angkhan/iStock via Getty Images

angkhan/iStock via Getty Images

After my most recent Exxon Mobil (XOM) article, I got a flood of Tweets, direct messages, and emails from people telling me they want oil exposure to somewhat offset the pain from high energy inflation. I was also told over and over again that some people prefer the California-based Chevron Corporation (NYSE:CVX). They are not wrong as I will discuss in this article. Also, CVX is my fourth-largest investment.

Chevron is in a terrific spot to benefit from very tight oil supplies as it boosts production – unlike most peers – and reduces production costs. If my bull case is even remotely correct, the company is in a good position to unleash a wave of cash over its shareholders through buybacks and dividend hikes. Not only that, but even historically speaking, Chevron has a habit of generating consistent returns for its shareholders without exposing them to abnormal volatility.

In other words, in this article, we’re going to discuss the tight oil supply, the related energy crisis, and why Chevron is almost a must-have for high-yield investors and everyone looking to add some quality yield to one’s portfolio.

The energy crisis and everything related to it (metals, agriculture, inflation, etcetera) is by far the most interesting topic I’ve ever worked on. However, it’s also the most frustrating issue as it is currently doing a number on consumers everywhere. The energy crisis is boosting inflation, it’s causing consumer sentiment to drop, and it’s a weapon of economic warfare in Europe thanks to the leverage Putin holds over most European countries (natural gas).

At this point, global growth indicators are slowing as recession fears are growing. Yet, energy commodities are doing just fine.

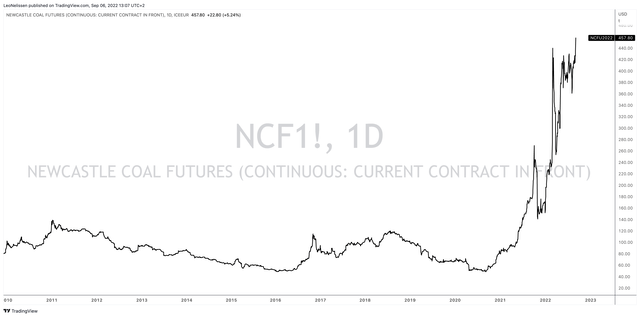

Newcastle coal is trading close to $460 per ton. That’s despite Chinese construction weakness, lockdowns, and lower global steel output.

TradingView (Newcastle Coal)

TradingView (Newcastle Coal)

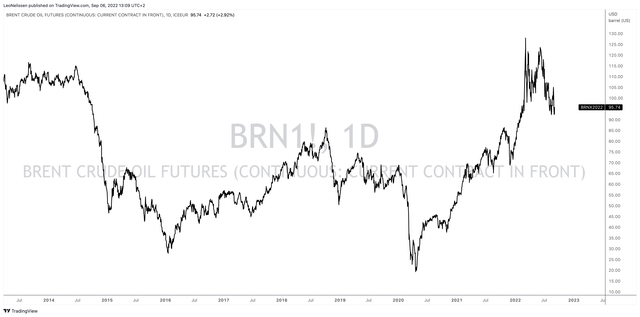

Meanwhile, Brent oil is trading close to $100. That’s down from $130 after the Ukraine invasion, but well above where it would trade if it weren’t for supply issues.

TradingView (Brent Crude Oil)

TradingView (Brent Crude Oil)

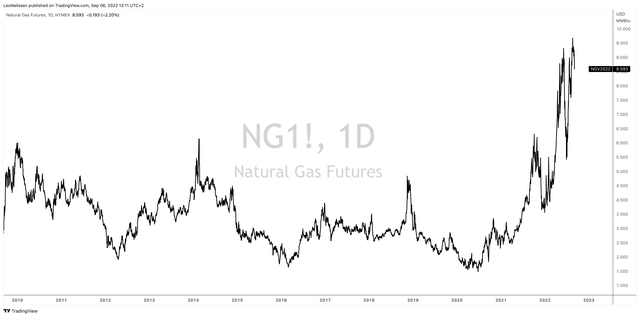

And then there’s US-based natural gas (Henry Hub), which is trading at $8.60 per MMBtu, which I am writing this. Prior to the pandemic, natural gas traded in the $1.80 to $3.50 range.

TradingView (Henry Hub)

TradingView (Henry Hub)

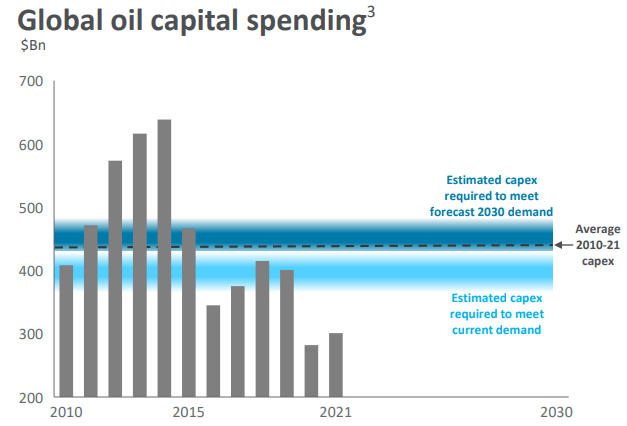

As I wrote in my Exxon article (reference in the introduction), we’re dealing with a very unusual situation. Upstream (drilling) oil investments are well below the required levels to satisfy our global oil demand.

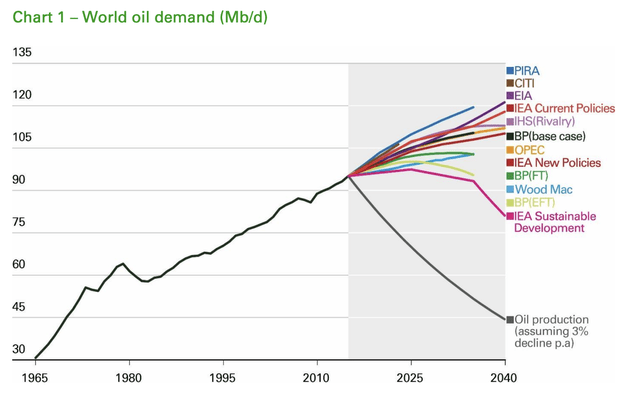

Using BP data, only the IEA sustainable development trend would do serious damage to oil demand. All other outlooks see rising oil demand to at least 105 million daily barrels.

BP

BP

While demand is expected to remain high, supply is not keeping up. Last year, I used the following chart, which shows that post-pandemic oil CapEx has fallen to roughly $300 billion per year. As the chart shows, this happened in two waves. The first started in 2014 when oil prices came down crashing due to accelerating supply and falling demand. Also, the US dollar strengthened a lot back then.

Then, production came back as companies needed higher output to repair their balance sheets.

This was followed by the 2020 oil crash when global lockdowns annihilated demand.

Seeking Alpha

Seeking Alpha

Since then, CapEx hasn’t come back. While the graph above hasn’t been updated since last year, it’s safe to say that this trend of subdued supply is still valid.

Last month, Bloomberg reported that the companies responsible for the huge boost in oil production in the US are now holding back: shale drillers.

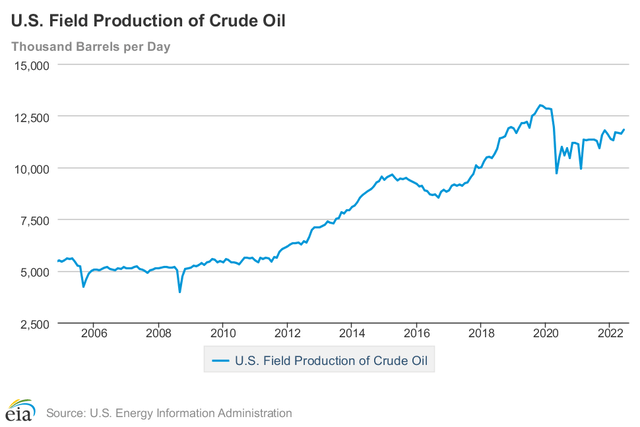

As the CapEx chart above may have suggested, oil production growth in the US is basically flat now. At 11.8 million barrels of oil per day, production is well-below pre-pandemic levels and the uptrend in production is the slowest since the years prior to 2012.

EIA

EIA

Basically, the unwillingness of US shale to boost production means that the two pillars of global oil supply growth are now gone. That’s OPEC’s commitment to keeping production high (more on that later) and US drillers, responsible for pretty much all global oil growth since the Great Financial Recession.

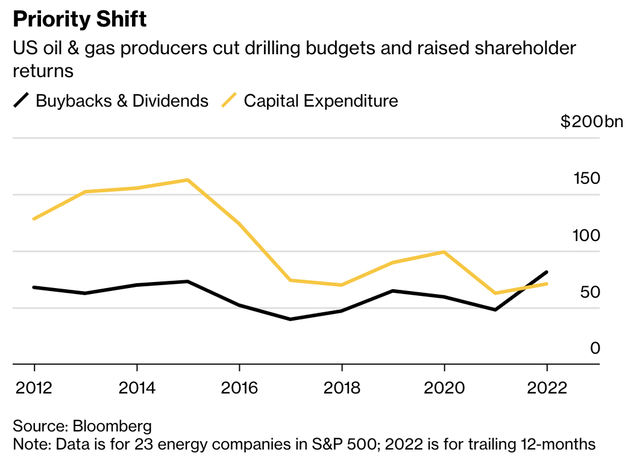

As an example of subdued CapEx, Bloomberg used the following chart. Essentially, what we see is that the 23 S&P 500 energy companies have refrained from boosting investments. What they did is boosting shareholder distributions. For the first time, oil and gas shareholder distributions are now higher than CapEx, which is truly remarkable and probably the single-best chart to display the current environment.

Bloomberg

Bloomberg

This has many reasons. The biggest one is risk management. Oil is the enemy. Environmental groups, governments, and related have made that abundantly clear in the past few years.

What we’re currently dealing with is an environmental agenda where expensive sustainable energies are preferred over oil and gas. Even worse, as a solution to the energy crisis, the IEA makes the case that investments in green energy need to be accelerated – instead of giving oil and gas producers a break.

For example, the IEA is working with the European Union on challenging energy problems in times of the Russia/Ukraine war.

Earlier this year, the organization asked a key question in one of its many reports.

A key question is what today’s energy crisis means for fossil fuel investments if we are still to achieve our collective climate goals. Are today’s sky-high fossil fuel prices a signal to invest in additional supply or a further reason to invest in alternatives?

The answer is exactly why I am bullish on fossil fuels as the answer – according to the IEA – is accelerating investments in renewables.

In the IEA’s landmark Roadmap to Net Zero Emission by 2050 published in May 2021, the analysis indicated that a massive surge in investment in renewables, energy efficiency and other clean energy technologies could drive declines in global demand for fossil fuels on a scale that would as a result require no investment in new oil and gas fields.

The need for this clean energy investment surge is greater than ever today. As the IEA has repeatedly stated, the key solution to today’s energy crisis – and to get on track for net zero emissions – is a dramatic scaling up of energy efficiency and clean energy.

Oil and gas companies know that they need to be careful. Let’s assume they boost production. Supply comes back roaring. If demand weakens again, most oil companies fear going out of business as it needs to be seen how willing banks and related financial institutions are to support “dirty” oil and gas when demand is low.

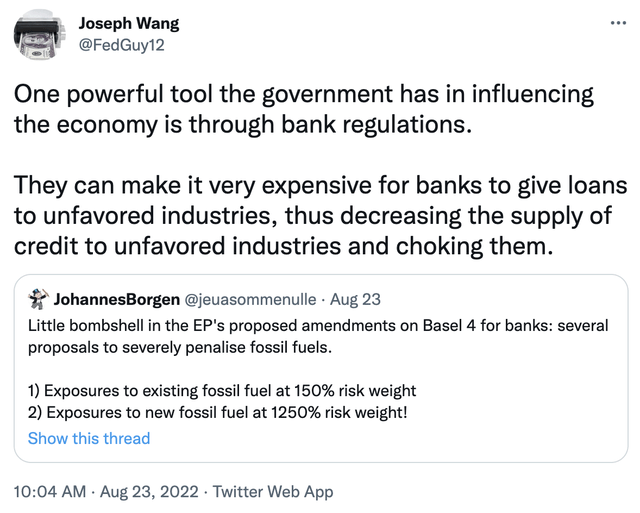

After all, we’re now seeing that even banks are making it much harder for fossil fuel companies to get funding as the tweet from financial markets expert Joseph Wang:

Twitter

So, to go back to the aforementioned Bloomberg article, the author summed it up quite nicely:

“They got castrated in 2016, they got slaughtered in 2020, and then they got demonized for ruining the environment after that,” said Smead, who is Continental Resources Inc.’s largest independent investor and a top-20 shareholder in Occidental Petroleum Corp. “Why would you do anything to help the people that hate you?”

Shale explorers also are unwilling to invest beyond current drilling plans because of “deteriorating efficiencies” amid cost inflation, said Noah Barrett, lead energy analyst at Janus Henderson, which manages about $350 billion.

Now, to make matters worse, OPEC is cutting output. You read that right. In the midst of an energy crisis, OPEC isn’t boosting output but reducing output.

The cut isn’t that big as it is 100 thousand barrels per day starting in October, but still, it’s making things worse.

“This decision is an expression of will that we will use all of the tools in our kit,” Saudi Energy Minister Prince Abdulaziz bin Salman said in an interview on Monday, after OPEC+ agreed to cut 100,000 barrels a day in October. “The simple tweak shows that we will be attentive, preemptive and pro-active in terms of supporting the stability and the efficient functioning of the market to the benefit of market participants and the industry.”

This first cut in more than a year shows that President Biden was not successful when he went to Saudi Arabia this summer. We can assume that OPEC is playing a political game here. Cutting output helps Putin, but it also makes sure that potential (future) OPEC production hikes do not mean that US shale players benefit from even higher prices.

Yet, the bottom line is that supply will remain a long-term issue. The only way to consistently bring energy prices back to “normal” is by embracing fossil fuels as a cheap and reliable source of energy. There is simply no other way around it if we want to avoid a huge wave of “greenflation” for many years to come.

Now, let’s discuss why Chevron is such a good place to be – (almost) regardless of what happens going forward.

Chevron is America’s second-largest oil company with a market cap of $309.0 billion, which makes it roughly $90 billion smaller than Exxon Mobil and more than $100 billion larger than British Shell (SHEL).

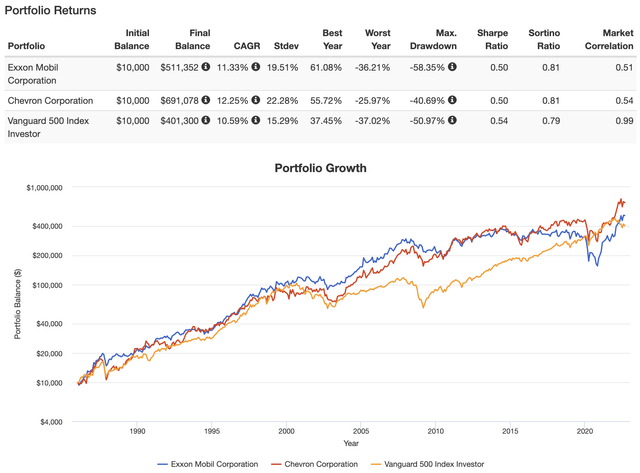

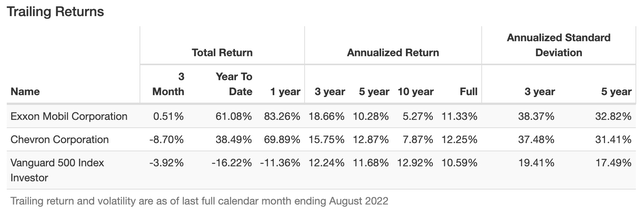

Going back to 1986, Chevron has returned 12.3% per year, including dividends. This beats XOM by almost 100 basis points. The standard deviation during this period was 22.3%. The S&P 500 returned 10.6%, with a low standard deviation, which makes sense as it’s a basket of stocks and less cyclical than energy. Yet, Chevron was still able to beat the S&P 500 on a volatility-adjusted basis (Sortino ratio).

Portfolio Visualizer

Portfolio Visualizer

Moreover, while commodity stocks, in general, lost momentum in 2011, Chevron still has returned 7.9% per year during the past 10 years. That’s more than 250 basis points above the annual average performance of Exxon Mobil.

Portfolio Visualizer

Portfolio Visualizer

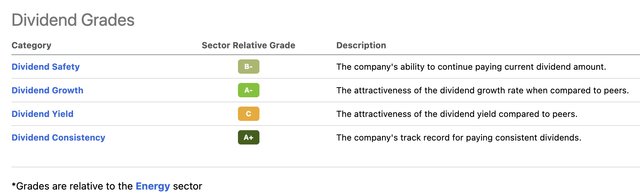

The company is also one of the most reliable sources of income thanks to a stellar dividend scorecard. First of all, Chevron scores an A+ on the Seeking Alpha scorecard – relative to the energy sector. Consistency is no surprise as the company has raised its dividend for 35 consecutive years, making it a member of the elite dividend aristocrat club.

Seeking Alpha

Seeking Alpha

Dividend growth isn’t very high, but that’s OK as the company is a high-yielding stock. Over the past 10 years, the average annual dividend growth rate was 5.1%.

That’s decent as it beats inflation (more often than not) and it makes its current yield even more attractive.

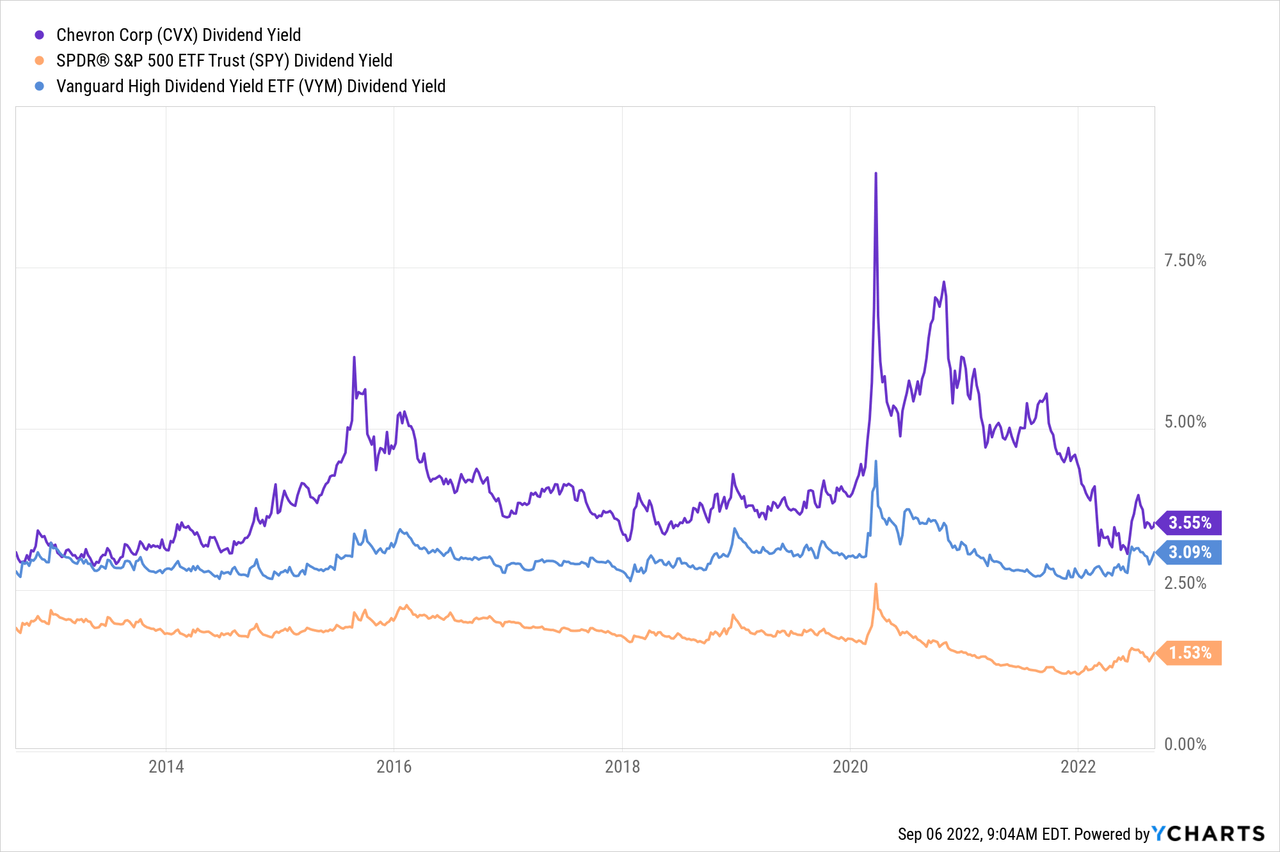

Chevron is currently paying investors $1.42 per share per quarter, which translates to $5.68 per share per year. That’s a dividend yield of 3.6%.

This yield is consistently above the Vanguard High Dividend Yield ETF’s (VYM) yield, which is currently 3.1%.

Moreover, CVX dividend growth has picked up a bit. In January, management announced a 6.0% dividend hike. That’s the first hike since a 3.9% hike in April of 2021.

I expect that dividend growth will be significantly higher than 5.5% per year (on average) going forward. That’s obviously based on my view on long-term energy prices, but also the company’s ability to make money.

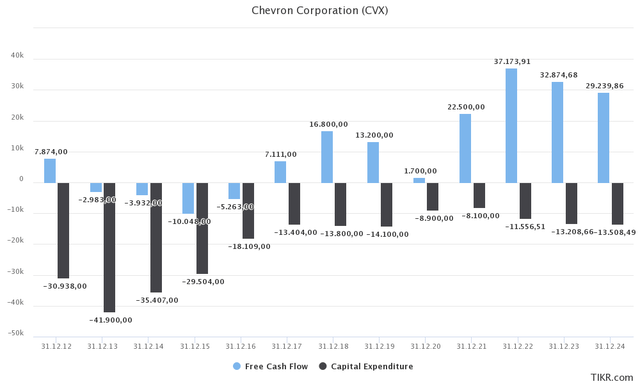

For example, Chevron has significantly lowered its CapEx. In the years going forward (including 2022), the company will not exceed $14.0 billion in annual CapEx. Prior to the oil crash of 2014, CVX did consistently more than $20 billion in CapEx.

TIKR.com

TIKR.com

Chevron’s C&E (capital and exploratory) budget is expected to be $15 to $17 billion per year between 2022 and 2026. That’s down from roughly $24 billion between 2015 and 2019, and almost $36 billion between 2010 and 2014.

Moreover, unit operating expenses are now on track to reach $12-$13 per barrel by 2026.

What this means is that under current circumstances, CVX should be able to do more than $30 billion in free cash flow (see the chart above) every year going forward.

This would imply an FCF yield close to 10%, meaning there is a lot of room to grow the dividend, engage in buybacks, and reduce debt.

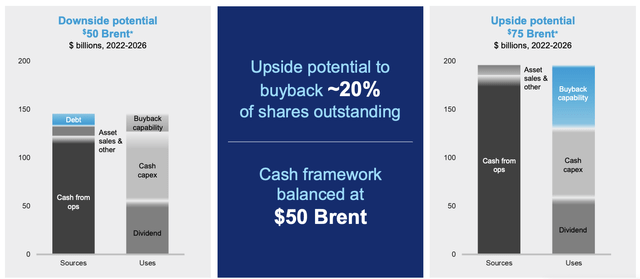

What’s interesting is that at $75 Brent, the company can do $40 billion in annual operating cash flow (almost $200 billion in total until 2026). This sustains the dividend, investments in operations, and buybacks equal to dividends. At a current rate, that implies more than 7% in annual shareholder distributions, which is truly impressive. Now, imagine if oil remains consistently close to $80-$90 billion. The impact would rise significantly given consistent CapEx plans.

Chevron Corporation

Chevron Corporation

Not only pricing is powerful, but also the company’s plans to grow output. In the Permian Basin, production is expected to grow to 1.2 to 1.5 million barrels per day (oil equivalent, meaning including natural gas and others). These operations alone could generate more than $4 billion in annual free cash flow – at $60 per barrel Brent.

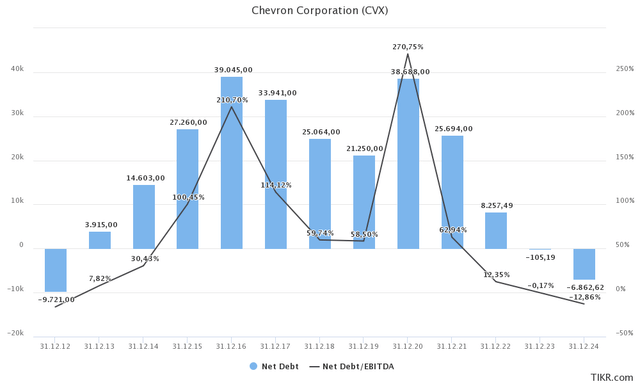

It also helps that Chevron already has a healthy balance sheet. If that were not the case, a lot of free cash flow would end up in bondholders’ pockets. Given that net debt is expected to be a mere $8.3 billion this year (less than 0.3x EBITDA), shareholders are in the front seat to benefit from the company’s value generation. Remember a lot of smaller oil stocks are still busy paying down debt, which keeps them from hiking (or initiating) dividends.

TIKR.com

TIKR.com

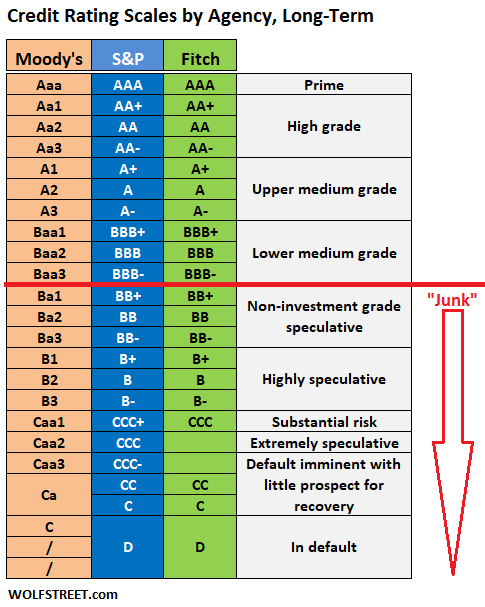

Moreover, the company has an AA- debt rating from S&P Global (outlook stable). This debt rating is high-grade debt and above the rating of a lot of countries. That’s truly fantastic and a great track record of its management given that the past 10 years were extremely tough on oil companies.

Wolfstreet.com

Wolfstreet.com

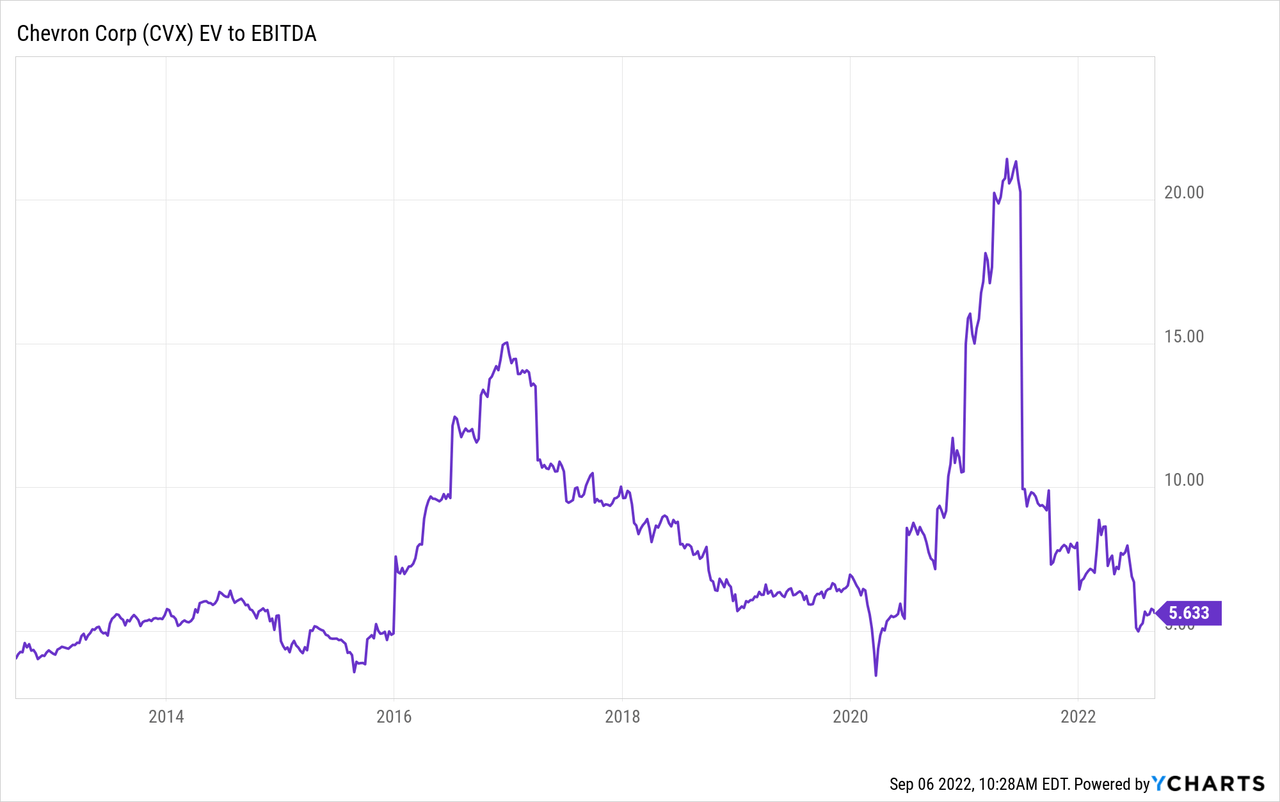

When it comes to the valuation, the company is attractively valued, trading at just 5.1x 2023E EBITDA of $62.0 billion based on its $315.6 billion enterprise value consisting of the $309 billion market cap, $1.0 billion in minority interest, and $5.6 billion in pension-related liabilities. Net debt is expected to be negative next year, so I made that a zero in my calculation.

This valuation is extremely attractive. The same goes for the implied free cash flow yield of 10% (on a long-term basis). That’s too cheap and allows for at least 30-40% upside to what I would consider a “fair value”.

With that said, here are my final thoughts.

I once again went with a rather confrontational title. However, it’s truly the situation we’re in and I have used pretty much every opportunity I’ve been given to explain that we need to fix this energy crisis before things get worse.

The situation is dire. Energy has become the main driver of inflation last year as supply isn’t keeping up with demand. Oil and gas companies are managing risk by focusing on debt reduction and shareholder returns instead of production growth. They know that net-zero policies are the single-biggest threat to their existence. Keeping production low is the best way to deal with these risks.

Moreover, OPEC is now cutting production to combat oil volatility – with Brent trading close to $100 per barrel.

In Europe, the situation is even worse as Putin is using its leverage by cutting natural gas exports. Meanwhile, European nations are unwilling to boost output because of net zero (for example, Holland).

What this means is that energy remains the place to be. After all, fossil fuels are here to stay whether we like that or not. Fighting this trend will only result in higher energy inflation as we’re currently finding out the hard way.

Chevron is a fantastic way for investors to protect their portfolios against commodity inflation – and generate high income. The company pays a very nice dividend yield and it has room to significantly hike its payout thanks to a stellar balance sheet and high free cash flow expectations – even at subdued oil prices.

Even before the energy crisis, Chevron was able to keep up with the market without exposing investors to above-average volatility. That’s a great recipe for conservative wealth generation.

Right now, this is getting even better.

Long story short, I happily remain long Chevron shares and I will use weakness to add to my position.

(Dis)agree? Let me know in the comments!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CVX, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.