Commentary

Common sense tells you this claim isn’t true, because everyone in California knows several people who have left for Texas to pay lower taxes. But the San Francisco Chronicle just headlined a story, “Yes, Texans actually pay more in taxes than Californians do.”

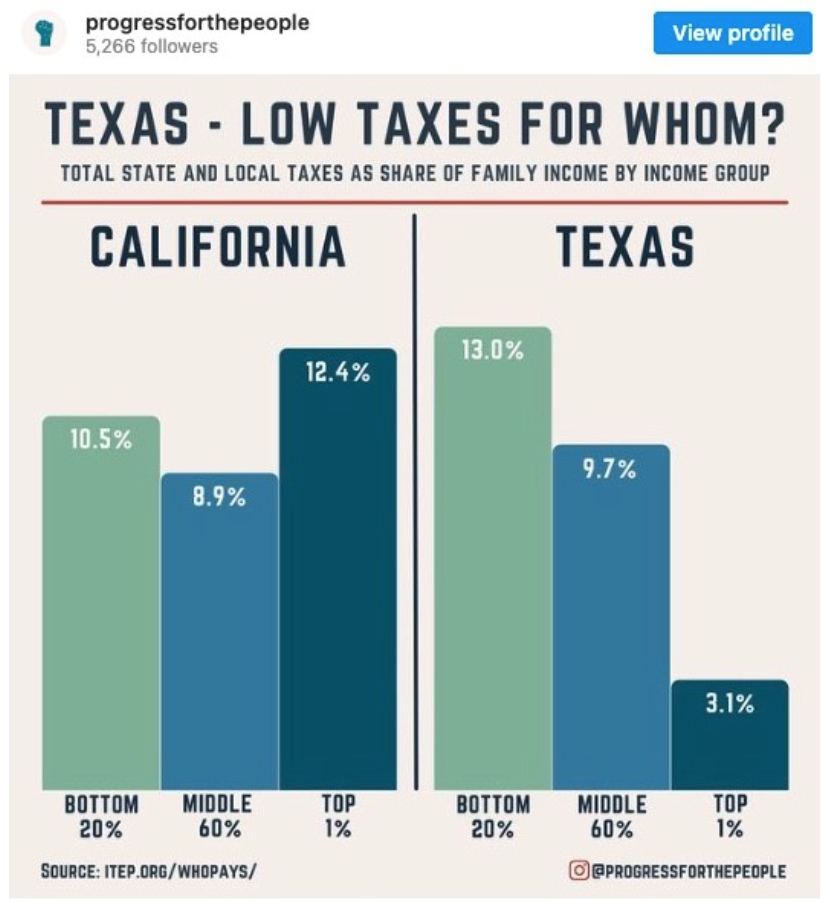

The story is based on this graph posted on Instagram by ITEP, the Institute on Taxation and Economic Policy:

The graph and analysis are misleading, Chuck DeVore told me; he’s the Chief National Initiatives Officer at the Texas Public Policy Foundation and a former California assemblyman before he moved to the Lone Star State a decade ago.

“ITEP is a union-funded think tank allied to the Democratic Party,” he said. “Naturally they grade success on the progressiveness of the tax code, while ignoring the benefits that is supposed to have for the poor. But the evidence shows states with a lower tax burden have a more dynamic labor environment, a lower cost of living, a lower true poverty rate, and a lower cost of living.”

He pointed to California suffering the highest poverty rate of the 50 states, when the cost of living is taken into account. Released last Sept. 14, the U.S. Census Bureau’s “The Supplemental Poverty Measure: 2020” found California’s poverty level is 15.4 percent, compared to 12.5 percent for Texas.

“Ever since the Supplemental Poverty Measure first was released in 2009, every single year California has had the highest poverty rate,” DeVore said. “You can’t tell me all ITEP’s preferred policies have had a positive effect on the people they’re supposed to be helping.”

DeVore brought up Washington, which like Texas has no state income tax. Billionaires like Bill Gates don’t pay state income taxes. But the Evergreen State’s poverty rate is just 7.5 percent, less than half California’s.

A couple more points I’ll make:

First, rich people don’t just make money from income and investment increases and blow it all on yachts. They use most of their wealth to invest in creating new companies and jobs. Those new jobs employ workers, lifting many out of poverty.

When Elon Musk took his Tesla headquarters and his personal residence to Texas, he took with him all that wealth, investing it in high-paying jobs in the Lone Star State. Left behind were the high-paying jobs he might have created in California—and the taxes he paid here.

Second, California’s sky-high cost of living acts like a “tax” on everyone, homeowners and renters alike. Consider these numbers from Zillow for the average home price:

It’s true California’s property tax rate is lower, at 0.73 percent on average, thanks to Proposition 13 from 1978. That’s compared 1.69 percent in Texas, more than double.

That once was a great advantage for Californians when property values were about a third of today’s as recently as the 1990s. But that’s not the case now.

Just compare the states’ two largest cities: Los Angeles: 0.73 percent of $991,551 equals $7,238 a year in tax. Houston: 1.69 percent of $272,048 equals $4,598 in tax.

Property tax alone in Los Angeles is 57 percent higher than in Houston.

Third, rents paid by poor people, the main concern of ITEP. Again, to simplify we’ll just take two cities. The average rent in Houston is $1,304. In Los Angeles, it’s $2,734—more than twice as high.

Fourth, gas prices. Californians pay a special 51 cent-per-gallon gas tax, as well as the “tax” of environmental regulations. According to GasBuddy.com, in Houston the lowest price for regular is $3.69 a gallon. In Los Angeles, it’s $4.79. Someone using 80 gallons a month would pay $88 more a month, or $1,056 more a year.

That especially gouges poor people, who tend to drive longer distances to work because housing is cheaper the farther it is from the Pacific Coast. Well, I guess with the new electric-car mandate, soon the poor will all be driving Teslas.

Fifth, let’s look at the state income tax paid by the middle class. In California, for those single or married and filing separately, it’s 9.3 percent on incomes between $61,215 to $312,686—that is, middle-class taxpayers. But $61,215 a year really is lower middle-class, unable to even dream of affording a home.

At one time, 9.3 percent was the top income tax rate, paid only by millionaires; so decades ago it was a millionaires’ tax. But inflation pushed the middle-class into that higher tax bracket. And in recent decades, tax increases have pushed the top rate to 13.3 percent.

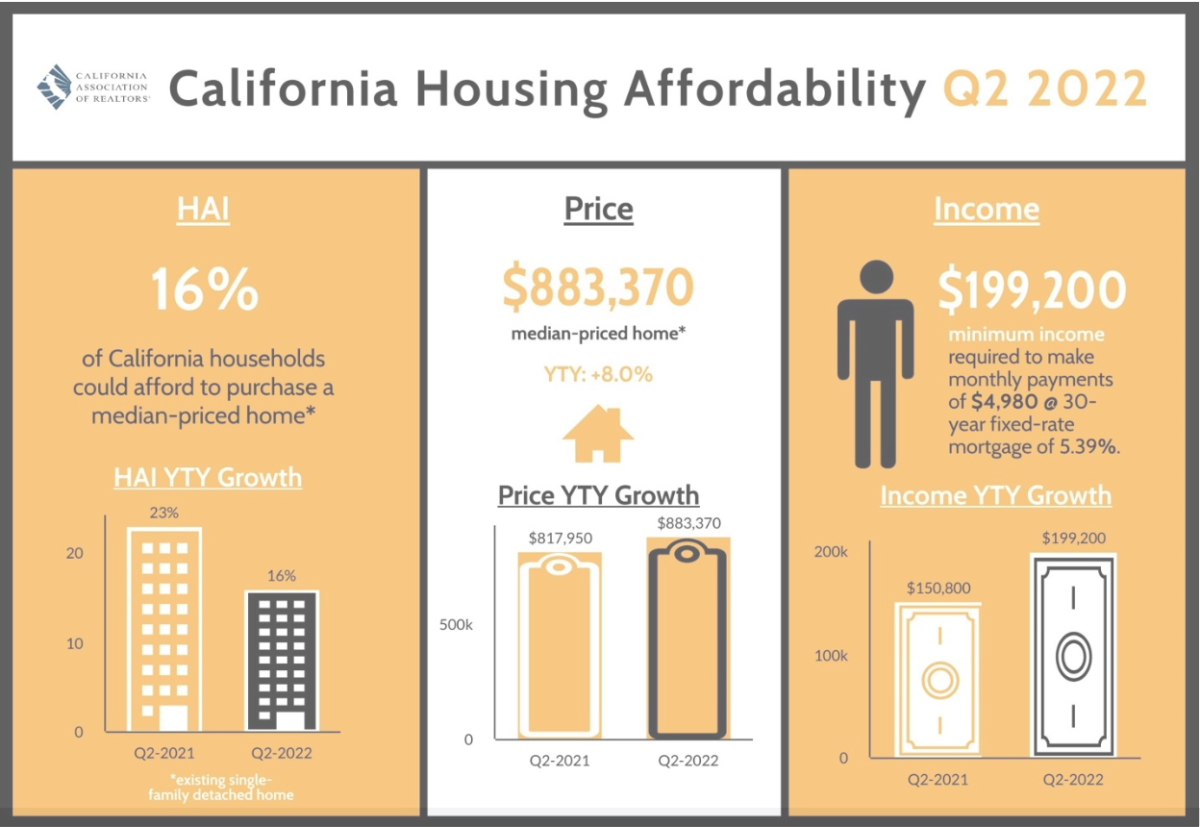

But look how hard it is for the middle-class, even those making $150,000 a year, to afford a home. In this state, according to an Aug. 11 survey by the California Association of Realtors:

Here’s their infographic:

In Texas, of course, the middle-class doesn’t pay anything near 9.3 percent—it pays 0.0 percent. And housing prices are half.

Which is why after the 2020 U.S. Census it gained two congressional seats, while California lost one. The only question is why even more people don’t leave progressive California for “unfair” Texas.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.

Powerful Wealth Building Resources