THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

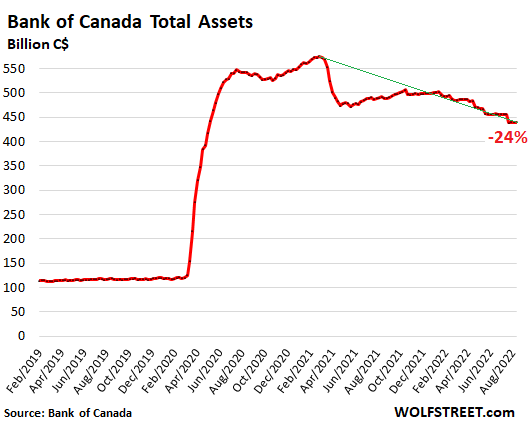

On the Bank of Canada’s balance sheet released Friday, total assets of C$439 billion were down by 24% from the peak in March 2021 (C$575 billion). By comparison, the Fed’s balance sheet peaked in April 2022. The BoC’s Quantitative Tightening (QT) started in essence in April 2021 and is way ahead of the Fed’s QT. We’ll get to the details and the funny-looking shape in a moment:

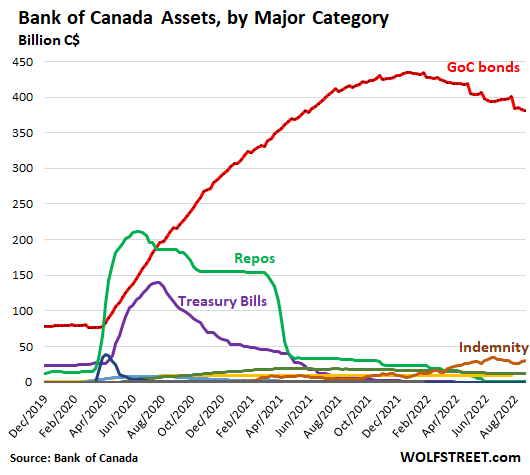

Repos: The BoC’s repo holdings peaked in June 2020 at C$210 billion, and then started unwinding. Most of them were gone by June 2021, and by June 2022 nearly all of them were gone. Now just C$400 million are left over, waiting to mature (green line in the chart below).

Canada Treasury bills: The short-term Canada Treasury bills that the BoC started purchasing in March 2020 peaked in July 2020 at C$140 billion. At that point, the BoC started to let them roll off the balance sheet when they matured. In March 2021, it announced that it would let them and repos go to zero, citing “moral hazard” as reason. By September 2021, the Treasury bills were mostly gone. By April 2022, they were totally gone, and remain gone today (purple line).

MBS: The BoC never bought a lot of these “mortgage bonds” to begin with. They peaked at just under C$10 billion in late 2020. In October 2020, the BoC said it would end buying MBS entirely, worried about the Canadian housing bubble. They have since then diminished due to the pass-through principal payments and remain a very small item, down to C$9 billion (yellow line).

Government of Canada (GoC) bonds: This is the biggie, the prime QE tool. In October 2020, the BoC announced that it would reduce its purchases of GoC bonds from C$5 billion a week to C$4 billion a week – but don’t call it “tapering,” it said at the time, though it was plain-old tapering.

In April 2021, by which time it held 40% of the outstanding GoC bonds, it reduced its purchases of GoC bonds to C$3 billion, citing “signs of extrapolative expectations and speculative behavior” in the housing market. In July 2021, the BoC reduced its purchases to C$2 billion a week.

In October 2021, it put the hammer down. In a surprise move, with inflation surging, it announced that it would end its purchases of GoC bonds entirely, beginning November 1, 2021, and would allow maturing bonds to roll off without replacement. There are no “caps” on the GoC bonds that roll off. Whatever matures, rolls off. The surprise announcement caused yields to spike.

This was the beginning of its official QT though total assets had already dropped a bunch because repos and Treasury bills had mostly vanished.

The BoC’s holdings of GoC bonds peaked at the end of December 2021 at C$435 billion and have in the eight months since declined by 12.6%, or by $54 billion, to $C381 billion (red line).

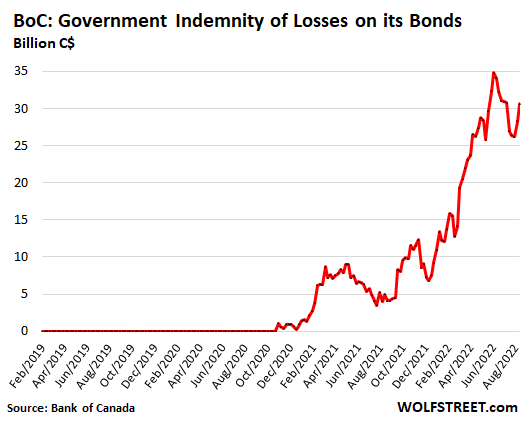

Note the brown line in the chart above – now the second-largest asset, “Indemnity.” This is the estimated value of the indemnity agreements between the federal government and the BoC. It represents the estimated losses from the securities holdings of the BoC if it were to sell them at current prices, which it would then be reimbursed for by the federal government.

As part of this QE craziness starting in March 2020, the federal government agreed to indemnify the BoC for any actual losses incurred on its bond portfolio. These losses were expected to pile up when bond yields begin to rise, as they’ve been doing since early 2021.

The BoC sets up the estimate of the losses as an asset on this balance sheet. If the BoC actually gets paid from the government for these losses, the amount is reduced by the reimbursement. This account is a form of a receivable, owed to the BoC by the federal government, for the losses on the bond holdings.

When yields rise, those losses rise. When yields fall, the losses decline (all bondholders experience that). During the bear-market summer rally that lasted in Canada, as well as in the US, from mid-June through mid-August, yields fell and bond prices rose.

But this rally ended in mid-August. Since then, yields have been rising and bond prices have been falling, and the estimated losses have also been rising again.

The chart below shows the detail of those estimated indemnities, based on the estimated losses. These indemnities peaked on the balance sheet dated June 15 at C$35 billion. Then, as yields fell and as losses fell, the value of the indemnities fell also, bottoming out at C$26 billion on the balance sheet dated August 10. Then they took off again. On the balance sheet dated August 24, released on Friday, they jumped back to C$31 billion:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

That’s just loonie.

Wolf, Fed had laid out a clear plan for tightening for 3 months of June, July and August wrt both Treasuries (Max $30 Billions) and MBS (Max $17.5 Billions).

How has Fed done wrt to the plan month on month? If MBS has not settled, we can ignore it.

We must also ignore any tightening from April to June as the plan was for June 1 onwards.

This data would help folks realize how serious fed really is because “Actions speak louder than words” and because Fed would double tightening from September!

The Fed’s QT is perfectly on track as planned. I update it once a month after the month-end Treasury roll-off shows up on the balance sheet. Next update coming on Thursday.

Thanks Wolf, this gives us some hope to hang on.

Though, realistically, it would take 4.5 years for fed to undo the $5 trillion crank. Also, historically speaking, global central bank track record for sticking to tightening after “Easing” is very poor, like no real precedence of success.

“Though, realistically, it would take 4.5 years for fed to undo the $5 trillion crank. Also, historically speaking, global central bank track record for sticking to tightening after “Easing” is very poor, like no real precedence of success.”

It’s very likely that there will be a US recession sometime in next 4.5 years – what’s the track record on CBs sticking to QT during recessions?

I will cover this in detail at the end of this week, probably.

The Fed cannot go back to $4.5 trillion in assets by 2026 because the liability side will be larger than that, and assets will always have to be larger than the liabilities.

By 2026, the largest liabilities will be currency in circulation (paper dollars), which is demand-based, and has been growing, currently $2.28 trillion, growing at a rate of about $125 billion a year. So currency in circulation may be $2.9 trillion by 2026. Banks get those paper dollars from the Fed in exchange for collateral, such as Treasury securities, which are assets and increase the asset site of the balance sheet.

Then there are reserves. They’re now plunging, but they’re unlikely to fall below $1.5 trillion and may be higher than $1.5 trillion by 2026.

Then there is the government’s checking account at the Fed (TGA), currently $535 billion. It’s likely to range between $200 billion and $600 billion.

Then there are RRPs, now $2.2 trillion but they may be back to zero by 2026 as liqudity gets mopped up. They’re also demand-based.

Then there are some other liabilities.

So if you add it all up, you get the minimum level of assets required: 2.9 + 1.5 + .5 = 4.9 trillion plus some odds and ends, and the minimum assets will likely have to be over $5 trillion, and they will keep growing as a function of currency in circulation.

Everyone has a plan until they get punched in the mouth with decreased foreign purchases and increased repo activity and additional government spending and debt forgiveness and a recession and escalated war and possibly a contested election.

Going to be interesting.

Dazed and Confused,

That’s tough to say since the only recession we’ve had when QT was even possible was the 2-month pandemic lockdown recession. I suspect you’re right, but there’s really no track record to look to for the US. I think it’ll come down to whether or not inflation is under control when a recession does hit.

I guess you can look to Japan’s CB, but Japan has been a basket case for decades and following their example may not be prudent.

Loonie. Canadian dollar. Good one.

👍😂

$816 CAD per person in Canada.

Taxes are gonna go up a bit more. 🙁

So the rich get richer and absorb no losses those get passed on to the kindle class and poor people.. what a great country and economic system we’ve created

Shame our current government just got re-elected, be best to remember who brought this hurt. “Budgets balance themselves” and all that garbage…

That “budgets balance themselves” trope is a dishonest truncation of the entire statement made by the Prime Minister at the time which went on to include a caveat about the necessity of economic growth to warrant the deficit spending in question.

Someone didn’t read the updated rules about comments. Can the partisan stuff.

One government of WEF Young Global Leaders that govern ex-legislation is someone else’s problem. Got enough problems in my own country.

“So the rich get richer and absorb no losses”

We all know Putin did it. Couldn’t have been the Fed, right ?

The Fed has the same problem with losses in their portfolio as rates go up.

My guess is that the FED will do the same Canadian accounting trick by working out a deal with Biden & Congress to reimburse for bond losses.

Austrian School,

The Fed’s losses will be dealt with differently. It’s a little too complicated to get into in the comments, but when that’s starting to be a big thing, I’ll cover it. That part is not at the taxpayer’s expense.

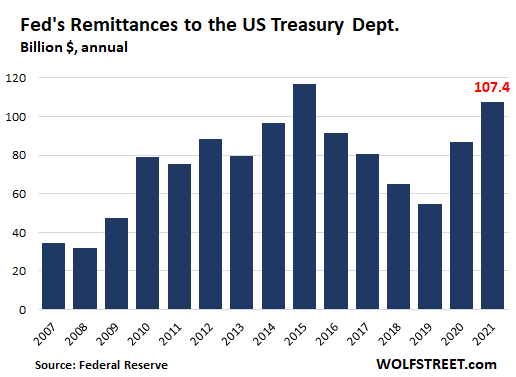

What is already happening though is that the Fed’s remittances to the US Treasury of its profits will decline/end as its bond losses eat into its interest income. For 2021, the Fed remitted $107 billion to the Treasury Dept. In 2022, this may go to zero, and that’s money that the taxpayer will not receive for 2022:

https://wolfstreet.com/2022/01/15/the-fed-released-its-preliminary-financial-statement-for-2021/

That part is not at the taxpayer’s expense.

ROTFL

sorry i couldn’t help me self.

But please keep paying tribute to the banking sector for God’s sake.

Most all of us are.

Banking Rates are going (already) negative worldwide as

we watch daily a blundering insufficient central off shore cartel steal the pay check (inflation) and offering our offspring a bowl of bugs.

I could go on.

Shandy

Wolf you never cover gold in your articles ,is it a lack of knowledge or your not interested in this subject

I covered gold occasionally, but not much has changed since then, gold is still gold, and it does what it does, and it’s hanging in there. Here are a couple of examples:

https://wolfstreet.com/2018/09/04/my-theory-about-gold-and-silver-for-long-term-investors/

https://wolfstreet.com/2018/09/24/gold-as-effective-diversification-in-the-everything-bubble-stocks-bonds-real-estate/

Wolf – good posts on gold. Thanks for the links.

Good article Wolf. Would be appropriate for you to inform readers of the 10’s of billions of $$$ being paid to banks in America and Canada on their reserves sitting on Central Banks balance sheets and juxtaposition this with the EU Central Bank policy of banks paying the CB to keep excess reserves on the CB balance sheet.!

GringoGreg,

Banks can buy government bonds with their excess cash or they can put it on deposit at the Fed or at the BoC, respectively, and they do both. They earn similar interest whatever they do, but deposits at the central bank provide greater liquidity.

As liquidity gets mopped up with QT, those deposits at the central banks plunge. That started already.

At the BoC, the deposits plunged by 50% since March 2021, to currently C$190 billion. The BoC currently pays 2.25% interest (annual rate) on those deposits. Those deposits will go back to zero in a year or two, and the BoC won’t be paying any interest on them at that point.

At the Fed, the “reserves” have plunged by 23% since late last year, to $3.3 trillion. Those reserves might go down to $1.5 trillion roughly. The Fed currently pays banks 2.4% on those reserves.

I don’t see how this is not at the tax payers expense to some extent. It seems like to me QE saves the tax payers money by buying bonds which lowers interest rates, while costing nothing since the interest is given back to the treasury. QT would seem to have the opposite effect and cost the government(tax payers) more by increasing borrowing costs. I maybe over simplifying things but I don’t see how you mover around trillions of dollars even if it just numbers in a computer and the cost is free.

It’s toonie

Million,billions trillions quadrillions its all bs ,as gates said we all end u broke . Maybe some self centered equilibrium t o think about it’s all relative .

I made it 1 day ,already In moderation f*** computers

“moderation” is a tripwire because I get tired of complaints about moderation.

“gates” (your prior comment, now released) is also a tripwire because I get tired of BS about gates, and I want to look at it first before it sees the light of day.

“orange” (which you didn’t use) is also a tripwire because I get tired of Trump-haters trying to dodge my “trump” trip wire.

etc. etc.

Don’t complain about it. Take it like a real commenter. Thanks.

Its now the House of Orange

Gotta keep up with the times.

Thanks will try to do better in future comments also try not to be political ,because everyone has a opinion,only creates bad vibes

Hi again from Tokyo, and full disclosure: I read the article! I’ll probably get clobbered for asking such a stupid question now, and it’s the Good Proprietor’s fault really (since I get so much of my financial ignorance eradicated thanks to this site), but:

-Could someone kindly explain to me the difference between: “Canada Treasury Bills” and “Government of Canada (GofC) Bonds”? And are US “T-Bills” also difference from “Government of US Bonds?” I really have no idea.

Domo Arigato!

Juicifer,

I’m always glad when readers ask these kinds of questions in the comments. That’s in part what the comments are for.

“Bills” (Canada Treasury bills, US Treasury bills, etc.) are short-term, meaning one year or less in duration, and they pay interest by adding it to the principal when they mature. For example, if you buy a 1-year bill for $1,000 that pays 3% interest, you will receive no interest payments during the year, but when it matures, you will get $1,030.

“Notes” and “bonds” are securities with a duration of 2 years or more. Securities between 2-year and 10-year maturities are “notes,” longer than 10 years are “bonds.” They pay interest every six months or once a year (the “coupon”), and when they mature, you get face value.

Usually, “notes” and “bonds” are lumped together and called “Treasury bonds” or “GoC bonds.”

OMG 🙂

why can’t you just google something like “bills vs bonds”?

Jucifer – Bills are shorter-duration bonds, but they’re still government debt bonds.

In the US Treasury space, Investopedia says there are Bills (maturing in 4 weeks to 1 year), Notes (2-10 years), and Bonds (20 or 30 years).

Paying it Forward…

When are these Central Bankers going to pay for their incompetence and be sent to prison ?

I once asked Wolf if I could change my moniker to “Central Bankers Swinging on Meathooks.”

DC, I like that imagery!

If the Fed drained $2 trillion+ from the system, would the average QT denier notice? https://fred.stlouisfed.org/series/RRPONTSYD

I think people get caught up in the word “overnight” when it comes to our Fed – it doesn’t matter that these are 1 day transactions when the amounts do not vary much day to day and in fact have tended to go up.

As our esteemed Wolf continues to point out in these articles, there is a lot of movement happening with central banks around the world. QT and interest rate increases are honestly just starting to flush through the system. There is a lot of debt pegged to 3 month LIBOR/90 day SOFR which by definition lags quite a bit: https://fred.stlouisfed.org/series/SOFR90DAYAVG. Highly leveraged businesses with floating rate debt are in trouble and the fun is just beginning. Highly leveraged governments who continue to deficit spend are in trouble and the fun is just beginning.

Indemnity looks like nitroglycerin to me . But I’m just a simple kind of guy ,with common sense . Coerrect me if I’m wrong

Good point.

Canada doing it is one thing – their ability to run a balanced gvt budget is at least theoretically possible (so they might have non-printed funds to *pay* their CB).

(Re repayment to the CB…people may not like it, but without it the CB would go broke. Too many commenters are under the delusion that CBs are a tool of a bankers’ cabal. In reality, CBs have long been the tools of *government* cabals – compelled to use inflationary printing to cover habitual government deficits. Just because the word “Bank” is in there, is meaningless. The second a CB stopped following their G’s direction, the CB’s leadership would be terminated.)

As for DC repaying our CB…how? From where? DC has had perpetual fiscal deficits for essentially 50 years. DC only *survives* due to the unbacked printing of money that the CB uses to buy US Treasuries that nobody else in the world would want, except at some default risk adjusted interest rate a multiple of the current one.

Yay Canada content! Much appreciated

Endorsed. Other than the fellow who writes the BondEconomics blog, it’s very difficult to find anything that analyses the Canadian economic scene — I generally have to try to draw analogous conclusions based upon US, UK or Australian sources.

Here is all my Canada content – something like 1-2 a month, maybe, it seems, going back years:

https://wolfstreet.com/category/all/canada/

[“Indemnity.” This is the estimated value of the indemnity agreements between the federal government and the BoC. It represents the estimated losses from the securities holdings of the BoC if it were to sell them at current prices, which it would then be reimbursed for by the federal government. ]

I’m trying to understand this. Why would the BoC have to sell at current prices? If the bonds are held to maturity, then there are no loses correct?

Welfare for rich?

I think it’s the difference of the value of the bond being cheaper with a higher interest rate…

The bond decreases in value below par and the GoC has to make up the difference….

Harvey Mushman,

It doesn’t HAVE to sell at current prices, and it doesn’t sell. This is an estimate of an accrued loss that will be reimbursed if it actually is incurred. And because the BoC gets paid from the government if it actually incurs a loss, it sets up this estimate of the indemnity as an asset.

This is (1.) a fairly straightforward accounting of (2.) a mind-blowing arrangement; but (3.) everything about QE was mind-blowing, so (4.) I don’t get too excited anymore. But I do want to point it out.

Wolf,

Under what circumstances would the BoC consider selling those bonds? Is it mostly in a emergency tightening scenario where inflation breaks loose and they need to pull every lever or do they get sold in less dire circumstances?

Excellent! I am selling shares in the “Yancey Inflation Indemenity Fund”.

That is a very good question Harvey. The answer is that the BoC does NOT have to sell its Canadian securities at current prices. The “indemnity” line is simply what accountants call a “contra” account. It is not real in the sense that there is no actual asset of value in it… they can’t sell it on the open market for instance. But it allows all of the Financial Statements to balance correctly.

A similar accounting line in American financial statements would be the “Goodwill” line which denotes how much a company paid for an asset over the Book Value of that asset. You can’t sell your “Goodwill” to someone else… you can only write it down as a loss if you prepay it or let it amortize naturally according to the GAAP schedule.

The indemnity line is actually a pretty clever trick for a central bank in the sense that it allows people looking at the Balance Sheet to understand the tradeoff between selling Canadian bonds off versus letting them roll of naturally. Since the BoC has this arrangement with the Canadian government there is an asset of value that needs to be accounted for in some manner… but the reality is that the BoC will most likely let these bonds expire naturally so the “indemnity” account will likely go to zero just as naturally.

HM,

I’m fairly sure that if the bonds were held to maturity, the inflationary pressure would remain in the system (from the initial unbacked CB printing that was used to buy the bonds in the first place).

It is only via the sale of the bonds, that the inflationary extra printed money can be drained back *out* of the economy…lowering inflationary pressures (the whole pt).

For me, it always helps to keep in mind 2 things.

1) Money is always just an “overlay” for the real asset economy. The ratio of all printed money to all existing real assets is “price” writ large…if printed money increases, this macro “price” goes up (by definition). When that macro “price” is increasing, that is “inflation” (again by definition).

2) All modern CB printing is unbacked by any real asset. You can’t take your printed dollar/loonie to the CB and say “gimmie some gold/land/bullets/tupperware/Leaders’ suits/etc”. When the CB printed the money in the first place (to buy the G’s bonds…to lower the G’s interest rates) there was no real asset behind that newly printed money.

Think of the whole modern monetary system as two card Monty, where the G is just playing alternating pocket pool with itself…

With the BoC removing the punch bowl, and the frequent mortgage refinance Canadians have to do, what effect would it have on a property bubble pop…

Would it accelerate a decline or not make a difference…

Can the Canadian economy stand a 40-50% haircut on property values?

Seems like an elephant is stomping around in a dark room…

There’s what’s called a trigger point on variable rate mortgages that 40 percent of buyers in the last two years took out when they got a mortgage. This short video from 2 days ago on youtube explains it.

” We are pleased to learn that our efforts to distance ourselves from poor economic policies in the states.”

Buy local. Break the shackles.

Chris Van Ihinger

2 years ago cbc business news/comment

Would there be a scenario where the Fed would have to realize their losses??

I’ve seen where Fed admits to “deferred assets” they would book on the balance sheet if they had to recognize loss.

It was explained that they would no longer be able to print money or pay out claims to treasury. Does this have merit to it? Or is it that there would just be no profit posted to treasury from interest payments?

1. “deferred assets”: yes

2. “they would no longer be able to print money”: No. But they might not want to for other reasons

3. “would no longer be able to… pay out claims to treasury.” I think what you’re talking about here are the “remittances” to the Treasury. If that’s what you mean, yes, there will not be any remittances to pay since there will be no profit to remit, as explained in my comment above.

More Canadian content please!

Wolf, I suspect if the Canadian housing bubble does pop, it wouldn’t be because of a 2008 like reasons.

I suspect the Chinese property market collapse will directly lead to pain like never seen before in the Canadian housing dream story. Thoughts?

Sometimes for fun I like to imagine the FED putting their entire balance sheet on the market all at once.

Really useful article. Before this article, I used to think that if the Fed let bonds just roll off the balance sheet, they couldn’t lose money. But that assumes the Fed only bought bonds on the issue date. If that’s not true – if the Fed purchased older bonds – say a 4% coupon 10-year bond in the aftermarket when the market rate for 10-year was 2% – they’d pay a premium. The premium gives them a built-in capital loss which hits once the bonds eventually pay off.

And a lot of the bond-buying in QE happens at/near the lows of the coupons for the long-dated bonds. So the losses could be significant.

If they confined themselves to buying bonds only on the issue date, the problem wouldn’t happen. But based on your article, I suspect they didn’t do this.

The new IRS agents should audit the fed, now that would be interesting. Slim pickens of that happening. Ron Paul gave them a scare with that 14 years ago.

David Pare,

Wait a minute… The Fed accounts for the premiums it pays over face value in a separate account (“Unamortized Premiums”) for all to see, and I report on it, and it amortizes to zero (writes off) this premium per bond during the maturity of the bond. In other words, it takes the loss of the premium as a loss throughout the maturity of the bank, and by the time it gets paid face value for the bond, the premium has already been written off.

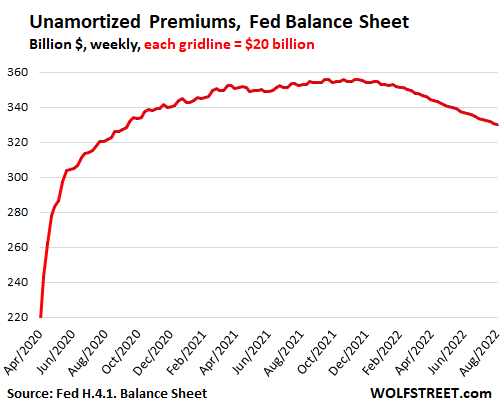

This is the account of the Unamortized Premiums, and you can see to what extent the Fed is taking the losses on a weekly basis, instead of when the bonds mature:

https://wolfstreet.com/2022/08/04/feds-qt-total-assets-drop-by-91-billion-from-peak-qe-created-money-qt-destroys-money/

The “unamortized premiums” peaked with the beginning of the taper in November 2021 at $356 billion and have now declined in a steady process by $26 billion to $330 billion:

Looks like the BoC is doing what everyone else did and looks like everyone over reacted financially to Covid.

It also looks like Fed liability at around 8.8 trillion is roughly double the BoC’s per capita.

Clarification: “is ‘doing’ should be ‘did’. The BoC did incur a lot of debt, like EU, UK, US, but is retiring it faster than US.

“Spiraling Losses on Bonds, to Be Paid for by Canadians”

All part of the ‘privatize the gains, socialize the losses’ paradigm.

The gains have already been privatized. This is the ‘socialize the losses’ phase. Together they’re called the ‘business cycle’ ( aka boom! bust!) to persuade people that this is all somehow normal, necessary, and good, when it’s really just financial engineering designed to accelerate the usual upward flow of money because outright armed robbery is generally frowned upon and isn’t actually legal.

Trying to get in on the pleonexia, chrematistiki, and exsanguination yourself often just gets your fingers burned when chunks of your portfolio go up in smoke, but some people do okay. They haven’t maximized wealth and income inequality yet but they’re doing the best they can and this seems to be a good way to get away with burning the general population without detonating the economy.

That comes later. Civilization has serious problems with excessive financial extraction which is crashing through the limits to which those problems can be externalized. So to speak.

The BoC needs another booster.

Where I live in Markham, Ontario Canada the Chinese still don’t get the message from the Bank of Canada. Home prices are 1 percent higher year over year as of August 17, 2022.

Where are the actual losses?

” …would allow maturing bonds to roll off without replacement.”

Isn’t this just accounting “in case” the BofC has to sell GofC bonds? If they just roll off, then there is no actual loss.

I guess that is why I can get as much as 4.6% on a one year GIC in Canada.

With the current QT policy in place i.e. “allow maturing bonds to roll off without replacement. There are no “caps” on the GoC bonds that roll off. Whatever matures, rolls off.”, how long will it take until the BoC BS returns to pre-pandemic level of 120bn C$?

Currently BS is $439bn and last 8 months dropped by $54bn so $80bn annualized – so if pace is constant, will be about 4 years BUT it depends on the maturity distribution of BoC GoC bond holdings – anyone have any insight into those?

Yep, the amount and variability of the roll off maturity dates would add color to the future economic outlook. They might already have a good idea when the shatner could hit the fan. The key will be getting inflation down before they can end QT otherwise “Trouble is a brewin in Gotham city”

Accounting question.

It is my understanding that banks can value their bond portfolios based either on “market value” or on the price on which the bonds were purchased. True?

Then what of central bankers (the Fed)?

The 2.7 Trillion of MBSs held by the Fed…..how are they valued? If rates climb, that value drops, does it not? Then how would it be referred to on the balance sheet? Mortgage holdings of 2.7 Trillion valued based on a 3% mortgage rate arent worth as much when rates are 5.5%.

Does this drop the balance sheet asset calculation? If not, shouldnt it?

Historicus,

Question 1: yes and no. Banks have to distinguish between securities they expect to hold to maturity, and securities they expect to trade or sell before maturity. The first are not marked to market because banks are going to get face value when the bonds mature; the second are marked to market because banks expect to sell them at some point.

So if you apply bank accounting rules to the Fed (which is not the case), then you’d have two groups of securities, those it expects to hold to maturity, and those it expects to sell. For now, the Fed has not decided to sell any MBS. In other words, it expects to hold its MBS to maturity. It might eventually change that, after a lot of MBS have already come off the balance sheet, but that’s not happening yet. So it would then, if it were to follow bank accounting, adjust the remaining MBS to market. This would be a much smaller amount.

The Fed did sell its corporate bonds in 2021, and it booked a big profit when it sold them, rather than marking the bonds to market over the period that it held them. This goes both ways.

24% sounds like a lot until you look at the chart

It’s nearly a quarter! That is a lot, this being just the beginning.

If you lose 24% of your assets, that’s a lot, especially if you know that it’s just the beginning.

I say we have the Canadians hold a School for Central Bankers, leaving out the course for Indemnity horse hockey because these monetary manipulators most likely have access to the futures markets to hedge their bond positions when they start pushing up yields. U.S. and Canadian Central Banks have what are called Flex-Charters that can be pulled and stretched to entail just about any financial instruments their little hearts desire. And they can leave their legislators totally out of the decision!

There will be a special session held for Governator Powell on QT because in the current red hot inflationary period we find ourselves in, capping monthly roll-offs just delays the inevitable. If you are going to play on the railroad tracks, might as well grease them a little to make it more interesting!!

wow, tiff should be fired and all his assets frozen, $31 billion losses due to QE, I so want pierre to come to power, pet this madness end.

Wow … what a gross misunderstanding of reality.

If you look around the world, Canada has actually done a lot better than most.

We definitely would not want PP interfering in bank policy, that much is certain.

Banks don’t want anybody interfering in bank policy.

What is rarely understood, if ever, is the degree to which corruption operates in economics and finance, limited only to what can be concealed and what the general population can be suckered into tolerating, which is really rather a lot, practically all in fact.

Wolf . I may stand corrected on this point but agency debt (MBS for example) unlike Treasuries, is backed but not guaranteed by the government and represents a real cost to the taxpayers should the government need to bail out these defaulting securities on the Feds balance sheet. I am curious to know what that number is.

Your email address will not be published.

Powell quotes Volcker, promises to “use our tools forcefully,” take “forceful and rapid steps” to reduce demand until “confident the job is done,” though it’ll bring “pain to households and businesses,” but not doing it will cause “far greater pain.” Hawk city. Finally got through to the markets?

Spending on gasoline plunges due to plunge in price. “Real” spending on durable goods, amazingly, jumps for 2nd month. Services spending rises but stuck below pre-pandemic trend.

Over the decades, recessions were preceded by spikes in unemployment claims. We keep our eyes on them as the recession watch has begun.

Craziness in used cars is far from over. Cheapest used EV models see biggest price gains. Only the Porsche Taycan, most expensive used EV, sees dip.

Forget “housing shortage.” It’s about crazy prices: For sales to revive at these mortgage rates, prices have to come down a lot, and they’re starting to.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy