Scott Olson

Scott Olson

Kraft Heinz (NASDAQ:KHC) is one of Warren Buffett’s most beloved brands and one of the largest holdings in Berkshire Hathaway’s (BRK.A) (BRK.B) portfolio. According to Berkshire’s most recent 13F, Kraft Heinz occupies the number 7 spot in the portfolio with a total value of $12.4 Billion, representing a 26% ownership of the company. After the merger engineered by Berkshire and 3G Capital in the third quarter of 2015, the stock has been on a literal downward spiral from just after the introduction:

Kraft Heinz 2015-Present (yahoo finance)

Kraft Heinz 2015-Present (yahoo finance)

The stock got as high as $92 a share in 2017, but has since plummeted to $35 a share as of September 8th, 2022, a drop of 61%. If the price had maintained its 2017 level, Kraft Heinz would be the 6th largest holding, just over the current value of Occidental Petroleum (OXY). With all that being said, Buffett has remained true to his word on this one when he maintained that he never wanted to sell.

My thesis is if Buffett still sees value in this, I’m on board. After analyzing the value of this stock using the Graham Number combined with an examination of the company’s improving balance sheet, this has the makings of a turnaround. Kraft Heinz is a buy at today’s prices.

For those unfamiliar with the story of how Kraft Heinz came about, it was a combined effort by both Berkshire Hathaway and a Brazilian private equity firm 3G Capital who collected all the pieces to put the new company together. The Original terms to shareholders in Berkshire’s $23 Billion purchase of H.J. Heinz were as follows:

H.J. Heinz Company (“Heinz”) today announced the completion of its previously announced acquisition by an investment consortium comprised of Berkshire Hathaway and an investment fund affiliated with 3G Capital. The acquisition agreement was first announced on February 14 and the transaction closed and became effective today.

Heinz shareholders will receive $72.50 in cash for each share of common stock they owned as of the effective time of the merger, without interest and less any applicable withholding taxes. As a result of the completion of the merger, the common stock of Heinz will no longer be listed for trading on the New York Stock Exchange and Heinz expects no further trading after the close of business on June 7, 2013.

The purchase of Kraft by Berkshire/3G controlled Heinz happened thereafter and the merged company went public in 2015. All in Berkshire spent about $23 Billion on Kraft Heinz, a stake that today is worth only $12.4 Billion. If you’ve followed this story at all, you’re probably aware that Berkshire is hands off and 3G is known as the cost-cutter engineering the turnaround of the company. This turnaround is starting to show signs of success.

The nadir of Kraft Heinz’s woes came in 2019 when an SEC investigation of accounting practices of the firm resulted in an impairment of assets resulting in write-downs of $15.4 Billion. This was comprised of a $7.1 Billion goodwill impairment and an $8.3 Billion impairment of Kraft and Oscar Mayer intangible assets. The impairments left Kraft Heinz with a loss of $12.6 Billion that year. The stock responded accordingly and began to drop thereafter.

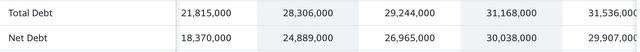

Fast forward to today and a lot of improvement can be seen in the numbers. When Peter Lynch searched for turnaround stories, the balance sheet was his main key indicator for which direction it was heading. According to the 1989 book One Up on Wall Street a successful turnaround story will have two main components, decreasing total debt with an increase of cash and cash equivalents, let’s examine:

Kraft Heinz Cash Position 2017-2021 (yahoo finance)

Kraft Heinz Cash Position 2017-2021 (yahoo finance)

Here we can see for the years 2017-2021, the cash position increased an average of 16% per year over this period from $1.6 Billion to $3.45 Billion.

Kraft Heinz debt reduction 2017-21 (yahoo finance)

Kraft Heinz debt reduction 2017-21 (yahoo finance)

In 2017, Kraft Heinz started with $31.5 Billion in total debt and ended in 2021 with only $21.8 Billion in total debt, a $9.7 Billion reduction, a decrease of 30%.

Both of these indicators are positive regarding a good turnaround story. While margins have near static forward projections, paying down debt and share buybacks can grow earnings through mindful engineering.

For tangible asset-heavy companies, I like to use the Graham number when setting my target. For those unfamiliar, this price target metric was popularized by Benjamin Graham in the original version of the Intelligent Investor, one of the first value investment classics. The formula is simple The Graham Number = Square Root of (22.5) x (TTM EPS) x (MRQ Book Value per Share). Our inputs are as follows, TTM EPS is $1.23 a share, and the most recent quarter book value per share is $39.83. SQRT (22.5) x ($1.23) x ($39.83) = $33.2. Now, this number is lower than the current market value but I would make one slight tweak to this equation. In an ideal world, earnings are equivalent to free cash flow, but when there are a lot of tangible assets on the books plus some carry-forward of impairments, we often find free cash flow higher than earnings due to accounting practices dealing with depreciation and amortization.

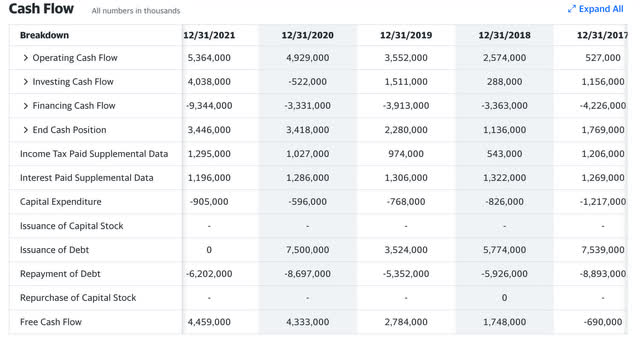

Kraft Free Cash Flow (yahoo finance)

Kraft Free Cash Flow (yahoo finance)

Let’s compare this to the income statement to see the discrepancy between earnings and free cash flow:

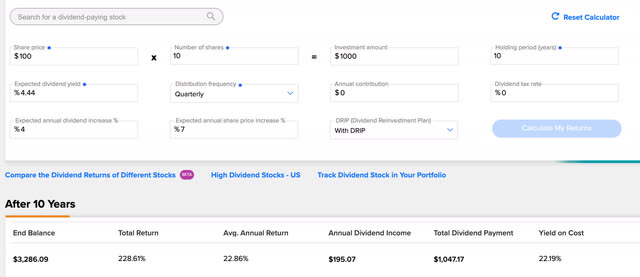

Kraft Income Statement (yahoo finance)

Kraft Income Statement (yahoo finance)

Observing the lines for net income versus free cash flow we can see that free cash flow in 2021 for instance of $4.3 Billion is 4.25 x higher than their net income of $1.027 Billion in 2021. On the income statement, EBITDA is the best proxy for free cash flow, but to be fairer in this reevaluation I will use EBIT as a better metric since as Charlie Munger points out, depreciation is a very real expense. The trailing 12 months’ earnings for Kraft Heinz is $1.5 Billion and EBIT is $3.2 Billion, therefore EBIT per share is 2.13 x higher than TTM eps.

Let’s rework the Graham number using EBIT per share instead of EPS. $1.23 TTM EPS x a factor of 2.13 higher for EBIT gets us $2.6 in EBIT per share. So once again, SQRT (22.5) x ($2.6) x ($39.83) = $48.27 a share, showing the stock currently trading at a discount by this re-calculation. This formula from the Intelligent Investor is not appropriate when evaluating companies that have amazing IP and intangible assets, but still very appropriate when evaluating companies that function on hard assets and some goodwill. This is especially true when some of those hard assets can be sold for income if needed. These are companies that are the most similar to those from Benjamin Graham’s era when almost every sellable product or service was 100% tangible.

Based on this, I reiterate my buy rating with a price range of $33 on the low end and $48 on the high end.

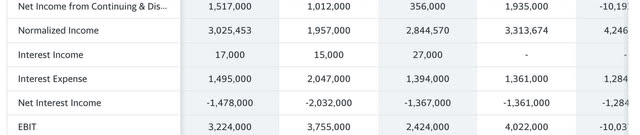

Kraft also pays a hefty dividend and one of the best ways to grow wealth is to collect dividends of companies that grow their dividends and compound them over time. Looking at the historical data of Kraft Heinz dividend, we can see that the dividend has been cut after that impairment year of 2019. The dividend was .55 cents a share in 2015, increasing up to .625 cents a share by 2018, and then was subsequently cut to .40 cents a share in 2019 and maintained at that level until the present.

For the three years of evidence in dividend increases that we have, the CAGR of dividend increases from .55 to .625 an average of 4.35% per year. We can assume that their internal dividend policy if the turnaround is executed well would fall somewhere in this range of a 4% increase per year. Let’s do a 10-year compound dividend analysis and use the current dividend yield of 4.44% as my starting basis.

compound dividends (Tipranks)

compound dividends (Tipranks)

We can see with these assumptions, that a $1000 investment with Drip and an annual share price appreciation average over 10 years of only 7% per annum, lower than the market average, could get you a 3 bagger, a tripling of your initial investment, over 10 years if the turnaround executes and the dividend increases are put back into play.

The forward annual dividend liability is $1.95 Billion and TTM free cash flow is at $3.2 Billion, a payout ratio of 60%. While 60% is not ideal (we would like to see sub 50%), they are certainly on track to have the ability to raise their dividend if free cash flow continues to increase over time.

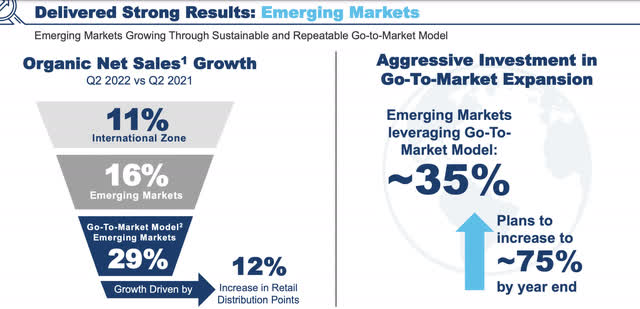

Kraft EM strategy (Kraft 2022 presentation)

Kraft EM strategy (Kraft 2022 presentation)

Emerging market investment seems to be an emphasis in the latest Kraft Heinz investor presentation. Being that Kraft specializes in processed foods with long shelf life, this could be an optimal time to enter emerging markets in full gear as shortages in fresh foods due to fertilizer shortages resulting in poor crop yields are going to make such foods more and more important. I’m very aware that natural gas is a key component in the multi-stage process of nitrogen-based fertilizer production (needed to produce ammonia), and that commodity is only getting more scarce in the world with the Russia/ Ukraine war.

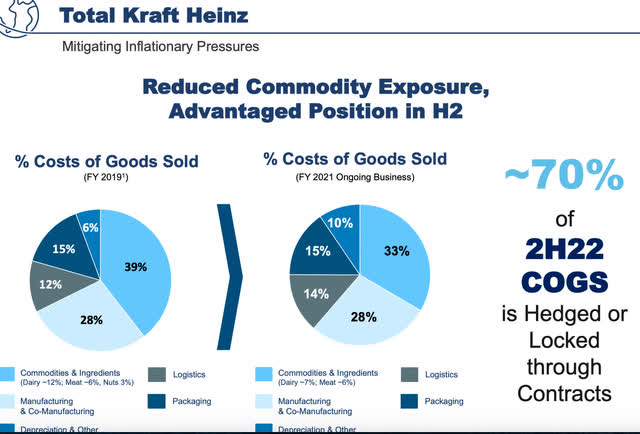

Kraft Heinz Inflation Mitigation (Kraft Heinz 2022 investor presentation)

Kraft Heinz Inflation Mitigation (Kraft Heinz 2022 investor presentation)

Kraft Heinz has also shown a great ability to mitigate its commodities exposure risk and reduce the cost of goods sold through futures contracts which will be essential in the packaged food wars that are set to ensue in the coming years of inflation. Having friends and contacts in China, with their repeated Covid lockdowns, the instant noodle market is doing very, very well at the moment according to them. We could expect macaroni and cheese (and other dry quick prep products) to fill similar voids on shelves all over the world.

The stock is cheap based on my analysis using EBIT instead of earnings per share in evaluating a price target. The company is showing signs of an executable turnaround with increasing cash positions and decreasing total debt. The dividend is a bonus and an especially large one if the company reinstitutes their previous dividend increases of 4% per annum. Kraft Heinz is a buy for me anywhere under $48 a share.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of KHC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.