THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

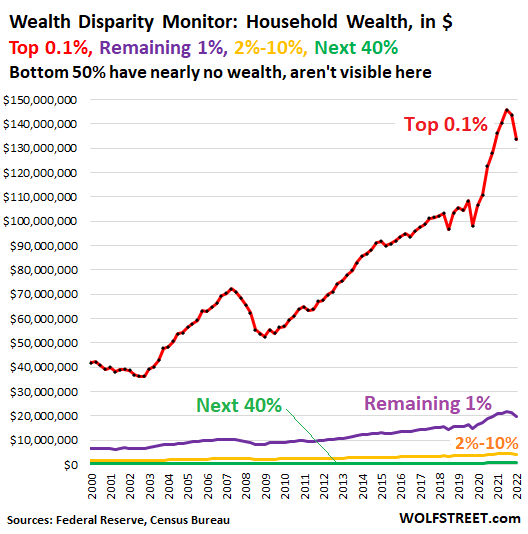

The Fed, in its new release of data on the distribution of wealth in the US, cut its classic category of the “Top 1%” into two new categories: the “Top 0.1%” and the “Remaining 1%.” And then there are the three classic categories of wealth or lack of wealth: the top 2% to 10%; the Next 40%; and the “Bottom 50%.”

The results of splitting out the 0.1% are shocking – though we’ve known it all along: Just how much wealthier the “Top 0.1%” are than even the “Remaining 1%,” and what kind of outrageous gift they got from the Fed’s money-printing and interest-rate repression. While the “Bottom 50%” have nearly no wealth.

The new release is for Q2, when the selloff in the stock market and the bond market was in full swing. The selloff hit the total wealth (assets minus debt) of the “Top 0.1%” the most, because they own the most stocks and bonds, and those got hit the hardest: The “Top 0.1%” lost $12 million in wealth per average household, compared to the end of 2021. And the unbelievably enormous and mind-boggling wealth disparity in America actually shrank visibly.

QE ended in early 2022. The Fed started raising rates in March. QT started in June. By now, interest rates have shot up, bond yields have shot up, and bond prices have fallen. The Nasdaq started falling late November. The S&P 500 Index started falling at the beginning of this year. In terms of Q2, by the end of June, the S&P 500 Index was down 24%.

And in effect, the Fed’s reversal of QE and interest-rate repression is deflating the Everything Bubble and is therefore deflating a portion of the horrendous wealth disparity that QE and interest rate repression had made so much worse.

So here is the average wealth (assets minus debts) per household, by wealth category in Q2, 2022, and by how much it changed from the end of 2021 (in bold). Note the gain by the Bottom 50%:

The “Bottom 50%” of households don’t show on the chart below because they have so little, and a big part of what little they have are durable goods, such as cars, a little home equity, and pension entitlements. They own nearly no stocks and no bonds, directly or indirectly. But their net worth actually jumped from minuscule to a little less minuscule! Kudos!

So here it is, my Wealth Disparity Monitor. It shows the wealth (assets minus debts) in dollars, per average household for each category. The bottom green line is the average household wealth of the better-off portion of the middle class, the folks below the top 10% and above the Bottom 50%, which is an indictment of the wealth distribution in America:

The explosion of the wealth of the “Top 0.1%” households through 2021 (red line) shows that they were the primary beneficiaries of the Fed’s policies since March 2020. These policies were designed to inflate asset prices, and only asset holders benefited from that. The more assets they held, the more they benefited. And those that already held the most assets, benefitted the most.

From Q2 2020, the beginning of the Fed’s crazy QE and interest rate repression, through the end of 2021, the average 0.1% households gained $47 million in wealth!

This was an obscene gift that the Fed handed this small number of households for a monstrous increase of their wealth, and for an exponential increase in the already ridiculous wealth disparity to the rest of the households, even to the “Remaining 1%.” It was also the greatest economic injustice committed in recent US history over such a short period of time.

These monetary policies are largely responsible for the worst inflation in 4 decades that is mauling the “Bottom 50%” of households because they have so little, and spend all their money on necessities.

By Q2, the “Top 0.1%” households gave up $12 million of that $47 million in gains they’d made since March 2020. So the Fed has a long way to go with its tightening policies before this Wealth Disparity gets back to something that doesn’t tear up the American society.

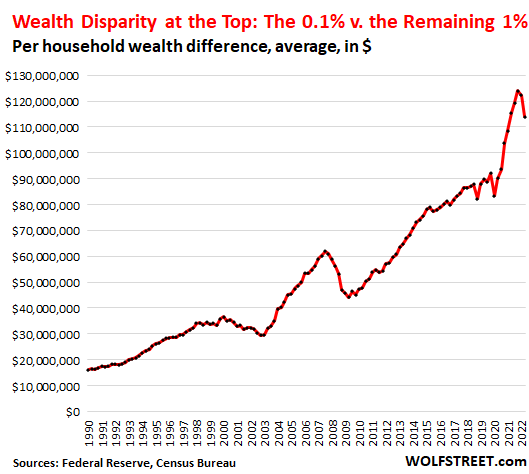

The wealth disparity even at the very top is just astounding. As we have long suspected, it’s not the 1% that get all the goodies; it’s the minuscule number of households that make up the top 0.1%: QE and interest rate repression since the Financial Crisis, and particularly since March 2020, simply blew out the wealth disparity between “The 0.1%” and the “remaining 1%.”

The effects of the Fed’s tightening are now beginning to dial back a small portion of that disparity; and there’s a long way to go:

My Wealth Disparity Monitor is a quarterly report card on the effects of the Fed’s monetary policies. The official reasoning for QE and interest rate repression is the well-known but dubious “Wealth Effect” which is the monetary equivalent of trickledown economics, where the Fed tries to make the already wealthy far wealthier by inflating asset prices with QE and interest rate repression, based on the doctrine that these households will then spend some of this newly gained wealth, which will then trickle down….

What we got instead of the wealth trickledown is a huge bout of inflation, of global inflation, since central banks globally have pursued similar policies of interest rate repression and QE.

Now the Fed and other central banks are furiously backpedaling, and as tightening progresses, there will be more progress in reducing the disastrous wealth disparity.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

Inflation is just wealth transfer.

It used to be nearly impossible to accumulate insane amounts of wealth when the top Federal Tax rate was 94%. In 1981 an actor became President and slashed taxes and dropped the marginal tax rate from 70% when he was inaugurated to just 28% when his term ended, and had a 74% top approval rating so it seems giving out free money worked better in the 80s vs 2022…

Yet today if the top capital gains rate for billionaires was say 60%, they could simply borrow off their shares and never pay a dime like the current scheme to avoid taxes today. The proposed billionaire taxes are not going to pass as the billionaires buy out Congress via lobby funds. And lobby reform is not going to happen as it takes tens to hundreds of millions to win elections. Catch-22…

That 0.1% chart looks like Fed’s balance sheet chart. Can we plot them together?

Eh Wolf, thanks as usual for the very informative slides.

Would like to see a precise chart comparing the 0.1% to the 1% so they are roughly same height.

My point is that the % increase, say during the pandemic, for the 2 groups probably grew by a fairly similar % . (We might be surprised if we also look at the other groups)

If it’s simply an application of the Matthew effect…

The numbers are still grotesquely obscene though for the top 0.1.

Jamie Dimon should be in prison, with no longer a dime to his name. Ditto Lloyd Blankfein. The list is long. Very long.

Greenspan, Bernanke, and Yellen would head the list. Felony counterfeiting and fraud.

Meanwhile wallstreet trying to spin up another rally with cnbc showcasing Fed President EVAN who is suddenly “Nervous about going too far, too fast”.

Fed is too slow and it will remain behind to never catch inflation!

We the people need to save this republic,this looks more like Rome every day .UNIED We stand divided we fall truer words were never spoken.Russia will become a puppet for China,boy China is smart ,get America – Russia in a conflict deplete military stockpiles then just rule the world .except financial mafia won’t let that happen,although it’s the reason we won the war

So if I ever make it to the 1% I still have the .1 percenters I can blame it all on.

It’s unfortunate, but there seems to be no good economic news anywhere at this point, and probably for the foreseeable future. My worries have been that we fall into a depression, which is already being signaled by many analysts who are using terms like prolonged recession, bad recession, worse than 2008, etc. I think they’re covering their bases for what’s about to happen. I hope the best for everyone

I’m hoping for a depression at this point. It’s what we badly need. No lessons were learned from the last housing bubble, and then they doubled down and blew the most massive everything bubble imaginable – a truly disgusting display of arrogance and recklessness.

Let it all crumble into oblivion. 12X median income house prices are a sham. Let’s get back to 2X gross income, where they were for over a hundred years before these money printers hijacked the country.

The problem is a depression hurts the poor the most. If you have 10 million you can afford to lose 8 million and still be fine.

The Bob who cried Wolf,

You’re not seeing the good news right in front of you, right here on this site in these charts: The stock market decline and the bond market decline will have very little impact on demand and the overall economy because most people in the US don’t own stocks and bonds and don’t really care. See the “Bottom 50%” who own nearly not stocks and bonds, and the next 40% who own only small amounts of stocks and bonds.

In other words, the Fed can keep taking down stock and bond prices, to unwind the insidious damage it has done, and very little will happen to the economy.

And another good thing: rising yields will turn savers and yield investors into spenders again.

There’s lots of good news right in front of you, right here.

Agreed Wolf. We need a crap ton more of the QT and rising rates, and no pivot, or no gutless Fed who capitulates in a few short months, bc it gets cold feet. The Fed is so damn far behind the curve, and a lot of people, that are in the 99% should be really angry about what the Fed has done the past 22 years. Because what happens when all the largesse is collapsed, is we will get a couple decades of really ugly blood letting out of the bloated system. The debt to gdp ratio indicates zero growth for years. The deficits are untenable and they’ve got to be stopped cold turkey. The government is bloated and has to be cut by a minimum of 80%. The worst part is with all the debt, the existing infrastructure cannot be repaired, upgraded or replaced. That’s our roads, our power grids, our water and sewer systems. All horribly under maintained and extremely fragile. It’s a very sad state of affairs here in the US, if not world wide. The Fed has been highly immoral and reckless.

Hi Wolf,

To your last point, how do rising yields turn savers into spenders?

Wouldn’t it be the other way around?

Ask the retirees that counted on the cash flow from their savings, and when that cash flow dried up, starting with QE and interest rate repression in 2008, they cut back their spending. As cash flow improves due to higher interest payments, they’re going to spend this cash flow because that’s what it is for.

This was one of the big negative economic effects of interest rate repression since 2008 on consumer spending, and why the economy recovered only so slowly — with at the time $8 trillion in savings not generating cash flow from interest anymore, and that money that stopped flowing couldn’t get spent. This has been well-documented.

Everything is connected in an economy. If you start manipulating one thing in one corner, there are counter-effects somewhere else.

A very sincere thank you, Wolf

“In other words, the Fed can keep taking down stock and bond prices, to unwind the insidious damage it has done, and very little will happen to the economy.”

It’s too bad there are circuit breakers to prevent something like a “flash crash” to zero on the DOW. Imagine all of a sudden the entire DOW is worth zero for a few minutes. The “little guy” needs something like that – you know, a win for once.

I disagree. With each of the last crashes, those in charge gave themselves more power. I think the solution lies somewhere in corporate governance and also how executive stock compensation is determined and taxed. Not just income tax.

@wolf “ the Fed can keep taking down stock and bond prices, to unwind the insidious damage it has done, and very little will happen to the economy.”

I’m an avid reader of yours but the above sounds like it was rushed. The economy is going down, as you explained in many articles about the housing market, for example. IMHO this return to reality is badly needed so, unpleasant as it is, the severe downturn is very healthy. But it will impact everyone.

If I misinterpreted your comment perhaps you’d like to post a piece on this topic, it would be very interesting.

I’ll give it a shot right here. These two things are not the same: asset prices and the real economy (jobs, GDP, etc.). The stock market decline will not contribute significantly to any economic slowdown. QT is reducing asset prices just as QE inflated them, and that doesn’t impact the economy much. Sure, there’s some impact, but it’s not much.

In terms of the rate hikes, yes, they will eventually have enough impact on the broader economy to reduce demand – at least that’s the goal — so that lower demand changes the pricing dynamics and therefore brings down inflation.

“You’re not seeing the good news right in front of new” (“you” ?)

Just think, at this rate in 200 years we’ll approach a fair and open society! Free of multi-millionaire predators. Yeah ! I can hardly wait.

Just about in time for Star Trek!

Elon Musk has to invent the Warp Drive and then we will follow the Star Trek storyline.

The Vulcans will save us!

I’m sorry but I can’t see the good news in a correction like this. Yes the top 10 percent will have their frothy wealth chopped down a bit, but how does that help the bottom 50 percent? Having a few points of yeild is pretty irrelevant when you have nothing to invest.

Those that “invest” by going to work every day, and work there asses off for a paycheck to paycheck lifestyle, may finally after 40 years get some leverage for higher pay. They need it, and deserve it.

The wealthy don’t loss money ,they short the market and make more money,by the way fools your 401k created this mess .stop giving them your labor to steal.VERY few people will get any money back

The bottom 50% will have rapidly growing wages and higher secure savings rates. Not all of us poor people are are speculator/gamblers in the equities/crypto markets. We missed out.

In other words, we will return to normal.

“Very little will happen to the economy”

Not sure how you make that claim. If the economy roared due to these policies shouldn’t the economy contract when you reverse them?

Higher rates will kill zombie companies thus increasing unemployment. Many of these are hi-tech companies that pay high wages.

While the top .1% lost 12 million, that is a rounding error for them. The 50-90% crowd absolutely depend on the stock market and asset prices, especially when it comes to their 401K. They also do most of the spending in this country. If prices of goods and services remain elevated, these folks will be hit hardest as their wealth declines thus reducing spending which cascade to reduced profitability.

I agree that it is a good thing to reduce the very damaging wealth disparity. But this adjustment will be the middle class who were told assets only go up and suckered into depending on that notion.

The working class will get screwed like we always do. Even when the fed comes in with all kinds of aid for the working class we all know it’s basically gonna be a fat cat bail out, and will be nothing more than the same sort of meddling that got us here in the first place. The correction is needed, there’s no doubting that, but the pain it’s gonna inflict is unimaginable to virtually everyone living today. In 2008-2010 I remember my mom saying that we all had no idea what a real downturn was like (she’s the silent generation so remembers the depression). Now she’s watching this one unfold and is very concerned.

I’m sure there’s good news somewhere in this, but certainly not for the masses. They will continue to work their asses off, but only if there’s jobs to work at.

On another note, regarding the bottom 50, my guess is that their net worth is up only because of the used car market driving up the costs of their only main asset. That market is starting to tank, too.

There’s a lot to digest in the numbers above, and yes, some is good, but the bulk of it is bad.

You can not overestimate the amount of damage malinvestment of capital has done to both the economy and to society. If prime rate can stay at around seven percent for the forseeable future (once it gets there), the ability for economic distortions to dominate and permeate the world we live in will effectively disappear. There will be little real ability for fake businesses to form, or for “sick” businesses to undercut prices of “healthy” businesses and drag them down.

Wealth DispAIRity Monitor might be more appropriate these days considering what is being valued and how hollow those promises of forking it over are proving in certain sectors.

I believe the increasing disparity of wealth is a function of the increasing leverage in the economy that began in the mid-1980s.

The ratio of total US debt (public & private) to GDP has increased from its longterm average of 1.5x to its current 3.7x — more than doubling over 40 years, with the gains accruing to those who were most levered.

Several WSJ reports after the GFC pointed out the biggest losses in net worth befell private-equity & real estate titans.

The trade has worked this way:

The political Leftwing, advocating on behalf of poor people, extolls policies intended to create tight labor markets, which invariably resulted in political backing for interest-rate suppression and “Greenspan’s Put” — a godsend for the highly geared.

Never forget, in the fall of 1990 Citicorp had weekly auction-rate preferred stock outstanding costing it 16% — that they could not refinance more cheaply. At the same time S&Ls, and the LBO/RE – operators like Robert Campeau and Donald Trump were dead in the water.

But they were all “saved” when Greenspan cut the FFR from (almost) 9% in 1989 to 3% by 1993 — a move aided & abetted by the Left because it would help the downtrodden.

Ask yourself: Is our world better off today because policymakers saved Citicorp and LBO/PE operators (Donald Trump, Henry Kravis, Leon Black, Schwarzman, David Rubenstein, et al.) from certain destruction in the early 1990s?

I think not. But the gains that accrued to the highly leveraged over the last 4 decades never would have happened without the intellectual ground paved by New Keynesians, most prominently James Tobin (Yellen’s diss. advisor.) See his testimony at the Clinton 1992 Economic Summit on youtube.

For the last several decades many “mini-Trump” wannabes have sought to achieve “intergenerational wealth” by buying houses with little or no downpaymet.

As Aeschylus wrote in the Oresteia : May it turn out well.

FYI: Wealth disparity “decreased” so far this year.

It seems the whole economic game is now oriented towards knowing what is to come in order know what moves to make. Data science focuses on making it easy to predict while most have no clue until it is done and even then they do not know what really happened. There are so many data points to achieve this and the most revealing was Robin Hood selling data on the “sardines” to the sharks and whales ahead.

The new investing reality seems to have less and less to do with any of the concepts taught in the last 50 years. How they tell you it is and how it really is breathless treachery…. Every man for himself and eat what you kill. Amazing to witness the permutations constantly changing….

This is happening in every sector of the economy and is behavioral economics at its finest.

I had a highly successful run with military surplus. I also was able to manufacture and compete with China on one product and even then I could not get a foothold except in the wholesale market which was not online. After 10 years of Amazon, EBay and PayPal I finally understood why China was able to prevail as they were chosen and I was not. The minions who are effectively serfs to the online system might make enough to call it a business but it would and could be shut down in a moment as I witnessed many times. Brutal at best.

Really, most here seem to be older and still believing in and operating in older system with some so savvy that it may work to some degree but the the elephant in this room is the reality that most are dinosaurs still hunting by the old rules. Wolf continually points out the treachery and foolishness easy to see and some not so easy to see.

Living in the outrage makes it hard to know what actually one might evolve in this truly dog eat dog reality unfolding before us.

What is the future for those here in the few remaining years?

AdamSmith,

“What is the future for those here in the few remaining years?”

Based on history, I don’t see much hope for improvement in the (former) United States of America. Therefore I have taken the same action that my German grandparents did in the 1920s when they left Germany for America.

I have “bugged out ” for a country where I can grow my own food, I have a fully paid for house and the people are wonderful and speak English.

I wish you well.

I’ll come and join you. Which country am I buying a ticket to?

I just want to point out that this train wreck took place under both Democrats and Republicans.

Actually, more like a plane wreck that crashed into a heavy population of innocent bystanders on the ground.

E. L.

Consider this is big “Thumbs Up”.

What happened in Italy is about to happen here.

Thanks for your reporting Wolf, great work as always! Just noticed a small correction needed…

“Next 40%” (purple): $768,000 (-$16,500; -2.1%) –> should be “(green)”

Thanks. I shouldn’t do stuff this late ;-]

I have every confidence that the selloff in equities and bonds, and the resulting far higher interest costs for lending is going to severely impact the UHNW households, I’m far less sanguine that the damage will be contained there.

A household that is at $160 million and sees $12 million in net worth? I doubt it will impact them much in a nuts-and-bolts way. But when tens of thousands of people (so far) are walking away from new home buys because of skyrocketing mortgage rates, that impacts the Main Street economy in many, many ways.

The founders of FB and Google have more money than God, and are responding by . . . . putting a hard freeze on new hiring, and announcing layoffs. The guy who cleans Zuck’s pool still has a job, but anyone who thought they were going to be laying carpet or bricks for FB’s new offices won’t be.

I’m not much of a trickle-down guy when economic times are good. But I’m very much a **it-rolls-downhill guy when things go pear-shaped.

Over the spring and summer in our neighborhood there were at least 10 landscape installs. There are currently zero. This was the main indicator I missed when the whole thing popped in 2008. I distinctly remember a friend saying the last install he did was for a referral I gave him in 2008. His business closed shortly thereafter. Since then I’ve made myself pay attention to these indicators, anecdotal as they are. Any one of us can walk around now and count the amount of houses being landscaped, painted, stuccoed, new windows, and even roofed (most roofs in need of replacement actually have five years to go). The masses of work trucks zooming up and down the streets has plummeted. Aside from the roof, most things we do to our houses is elective and can wait. The money has tightened big time in this type of construction. What’s scary is that interest rates are no where near what they were in the 80’s and we all know we have a long way to go to tame inflation. Everyone knows that 8% is a total bs number. Inflation of what we need is way higher.

As someone solidly in the bottom 50%, I’m still amazed by the resentment against the stimulus checks that merely refunded $5K in tax money to working class families. The real stimulus money never reached the bottom.

I didn’t perceive much resentment about helping working families.

There did seem to be a lot of criticism about 1) youngsters playing the unemployment bennies and stimulus checks to fund a life of Riley, and 2) employers defrauding the government for tens of billions.

Like with foreign aid, the United States is grossly incompetent at implementing programs to help people in real need without blowing most of it on grifters.

I’m not going to speak for others, but I resent that “stimulus” because most of the lower income households don’t pay anywhere near that much in taxes to begin with. Someone who pays $800 in taxes and gets $8,000 in “stimulus checks” is not getting a “refund.” They’re getting “free stuff.”

“The official reasoning for QE and interest rate repression is the well-known but dubious ‘Wealth Effect’ which is the monetary equivalent of trickledown economics, where the Fed tries to make the already wealthy far wealthier by inflating asset prices with QE and interest rate repression, based on the doctrine that these households will then spend some of this newly gained wealth, which will then trickle down….

What we got instead of the wealth trickledown is a huge bout of inflation…”

So, that somehow doesn’t register much larger on your sensitive resentment meter?

The only resentment I have with stimulus checks is that they were paid out to families making 200K with jobs. I believe that it should have been a safety net below a much lower income or tied with unemployment.

I do resent the fraud with forgiven PPP loans. Some business owners paying themselves millions in salary and buying expensive cars and houses.

Of course, they also paid their minimum wage employees in order to be forgiven.

We would need quotas in Congress according to these wealth brackets and in other parliaments too of course.

One simple way to manage this would be to make anyone over the age of 60 eligible to serve in any office. Enough with the gerontocracy! I am 68 myself but I am sick and tired of being ruled by rich white old codgers who don’t give a d*** about the future.

That should be ineligible! Darn autocorrect!

lol… you don’t think there are thousands of young men and women that would jump at the chance of getting access to dark money for acquiring wealth and power?

Wow, my fellow Americans are struggling, that’s my read. Our personal story follows. My interpretation based on Wolf’s explanations is that we’re doing extremely well based on our income, but we somehow are made to feel by society that we’re not keeping up based on what we see. Glad to have this reinforcement of knowledge instead to show the truth.

On the spreadsheet where I track our personal wealth, I never increased our asset values to post-pandemic pricing because we had no intentions of selling our real estate and because I never believed the gains were real or sustainable (thanks Wolf!). And even though we are both in our early 40s, and even though neither one of us have any inheritance or ever had an income (excluding capital gains and real estate income) higher than $50k in a year, somehow by this chart we’re in the top 30%. We live modestly, but not miserly. We have a kid and pets and hobbies, take European vacations to see distant family, eat well, go out for dinner and things like that. But we also live rurally and have a house that cost us just above $100k that we paid off a while back. I’m a tradesman, work on my own house, and also the household mechanic (late model cars bought at auction or on the cheap through Craigslist always, never having paid more than 25k for a vehicle, which was a work truck). We never found it hard to invest 40-50% of or earnings per year. We own no stocks besides whatever minimal amount my wife puts into her retirement fund to get the match.

So my read on this data is that the bulk of American households, based on our personal situation, are bad at money management. I need to stop looking at their overpriced cars, houses and toys and equating that with success. I guess you can’t see the debt attached to it.

FYI all of our excess income has gone into real estate, and the same type – small apartment buildings producing about 20% ROI on cash invested, with working class tenants and respectable income (but not exorbitant), 100% of which goes back into the properties. Many of our tenants, about 50%, make more than we do. We had just gotten up to the pace where we could start buying properties more frequently (closed in March 2020 on the last one), then the pandemic happened.

Hopefully during the next crash we will focus on shoring up the bottom for necessities and will ignore the needs of the top. And hopefully a more fair society will emerge.

Can the 0.1% collectively even sell off much of their stock in this decline without taking a big price hit? Or even sell off a second home? I don’t see the markets being liquid enough to allow for that.

Well, if a .1 percenter has owned the same DJI stocks for the last two years, s/he is still, on average, up 6%. So maybe a bitter pill to swallow, but no big price hit.

I wonder what the real strategy is now for the Zuckerbergs and such. Have they already borrowed against their stock when rates were below 1%? It seems they have to forever hold a major portion of their company stock, what would it look like selling off your company? But can they just watch their precious wealth go down the drain?

Unless of course you are the Musk man. One day he is in court being sued for a 46 billion tab to buy Twitter. The next he’s joyriding in his spaceship. It’s all good.

Musk is building rockets to go to mars @97 million apiece,taxpayers got it no worries

Of course they can sold out Microsoft around 16 months ago then price of stock is down ,but it’s not a rigged game. Or musk taking profits hahahahaha

Terrific article, thanks

I’d like to dig deeper in to the data.

Please provide a link to the underlying Federal Reserve data.

https://www.federalreserve.gov/releases/z1/dataviz/dfa/

Are these figures nominal or “real” i.e. inflation-adjusted?

The above “Wealth Disparity Monitor” chart shows the top .1% households average about 135 million in assets. The bottom 50% average such a relatively insignificant fraction of household assets, in can be considered nearly zero compared to the .1%’ers.

If the difference was adjusted for inflation, then one would have to assess how much harder the inflation hit the bottom 50%’ers. Simply adjusting for inflation would assume that inflation

hurt both groups equally.

Presumably the wealthiest have done worst recently because a higher proportion of their wealth is in financial assets (stocks, bonds, crypto etc.) that have already suffered a deep draw down.

The bottom 80% most likely have most of their wealth tied up in their home equity which is still benefiting from the massive gains of the pandemic housing boom. If or when the pandemic housing boom turns into a bust, the bottom 80% might start to suffer much deeper losses to their net worth and wealth inequality might start to trend up again.

Wolf states:

“The “Bottom 50%” of households don’t show on the chart below because they have so little, and a big part of what little they have are durable goods, such as cars, a little home equity, and pension entitlements.”

So the “Bottom 50%” has relatively minimal home equity that is not large enough to suffer “deep” losses in a housing crash. They’ll just continue living in the house as before.

It’s already turned into a bust. Houses are basically not moving. The housing market has seized up. If any sizeable portion of the homeowners tried to sell their houses to “realize their gains,” we’d go from having a “shortage” to a “glut,” and prices would plummet.

Another interesting point is that the 99-99.9% actually have more collective wealth than the top .1%. If you take 9 households with average wealth of $20 million, that’s more than the 1 household with wealth of $134 million.

But wait! The top 10% excluding the top 1% collectively have even more money – $4.4 million times 90. And they also have what the top 1% doesn’t have – substantial voting power. With about 10 million households, they might count for up to 15% of the ballots cast, because they have more adults and a more likely to vote than poorer households.

“Dropping Stocks & Bonds Reduce Outrageous US Wealth Disparity”

If one looks at a graph comparing the wealth of the top 1% versus the bottom 90%, one can see a two steps forward, one step back ratcheting effect for the former and no gain from that for the latter.

Shorting and the ability to buy REAL assets at fire sale prices during the busted bubble phase result in that and the people in a position of adequate power to fix what is behind this bubble/bust effect don’t because they benefit from it.

The beneficiaries of the process which causes bubble/busts include, besides the top 1%, politicians who borrow to provide services (effectively bribing for votes) which can’t be provided with just tax receipts.

calling the middle class “middle” is a farce. We need a new term. Like half a percenters of the 1%( maybe)

I think the term you’re looking for is “peasant”

Your email address will not be published.

Bank of England: won’t “hesitate” to hike rates “as much as needed.” Bond market fears much higher inflation and interest rates, for much longer.

But this time, there’s over 8% inflation.

Holy-moly mortgage rates close in on 7%.

It’s like a dam broke. And now higher interest rates and mortgage rates for much longer, with lower asset prices, as the Everything Bubble gets repriced.

The ridiculous price spikes now face Bank of Canada’s monster rate hikes, QT, and spiking mortgage rates.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy