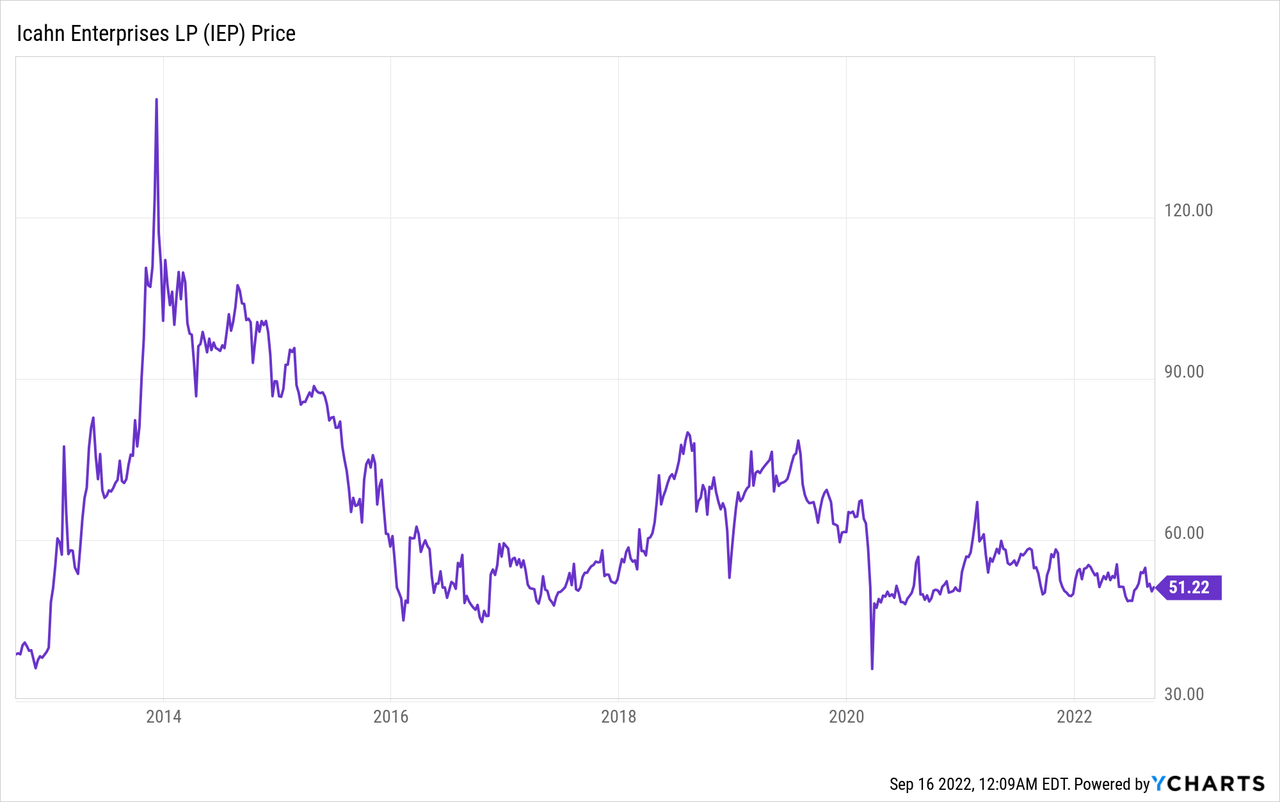

The main question I have about Icahn Enterprises (NASDAQ:IEP) is if the dividend is sustainable. The reason for that being, with a 15% and above annual yield, there are few other ways to diversely compound returns in the market today, outside of growth stocks. Given that the company has its feet in so many different industries and the share price barely moves, it remains a very solid investment compounder – if it can stick.

The more time that passes, the more I see that the answer to that question is a yes. The company has not only been trying to better position themselves to come out of the rut they’re in when it comes to profitability, but also tackling issues like long term debt and interest and further diversifying their business.

With the sizable amount of cash that they hold, I do believe that the company has a sustainable dividend and I discuss what my own strategy is for accumulating a position in the company.

I am in no way share or form a technical trader and never aspire to be. However, over the past few years shares of Icahn Enterprises have been trading in a pretty narrow range between roughly $51.00 per share and $55.00 per share. This means that I’ve had alerts set for when the stock reaches $51.50 per share or below and buying a certain number of shares.

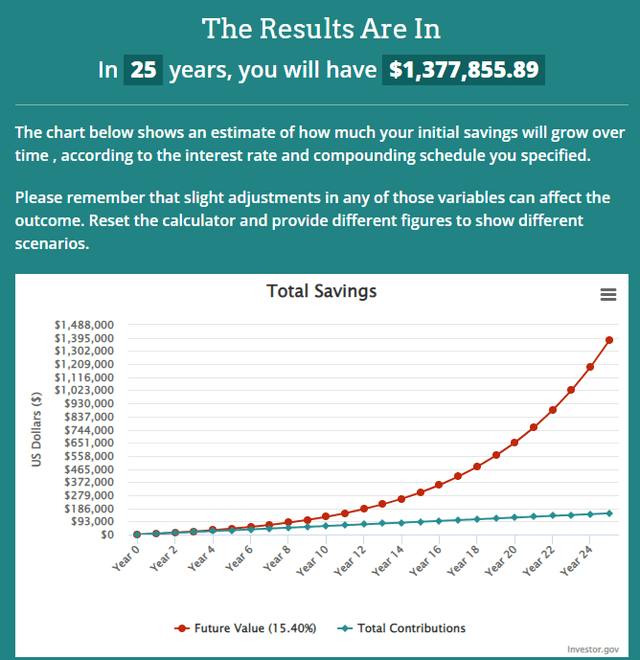

This has allowed me to maintain my purchase price at below $52.00 per share, which is an annual yield of about 15.4% or above. This is how much that money will be worth if that yield is maintained over the next 25 years:

Placing a $500 investment at current levels and adding $500 monthly to the position, totaling $150,500 in investments over the course of those 25 years results in a worth of over $1,400,000, more than 9x the original investment.

Investor.gov Compound Interest Calculator

Investor.gov Compound Interest Calculator

So this seems pretty great, but it’s important to make sure that the company is on solid footing since so much of its share price and valuation relies on this heavy dividend payments and any adjustments to the downside can spell disaster for the company.

One of the main reasons I’m optimistic about this is also a reason another Seeking Alpha contributor, as well as many other investors, seem to be pessimistic. The reason is that Carl Icahn himself owns a significant portion of the shares outstanding through his trust and personal fortune. This in it of itself isn’t a serious plus or a concern but it does mean something about the distribution of the company.

And that is – he takes almost all of the dividend in new units, or shares, instead of in cash. This results in the company paying a mere few hundred million dollars in dividend payments instead of the projected $2.58 billion we get by multiplying the $8.00 per share with the more than 322M outstanding shares.

While this can seem like some form of a scheme, it’s relatively simple to me. Carl Icahn and other major shareholders get their dividend payment in new units and I get the 15% and above yield with my smaller position, allowing it to compound. The main risk here is dilution, which can affect the share price, and I’ll discuss that in the upcoming section where I go over the major risks.

One of the weird things about the company is that they do generate a sizable chunk of their actual cash from investments and activist investing in the markets. This means that their usual business segments generate the numbers I’ve mention and will mention, but their investment activities are realized at “divestitures” in their cash flow reporting.

This past year, the company generated $382 million in cash from these divestitures and another $205 million from investments in marketable and equities securities. This figure is rather unpredictable, so I’m trying not to put too much stock into it, but it can certainly be considered a negative volatility metric as it did in 2018, for example, lose the company over $500 million.

Even so, the bottom line here is that the company has paid just $131 million in cash dividend payment in the last year, with the rest being in new units. This means that the company’s core dividend is more than sustainable, especially since they currently hold just shy of $2.5 billion in cash and equivalents, which they can use for these payments.

But that’s not the only thing that has me optimistic about their profit margins and the sustainability of their dividend.

One of the things I’m most optimistic about is the company’s efforts to minimize their interest expense by using their cash to pay down debt. It paid just shy of $1.1 billion in interest expense just a few years ago and now pay just under $600 million in interest expense.

The company has reduced its overall debt load from $12.6 billion in 2016 to just over $7 billion as of their latest financial reporting. This has in turn reduced the interest expense they pay from $1.1 billion to just shy of $600 million over the aforementioned time period.

But this isn’t the only thing that’s boosting profit margins.

The company’s efforts also lie in their operating expense, which they have managed to control and streamline to create a more efficient working body. They reported just over $1.9 billion in SG&A (selling, general and administrative) expenses in the 2016 reporting period, which they’ve managed to bring down to just over $1.2 billion in their most recent financial reporting.

With the combination of these efforts, they’ve saved $1.2 billion annually and I believe they will be able to save another $250 million over the next 2-3 years by reducing both even further (relative to revenues they generate, of course). This can provide for an even better environment where they can use this cash to both further lower debt but also limit the execution of more share in lieu of cash dividends.

The main risk I see is them being forced to but their dividend. Because the business itself is so sporadic in nature given the various industries and the reliance on trading and investing activities, there’s not much appeal in the company from a growth perspective if not for the high payout of cash retail investors get from the above 15% yield.

This can potentially be compounded by something we’ve seen far too much of in other companies. Given the fact that Mr. Icahn is 86 years old, it’s highly likely that the company will be run by someone else within the aforementioned 25 year time frame I gave to this investment. This means that, as we’ve seen with almost every other company, when new management takes place in the current environment they may shake things up and cut the dividends so they can either be paid in cash dividend for the shares owned or any other thing which can result in a loss of share value.

The other risk is if the company continues to dilute existing shareholders with payment of distributions in new units. This, as of now, doesn’t matter all that much and I’d suspect this will continue to be the case for the next 5-10 years, but it can become a problem if any significant portion of these new shares are then sold to the general public which demands cash payment for their shares.

Overall I see this as the major risk but for now there doesn’t seem to be a significant diluting factor to the share price given the range we’ve seen it in as it grows the business – as long as it stays within the $50.00 to $55.00 or above per share range, the compounding element will create a 9x return on investment and that’s all we should be caring about.

As I see the status quo of Icahn Enterprises remaining the same for at least the next 5 to 10 years, their 15% and above annual dividend yield is one of the best opportunities to compound wealth the market has today.

With a sustainable dividend payment and a predictable range of share price movement, this can become a gold mine if you have the time and risk tolerance to wait for your investment to multiply by 9.

I remain bullish on Icahn Enterprises’ long-term prospects and will continue to add to my position throughout the next 10-15 years, pending any changes, which will surely prompt an update to my thesis.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of IEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Opinion, not investment advice.