THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

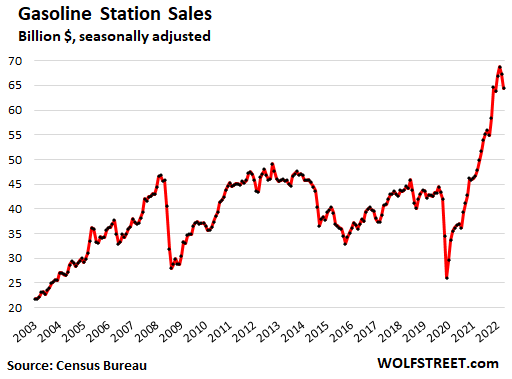

There was a big drop in sales at gas stations, driven by a plunge in gasoline prices and a drop in demand for gasoline (both of which I discussed yesterday).

But retail sales without sales at gas stations jumped by 0.8% in August from July, and has been on a solid upward trend for months, even as inflation has shifted from goods, sold by retailers, to services, which are not sold by retailers.

Retail sales track sales of goods, not of services. And inflation has been shifting from goods to services, and services inflation is now driving overall inflation (which I discussed a couple of days ago), even as some goods prices are coming down.

The retail sales data today by the Census Bureau are based on surveys of about 5,500 retail businesses, by retailer category, from the retailers’ point of view, not the consumers’ point of view.

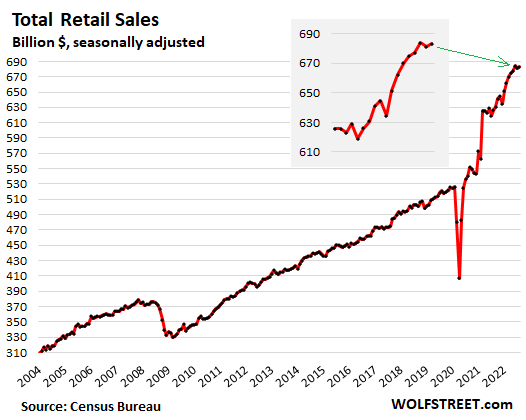

Overall retail sales rose by 0.3% from July, despite the drop at gas stations, and by 9.1% year-over-year, to $683 billion (seasonally adjusted). Compared to August 2019, the last normal year, total retail sales were up by an astounding 31.1%.

Retail sales are grouped by categories of retailers, such as auto dealers and ecommerce sales, and not by product category. But CPI inflation is measured by product category. So CPI inflation cannot be easily applied to retail sales because the categories don’t match.

Overall CPI inflation in August rose by 0.1% from July, and by 8.3% year-over-year. The CPI for services is spiking relentlessly but doesn’t figure into retail sales because retailers sell goods.

CPI for gasoline: -10.6% in August from July. But retail sales at gas stations include the other stuff they sell. Many gas stations are in effect convenience stores, selling food, beverages, and other stuff, and the drop in the price of gasoline was moderated by price increases in the other stuff they sell.

CPI for “food at home”: +0.7% in August from July – which falls into the retailer category of “food and beverage stores.” But Walmart is also a huge grocery retailer, and it is part of “general merchandise retailers,” not food and beverage stores.

CPI for durable goods: +0.5% in August from July. Durable goods are sold by several retailer categories, including new and used vehicle dealers, ecommerce retailers, appliance stores, electronics stores, furniture stores, general merchandise stores, etc. Their different products face different pricing environments, with some prices declining (i.e. used vehicles and electronics) and with other prices rising (i.e. new vehicles).

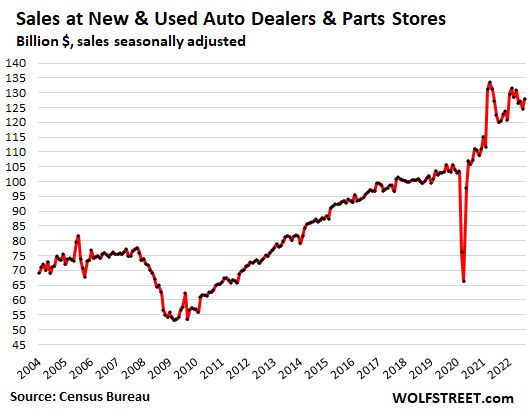

Sales at New and Used Vehicle and Parts Dealers, the largest category, jumped by 2.8% in August from July, and by 6.8% from a year ago, to $128 billion, seasonally adjusted. Compared to August 2019, sales were up 21%.

This comes on a mix of much higher prices and much lower unit sales as new vehicle dealers are still facing large-scale inventory shortages, though they have shifted, and some brands have now plenty of inventory, while other brands are essentially out of fuel-efficient vehicles.

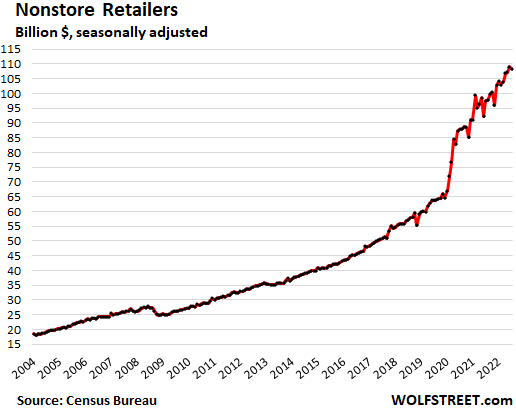

Sales at ecommerce and other “nonstore retailers” fell 0.7% from the record in July, to the second-highest ever, $108 billion, seasonally adjusted, up by 11% year-over-year and up by 70% from August 2019.

Included here are sales by pure ecommerce retailers, by the ecommerce operations of brick-and-mortar retailers, and by stalls and markets:

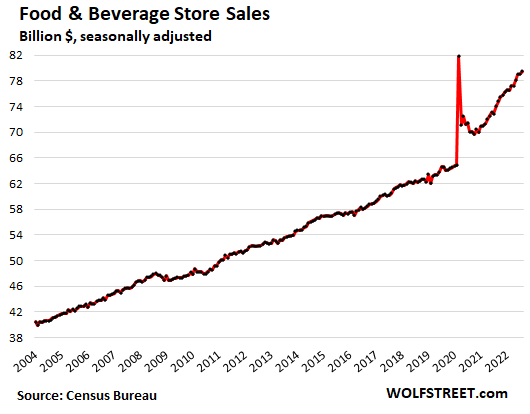

Food and Beverage Stores: Sales rose 0.5% for the month, and 7.2% year-over-year, to $79.5 billion, up 23% from August 2019:

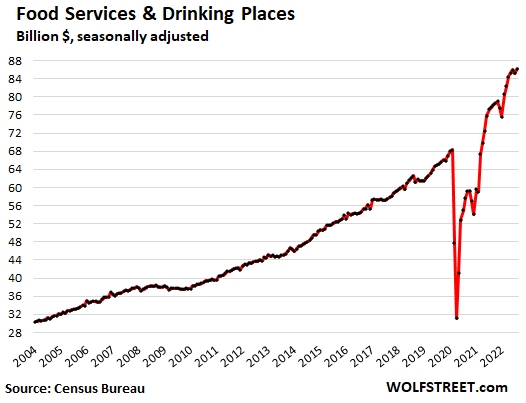

Food services and drinking places: Sales jumped by 1.1% in August from July, and by 10.9% year-over-year, to a record $86 billion. This was up by 32% from August 2019. Included here are bars, restaurants, cafes, cafeterias, delis, fast-food places, etc.

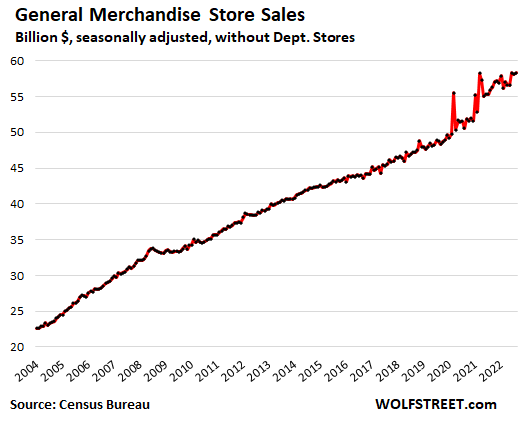

General merchandise stores: Sales rose 0.4% for the month, and 4.2% year-over-year, to $58 billion, up by 20% from August 2019. Walmart and Target are in this category, but not department stores:

Gas stations: Sales dropped 4.2% for the month, to $64 billion, the second month in a row of declines, as gasoline prices fell. Sales were still up by 29% from a year ago, and by 51% from August 2019. Sales at gas stations include the other stuff they’re selling: Many gas stations are in effect convenience stores, selling all kinds of food, beverages, and other stuff, and the price drop in gasoline is moderated by price increases in their other stuff.

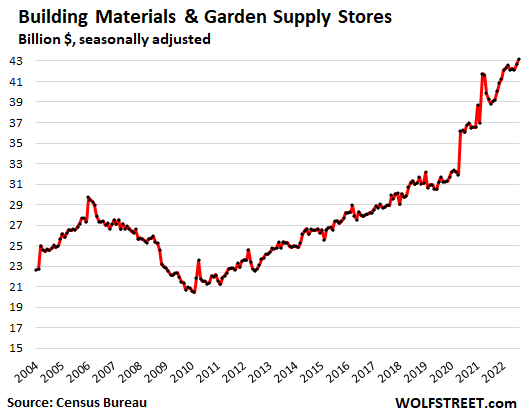

Building materials, garden supply and equipment stores: Sales jumped by 1.1% for the month, and by 10.5% year-over-year, to $43 billion, seasonally adjusted, up by 36% from August 2019:

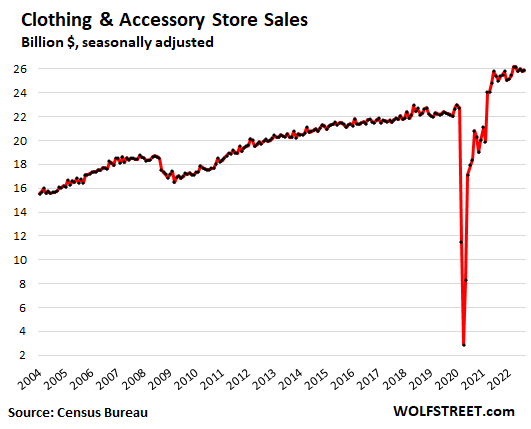

Clothing and accessory stores: Sales rose 0.4% for the month and 3.5% year-over-year, to $26 billion, up 16% from August 2019:

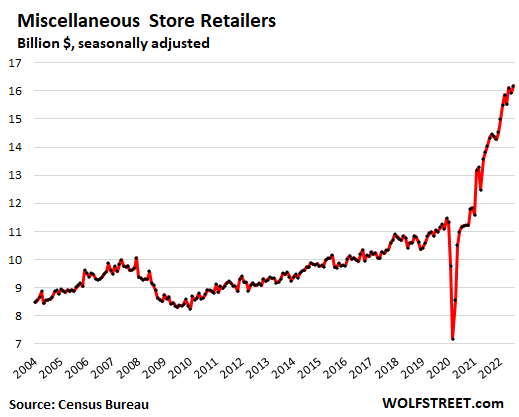

Miscellaneous store retailers (includes cannabis stores): Sales jumped by 1.6% for the month, by 15% year-over-year, and by 47% since August 2019, to $16.2 billion:

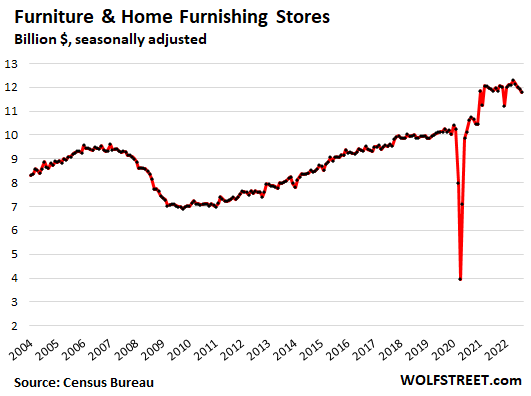

Furniture and home furnishing stores: Sales fell 1.3% for the month and 1.6% year-over-year, to $11.8 billion. This was still up 16% from August 2019:

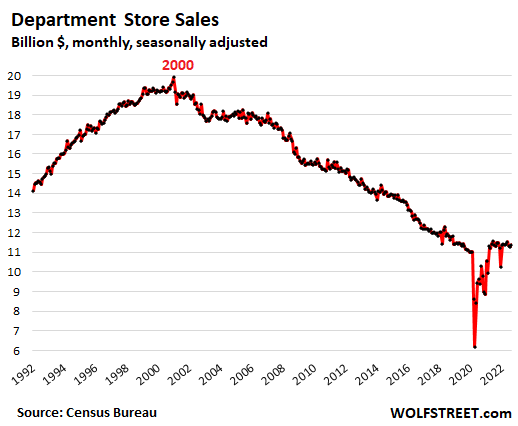

Department stores: Sales rose by 0.9% for the month, and by just 0.7% year-over-year, and were essentially flat with August 2019, at $11.4 billion. Compared to peak-department-store in 2000, sales were down 43%. Numerous department stores, from Sears on down, filed for bankruptcy and mostly vanished. Anything you can buy at a brick-and-mortar department store, you can buy online, including at that chain’s website, and that’s where these sales went:

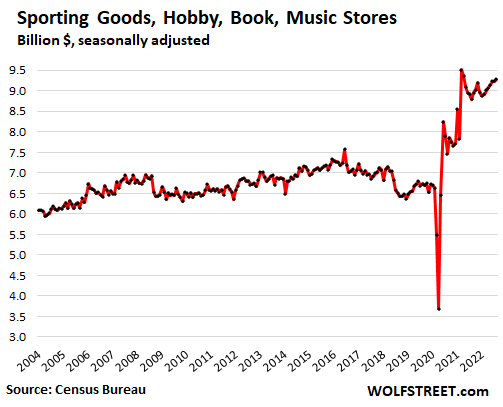

Sporting goods, hobby, book and music stores: Sales rose 0.5% for the month, and 5.5% year-over-year, to $9.3 billion, up 38% from August 2019:

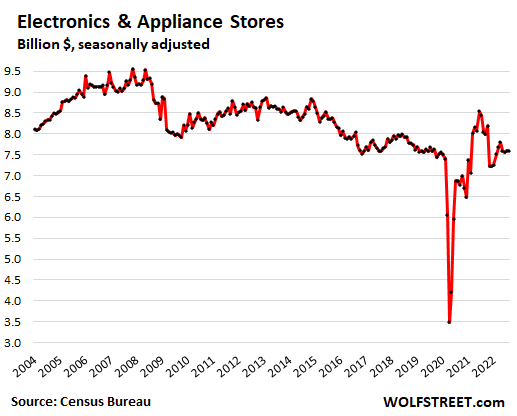

Electronics and appliance stores: Sales dipped 0.1% for the month, and fell 5.7% year-over-year, to $7.6 billion, which was flat with August 2019.

In this category are only specially electronics and appliance stores, such as Best Buy’s brick-and-mortar stores or Apple’s brick-and-mortar stores. It does not cover other retailers that sell electronics and appliances, and it does not cover ecommerce sales of electronics and appliances. This brick-and-mortar category is also on the slow way out, with sales today down 15% from where they’d been 15 years ago:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

Sales chuggin along. Much on credit card

About 45% of credit card users pay off full balance every month. I do that for the 2% cash back and not having to worry about keeping money in my wallet.

Same here, I specifically grabbed a CC with no FX fees for crossborder (I’m in CAN) as well.. ever since then my leftover foreign currency coffee tin has been slowly depleting and best of all I’ve ditched my George Castanza wallet few years ago, it’s small and nice now, just a few too many cards though 😂

Did that wallet leave a mark? 😁

I paid $2.38 for gas today in Tucson

??? love grocer 4x points

You took the jab to get back north for the luxury of paying off a bank card on time?

Good grief.

Only 45%??? I thought it was much higher. Are people really stupid enough to pay 18% interest?

That ~44% was taken from a survey in October of 2021, when consumers were still likely flush with stimmiez, unemployment bennies, and wealth effect. I bet it’s much lower now.

more like 1/3

being one I paid interest since 1995 $000,000.00

Only 45%. That is scary to me.

Looking forward to faster asset liquidations in the coming Depression.

Based on the Fed’s FRED tool, revolving consumer credit has now blown past its Feb 2020 peak and has been climbing back as if powered by rocket fuel, at the fastest rate on record.

Americans used stimmies, cash-out refi money, and deferred mortgage/rent/student loan payments to pay down their credit card balances in 2020, but by mid-2021 that effect had turned the corner. As a whole, credit card balances are growing fast as ever. I have a feeling that the percentage of fully paid balances is probably dropping too. The average American consumer can’t play chicken with the inflation train for much longer.

Not Sure,

Why do people keep posting this clueless BS. I’m going to start deleting this clueless BS. READ THIS:

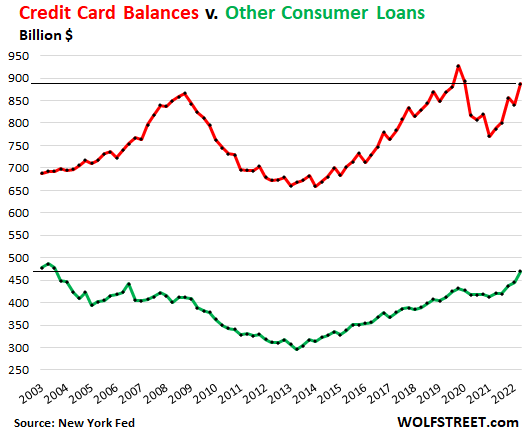

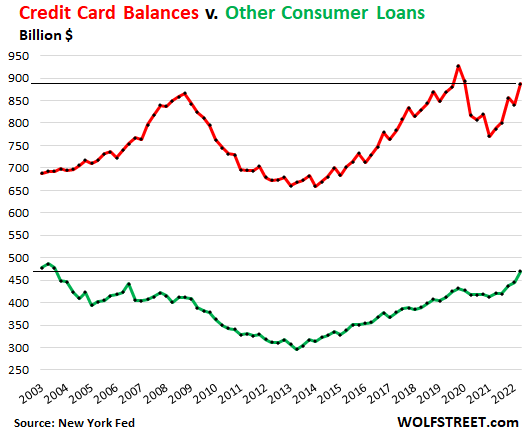

Everyone pays with a credit card as a payment device. Most people pay off the entire balance when due and never pay interest, but collect 1.5% cash back or travel miles or whatever. During the weeks before those balances are paid off, they count as credit card balances, even if they never accrue interest.

Fitch estimated that the total amount paid with credit cards for goods and services in the US reached $4.6 trillion in 2021, an average of $1.15 trillion in purchases via credit cards per quarter.

Yet the total credit card balances outstanding in Q2 only grew by $46 billion, which shows to what massive extent credit cards are used as payment method, and to what small extent they’re used as borrowing method, which makes sense, given the usurious interest rates.

The credit card balances of $887 billion in Q2 include transactions incurred roughly in June but paid off in July that are not accruing interest. And this was boosted by the surge in traveling, much of which is paid for with credit cards.

Other consumer loans, such as personal loans, payday loans, and Buy-Now-Pay-Later (BNPL) loans, all combined, rose to $470 billion in Q2, below where they’d been 20 years ago, despite 20 years of inflation and population growth.

Here are those balances, and despite population growth and massive inflation over 20 years, and the universal use of credit cards as payment device, not borrowing method:

https://wolfstreet.com/2022/08/03/people-trying-to-dodge-legal-usury-credit-card-balances-delinquencies-third-party-collections-and-bankruptcies-in-q2/

I do the same thing; pay it off every month and get the cash back.

But, two points here…

First, I use an Amazon CC and get 5% for Amazon purchases plus 1-2% everywhere else. Of course, I use Amazon a lot and so it really adds up. Since lots of you have this same card, I want to drop a tip for you. Never use your accumulated points to make a purchase there. You won’t get the 5% back. Instead, put it on the card and then login once in a while and apply the points to your account.

Second point… I still carry a healthy money clip. Cards are convenient, but I only use the card at places that I regularly shop and use it (so I don’t miss out on many cash back points). But, if I need to stop somewhere else, I’m not risking a card skimmer and getting hacked. That’s a painful process to deal with. Most importantly, I NEVER use a CC eating out. No way I’m handing my card to some seemingly nice gal to walk off with for fifteen minutes.

Ok, one last unrelated point… I do a LOT of little things to be frugal. I try to save pennies because PENNIES MAKE DOLLARS (put that on a post-it note and thank me later). So, I don’t eat out very often. It’s almost always some sort of family outing/celebration. But when I do, I want to enjoy it. I’ll pick up the tab for the whole extended family and I want everyone to order any thing that pleases them. I won’t fret for a moment about the cost. And I tip very generously – THAT is part of the cost of eating out. Plan accordingly. The point is, because I don’t do it very often, it really doesn’t matter.

I guess I mention this because I know other frugal people that can’t even enjoy eating out because they focus so much on the cost. If I’m going out, I’m going to enjoy it fully.

There’s times to focus on the budget, and there’s also times to remember that life ain’t no dress rehearsal.

If you have an Amazon credit card you get 5% back on your drug copays too if you use Amazon pharmacy. Free delivery in two days (if a Prime member) and very pleasant customer service. Save on drugs not covered by your drug program too – a 90 supply of 5mg tadalafil, generic for Cialis, is about $22 bucks without insurance. It’s more than $500 at Walgreens. Oh, and of course you get 5% back on that $22 as well.

Still amazed that the USA still has pennies.

Still amazed that there are restaurants where you have to give them your card instead of just tapping.

Still amazed that not everyone has a chip card (tap) not insert.

You gotta do what makes you comfortable, but I’ve been eating out for many years, using various credit cards, and mine has been compromised exactly once, and it wasn’t from a restaurant.

Why then, if the modern day consumer is such a shrewd & savvy dude, does usury remain the titanic industry that it always has been? Gotta be something in it for the fat cats at Capital One — it ain’t a library card.

Perhaps that is the problem?

I too once played old schooling street level money managment theory.

That is until ronald reagan changed political parties.

Down here in california we know.

(Steven Stills)

the data on gasoline store sales doesnt make sense. you had a previous article that showed demand destruction on gas sales and prices have dropped, but sales are barely down.

i assume there is a lag effect going on here, so maybe the numbers reflect what was happening in July?

People are tired of pizza slice @2.99 Ora pop at 1.59 hotdogs a on sale .99 now 1.99 . So I just quit buying there junk food if others follow it will change .Per wolf

rodolfo,

Everyone pays with a credit card as a payment device. Most people pay off the entire balance when due and never pay interest, but collect 1.5% cash back or travel miles or whatever. During the weeks before those balances are paid off, they count as credit card balances, even if they never accrue interest.

Fitch estimated that the total amount paid with credit cards for goods and services in the US reached $4.6 trillion in 2021, an average of $1.15 trillion in purchases via credit cards per quarter.

Yet the total credit card balances outstanding in Q2 only grew by $46 billion, which shows to what massive extent credit cards are used as payment method, and to what small extent they’re used as borrowing method, which makes sense, given the usurious interest rates.

The credit card balances of $887 billion in Q2 include transactions incurred roughly in June but paid off in July that are not accruing interest. And this was boosted by the surge in traveling, much of which is paid for with credit cards.

Other consumer loans, such as personal loans, payday loans, and Buy-Now-Pay-Later (BNPL) loans, all combined, rose to $470 billion in Q2, below where they’d been 20 years ago, despite 20 years of inflation and population growth.

Here are those balances, and despite population growth and massive inflation over 20 years, and the universal use of credit cards as payment device, not borrowing method:

https://wolfstreet.com/2022/08/03/people-trying-to-dodge-legal-usury-credit-card-balances-delinquencies-third-party-collections-and-bankruptcies-in-q2/

Not really…. more alike skrewed numbers on cooked balance sheets for the enabled banker ponzi to continue.

Looking at this data, sure looks like consumers are not budging and in turn of course inflation isn’t either.

Without (massive/deep) recession this is not going to get fixed.

It all looks very bubbly to me, except of course department stores.

You mention durable goods. I wonder how many of today’s products truly belong in that category. With the “Made In China” phenomenon, low-quality products have never been so rampant.

It used to be you paid more for a fridge or a sound system, but at least it had a fair chance to be guaranteed quality. Prices came down (thanks to the Walmart-China duality) but quality went through the floor.

Now we are living in the Age of the Disposable, where even washing machines break down after extended use. Nothing is sacred in the marketplace anymore, but the Almighty Dollar.

I repaired my washing machine myself for $100 or so. Cold water solenoid was leaking water into the drum. Might have failed due to the extremely hard (mineralized) water around here. I am old school — if it is broken fix it.

Your personal well water?

Nope, Phoenix area water.

Fixed my refrigerator also,you tube ,and bought 2 parts replaced both temperature sensor and defrost sensor.no previous experience on appliance repair but did solder copper wires instead of butt connectors. Working well 50$ for parts If refrigerator fan goes it’s junk no replacement part ,already 10 years old.

Greatvampire,

Hahaha, yes every time I write the phrase, I’m tempted to precede it by “hopefully” — but I have so far been able to bite my tongue.

Might as well buy now. Price is only going to go up. Value of cash is only going to go down. So inflation good for the economy in that sense. Deflation is the opposite of this and that is why it is so feared by the Fed.

Yep, I just bought 2 years of wiper blades for 2 cars from Costco because they are just $10/ea. I’d be foolish to think they will cost less going forward. If you’ve got room for things that won’t go bad, why not?

Yep just bought a case of tuna at Aldi ,77 cents a can .By the way it should last 7 years ,beans rice sugar soup . Already made 25% on canned chili

Those leftover pork chops were kinda stiff, so I went and et me a can of your tuna, Ms Daisy..

People do not hold off on hardly any purchases because of deflation. That’s a complete myth. It contradicts how people normally act. Look at electronics.

It happens for houses which are supposedly “investments”. Same for cars. Maybe for some other big-ticket purchases but that’s about all.

So why is there such a fear of deflation?

OK, I’ll answer my own question:

“Economists fear deflation because falling prices lead to lower consumer spending, which is a major component of economic growth. Companies respond to falling prices by slowing down their production, which leads to layoffs and salary reductions. This further lowers demand and prices.”

I don’t know what economists fear. Being un-employed would be a guess. I can tell you the sellers of debt fear deflation. If the house like yours across the street sold today for 200k and you bought it for 500k 3 years ago you might give it back to the debt sellers that financed the 500k by walking away from it or quit paying for it and squat in it until evicted. If that $1000 hand held pacifier was financed and a new one just like it was $500 would you keep paying for it ? You might,but a lot of people would give it back. The sellers of debt fear deflation. The biggest sellers of debt, their only function,is the Fed and its Fiat money pump. The Fed owners, the banks, and their debt franchisers, Wall Street, enables a steady stream of grift flowing to Congress which is the bitch master of the Fed. This collective are all terrified of their grift going on a diet due to deflation. If you are a saver because you could not afford debt your deflated steak tonight is $5 instead of $15 a year ago. You can have two steaks a month instead of one every 3 months. If your home is paid for and its purpose is to give you shelter why would you care if it was worth 500k two years ago but has deflated to 250k today? You could grin while watching the shit show in the county commissioners meeting when they try to reconcile tax rates to all the home owners with a deflated asset. You can add the government tax racket to the list of those that fear deflation. You can enjoy your deflated $5 steak in your $250k house and have a another grin. It will taste even better.

So when electronic prices fall (PCs, phones, etc), people must be spending less? So we shouldn’t have much of an electronics industry, right?

They’re buying more electronics, and they’re going upscale on what they buy, and they’re replacing stuff more often to get the latest and greatest, etc.

Persistent deflation is very bad news in a context of massive debt.

Ed C,

There is a difference between asset or credit deflation and price deflation. It’s been covered on this site.

Given today’s financial leverage, yes credit deflation (which will cause asset deflation and potentially price deflation) would be a disaster for most people. But that’s because most people are actually broke or close to it.

A second reason is because American society has an overwhelming sense of entitlement where most people believe they have a birthright to minimum living standards, even if means using the ballot box to steal from someone else, what’s commonly called “democracy”.

As for economists, they are utterly clueless. That’s why they believe the BS that falling consumer prices motivate people to go sit in a closet somewhere instead of living life like they really do.

I believe that’s because people no longer have a sense of “time value of money”. Ever since the banks started ramming credit down peoples throats (around 1992?), people changed their buying behavior. “Young” people can’t imagine a world without debt. People are still shocked when I tell them I have no debt. I’ve heard, “what do you mean?”, with an intonation as though they have no idea of how the mechanics of that would even work.

@AF,

You’re so right. The story that deflation is dangerous because people would hold off on buying is a tired old bugbear that is trotted out by know-nothing hacks every time somebody questions the “wisdom” of inflation.

In reality, it’s a psychological trick played on the dumb masses that makes them accept a phenomenon that they should really be up in arms against. 2% inflation is nothing more than “redefining zero” for people who do not understand math.

For example, people will be happier with a 1% salary raise in a 2% inflation environment than no raise in a 0% inflation environment. They accept inflation as some kind of natural phenomenon, while in reality inflation is simply legalized theft.

When a long long time ago the fisherman and the baker decided that they did not need to always exchange one bread for one fish but could use a means of payment like shells, they never envisaged that the value of one shell would diminish over time so that one would no longer buy a fish or a bread. That “refinement” has been added by banks and they have managed to convince people that this is “normal”.

Well, it isn’t.

JO, you’re not factoring in the power of a monopoly or duopoly, which is the rule, not the exception, in most major industries. They can exercise what Warren Buffet values in an investment: pricing power.

Also, the middlemen or intermediaries (between the producer and the consumer) also create inflation.

The trope of a fisherman exchanging fish for bread is akin to the way politicians buffalo voters with images of “putting food on the table”. That homily is solid crap. Families ain’t what they used to be, if they ever were.

combining the spectacular rise of spending at all levels in the economy with the believe by the political party currently in control of washington that MMT is working and we need MUCH more spending -National Guaranteed Income – etal -makes me happy to be old – I will say that to be fair -MMT is working so far and most young people are thrilled with it

It’s certainly working to ignite inflation.

MMT has caused inflation and that is why spending bis up, and the fed is trying to fix it because they used MMT too long and aggressively.

Yup…..MMT and irresponsible fiscal policy

This should come as no surprise as jobs are plentiful and even flipping burgers pays $20/hour. Until jobs disappear expect people to try to enjoy their lives.

Good point. Misers tend to forget about “enjoying their lives.” Unfortunately enjoying life for many people is really a euphemism for status-seeking.

It is funny how many of these miserable rich cretins are coming out of the wood works to warn how Fed is going to crash this and that. As long as the masses were suffering it was ok, but now that their cheap money source is affected, its the end of the world. For that alone I would happily take a crash any day. Dont care if it takes my 401k with it, I want to see these things 6 feet under, with a bloody stake and some garlic on it so they cannot re-emerge.

To be fair, the masses bear some responsibility here as well, as aptly described by Will Emerson in Margin call. If someone wants to live beyond their means, and the banks want to enable that, then the banks need to be responsible for any negative outcome, not tax payers.

And hopefully some meaningful measures put in place to avoid a repeat of this situation.

We have a new breed of bankers who are gamblers, not accountants. So they really dont care about risk because they just get bailed out.

Nearly all mortgage debt doesnt get held by the originator, so bundle up that junk and throw it to the American taxpayer.

Same goes, I think, for the consumer-gambler. I would salute those patriotic small spenders except they will be back in a flash with hands out for a stimmie bailout (with a vengeance, and all kinds of phony accusatory-victimhood narratives).

gametv, I don’t think that most people in finance concern themselves with taxpayer bailouts or government backstops. Their only concern is reaching quota or earning bonus, monthly. “Loan qualification?” = Kryptonite for brokers.

So that’s the guy who made $2,500,000 in the year, but spent only $76,000 on hookers, booze and blow.

Great movie.

So we don’t really know whether the amount of stuff sold actually rose, or whether the dollar volume merely rose?

If for instance gasoline prices rose 3% in a given time frame, and the amount of gas sold remains the same, that gets reported as a 3% increase in gasoline sales, even though all the action was arguably dollar depreciation (inflation)?

If so, retail sales reports need quite a bit of unpacking to make sense. Wolf, maybe you can help clear this up…

I worked for a company that had annual bonuses, circa 1981. Sales quotas were reached but unit sales went negative. Management was pissed that they had to pay out bonuses even though they weren’t movin’ the freight.

I can confirm. Travelled cross country 3 times this year, the last 2 times – notably less traffic on the interstate highways. I follow RV trends and noticed that every RV dealer I passed during my travels was chock full of inventory. RV bust???

I hope so.

The graphs are looking like sales in most categories either have returned or are returning to their pre-pandemic trend. Just eye-ballin’ it.

What plunge in gas prices? Here in the Bay area, they’ve gone up almost 10% in the last 3 weeks.

That’s a lie. Even in San Francisco, they dropped 15% from the mid June through Sep 12, per EIA, even at my gas station from hell they dropped below $6. The first weekly uptick in San Francisco was this week (+4%). We got gas in San Jose last Friday for $4.50

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMM_EPM0_PTE_Y05SF_DPG&f=W

Last year I made the point that anyone on Social Security should consolidate their purchases, especially large ones, into the third quarter to push CPI higher in Q3. Basically using their purchasing power to boost their own incomes. I know I’m doing it. Maybe it’s becoming a thing.

Hahaha! Smart!

Fedex a disaster after hours. Interesting

After today’s crash, Fedex is still over 10% higher than it was on this date in 2019.

Is it really a crash or just a return to normal?

Most of it not in the US, but due to its troubles in Asia and Europe at its Express unit. Its FedEx Ground in the US, which delivers the WOLF STREET beer mugs, also has problems, and I should write about it, and I might, because I have never seen such a clusterf**ck, something has seriously gone wrong there recently in terms of service, and I’ve been sending out the beer mugs for a few years, and I think it’s driving customers away to UPS and others. Nearly every mug I sent out that was on my Mug List for the past nine months was delayed, often for days.

Because like most other companies,they hire part time help who don’t give a shit ,with no loyalty so just move to another job my brother works for liquor distributor went to 20 % full time rest part time .on night shift now they have hardly any one . So Management can get BIG Bonuses .Worker bees are feed up ,this will not end well .Remember ford in the 20 s it’s about to return ,never seen people so angry

If Fedex and UPS merge, will they become the Fedups 😉

Lol!

Wolf, I believe this describes every service today. I had to contact Experian literally eight times just to have them get my address change straight. They somehow managed to screw it up a different way every time before succeeding. One time I was on the phone with the service rep telling them that the two diffenent PO Box address lines they entered for my mailing address was obviously an invalid address. Yes, it is *that* bad.

Full employment, the best wages growth this century, and a booming retail sector… Despite much hysteria, the US looks in pretty good shape.

At least on paper, but as far as i’m concerned its a good thing. Powell won’t be shy to continue raising interest rates due to employment #s alone.

What I see in this article is that retailers, with some specific exceptions, are pricing products exactly in line with CPI. You see the 9.1% growth rate in most of those charts. Why not, most retailers are extremely savvy, particularly first and second generation immigrants. Clearly they read the BLS along with us.

K. Shaine Tyson,

You have not read a single thing in this article. Not even the subtitle. You’re just regurgitating BS. Commenting on the article without having read it violates commenting guideline #1 and normally would send this comment to the shredder. I’ll let it sit here for a while so you can get informed about commenting guidelines. Read them:

https://wolfstreet.com/2022/08/27/updated-guidelines-for-commenting-on-wolf-street/

We are just nowhere near a recession yet.

Oops, wasn’t meant to nest here.

“when consumers were still likely flush with stimmiez, ”

That helicopter never flew by here by the way.

I did not see it nor did my Schipperkes. If anyone did get it good riddance.

If you have an Amazon credit card you get 5% back on your drug copays too if you use Amazon pharmacy.

Not sorry and no thanks

-k

God only knows what they’re doing with your pharma med information.

Your email address will not be published.

The purpose of MBS purchases was to repress mortgage rates and inflate home prices. That process has already started to reverse.

Long-term stagnation turns into sharp decline.

Rate hikes to keep up with the Fed would work. But the Bank of Japan still digs in its heels. Its balance sheet has shrunk for months though.

But for yield investors: Short-term Treasury yields near 4%. Six-month CD yields at 3.5%, if you shop around.

An ugly CPI print of inflation that’s entrenched and getting worse in vast parts of the economy. The Fed will have a heck of a time cracking down on it.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy