Astrid Stawiarz

Astrid Stawiarz

Michael Burry is a legendary Investor who is most famous for predicting the housing crisis of 2008 and profiting in the process. Burry’s story was popularized in the academy award-winning movie the “Big short” which explained complex financial concepts such as mortgage-backed securities in simple terms.

Burry was very active in 2020/21, investing early into stocks such as GameStop (GME), before selling out at a healthy profit before the bubble popped. Burry has also been investing into “water” via a series of investments into almond farms. More recently, Burry has warned of a market bubble on Twitter and has sold almost all his stocks. As the portfolio manager at Scion Asset Management, Burry must disclose his trades to the SEC in a 13-F filing each quarter. His 13-F filing indicates Burry did sell a large swath of his positions from Booking Holdings (BKNG) to Warner Bros. Discovery (WBD) in the second quarter. Interestingly Burry even sold out of tech giants such as Google (GOOGL) (GOOG) and Meta (META), which are generally seen as “safe bets” and high-quality businesses. However, the second quarter trade data does indicate a purchase of one stock, The GEO Group (NYSE:GEO). In this post, I’m going to reveal Burry’s comments on the “market bubble” before revealing further details about GEO Stock, including the buy point Burry invested into the stock at.

Michael Burry’s vast selling in the second quarter indicates to me that he believes the stock market has further to fall. He is very active on Twitter and often posts very prophetic and often eerie quotes, before deleting them afterward. Here is a brief Tweet timeline, from an archive on Burry’s posts.

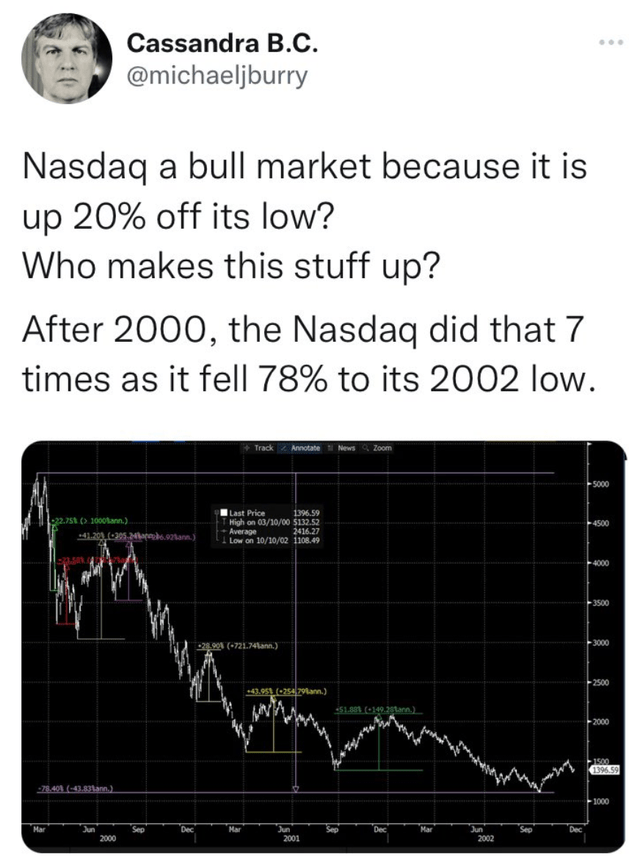

On August 11th, 2022

Michael Burry points out that even a slight recovery in the Nasdaq, does not mean the market has recovered. This happened “7 times” during the technology bubble/crash of the year 2000, before falling to a low in 2002.

Michael Burry Tweet (Michael Burry)

Michael Burry Tweet (Michael Burry)

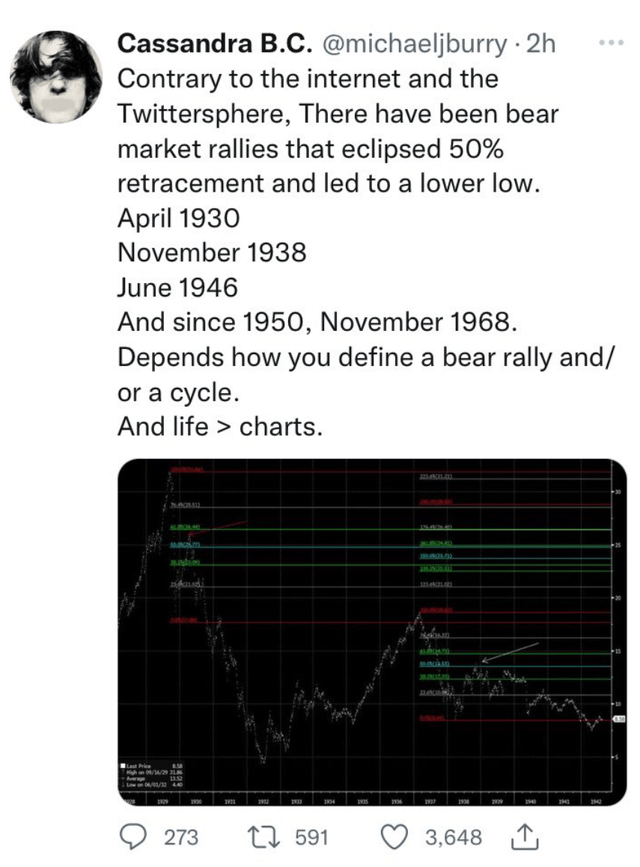

On August 15th, 2022

Michael Burry highlighted that some historic “bear market rallies” had a “50% retracement” before falling further.

Michael Burry Tweet (Twitter)

Michael Burry Tweet (Twitter)

On August 21st, Burry points out that “doomsday scenarios rarely come true because of debt”. US debt to GDP was 107% in 2017, and 108% in 2019 and this jumped to a substantial 134% in 2020. As billionaire investor Howard Marks once said “Trees don’t grow to the sky”, the question is nobody knows how much debt can be piled on before adverse effects start to occur.

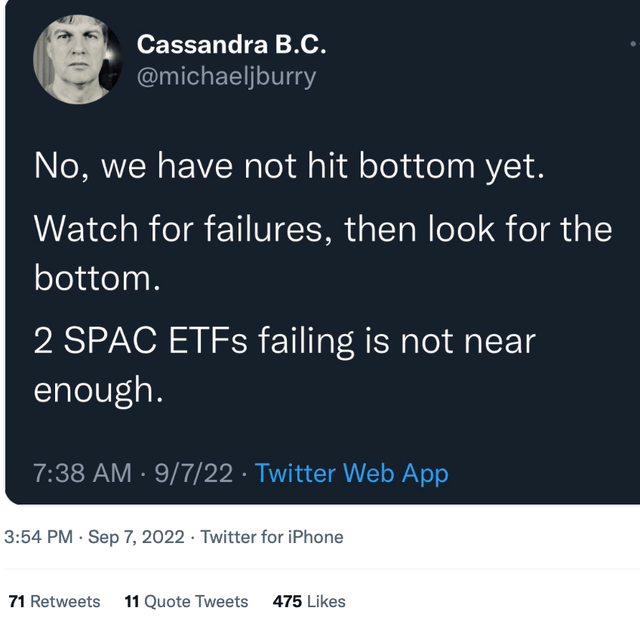

On September the 7th, 2022

Burry states “No, we have not hit the bottom yet, Watch for failures then look for the bottom. 2 SPAC ETFs failing is not nearly enough.”

Michael Burry Tweets (Twitter)

Michael Burry Tweets (Twitter)

Burry also highlights that Crypto has crashed and draws parallels with prior crashes. The series of Tweets and portfolio sales allows an easier conclusion to be drawn that Burry most likely thinks we are in still in a bear market and possibly a bubble which could mean a potential further devaluation in stocks.

As of the second quarter of 2022, Burry’s portfolio did show he had purchased a stake in just one stock The GEO Group Inc. Burry purchased 501,360 shares at an average price of $6.65, for ~$3.3 million. His position has increased in value by ~20% already since his purchase, beating the market as the S&P 500 is down by ~14% year to date. I will be launching a service on Seeking Alpha soon, which includes trade tracking of legendary investors, so be sure to follow if you want to stay updated on the release date.

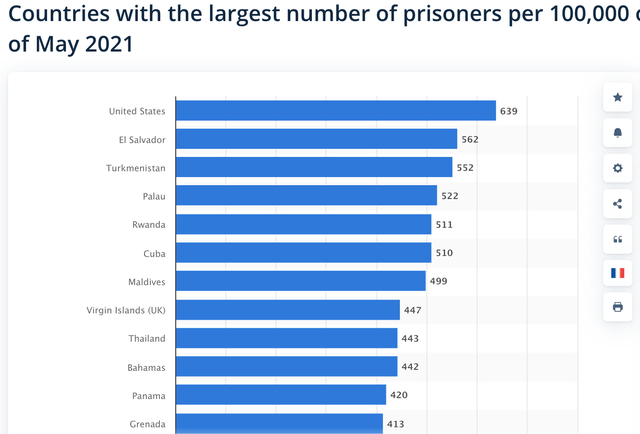

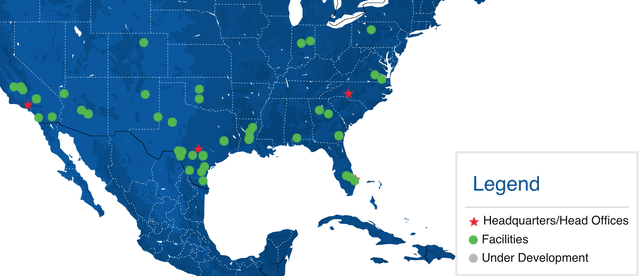

The GEO Group is a company that builds/invests/manages private prisons and mental health facilities across the USA, South America, Canada, and the UK. The United States has the highest prison population of any country with one-quarter of the world’s prisoners housed in US facilities. Over 2.19 million people were in US prisons as of 2019, which is more than the population of Paris the capital city of France, which has 2.17 million people.

Countries with the largest number of prisoners per 100,000 people (Statista)

Countries with the largest number of prisoners per 100,000 people (Statista)

You may be thinking, who cares? Many of these people on the “inside” also include those who might be innocent, awaiting trial, or have been caught on the wrong side of corruption. In addition, the US has some of the highest reconviction or “recidivism” rates with an eye-watering 44% of convicts, reoffending within their first year out. This is bad for society for a number of reasons. Firstly, taxpayers generally pay vast amounts for federal prisons and facilities, with the average per-inmate cost of incarceration in the U.S. being over $31,000 per year. These costs are of course heightened when these facilities act as a “revolving door” for certain convicts which may actually come out worse.

We also have the strain on policing, the legal system, and of course new victims which could be anyone. It is easy to blame the inmates, but the world is often not so black and white, a poor system tends to produce poor people. The majority of these people have issues reconnecting with family and finding a job when out and thus go back to crime because it is all they know.

GEO Group Facilities Map (Investor details)

GEO Group Facilities Map (Investor details)

As an investor or entrepreneur, where there is a “problem” or “pain point” there is potential for profit. A solution many of these issues highlighted is private facilities, such as those ran by The GEO group.

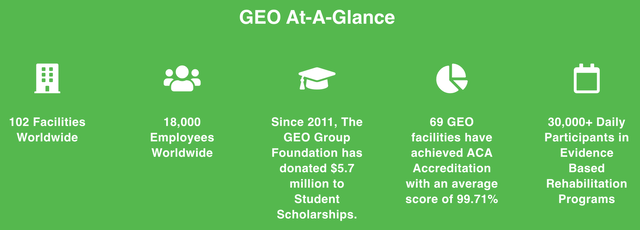

The GEO Group is a global leader in “evidence-based” rehabilitation. The company offers education, vocational training programs, cognitive behavioral therapy, and even faith-based services. Its entire program is called the “Continuum of Care” which also includes post-release support services.

The GEO Group Services (Official Website)

The GEO Group Services (Official Website)

In past tweets, Michael “Big Short” Burry has highlighted that “building more prisons doesn’t equal more crime”. In addition, he pointed out that federal prisons have a prisoner-to-guard ratio of 10 to 1, while private prisons have a much better ratio of 9 to 1. In addition, these private facilities tend to have better rehab characteristics, as mentioned prior.

The GEO Group (Official Website)

The GEO Group (Official Website)

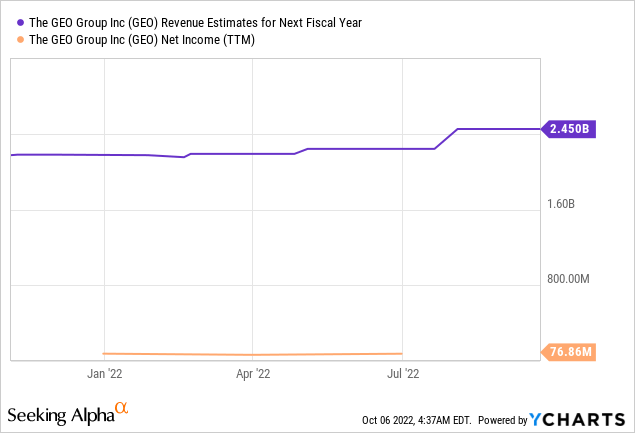

The GEO Group generated strong financials for the second quarter of 2022. Revenue was $588.1 million which beat analyst estimates by $26.68 million. In addition, Earnings Per share was $0.37 which beat analyst estimates by $0.06.

The business also generated an Adjusted EBITDA of $132.3 million in Q2,22, which increased from $118.4 million generated in the second quarter 2021.

Adjusted Funds from Operations [AFFO] was $84.2 million or $0.69 per diluted share, which was fairly constant compared to $85.5 million, or $0.71 per diluted share, generated in the equivalent period of the prior year.

Management’s strategy is to reduce its debt and then focus on improving cash flow for investors. Since 2020, the business has paid down $375 million in debt, with $130 million of that reduction coming in the first half of 2022 alone. The company has also been selling underperforming assets and have raised $70 million in the process.

At the time of writing, the business has $2 billion in net recourse debt outstanding, which doesn’t include “non-recourse debt” such as finance lease obligations or mortgages. Given they have a balance sheet of $588 million in cash and cash equivalents. In addition to just $16.7 million in short-term debt, due within the next 2 years, they are in a solid position.

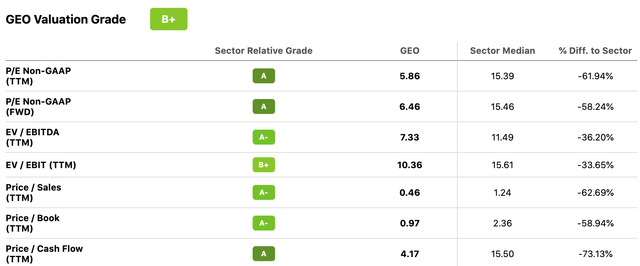

Michael “Big Short” Burry is the king of valuation, as he successfully valued the assets related to the housing bubble of 2008. Thus as my first valuation, data point I have calculated from his 13-F filing transaction data that Burry paid an average price of $6.65 per share, which is ~29% lower than where the stock trades at the time of writing. Therefore it is clear to see that Michael Burry has “beat the market” as the S&P 500 is down by ~15% year to date and Burry has posed a 29% profit.

The second data point, is the Price to Earnings ratio which equals to just 6 and is 57% cheaper than the industrials sector median. Its Price to Cash Flow ratio = 4.2 which is 73% cheaper than the sector median. In addition, the business trades at an Enterprise Value to EBITDA of 7.3 which is ~36% cheaper than the sector median.

GEO valuation (Seeking Alpha)

GEO valuation (Seeking Alpha)

Michael Burry is only human and thus he cannot always predict future crashes consistently. For example, Burry famously shorted electric vehicle maker Tesla (TSLA), which turned out not to be successful. His logic was correct in that Tesla had an extremely high valuation relative to other traditional “automakers” in 2020. However, what Burry failed to predict was the “madness of the crowd” which led to a momentum-fueled rally in Tesla stock by over 800% in 2020. Tesla also managed to become profitable, its EV demand had stayed strong and Musk built out Gigafactories globally in record time. The company has even grown into its valuation, in my opinion. Musk has called Burry a “broken clock” who is only right once a decade. Therefore, in this post, I have done an independent analysis of GEO stock.

Michael Burry is a legendary investor who is still very active in the stock market. I think Burry believes it is likely the stock market has further to fall, with high debt and inflation rampant. I personally believe he may be correct, but selling stocks if already down also seems like a poor strategy so I would rather hold. Despite the gloomy outlook, Burry appears to be bullish on one stock, the GEO group. I agree with his thesis due to the points I have highlighted, and it looks to me to be a great long-term investment.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.